Table of Contents

What is effective Accounts Receivable Management Strategies?

· Accounts Receivable Mgt describes the procedures and guidelines used to handle unpaid invoices from customers who are past due. This process makes sure that clients always pay their bills, no matter what.

· It ensures that one's cash flow is consistent and that one's company continues afloat. Receivables are balances that one's customers are legally required to pay.

· So, it only makes sense to take every effort to guarantee that one's clients pay one on time.

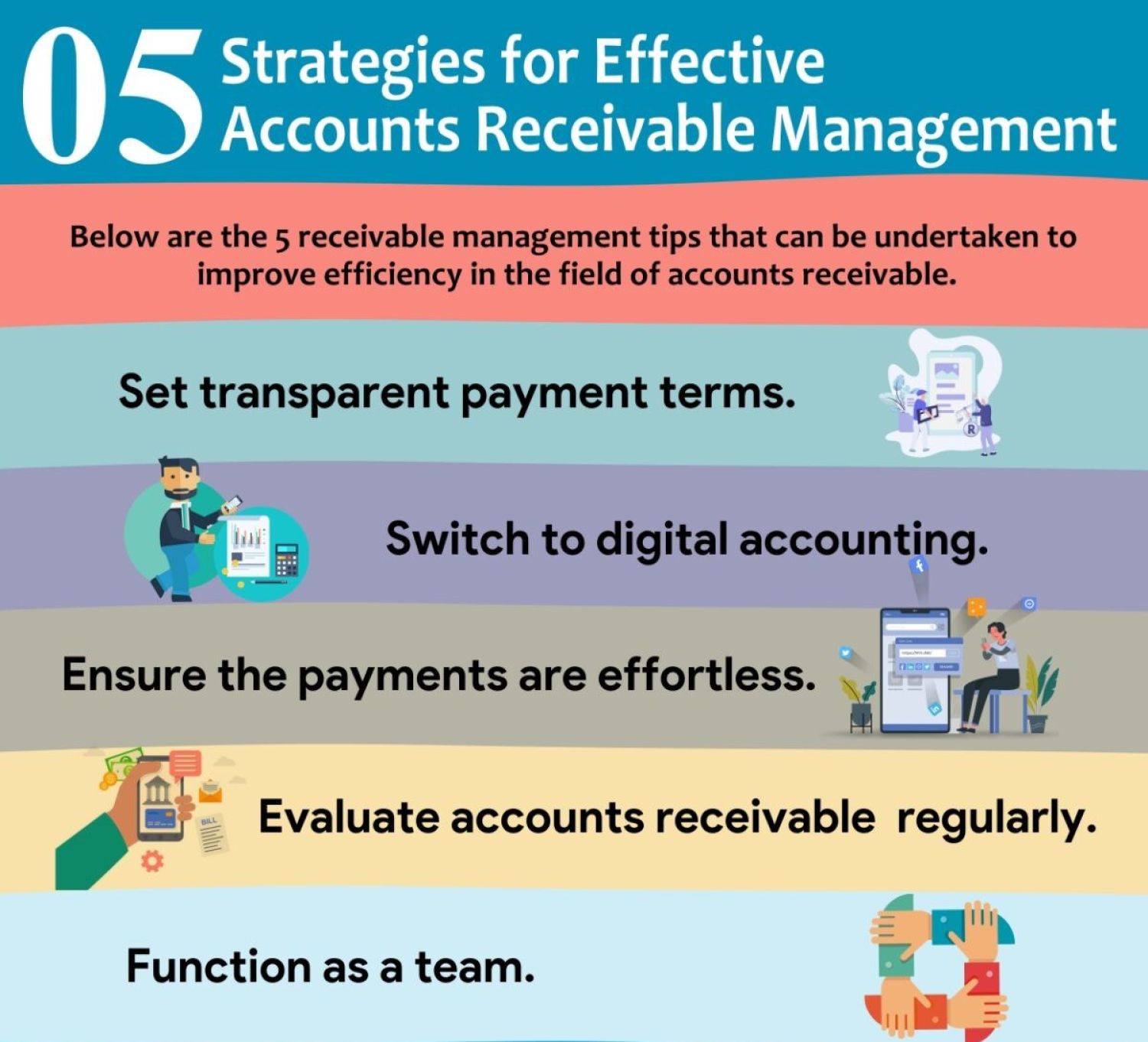

The five receivable management suggestions listed below can be used to increase productivity in the area of accounts receivable.

Establish clear payment terms

· Before the first invoice is even sent out the door, the process of accounts receivable management starts.

· The best method to make sure that payments are made without a hitch is to establish the terms in advance.

· Coherent payment conditions between a corporation and a client are important since they clearly state what is expected of each party.

· Both parties should sign once everything has been clarified and agreed upon to ensure that every detail is understood.

Use digital accounting alternatives

· By automating client account communications and minimising manual processes whenever possible, one can save time and improve consistency in their process.

· In view of this, accounting software can help with the automation of numerous accounting operations. When bills are transmitted electronically,

· Rather than lingering about their office in piles of paperwork, waiting to be found, they are instantly delivered to the inbox of the client assigned to receive them. If there are any questions, it is simple to refer back to a digital copy of what was sent.

Use digital accounting alternatives.

· By automating client account communications and minimising manual processes whenever possible, one can save time and improve consistency in their process.

· In view of this, accounting software can help with the automation of numerous accounting operations. When bills are transmitted electronically,

· Rather than lingering about their office in piles of paperwork, waiting to be found, they are instantly delivered to the inbox of the client assigned to receive them. If there are any questions, it is simple to refer back to a digital copy of what was sent.

Work as a complete team

· The finance team shouldn't be thought of as having sole control over payments since they shouldn't be seen as a technological one-step process.

· Effective cash collection actually involves a number of different departments and involves a variety of different factors. It is easier to keep all the departments on the same page and involved in the AR management process when all client-facing teams, such as the sales team, are made aware of the procedure.

· It raises productivity, reduces waste, and gets rid of mistakes that could cost you money or time.

Periodically evaluate your receivables

· One of the most crucial Receivable Management Tips is keeping accurate track of accounts receivable.

· A comprehensive schedule for assessing and tracking the state of one's accounts receivable should be created. It's important to keep track of which accounts are past due and for how long.

· Run reports to identify customers that are routinely late with payments and payment trends. In this manner, it is possible to keep track of payment dates and ascertain whether errors or late payments are having an effect on the numbers.

Rajput Jain and Associates is here to offer you the best accounts receivable management system which help you to manage your business more effectively,