Table of Contents

IBC : Realisation & Distribution of Assets by Liquidator

Liquidation under the IBC 2016 with special focus upon priority of claims :

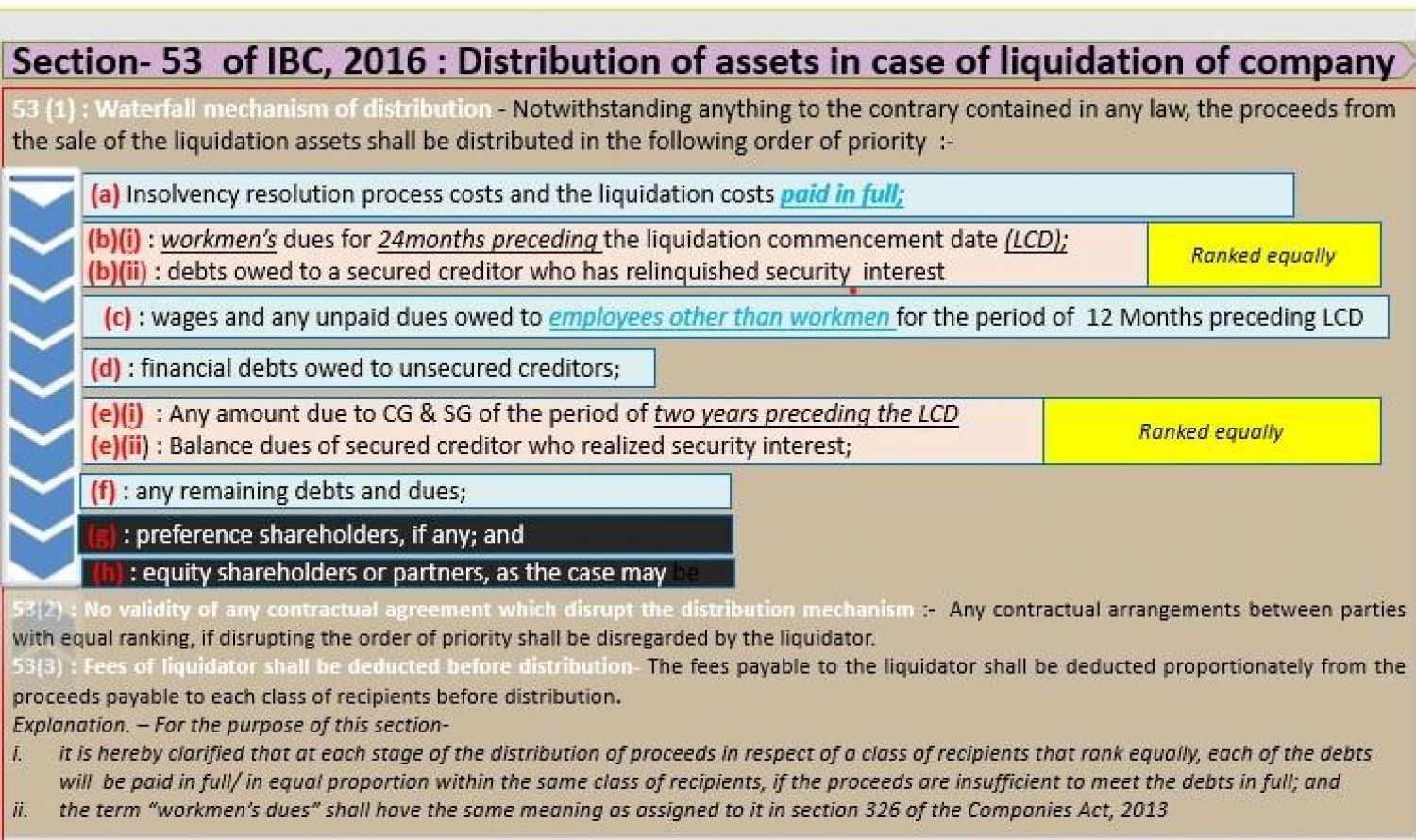

- Under section 53(1) of the Insolvency Code, 2016, the fees payable to the liquidator shall be deducted proportionately from the proceeds payable to each class of recipients, and the proceeds to the applicable recipient shall be dispersed after such deduction.

- Both the IBC and the Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016 (hence referred to as the "Liquidation Regulations") deal with the process of corporate debtor liquidation.

- A liquidator is appointed by the Adjudicating Authority to carry out the liquidation procedure. Once the corporate debtor's liquidation procedure has begun, its assets will be sold and dispersed among creditors, workers, shareholders, partners, and others in the sequence of priority established by the Code. The most essential part of the liquidation procedure is the distribution of the net proceeds of the corporate debtor's assets according to priority. The "waterfall mechanism" is another name for the priority order.

After liquidation, COC had no role to play as a claimant whose matters had to be determined by the liquidator.

COC cannot move an application for his removal. The COC has no role to play and that they are simply claimants,

IBC: just after liquidation order, COC had no part to play as they were merely a complainant whose matters were to be decided by the liquidator and thus could not push a request for the dismissal of the liquidator in the absence of any legal provision

The lead bank in the COC challenged the appointment of the liquidator after the AA passed the liquidation order. The NCLAT held that after the liquidation order, the COC has no role to play and that they are simply claimants, whose matters are to be determined by the liquidator and hence cannot move an application for his removal.

- 21.01.2020 In the ‘CIRP ’ of ‘M/s. ORG Informatics Limited’- (‘Corporate Debtor’), the 'Creditors Committee' of which the 'Punjab National Bank' is the lead creditor, agreed to push an application to wind up the 'Corporate Debtor' debtor.

- Pursuant to Sections 33 & 34 of the Insolvency and Bankruptcy Code, 2016, the 'Resolution Specialist' was asked to push wind-up demand. By impugned order of 20 November 2019 the said application was accepted by the Adjudicating Authority (National Company Law Tribunal), Ahmedabad Bench, Ahmedabad. The 'Qualified Settlement' was asked to act as a liquidator.

- The Appellant's argument is that he is against the Liquidator's appointment. However, we are not inclined to intervene with the impugned order as the 'Committee of Creditors' has no role to play after the liquidation and they are merely a complainant whose matters are to be decided by the liquidator and cannot push motion for dismissal of the liquidator in the absence of any provisions under the law.

- We do not find any merit in that appeal. It is also discontinued. Few costs.

TDS Not Required U/s 194-IA on sale of Property under Liquidator- IBC

In the present case, the Appellant Liquidator lodged an appeal against the order passed by the NCLT refusing to issue instructions to the successful bidder and the Tax Authority not to deduct 1% of TDS u/s 194IA on the sale consideration.

Required to adhere to the IBC Act 2016 proceedings, an auction was held for the sale of assets of Corporate Debtors.

Income Tax Law stated U/s 194IA of the Act, the purchaser of immovable property is needed to deduct TDS @ 1 % of sale value where INR has exceeded 50 lakhs or more.

In view of the above requirement of the Income-tax Act 1961, the Liquidator filed an application before the NCLT for direction against the successful bidder and the Income Tax Authority not to deduct 1 % of the TDS from the sale Value receiving on the assumption that the Income Tax Duties may be recovered by the Income Tax Department under the waterfall system stated as per provision of section 53 of the IBC 2016, which deals with the distribution of the proceeds from the sale.

It was argued that the provision for the deduction of tax deducted at source under section 194IA, of Act, is inconsistent with Section 53(1)(e) of the Insolvency and Bankruptcy Code, 2016 & according to the provision of Section 238 of the Code, Section 53 of the Code has an overriding effect.

Fortunately, the Honorable Court- NCLT held that the deduction of TDS U/s 194-IA does not imply an assessment & increase of the Income-tax Dept's demand for tax collection. Consequently, the Honorable Court - NCLAT rejected the application,

Honorable Court - NCLAT focused on the below Question of law;

'Whether the provisions of U/S 194—IA of the Tax law are inconsistent with Section 53(1)(e) of IBC code? ”

Honorable Court - NCLAT concluded the amendment constructed of Section 178(6) of the Income-tax Act 1961 w.e.f 01/11/2016, which provides the provisions of the IBC Code an overriding effect on the Liquidator's tax liability for the company under Liquidation.

Honorable Court - NCLAT argued that, as a result of the amendment, whole Section 178 had no application for liquidation proceedings under the Insolvency and Bankruptcy Code, 2016.

In addition, Section 45 of the IT Act provides that any profits or gains arising from the transfer of capital assets are to be charged to Income Tax on capital gains. Thus, Tax deducted at Souses u/s 194 IA is nothing more than the advance capital gain tax collected by the transferee (purchaser) on behalf of the transferor (seller).

The NCLAT responded by pointing out that, pursuant to Section 194 IA of the IT Act, 1 percent of the TDS is recovered as a primary consideration to the other creditors of the transferor, which is a partial capital gain tax, whereas Section 53(1)(e) of the Waterfall Code provides that the government fees are the fifth priority.

The NCLAT contended that the Liquidator of a Company in liquidation under the Code is not allowed to submit the Income Tax Return, and there is no issue of claiming the refund of the TDS deducted under Section 194 IA of the IT Act.

In addition, NCLAT noted that pursuant to the provisions of the Income-tax Refund under the Income-tax law, it is a cumbersome process to withdraw the refund from the Income Tax Department, & therefore IBC Code & IBBI (Liquidator Process) Regulation 2016 are silent on this matter of filing the ITR Return as the Code provides for a time-limited time frame for the finalization and maximization of the value of assets & the cessation of the biz.

In reply to the question put forward for the benefit of the appellant, the NCLAT held that Section 194-IA did not comply with the terms of Section 53(1)(e) of the Code and, pursuant to Section 238 of the Code, the provisions of Section 53(1)(e) had an overriding effect.

The contested order of the NCLT is thus set aside as not legally self-sustaining. The Tax Dept. was instructed to refund the number of TDS that had been deposited with the appellant & the appeal was allowed in the favour of the appellant.

Total Details of CIRPs resulted into liquidation as on 30.09.2021.

IBBI released data of CIRPs resulted into liquidation as on 30.09.2021 (Since IBC came in force), Total admitted claims of INR 7414 Billions in 1423 Corporate Debtors. Resolution plans received only in 296 cases. Link

Popular Article :

- Complete Coverage about the IBC Form

- All the Forms and returns under IBC Law

- Notification under section 10A of the IBC Code, 2016

- The IBC (Application to Adjudicating Authority) (Amendment) Rules, 2020

www.carajput.com