Table of Contents

- Complete Explanation On Ibc Section 29a Eligibility Check

- Ibc Section-29a clearly States That

- (a) Is An Undischarged Insolvent

- (b) Is A Wilful Defaulter

- (c) An Account Of A Corporate Debtor

- (d) Has Been Convicted For Any Offense Punishable With Imprisonment –

- (e) Is Any Disqualified To Act As A Director

- (f) Is Prohibited By sebi From Trading In Securities/ Accessing securities Markets;

- (g) Has Been A In The Management Or Promoter Or Control Of A Cd.

- (h) Has Executed A Guarantee In Favor Of A Creditor

- (i) [is] Subject To Any Disability, Corresponding To Clauses (a) To (h), Under Any Law In A Jurisdiction Outside India; Or

- (j) Has A Connected Person Not Eligible Under Clauses (a) To (i)

- Rajput Jain And Associates - 29a Eligibility Check Services

Complete Explanation on IBC Section 29A Eligibility Check

IBC Section-29A clearly states that

“A person shall not be eligible to file a Vibal resolution plan, In case that person, or any other person acting jointly or in concert with a such person—

As above expression in the section 29A of IBC Act - ‘acting jointly or in concert’ signifies 2 or more persons acting together as a group. In the matter of ARCELOR MITTAL INDIA PRIVATE LTD. VS S. K. GUPTA, Honorable Supreme Court stated that, above section 29A stated on “acting jointly” in opening sentence of Sec 29A cannot be confused with “joint venture agreements”. Its means that Few persons come together & start acting “jointly” in sense of acting together.

(a) Is an Undischarged Insolvent

(b) Is a Wilful Defaulter

As per the Master Circular of RBI Guidelines issued under Banking Regulation Act, 1949;

A Willful Defaulter is a borrower – when borrower fails to fulfil his obligations—even when borrower is capable of doing so—does not use the money for the intended use, embezzles the money without using it for that purpose or using it for another purpose, disposes of the property or assets provided to secure the loan without the lender's knowledge, misrepresents falsifies reports, & engages in fraudulent transactions.

(c) An account of a corporate debtor

under the Mgt or direction or control of the aforementioned person, or of whom the aforementioned person is a promoter, designated as a NPA in line with RBI guidelines issued under the Banking Regulation Act, 1949 & at least a year has passed between date of such classification & start of Corporate Insolvency Resolution Process.

This essentially basic means of above guidance that an entity that is declared insolvent & whose Loan or Bank accounts are classified as NPA is not eligible to be become as a resolution applicant if it has not been able to pay past old Overdue amounts, including interest & charges related to account, before submission of the resolution plan for 1 or more years. The Honorable supreme court read this section, examined concept of "control," & noted that term "control" in IBC Section 29A(c) only refers to positive control in Honorable supreme court ruling in the matter of Arcelor Mittal India Private Limited vs. Satish Kumar Gupta & Ors.

In the above Honorable supreme court Judgment clear that "Section 29A is a transparent provision; & care must be taken to ensure that person who is managing corporate debtor do not reappear in a different capacity to take over business without first repaying old outstanding their debts."

That’s means that anyone who wants to file a resolution plan and is operating jointly or in concert with other people who are categorised as NPA and whose debts have not been paid off for a minimum of a year prior to the start of Corporate Insolvency Resolution Process is ineligible to do so. But if he make all the overdue payment and interest thereon & charges relating to NPA accounts before submission of resolution & Moreover Resolution Applicant should Not be a related party to the CD.

(d) Has been convicted for any offense punishable with imprisonment –

(i) for 2 years or more under any Act specified under the 12th Schedule; or

(ii) for 7 years or more under any law for the time being in force:

Moreover, the definition of "connected persons" is broad & includes the holding company, subsidiary, associate company, or any related party of the proposed acquirer, its promoters, the board of the acquirer, and the proposed management of the corporate debtor or its promoters. As a result, the ineligibility does not apply to these individuals. This need, But same would not apply to a resolution applicant that is a financial entity and isn't connected to the corporate debtor.

(e) Is any disqualified to act as a director

As per Sec 164(1) of the Co. Act, 2013, If a Director is found to be mentally incompetent, they lose their eligibility. Not having enough money, He/she has been found guilty of offences involving related party transactions (under section 188 of Companies Act, 2013), has been sentenced to six months in prison for an offence involving moral turpitude, has an order from the court or tribunal declaring him disqualified, and his case regarding insolvency or unsoundness of mind is still pending. Director is prohibited from taking or acquiring DIN No .

(f) is prohibited by SEBI from trading in securities/ accessing securities markets;

The Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Markets) Regulations, 2003, specifically mentions certain activities that are prohibited under Sections 3 & 4. These activities include buying, selling, or dealing in securities in a fraudulent manner; engaging in fraudulent activity when securities are issued, listed, or proposed to be listed on a recognised stock exchange; & dealing in securities unfair trade practiced & in a fraudulent manner.

(g) Has been a in the management or promoter or control of a CD.

In this above class of indelibility come into picture when undervalued transaction, fraudulent transaction, extortionate credit transaction, a preferential transaction, has taken place & in respect of which an order has been made by NCLT under IBC Code:

This ineligibility takes effect when in the management or the promoter or control of a CD is involved in undervalued transaction, fraudulent transaction, extortionate credit transaction or preferential transaction,

Consequently, it is evident that the concept of "management or control" is based on the idea of "Noscitur a sociis." Put simply, it's a rule that it’s a above rule used by NCLT or NCLAT courts in interpreting legislation by interpreting ambiguous words & understanding them with words with which it is associated in above context.

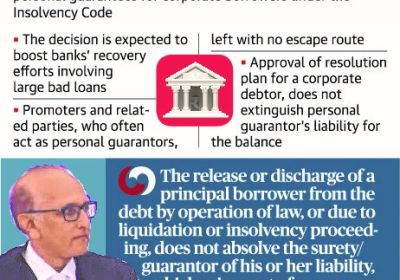

(h) Has executed a guarantee in favor of a creditor

With respect of a CD against which an application for insolvency resolution made by such creditor has been admitted under this Insolvency and Bankruptcy Code 2016 & such guarantee has been invoked by creditor & remains unpaid in part & full.

This ineligibility occurs when a person takes a guarantee for a corporate debtor who is Insolvent. In this reference on Important Judgments come out in relation to person takes a guarantee for a corporate debtor who is Insolvent, In this cases where a creditor has not invoked guarantee or made a demand, guarantee should not be prohibited. Which means that No default in payment of dues has been made & therefore cannot be covered u/s 29A(h) of the Insolvency and Bankruptcy Code, 2016. ( RBL BANK LTD. VS. MBL INFRASTRUCTURES LTD)

(i) [Is] subject to any disability, corresponding to clauses (a) to (h), under any law in a jurisdiction outside India; or

In common parlance-any of above related ineligibility arising from above mentioned clause in section 29A(i) will be effective under any law outside borders of India or in India.

(j) Has a connected person not eligible under clauses (a) to (i)

As stated by IBC law meaning of connected persons includes holding company, associate company, subsidiary, or any related party of the proposed acquirer, its promoters, the acquirer's board, as well as the proposed management of the corporate debtor or its promoters, are all included in the very broad definition of "connected persons," However, connected persons would not apply to a resolution applicant that is a financial organisation and isn't connected to the corporate debtor. This ruling come in to picture from the the supreme court provided this rationale judgement of M/s Arcelor Mittal India Private Limited vs. Satish Kumar Gupta & Ors,.

Insolvency and Bankruptcy Code, 2016 is still at starting stage & will required more interpretation before it settles down. Now hope for better Insolvency and Bankruptcy laws to be made & implemented for better growth & development of Indian Nation.

Rajput Jain and Associates - 29A Eligibility Check Services

RJA uses advanced systems & technologies to get comprehensive complete corporate due diligence on any given target timeline. Client can take the help & support on find out the solution on eligibility Check Services u/s 29A to checks on any given target & CD’s related parties on Rajput Jain and Associates

29A Cerificate under the IBC law