TDS

Frequently Asked Questions(FAQ’s) on TAN

RJA 03 Oct, 2021

Frequently Asked Questions(FAQ’s) on TAN Ques-1: How am I supposed to get my TAN number online? Ans. You can register for a TAN number of websites; you need to visit the local TIN-NSDL site by clicking on .https://carajput.com/services/tan-registration.Php Now, clicks New TAN ...

Limited Liability Partnership

Conversion of firm to Limited liability Partnership

RJA 02 Oct, 2021

SUMMARY OF CONVERSION OF FIRM TO LLP At first, the applicant is required to have a Digital Signature Certificate, to authorize all the documents online. It is mandatory for all the partners to hold a digital signature. After obtaining DSC, the designated partners are required to apply for a DPIN (...

GST Registration

key changes in new gst amendment w.e.f. 1st Jan 2022

RJA 01 Oct, 2021

Important Change in Compliances for New GST Registrants From 1st Jan 2022 From 1st January your GSTR-1 filing could be blocked As per CBIC's newest advisory, GSTR-1 filing will be blocked as of January 1, 2022, if a monthly GSTR-3B return filer has not submitted GSTR-3B for the previous month. ...

NGO

FAQ's on NGO's Tax benefits & Tax Incentives

RJA 29 Sep, 2021

FAQ's on NGO's Tax benifits & Tax Incentives Q.: What is the difference between Section 12A and Section 12AA? Everything you need to know about Sections 12A and 12AA If certain circumstances are met, a trust, society, or section 8 company can apply for registration under Section 12A of ...

FEMA

COMPARISON BETWEEN BRANCH OFFICE & COMPANY

RJA 26 Sep, 2021

COMPARISON BETWEEN BRANCH OFFICE & COMPANY Branch Office: It implies an institution founded by parent company to perform the similar business operations at different locations. one in every of the common strategies of the businesses to expand their business at the national ...

GST Filling

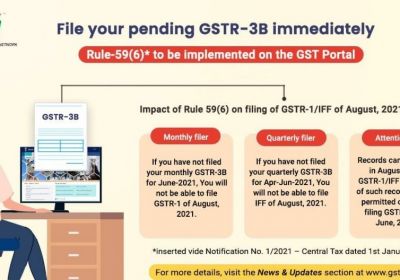

New Restrictive GST Rule Implementation of Rule-59(6) is a useful tool for taxpayers & tax officers

RJA 26 Sep, 2021

GSTN advises tax payers to register their pending GSTR 3B as early as possible after the implementation of Rule 59(6) on the GST Portal on 1st September. The Goods and Service Tax Network (GSTN) has issued an advise on the implementation of Rule 59(6) of the CGST Rules, 2017 on the ...

RBI

RBI warns of KYC fraud. Here’s what you should do.

RJA 26 Sep, 2021

RBI warns of KYC fraud. Here’s what you should do. ·The Reserve Bank of India (RBI) has issued a warning to the public against frauds perpetrated in the name of KYC updation. ·The RBI said in a statement that it has received complaints and information regarding ...

COMPANY LAW

FAQ’s on Winding Up of Private Limited Company

RJA 25 Sep, 2021

FAQ’s on Winding Up of Private Limited Company Why is liquidation important? Liquidation is important for the subsequent reasons- After the completion of the liquidation process, the directors as well as the other company officials bear no liability against any stakeholder. If&...

IBC

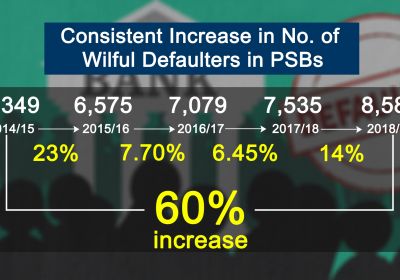

Wilful Defaulters under IBC 2016

RJA 24 Sep, 2021

WILLFUL DEFAULTERS UNDER IBC 2016 BRIEF INTRODUCTION It has been proposed that, as the promoters of defaulting companies have been vested with the right to bid for their own businesses, the same acts as a blockage in the insolvency proceedings. However, wilful defaulters or those borrowers who have diverted ...

IBC

GST & MCA on Insolvency Code Under IBC Code

RJA 24 Sep, 2021

GST & INSOLVENCY CODE It appears that the economy poised for certain substantial gains, arising from the structural reforms, being applied by the govt. Over the years, The ET Awards ceremony has provided the right platform for government and industry to come back ...

Financial Services

FAQ's on Start-Up Fund Raising

RJA 24 Sep, 2021

FAQS ON START-UP FUNDING Q.: What is Business financial Services ? Ans.: Business financial Services Business Financial Services is a term that refers to the services offered by the finance industry. Business Financial Services is another term for companies that deal with money management. Banks, investment banks, insurance companies, credit ...

Goods and Services Tax

WRITING OFF OF UNREALIZED EXPORT BILLS

RJA 23 Sep, 2021

WRITING OFF OF UNREALIZED EXPORT BILLS BRIEF INTRODUCTION Exports are available with various incentives in India like refund of taxes paid with regard to export, various duty-free scripts, Duty Drawbacks etc. However, these incentives would be available, provided the realization of consideration in respect of export&...

FCRA

FCRA Returns Forms & Related Documents required under FCRA Act

RJA 21 Sep, 2021

Returns under FCRA 2010 S. No. Return Name Due Date Details to be Provided 1. FC - 1 Within 30 days of receipt (Part A&B) Within 45 days of being nominated (Part C) Intimation of receipt of foreign contribution by way of gift / as Articles / Securities / by candidate for Election 2. FC - 2 ...

NBFC

Returns by NBFC with RBI, NBFC Return Filing

RJA 20 Sep, 2021

Returns by NBFC with RBI According to the Master Direction- Non-Banking Financial Company Returns (Reserve Bank) Directions, 2016, NBFCs are required to file various returns to RBI regarding deposit acceptance, prudential standards compliance, ALM, and other matters. The master directives establish the groundwork for RBI-compliant and secure NBFC operations. The NBFC ...

AUDIT

ASSESSMENT OF BUSINESS FOR FUTURE SUCCESS

RJA 18 Sep, 2021

ASSESSMENT OF BUSINESS FOR FUTURE SUCCESS BRIEF INTRODUCTION In today’s world, internal audit has attained greater attention, with the growth and expansion in corporates and organizations. Many large enterprises and corporations choose to create their internal audit services and departments, training their employees. When deciding ...

AUDIT

Internal audit strives to add value to organizations valuation

RJA 18 Sep, 2021

INTERNAL AUDIT Internal audit is the best tool for identifying opportunities to enhance the efficiency of activities, allowing you to get the information necessary to realize the goals and solve the issues facing the subject within ...

AUDIT

Assessment of Business Risk for future success,

RJA 18 Sep, 2021

ABOUT BUSINESS RISK In an extremely complex and dynamic environment, an auditor is vested with the responsibility to consider various risks associated with the business and the same be inculcated in their audit plan. Audit principles and methodologies frequently use the concept of risk to raised orient audit ...

AUDIT

Common Mistake Encountered in Businesses

RJA 18 Sep, 2021

COMMON MISTAKES ENCOUNTERED IN BUSINESSES GENERAL ACCOUNTING MISTAKES Accounting is usually seen by the entrepreneur as a necessary evil. Everyone knows that accounting is crucial and necessary for any business and yet the vast majority dread it. it's true that accounting still requires&...

NRI

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS

RJA 18 Sep, 2021

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS BRIEF INTRODUCTION It is commonly seen that taxation system is an integral part of Indian economy. In India, several taxes have been levied on products and services, being available to the citizens of India. These taxes are used to finance ...

NRI

NRI RECOGNITION OF TAXABLE INCOME IN INDIA

RJA 18 Sep, 2021

RECOGNITION OF TAXABLE INCOME IN INDIA NRIs are required to tax on any sought of income, being earned in India. Thus, as an NRI, one must pay tax in respect of following income - • Income earned or received in India. • Salary received or is expected to be received ...

Goods and Services Tax

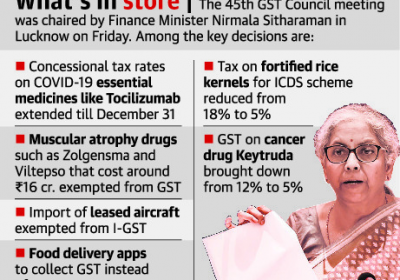

Key highlights of 45th GST Council Meeting : GSTN

RJA 17 Sep, 2021

Key highlights of 45th GST Council Meeting : GSTN the GST Council had its 45th meeting On the 17th of September 2021. This meeting, which took place in Lucknow, was keenly anticipated by the taxation community. It's interesting to note that this was the first time the two of them ...

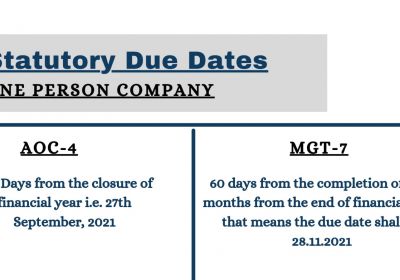

One Person Company

Overview On One Person Company(OPC) Annual Compliances

RJA 16 Sep, 2021

One Person Company Annual Compliances BRIEF INTRODUCTION One Person Company is all about a revolutionary idea, being introduced under the Companies Act 2013. In the previous Companies Act, being in force, companies can be formed, with a minimum of two directors and shareholders, which we call as Private Limited Company. However, ...

GST Compliance

Complete guide on E- commerce operator

RJA 14 Sep, 2021

COMPLETE UNDERSTANDING E COMMERCE OPERATOR MEANING Electronic Commerce Operator is basically a person, undertaking activities related to owning, operating or management of digital or electronic facility. And Electronic Commerce has been defined to mean the availability of products or services or both, including digital products over digital ...

SEBI

Compliance due date requirement under SEBI (LODR) Regulations

RJA 14 Sep, 2021

Compliance Requirement under SEBI (Listing Obligations and Disclosure Requirements) (LODR) Regulations, 2015 SEBI – Securities Exchange Board of INDIA 1. Half Yearly Compliances: Sl. No. Regulation reference (Reg.) Compliance Particulars Timeline / Due Dates Quarter 1 (For the Quarter Ended June) Due Dates 1 23(9) Disclosures of related party transactions 30 days after the release of ...