Table of Contents

COMPLETE UNDERSTANDING E COMMERCE OPERATOR

MEANING

- Electronic Commerce Operator is basically a person, undertaking activities related to owning, operating or management of digital or electronic facility.

- And Electronic Commerce has been defined to mean the availability of products or services or both, including digital products over digital or digital network.

- So all companies providing their product or service by means if internet have been covered under this definition. It is to be noted that digital mode covers websites and apps used to conduct business activity.

- It is additionally cleared by CBEC in its FAQ on e-commerce operator that an individual who is selling own goods or services through self-hosted website shall also be considered as e-commerce operator.

GST IMPLICATIONS ON E COMMERCE OPERATOR

The one who is selling only own goods or services is required to undertake registered under GST regardless of their turnover. Threshold limit of Rs. 20 lakh or 10 lakh isn't applicable on them. Therefore whether or not he makes a sale of Rs. 1 he's required to obtain GST registration.

- If an e-commerce company is purchasing goods from multiple vendor and selling through own website, then also the said provison is applicable because in such case company isn't working as aggregator. The corporate entity is liable for the payment of GST at time of buying goods from vendors, however, in case of aggregators, GST will be applicable when they make supplies to their final customer.

- Also it has been observed that a person registered under GST, would be susceptible to charge GST in respect of all sales made by them, irrespective of the nature and mode. This is often a giant burden for persons who just want to try out this fast increasing stream.

- For example – someone who has turnover of Rs. 15 lakh from their cleaning services. He doesn’t require to get registered and charge GST (He can register voluntarily). He now wants to start out an app so that their customers can use app to induce clothes picked up and dropped at their home. Now with start of app and making first sales through app, he becomes responsible for GST charge on its total sale of Rs. 15 lakh. GST rate on cleaning services is 18%. This implies that once the person makes initial sales, he would be liable to make payment of Rs 2.7 lakh GST on the same. Input tax credit and all the other rules are like a normal dealer.

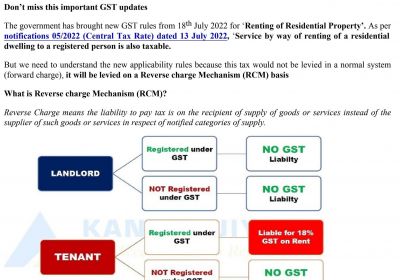

GST ON PERSONS COVERED UNDER SECTION 9(5)

- E-commerce aggregators are required to take up registered regardless of the threshold limit. However, the suppliers making supplies through such aggregator would be allowed to take up the advantage of threshold limit for GST registration.

- The companies, being notified under section 9(5), would also be required to collect TCS, on behalf of the suppliers, making services using its platform. Only services are often notified under this section.

- Since these companies are collecting tax by itself, there's no doubt of collecting TCS under section 52 from payment made to the suppliers.

NOTIFIED SERVICES UNDER SECTION 9(5)

- Services by way of transportation of passengers by a radio-taxi, motorcab, maxicab and motor cycle for instance – Ola, Uber. Such services also are covered under section 9(3) i.e reverse charge. And it's also notified via notification no. 5/2017 that if a supplier provides only those services on which entire tax is paid on reverse charge then such supplier isn't required to take up GST registration. So, if there's someone operating 5 cars through uber and has turnover of Rs. 25 lakh then also he's not required to register.

- Services in respect of providing of accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places, being meant for residential or lodging purposes, shall be liable for GST registration. For instance – Goibibo, Makemytrip. Therefore if a hotel has turnover of over Rs. 20 lakhs then section 9(5) isn't applicable and hotel itself is susceptible to get registered and pay GST and covered within the below mentioned point.

PERSONS NOT COVERED UNDER SECTION 9(5)

- Suppliers providing their goods using websites and apps like flipkart, shopclues shall be covered under this section. Such a corporation and also the suppliers supplying goods or through it are required to take up GST registered regardless of the threshold limit.

- Such companies are required to collect TCS at the rate of 1% of net taxable supplies. Net taxable supplies mean the supplies made through such aggregator, as reduced by the amount of sales return, if any. The said amount of TCS is highlighted in the GSTR-2 of the suppliers and the same shall be availed as Input tax credit. If the products or services don't seem to be taxable then there's no requirement for TCS.

- Aggregator is additionally required to file a statement of TCS collected with in 10 days from the end of the month.

SHARED STORING FACILITY

- Any registered person can declare a premises as a place of business if he has requisite documents to be used of the premises as his place of business (like ownership document, agreement with the owner etc.) and there's no restriction about use of a premises by multiple persons.

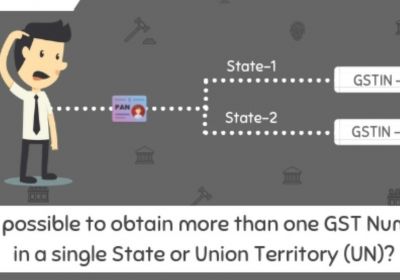

GST REGISTRATION FOR E-COMMERCE OPERATORS

- It is mandatory for e-commerce operator (as defined above) to get GST registration regardless of the value of supply made by them.

- E-commerce operators should register irrespective of the turnover. Threshold limit of Rs. 20 lakh/10 lakh isn't applicable to e-commerce operators. they're not allowed to register under the composition scheme.

- All the members undertaking supplies using e-commerce websites, are mandatorily required to obtain GST registration, irrespective of their value of supply. The said entity should apply for GST registration, whether they own such websites and goods supplied, or not.

Services included under section 9(5) of CGST Act, 2017:

- In case services notified u/s 9(5), the e-commerce operator is prone to pay tax, on behalf of the suppliers. Where such services have been supplied using its platform, all the provisions of the Act shall be applicable to such e-commerce operator as well.

TAX COLLECTED AT SOURCE ON E-COMMERCE OPERATOR

- Tax Collected at Source (TCS) provides for a mechanism, wherein the e-commerce operator is required to collect a specified percentage of payment to e-commerce supplier, when the supplier make supply of specified goods or service using its portal.

- TCS deducts at the rate of 1% on the net value of the products or services supplied through the e-commerce operator i.e. an e-commerce operator is required to deduct 1% TCS on the net taxable value of supplies.

- Such amount of TCS be collected in respect of supplies, wherein the supplier has collected payment from the customer.

- The said amount of TCS collected must be remitted to government within 10th of the next month, from the month in which the invoice is generated.

- TCS are available as credit while filing GSTR-2 return.

PLACE OF SUPPLY FOR E-COMMERCE OPERATORS

GST is destination based tax. Goods / services are going to be taxed at the place where they're consumed meaning thereby place from where goods / services are sold isn't in any respect relevant, however, the place wherein the goods or services supplied, has been consumed, shall be considered as the place of supply under GST.

GST RETURN FILING

- GSTR – 8 return shall be filed by E-commerce operator after the end of every month and the same be filed on and before 10th of the succeeding month. Under GSTR-8 return details of outward supplies of products and repair made by sellers through the platform and amount of TCS collected is to be reflected.

- E-commerce operator is additionally required to file an annual return and the same be filed by 31st December coming after the end of the relevant FY.

- The amount of TCS, being collected and deposited with the government, would be reflected in the GSTR – 2 of the e-commerce operator.

- The E-commerce supplier is required to disclose the following details of supplies, as declared in FORM GSTR-8, and both the details should match with each other.

• GSTIN of the supplier.

• GSTIN or UIN of the recipient, if the recipient could be a registered person.

• State of place of supply.

• GST Invoice number of the supplier.

• Date of invoice of the supplier.

• Taxable value; and

• Tax amount

GSTR 1 RETURN

It may be a monthly return filed for sales or outward supplies. Every person registered under GST is required to file GSTR-1, in order to provide details of their outward supplies. 10th day of following month is that the maturity for filing GSTR – 1 by all entities.

GSTR 2 RETURN

It may be a monthly return of purchases or inward supplies. Every registered person is also required to file GSTR 2 return, however, the same is not required on the part of an Input Service Distributor, non-residential taxable person and person required to deduct TDS or e-commerce operator system. The due date is 15th day of succeeding month.

GSTR 3 RETURN

- It’s a monthly GST return that's divided into part A and B. Part A contains the data that's furnished through returns in forms GSTR-1 and GSTR-2, provides for other liabilities of previous tax periods. this may be generated electronically. On the other hand, Part B contains the details of liabilities, interest, penalty, and refund claimed from cash ledger. Also, it's auto-populated. The liabilities is calculated based on GSTR – 1 and after adjustments for Input Tax Credit claimed in GSTR-2.

- Every registered person must file GSTR-3 return apart from the following except an Input Service Distributor, non-residential taxable person and one that is required to deduct the TDS or e-commerce operator system. The due date for filing of GSTR-3 is 20th of the succeeding month.

GST ON GOOD RETURNED BY BUYERS

The e-commerce operator is required to collect TCS only on the amount of net taxable value of the supplies. Net taxable supplies mean the value of supplies of products or services made during any month, as reduced by the supplies returned to the suppliers during the said month.

E-COMMERCE SELLERS GST REGISTRATION NEEDS

Persons supplying goods/services through an e-commerce operator shall be classified as an e-commerce seller. They'll be selling goods/services through one or more e-commerce operators and should also sell through their shops/office together with such platforms.

Such sellers will be classified into three categories for the aim of applicability of GST provisions. They are

- Selling goods – Such sellers are required to take up registered under GST whether or not there turnover is less than the threshold limit of Rs. 40/20/10 lakh. Thus, they would be required to obtain GST registration before undertaking any e-commerce supplies. All platforms like Amazon, Flipkart etc. require their suppliers to quote their GSTIN at time of registration on theor platform.

- Suppliers providing services apart from those mentioned under Section 9(5), would be required to obtain GST registrtaion and collect GST, where their turnover exceeds the prescribed threshold limit of Rs 20/10 lakh. And if they're not registered then GST isn't liable on such transaction done through e-commerce operator.

- Suppliers providing services mentioned under Section 9(5), would be susceptible to obtain GST registration, irrespective of their turnover threshold limit.

FAQs On E-COMMERCE Buniess

Q.: Who is considered As E-Commerce Operator?

- Electronic Commerce Operator is basically a person, undertaking activities related to owning, operating or management of digital or electronic facility.

- And Electronic Commerce has been defined to mean the availability of products or services or both, including digital products over digital or digital network.

- As per the above definition someone who is providing a platform for others to sell goods or services is taken into account an e-commerce operator. Main examples of such operators selling goods are Amazon, Flipkart, Snapdeal and operators selling services are Uber, Ola, Swiggy, Urban Clap.

- A person selling goods or services through his personal website isn't an e-commerce operator and so below provisions don't apply to them. Such a suppliers is required to charge GST and file returns.

- A businessman has registered on Justdial/Indiamart. A buyer reaches out to such seller and makes an order to purchase certain item. Such a transaction has taken place using the Justdial/Indiamart and hence, cannot be considered as e-commerce operator transaction.

Q.: Are e-commerce operators mandatorily required to take up GST registration?

Yes, GST registrtaion is mandatory for all e-commerce operators, irrespective of their turnover. Thus, before making any supplies as an ecommerce operator or within 30 days of making such supplies, the supplier shall apply for GST registrtaion.

Q.: Should the sellers be required to take up GST registration, even in case of using e-commerce platforms?

Yes, suppliers supplying their product using e-commerce platforms, are required to obtain GST registration irrespective of their sales turnover.

Q.: What is GST TCS?

- Under GST Act 2017, the Ministry of Finance introduced a mechanism, wherein, the e-commerce operator is required to collect TCS, just like TDS. The TCS would be collected where the supplier provides goods or services using a registered e-commerce portal.

Q.: What Is Section 9(5) And Services Covered Under Section 9(5) Of CGST Act?

Section 9(5) states that the govt may specify the categories of services on which e-commerce operator is prone to collect and pay GST as if e-commerce operator is providing the service.

The categories of services specified by the govt under this section

- Services involving transportation of passengers using radio-taxi, motorcab, maxicab and motorcycle.

- Services involving providing of accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places, especially meant for residential or lodging purposes. However, where the turnover of hotel does not exceeds Rs. 20/10 lakh, the provisions of section 9(5) shall not be applicable.

- Services invloving housekeeping, like plumbing, carpentering, excluding the service provided through electronic commerce operator.

Q.: What is the rate of GST TCS?

- TCS shall apply at the speed of 1% on the overall net value of the products or services supplied through the e-commerce operator.

- For example, where the value of the products sold to a customer amounts to Rs.1 lakh, the e-commerce operator is required to collect and deposit Rs.1000 from the payment to be made to the supplier, as Tax Collected at Source.

Q.: What is the due date for remitting GST TCS?

The e-commerce operator shall remit the GST TCS to the govt., within 10 days after the end of the relevant month.

Q.: How to claim the credit of TCS deducted by e-commerce operators?

The supplier is eligible to claim the credit of TCS deducted by the e-commerce operators. The said amount of TCS collected can be used by the supplier to set off their GST liability while filing GSTR 3 or GSTR 3B.

Q.: Can e-commerce suppliers store their goods during a common warehouse?

Yes, suppliers on an ecommerce platform can store their goods at a typical warehouse. However, before storing goods, the supplier is required to add the said warehouse of the e-commerce operator as a place of business on the GST portal.

Q.: Will online travel agents be responsible for TCS?

Yes, online travel agents supplying services using an ecommerce platform would be susceptible to TCS.

Q.: Should e-commerce operators require to file GST returns?

Yes, ecommerce operators are mandatorily required to file GSTR-8 monthly and an annual return. Under the monthly GSTR-8 return, ecommerce operators must provide details of outward supplies of products or services made by sellers through the platform and the amount of TCS collected.

Q.: Who Is susceptible to Collect And Pay GST – E-Commerce Operator Or E-Commerce Sellers?

- Selling Goods – The e-commerce seller is responsible for the collection of GST and pay to the govt.

- Selling services apart from mentioned in Section 9(5) – The e-commerce seller is liable for collection of GST and pay to the govt.

- Selling services mentioned in Section 9(5) – The e-commerce operator is susceptible to collect and pay GST to the govt.

INDUSTRY WISE ANALYSIS AND COMPARISON

|

INDUSTRY |

EXAMPLES OF E-COMMERCE OPERATOR |

REGISTRATION REQUIREMENT |

GST COLLECTION |

|

SELLING GOODS |

AMAZON, FLIPKART, SNAPDEAL |

SELLER IS REQUIRED |

SELLER TO COLLECT |

|

HOUSE KEEPING SERVICES, WITH TURNOVER BELOW THRESHOLD LIMIT |

URBAN CLAP |

NOT REQUIRED |

OPERATOR TO COLLECT |

|

HOUSE KEEPING SERVICES, WITH TURNOVER ABOVE THRESHOLD LIMIT |

URBAN CLAP |

SERVICE PROVIDER IS REQUIRED |

SERVICE PROVIDER TO COLLECT GST. |

|

OTHER SERVICE INCLUDING FOOD AGGREGATORS*, WITH TURNOVER BELOW THRESHOLD LIMIT |

SWIGGY, UBAN EATS, URBAN CLAP (BEAUTICIAN) |

SERVICE PROVIDER TO REGISTER |

SERVICE PROVIDER TO COLLECT GST |

|

HOTEL, WITH TURNOVER BELOW THRESHOLD LIMIT |

GOIBIBO, OYO, MAKEMYTRIP |

HOTEL NOT REQUIRED |

E-COMMERCE OPERATOR TO COLLECT GST. |

|

HOTEL, WITH TURNOVER ABOVE THRESHOLD LIMIT |

GOIBIBO, OYO, MAKEMYTRIP |

HOTEL IS REQUIRED. |

HOTEL TO COLLECT GST. |

|

CAB AGGREGATOR (IRRESPECTIVE OF TURNOVER) |

OLA, UBER |

CAR OWNER REGISTER, PROVIDED THE TURNOVER APART FROM CAB AGGREGATORS, EXCEEDS RS. 20/10 LAKH. |

CAB AGGREGATOR TO COLLECT GST |

FAQ on e commerce operator

Question: Person Selling via e commerce operator whether for input tax credit available on shipping charges refund application can be filled or not because there is large amount of unutilised input tax credit in electronic credit ledger

Answerer: The e-commerce operator is required to collect tax at source(TCS) at the rate of 1% on the net value of taxable supplies made through it by other suppliers. The TCS collected by the e-commerce operator can be claimed as ITC by the e-commerce seller in their GSTR-3B return. The input tax credit can be used to pay the output tax liability or can be carried forward to the next tax period. However, if the e-commerce seller has a large amount of unutilised input tax credit in their electronic credit ledger, they can file an application for refund of the excess input tax credit under the Goods and Services Tax law.

Question: hotel booking via make my trip and others are covered under section 9(5) ? They are already deducting TCS. Will this booking constitute EXEMPT supply ?

Answer: This means that the e-commerce operators are liable to pay Goods and Services Tax on the hotel accommodation services provided through them, as if they are the suppliers of such services. The Goods and Services Tax rate applicable for hotel accommodation services is 12% or 18%, depending on the tariff of the hotel room. And The e-commerce operators are also required to collect tax at source (TCS) at the rate of 1% on the net value of taxable supplies made by other suppliers through them. The TCS collected by the e-commerce operators can be claimed as ITC by the hotel owners in their GSTR-3B return.