Table of Contents

One Person Company Annual Compliances

BRIEF INTRODUCTION

One Person Company is all about a revolutionary idea, being introduced under the Companies Act 2013. In the previous Companies Act, being in force, companies can be formed, with a minimum of two directors and shareholders, which we call as Private Limited Company. However, under the new Companies Act, 2013, a single can also form a company. Where any person forms a One Person Company and registers the same with MCA, there are certain compliances that are required to be complied with by the OPC. So in this article, we would be discussing about the mandatory compliances, which an OPC is required to undertake after its incorporation.

MEANING

According to Section 2(62) of Companies Act, 2013, OPC is basically company incorporated with only one member. Apart from this, members of a company have been termed as the shareholders, since they are the subscribers to MOA.

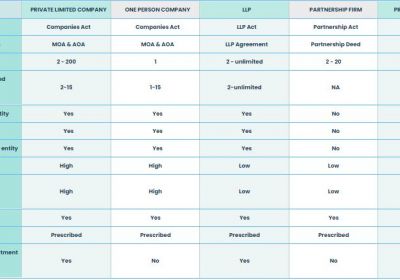

Read More about kind-of-business-structurescan be made in India

DOCUMENTS FOR COMPLIANCE OF OPC ANNUAL COMPLIANCES

- MGT 7 Filing:

- Details of the securities, being held by OPC

- List of debentures and loans

- List of main business activities

- CIN/PAN

- Details of shares and shareholding

- AOC 4 Filing:

- Auditor’s Report

- Director’s Report

- Notice of Annual General Meeting.

- Balance Sheet

- Profit and Loss Account

- ITR 6 Filing:

- Copy of VAT/Service Tax Returns

- Bank Statement for the relevant year

- Copy of TDS Challans/deposits

- Copy of Purchase and Sale invoice.

- Copy of Expense invoice.

- Copy of PAN of the company

- Copy of Credit Card Statement

COMPLIANCE MANAGER

It is provided under the act, that all the returns are required to be signed by the Company Secretary of the OPC and where the OPC is not required to appoint a CS, the same be signed by the Director of the company.

ANNUAL FILING WITH MCA& AGM

MGT 7

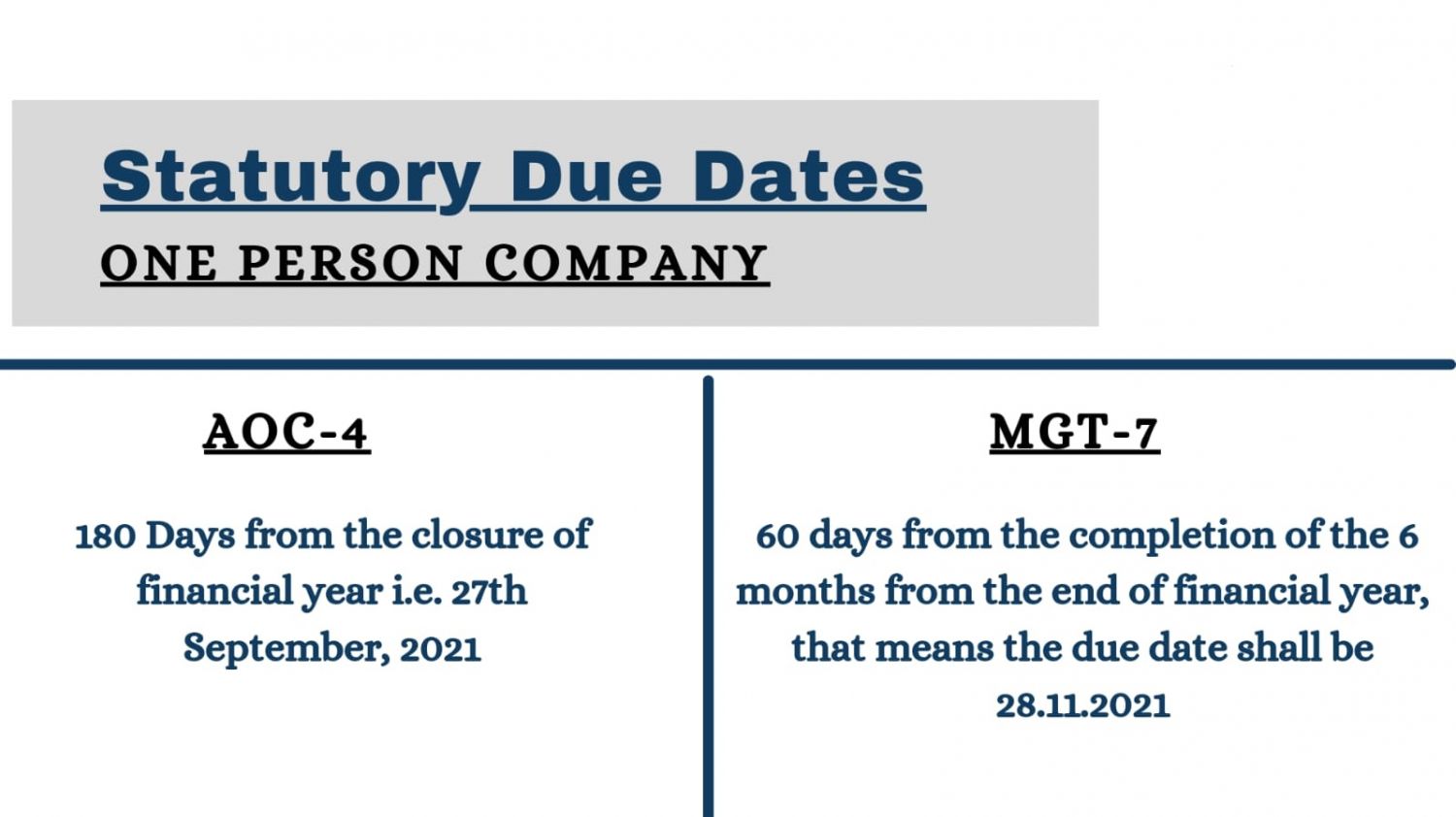

- The OPC is required to filed their Annual Return Filing with the Registrar of Companies.

- The said return be filed as an attachment with Form MGT 7.

- The annual return be signed by the Company Secretary of the OPC.

- In case, the OPC is not required to appoint a CS, the return be signed by the director.

- The said return be filed by OPC, once in every financial year.

- Documents for filing of MGT 7:

- CIN/PAN

- List of main business activities

- Details of shares and shareholding

- List of debentures and loans

- Details of other securities held by the company

INFORMATION PROVIDED UNDER ANNUAL RETURN

- The annual return must disclose the information and documents in respect of compliance certificate, address of the registered office, register of members, details of shares and debentures holders, information in respect of management of company, details of debt owned by the company.

- The annual return shall also disclose the shareholding pattern of the Company, along with the changes in directorship in a particular FY and details of securities transferred.

AOC4

- As pe the Companies Act 2013, OPC is required to file their Audited Financial Statements in E-Form AOC 4.

- The said form shall be signed by the Board of Directors of the company.

- AOC-4 form must be filed within 180 days from the end of the relevant financial year and the same be filed with ROC.

- The financial statement should consist of Balance Sheet, Profit and Loss Account, Audit report, and notes to the accounts.

- Also, the OPC is required to appoint a practicing Chartered Accountant as the auditor of their company and such an appointment be made within 30 days from the date of incorporation.

FORM ADT-1

- Where the OPC appoints an auditor for their company, the same is required to file Form ADT-1 within 15 days from the date of conclusion of first AGM.

- In the First AGM, the OPC is required to appoint a CA as the auditor of the said OPC, and the auditor shall hold the office as an auditor, till the conclusion of 6th AGM.

- It is to be noted that form ADT 1 shall not be filed, in respect of appointment of First Auditor.

- However, where any subsequent Auditor is appointed, the OPC would be required to file Form ADT-1 at every appointment of auditor.

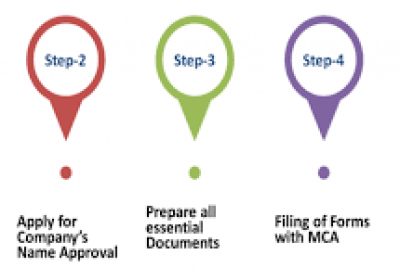

PROCESS OF E FILING OF FORMS

The forms AOC4 , MGT7 and ADT-1 can be filed online by following the given procedure -

- The first step is to visit the MCA website

- Download the relevant E form from the website.

- Then you have to fill out the form

- Then you have to click on the upload E form button

- Then you have to upload your E form.

- After uploading of E form, the system will show you a fee to be paid

- You can pay your fee online

Apart from filing of different forms, an OPC shall conduct at least 2 board meetings in each Financial year. Also, unlike other companies, OPC is not required to hold or conduct compulsary Annual General Meeting in each of the FY.

Filing of IT returns, Financial statement, and annual return are mandatory for every OPC. Every year, OPC is required to comply with the compliances, as provided under various laws. For the ease of compliance, all these filings have been provided with an online platform; where the applicant can file the requisite forms online itself.

So if you have incorporated an OPC, you would be liable to comply with all the above-mentioned compliances. Otherwise, you might face certain legal problems, along with hefty fines. Apart from annual filings, OPC is also required to comply with regulations of TDS, GST, PF and ESI and some others event based compliances.