NRI

Analysis of NRI Fixed Deposits Investing with Tax Implications

RJA 16 Nov, 2021

Analysis of NRI Fixed Deposits Investing with Tax Implications Are you considering about investing in India? Are you worried about the tax implications of being a non-resident alien? The investment prospects in India may be tailored to meet the needs of NRIs, and they can enjoy a hassle-free banking and ...

Limited Liability Partnership

Limited limited Partnership Strike Off (Closure)

RJA 13 Nov, 2021

LLP Strike Off (Closure) E- Form 24 is needed to be filed for striking off the LLP Name under of Rule 37(1)(b) of LLP Rules 2008. Morover, ROC also has power to strike off any defunct Limited limited Partnership after fullfil the requirments himself of the need to strike off &...

Goods and Services Tax

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline

RJA 12 Nov, 2021

GSTN Issue GST Offline Tools for Download and Prepare GSTR Returns Offline Under GST regime various activities related to GST to be done online like GST registration, GST refunds, GST filing, GST application & lot of other. GST taxpayers must go to the GST site online and fill out the ...

INCOME TAX

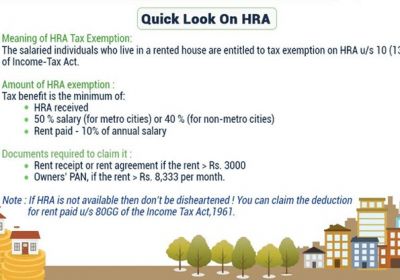

How to claim HRA allowance while Filing Income tax return?

RJA 11 Nov, 2021

How to claim HRA allowance, while Filing Income tax return? HRA is one of the most significant benefits accessible to salaried workers (House Rent Allowance). You can utilise the HRA to partially or totally lower your tax liability if you are a salaried individual who lives in a leased home. ...

TDS

After filing a regular TDS return, we may receive a TDS notice

RJA 11 Nov, 2021

After filing a regular TDS return, we may receive a TDS notice for: Late fee penalty (u/s 234E) Some interest pending amount (u/s 201(1A), 206C(7)) Interest u/s 220(2) Short deduction Or for a variety of other reasons that can be addressed simply by include challan in the ...

OTHERS

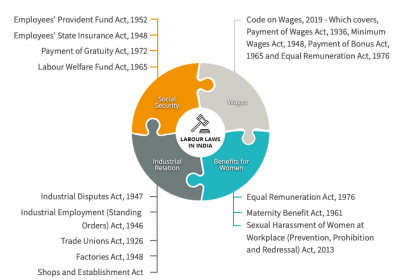

What are the Statutory Compliance of Manufacturing Industry?

RJA 07 Nov, 2021

What are the Statutory Compliance of Manufacturing Industry Statutory compliance refers to a company's procedures for adhering to legislation created by the local, state, or federal governments. Manufacturing industries employ a large number of labourers, employees, and workers, who provide a wealth of human resources and potential. As a ...

Goods and Services Tax

Key Analysis of Rate Notifications issued by CBIC

RJA 06 Nov, 2021

Key Analysis of Rate Notifications issued by CBIC 45th GST Council, chaired by the Honorable Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman, will be held in Lucknow on September 17th, 2021. The council's recommendations included some reliefs in view of the COVID pandemic, compensation cess utilisation, GST law ...

Goods and Services Tax

Whether Self-Certification of GSTR-9C really a Good Step?

RJA 06 Nov, 2021

Whether GSTR-9C Self-Certification Really a Good Step? The Finance Act of 2021 implemented amendments to the CGST Act, eliminating the need to provide a CA-certified Reconciliation Statement in GSTR 9C. GST Taxpayers with a revenue / sale receipt more than INR 5 CR in the last FY are needed to submit &...

INCOME TAX

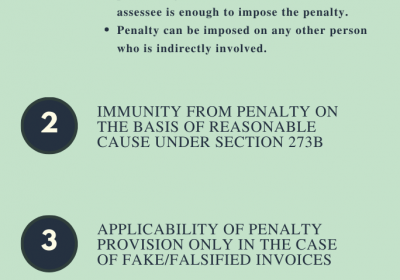

Penalty for false entry or fake invoices -New Section 271AAD

RJA 06 Nov, 2021

Penalty for false entry or fake invoices -New Section 271AAD The Finance Bill 2020 added New section 271AAD under Penalties Imposable - Chapter XXI With effect from 1-04-2020. Section 271AAD "During any proceeding under income tax Act, Without prejudice to any other provisions of income tax Act. &...

Goods and Services Tax

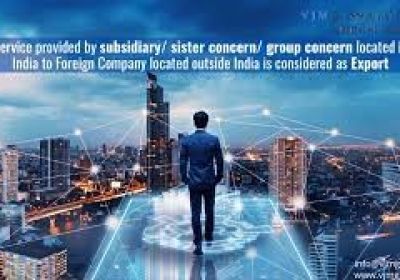

Export considered as a service offered by a sister concern located in India to a foreign Co. Abroad

RJA 06 Nov, 2021

Export is considered as a service offered by a sister concern, subsidiary or group concern located in India to a foreign company located outside India. There are major benefits to "exporting" goods or services. To constitute a transaction as "Export," however, a set of conditions must ...

Financial Services

Top 10 Financial Services Companies in India

RJA 05 Nov, 2021

Top 10 Financial Services Companies in India India’s diverse and comprehensive financial services industry is & supply drivers (new service providers in existing markets, new financial solutions and products, etc.) and growing rapidly, owing to demand drivers (higher disposable incomes, customized financial solutions, etc.). The Indian financial services ...

OTHERS

What are the Roles of a Chartered Accountants ?

RJA 05 Nov, 2021

How does a Chartered Accountants help in tax planning? Tax planning is not about avoiding taxes; it's about minimising them by taking use of allowances, deductions, refunds, concessions, and exclusions that are available within the legal framework. In reality, it's not as simple as it appears. A Chartered ...

INCOME TAX

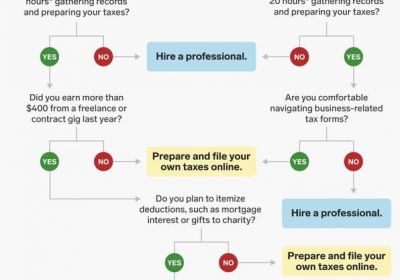

Why should you hire a CA as tax consultant?

RJA 05 Nov, 2021

Why should you hire a Chartered Accountants as tax consultant? To be honest, the necessity is mostly determined by the needs of your company. In today's world, every dollar you save can be reinvested. Accurate accounting guidance will certainly assist you in properly planning your business capital. When it ...

INCOME TAX

What is AIS (Annual Information Statement)?

RJA 05 Nov, 2021

What is AIS (Annual Information Statement)? Annual Information Statement (AIS) is a comprehensive view of information for a taxpayer displayed in Form 26AS of income tax portal. Taxpayer Information Summary (TIS) is an details category wise information summary for a income tax taxpayer. Income tax taxpayers can access the “...

Goods and Services Tax

FAQs on GST cancellation, valuation and Classification

RJA 02 Nov, 2021

FAQs on GST canceelation, valuation and Clasification Query1: Whether a person suo moto can apply for revocation of cancellation of registration whose registration has been cancelled by the proper officer and what is the time limit for submitting such application? Answer: Yes, a person ...

Goods and Services Tax

Taxability Position on IRP Under GST

RJA 02 Nov, 2021

GST rate on permanent transfers of IPR in respect of goods has been increased by the CBIC the government must issue clear instructions to avoid future controversies, tax avoidance, and subsequent litigation, as well as proper compliance to promote ease of doing business with regard to applicability of GST on ...

INCOME TAX

Consequences if you do not verify your ITR?

RJA 01 Nov, 2021

Consequences if you do not verify your ITR? What will Consequences if you do not verify your Income tax Return with 120-day deadlines; it could happen that you forgot to do so. The final phase in the tax return process of filing is verification (ITR). The ITR should ...

Goods and Services Tax

How to generate E- Way Bill Under the GST ?

RJA 01 Nov, 2021

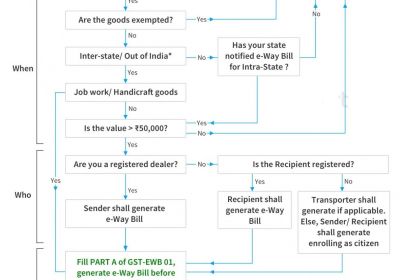

How do I create an eWay Bill? On the e-Way Bill Portal, you can generate an E-Way Bill. All you need is a Portal username and password. Check out our article – Guide to generate e-Way Bill online – for a comprehensive step-by-step guide on e-Way Bill generation. When unregistered ...

OTHERS

Are you looking for a Top CA firm in India?

RJA 01 Nov, 2021

Are you looking for a Top CA (Chartered Accountant) firm in India? We've compiled a list of the Top 11 Chartered Accountants Firms in India as of today, complete with descriptions. There are Top CA firms based in India that have branches both in India and internationally. We also witness ...

OTHERS

Why do you need to hire a Top CA Firm in India?

RJA 01 Nov, 2021

WHY DO YOU NEED TO HIRE A TOP CA FIRM IN INDIA ? Everyone believes that a Chartered Accountants is only needed once a year to file our returns and pay our taxes, which is a major fallacy. CA can assist a company in growing and improving its financial situation. ...

INCOME TAX

CBDT Notifies E-settlement scheme 2021 for pending applications with settlement commission

RJA 01 Nov, 2021

CBDT notifies E-settlement scheme 2021 for pending applications with settlement commission CBDT of Direct Taxes by exercise power u/s 245D (11) and 245D (12) of Income-tax Act has issued a Scheme may be called E-Settlement Scheme 2021 to settle pending income-tax settlement applications transferred to a settlement commission. (Notification No. 129/2021/ F.No. 370142/52/2021...

Goods and Services Tax

SC disallowed Bharti from taking INR 923 Cr GST refund by changing GSTR Return

RJA 30 Oct, 2021

Supreme Court Bench Disallows Bharti Airtel from seeking Rs. 923 crore GST Refund by Rectifying Return Facts- The Respondent was having issues filling GSTR Form 3B due to several glitches in the Online GST Portal, according the brief facts of the case. Despite these issues, the Respondent filed its GST ...

OTHERS

8.5% interest rate on PF Deposits: Approval by Ministry of Finance for FY21

RJA 30 Oct, 2021

8.5% interest rate on PF Deposits: Approval by Ministry of Finance for FY21 The board of retirement fund body of EPFO had recommended an 8.5 percent interest rate for FY21. Ministry of Finance endorsed a 8.5 % interest rate for FY 2020-21 for PF, Board of retirement fund body Employees Provident Fund Organization (...

OTHERS

DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh

RJA 30 Oct, 2021

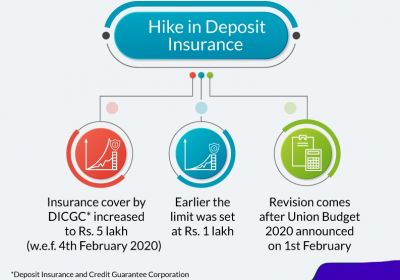

DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh. Deposit Insurance and Credit Guarantee Corporation Act was amended to increase the deposit insurance from earlier INR 1 lakh to INR 5 lakh. DICGC on September 21 announced it shall pay the depositors of the insured ...