COMPANY LAW

Tax & Statutory Compliance Calendar for January 2023

RJA 29 Jan, 2023

Tax & Statutory Compliance Calendar for January 2023 S. No. Statue Purpose Compliance Period Timeline Date Compliance Details 1 Under Goods and Services Tax GSTR-1- Quarterly Returns with Monthly Payment October -December, 2022 13- January 2023 GSTR-1 of registered person with turnover less than INR 5 Crores during the preceding year and who has ...

GST Filling

Time Schedule for Filling of GST Refund Application

RJA 29 Jan, 2023

Time Schedule for Filling of GST Refund Application Punctual refund procedures are important for the best tax management since they open the door to trade by releasing restricted money. The claim for GST Refund process is now completely online and scheduled under the GST regime, throwing the previously time-consuming ...

NRI

CBDT exempts NRIs from Online filing form 10F Upto 31 March 2023

RJA 26 Jan, 2023

Central Board of Direct Taxes exempts non-resident Indians (NRIs) from Online filing form 10F Upto 31 March 2023, The Central Board of Direct Taxes has exempted non-resident Indians (NRIs) without PANs from Online filing Form 10F up to March 2023. Central Board of Direct Taxes notification No. 03/2022, dated July 16, 2022, issued by the Directorate ...

TDS

TDS applicability when Purchased Crypto Currency

RJA 26 Jan, 2023

TDS (Tax deducted at source) when you purchased Bitcoin or Crypto Currency 1% Tax deducted at source on the sales transaction will be applicable if a customer exchanges a Bitcoin or Crypto Currency or Virtual Digital Assets to purchase another Bitcoin or Crypto Currency or Virtual Digital Assets. For Example, if ...

Valuation - Merger & acquisition

Purpose of valuation Report from an IBBI Registered Valuer required

RJA 25 Jan, 2023

Purpose of valuation Report from an IBBI Registered Valuer required We've compiled a list of reasons why you should get a business valuation: Change in ownership due to retirement or succession for the heir. Gifting shares of the business to your successors. Merger with another entity New shareholders addition ...

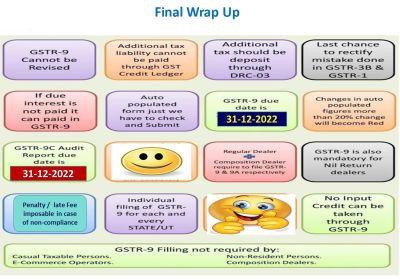

GST Filling

Clarification on HSN code Summary in annual GSTR 9 Return

RJA 26 Dec, 2022

Key Clarification on Harmonized System of Nomenclature Code Summary in annual GSTR 9 Return Annual GSTR 9 Return Disclosure of Harmonized System of Nomenclature Code Summary. Harmonized System of Nomenclature Code Summary should be after net of Credit Note & Debit Note/adjustment. Exempted & Taxable Supply Harmonized System of Nomenclature Code ...

INCOME TAX

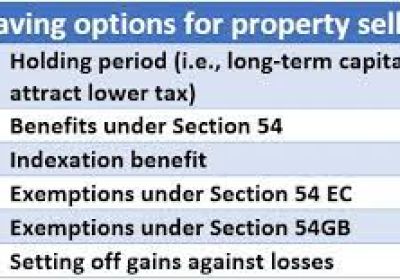

Reverse Tax benefit on Home Loan if Selling House in 5 years of possession

RJA 25 Dec, 2022

Selling House within 5 years of taking possession will Reverse Tax advantage on Home Loan As per Sec 80C of income tax act 1961, In case we sell house within 5 years from the end of the FY in which property possession was taken, all the income tax advantage availed U/s 80C&...

GST Compliance

48th Meeting GST Council recommendations highlights

RJA 19 Dec, 2022

Brief highlights of 48th Meeting GST Council recommendations The GST Council has, among other things, recommended the following amendments to the GST tax rates, trade facilitation measures, and GST compliance streamlining measures: E-invoice Related : CBEC Circular will be issued for clarification on GST New e-invoices applicability with effect from 1...

INCOME TAX

Consequences of ignorance & Non-Filling of Tax Return

RJA 17 Dec, 2022

What are the consequences of ignorance & Non-Filling of Tax Return? Income Tax Return as it is generally referred to, is a formal document that you are mandated by law to submit annually. ITR filing is required if you want to avoid certain serious consequences, even though it may seem ...

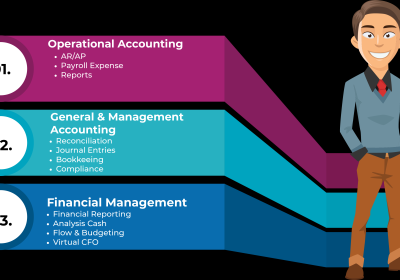

Outsourcing Services

Importance of Principles of Financial Accounting Services & Why It Matters?

RJA 13 Dec, 2022

Importance of Principles of Financial Accounting Services & Why It Matters? What is Financial Accounting? Financial accounting is the process of documenting, gathering, and summarising the numerous transactions resulting from business operations throughout time. It belongs to a certain area of accounting. When one uses outsourcing financial accounting services, the ...

Outsourcing Services

Key reasons of outsource bookkeeping from foreign to India?

RJA 09 Dec, 2022

Key reasons of outsource bookkeeping from foreign to India? Businesses are conscious of the importance of bookkeeping in maintaining their financial stability. There is a significant amount of interest in outsourcing bookkeeping and accounting work to India from countries across Europe, the US, Australia, and other Gulf countries. Numerous nations ...

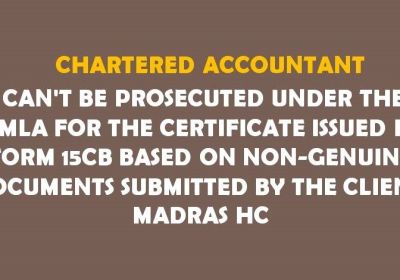

Form 15CA & 15CB Certificate

CA cannot be prosecuted for form 15cb based on client's submitted fake documents

RJA 05 Dec, 2022

ICAI member is not required to verify genuineness of supporting documents while issuing 15CB certificate High Court said on 23.11.2022 in a CA’s criminal case held that a CA in India while issuing Certificate 15CB is needed to only examine the remittance nature & Nothing more on that. CA ...

COMPANY LAW

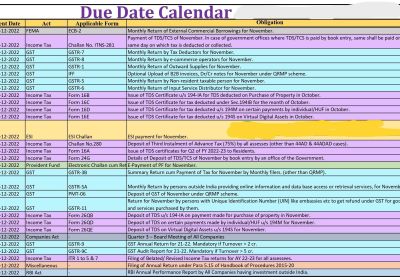

Tax and Statutory Compliance Calendar for December 2022

RJA 01 Dec, 2022

Tax and Statutory Compliance Calendar for December 2022 S. No. Statue Purpose Timeline & Compliance Period Due Date Compliance Details 1 Income Tax Tax deducted at sources / Tax collected at source Liability Deposit November -2022 7-December-2022 Timeline of depositing Tax deducted at sources / Tax collected at source liabilities under the ...

INCOME TAX

LTC is only allowed for travel with in India - SC

RJA 26 Nov, 2022

What is Leave Travel Concession? Leave Travel Concession is an exemption for assistance/ allowance received by the employee from his employer for travelling on leave, related provision is stated in the section 10(5) of the Income Tax Act 1961. Value of travel assistance or concession received by or due to the ...

IBC

IBC case law - SC, NCLT & NCLAT Rulings on Resolution Plans

RJA 21 Nov, 2022

Supreme Court, NCLT & NCLAT Rulings/Findings relating to Resolution Plans under IBC Code Under article also cover the contains of numerous rulings & observation in relation to resolution plans, also included, duties of various stakeholders, how Resolution Plans is approved etc, as per the orders of the Adjudicating Authorities ...

IBC

What are the key factors to an effective Section 29A Due Diligence

RJA 20 Nov, 2022

IBC Section 29A - Due Diligence of Resolution Applicants IBC 2016 Section 29A has establishing as one of the key essential laws in determining the eligibility of Resolution Applicants in the CIRP. The IBC, in its initial form had not inserted any regulations to prevent defaulting promoters via repurchasing or buying-back ...

Goods and Services Tax

GST applicability on compensation, liquidated damages, & penalties for contract violations etc

RJA 15 Nov, 2022

GST applicability on compensation, liquidated damages, & penalties for contract violations, among other things. The taxability of liquidity damages, cancellation fees, late payment fees, etc. arising from contract breaches is a very frequent query under GST. The issue is raised by Central Goods and Service Tax Act, 2017, Schedule II, Paragraph ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Nov 2022

RJA 01 Nov, 2022

Tax & Statutory Compliance Calendar for Nov 2022 S. No. Statue Purpose Compliance Period Deadline Compliance Details 1 Income Tax tax deducted at source Certificate October -22 14- November -22 Deadline for issue of tax deducted at source Certificate for tax deducted U/s 194-IB, 194-IA, & 194M in ...

Goods and Services Tax

Haryana jurisdiction Govt 373 GST registrations cancelled of all non-filers of GSTR-3B

RJA 01 Nov, 2022

Haryana jurisdiction Govt 373 GST registrations cancelled of all non-filers of GSTR-3B upto March 2021 Gst Dept. Govt of Haryana had identified 373 active GST registered taxpayers of State jurisdiction who had not submitted FORM GSTR-3B up till March 2021. These GST taxpayers were liable to be cancelled under the provisions ...

GST Consultancy

GSTN added a new Federal Bank, total No of banks accepting GST payments to 20

RJA 01 Nov, 2022

20 Banks now Accept GST payments because to the addition of a new Federal Bank to the GSTN. A dealer who has registered for GST can generate a GST Challan on the GST Portal to pay tax, fees, penalties, interest, and other amounts. The payment methods include OTC, NEFT, RTGS, and ...

NGO

Documents to be maintenance by NGO or Trust as per New Rule 17AA

RJA 01 Nov, 2022

NGO’s Books of account & other documents to be kept and maintained- New IT Rule 17AA Central Board of Direct Taxes established new rule 17AA via income tax Notification No. 94/2022 dated August 10, 2022, which specifies the books of account and other documents that must be kept by each ...

TDS

Deadline of TDS Return filing for second QTR of FY 2022-23 Extended

RJA 27 Oct, 2022

Deadline of submitting TDS Return(Form 26Q) for second quarter of Financial Year 2022-23 extended till to 30th Nov 2022. CBDT has extended the Timeline of filing of TDS Return in Form 26Q for 2nd QTR of FY 2022-23 from 31st Oct 2022 to 30th Nov 2022. Central Board of Direct Taxes issue ...

INCOME TAX

Easy way of checking status of your Income tax refund

RJA 22 Oct, 2022

Checking status of your Income tax refund The Income Tax Department gives taxpayers the option to track the progress of their ITR refund after 10 days from the day the ITR was filed. Income Tax e-filing platform now allows taxpayers who filed their ITR more than 10 days ago to monitor the ...

INCOME TAX

Verification of Undisclosed income under 'Operation Clean Money'

RJA 21 Oct, 2022

Verification of cash deposits & other Undisclosed income under 'Operation Clean Money' On January 31, 2017 the Income Tax Department initiated Operation Clean Money to investigate the sizable cash deposits made between November 9 and December 30, 2016. This operation was started with the intention of checking the taxpayer's cash transaction history, namely if ...