Table of Contents

Importance of Principles of Financial Accounting Services & Why It Matters?

What is Financial Accounting?

- Financial accounting is the process of documenting, gathering, and summarising the numerous transactions resulting from business operations throughout time. It belongs to a certain area of accounting.

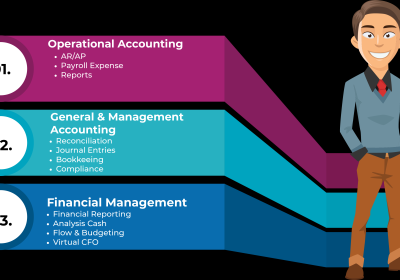

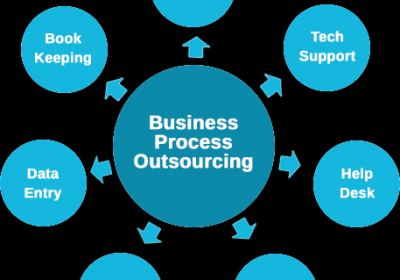

- When one uses outsourcing financial accounting services, the preparation of financial statements like the balance sheet, income statement, and cash flow statement—which summarise these transactions among others and document the operating performance of the company over a specific time period—is taken care of.

- Both the public and private sectors employ financial accounting services outsourcing firms. It's possible that a general accountant's duties differ from those of a financial accountant because the former works for oneself or herself instead of working for a company or organisation.

Principles of financial accounting Outsource services:

Finance and accounting outsourcing services are often governed by five guiding principles. These guidelines govern how organisations should assemble their financial statements and are the basis for all technical assistance in financial accounting. Companies that outsource finance carefully follow these five guiding principles.

Full disclosure principle

The full disclosure principle states that financial statements should be prepared in accordance with financial accounting standards that explicitly disclose a company's financial situation through footnotes, schedules, or commentary. This concept controls the quantity of information that is disclosed in financial statements

Matching principle

The matching principle states that revenue and expenses must be reported at the same time as they are incurred. This regulation tries to stop companies from recording revenue in one year while spending money to generate that revenue in another. This concept determines the order in which transactions are recorded.

Principle of revenue recognition

Revenue must be acknowledged in accordance with the revenue recognition principle as soon as it is earned. This rule outlines the amount of revenue that must be reported, when it must be reported, and under what circumstances it cannot be disclosed.

Principle of Objectivity

Regardless of the fact that financial accounting incorporates components of expert judgement and estimations, the Objectivity Principle states that a set of financial statements should be compiled objectively and without consideration of any personal bias. This principle identifies the situations where objective analysis should be avoided in favour of technical accounting.

Principle of cost

The Cost Principle outlines the procedure for regularly documenting costs. This concept specifies the amount for which expenses should be recorded (or, at cost of transactions), as well as how they should be properly recognised over time in the appropriate situations (i.e., an expense is incurred over the useful life of a depreciable asset).

Key Reasons for outsourcing financial accounting services

- Financial accounting establishes a consistent set of principles for producing financial statements. This standardised set of rules guarantees consistency between reporting periods and among different companies.

- Financial accounting provides managerial knowledge. Even while alternative approaches, like cost accounting, may provide better insights, financial accounting can promote strategic thinking if a firm analyses its financial data and takes reactive investment decisions.

- By increasing accountability, accounting and finance outsourcing services reduce risk. Accounting for finances ensures that reports are produced according to accepted practises that hold companies responsible for their performance. Financial data is used by lenders, regulatory bodies, tax authorities, and other third parties.

- Financial accounting provides managerial knowledge. Even while other approaches, like cost accounting, may provide better insights, financial accounting can promote strategic thinking if a firm analyses its financial data and takes reactive investment decisions.

- Transparency is encouraged by financial accounting. By improving accountability, accounting and finance outsourcing services reduce risk. Accounting for finances ensures that reports are produced according to accepted practises that hold companies responsible for their performance. Financial information is used by lenders, regulatory bodies, tax authorities, and other third parties.

- Financial accounting provides managerial knowledge. Even while other approaches, like cost accounting, may provide better insights, financial accounting can promote strategic thinking if a firm analyses its financial data and takes reactive investment decisions.

- Normally Transparency is encouraged by financial accounting. By improving accountability, accounting & finance outsourcing services reduce risk. Accounting for finances ensures that reports are produced according to accepted practises that hold companies responsible for their performance. Financial information is used by lenders, regulatory bodies, tax authorities, and other third parties.