Table of Contents

- Key Clarification On Harmonized System Of Nomenclature Code Summary In Annual Gstr 9 Return

- What Is Consequences If Mistake Declaring The Sac / Hsn Code Of Gst Supplied.?

- Faq On Gstr-9/9c For Fy 2024-25 Provides Detailed Clarifications Issued By Gstn.

- Gstr-9 Mandatory Vs Optional Tables & Caps Summary For Fy 2024-25

Key Clarification on Harmonized System of Nomenclature Code Summary in annual GSTR 9 Return

Annual GSTR 9 Return Disclosure of Harmonized System of Nomenclature Code Summary.

- Harmonized System of Nomenclature Code Summary should be after net of Credit Note & Debit Note/adjustment.

- Exempted & Taxable Supply Harmonized System of Nomenclature Code also to be included in HSN (Harmonized System of Nomenclature) Code summary

- HSN (Harmonized System of Nomenclature Code) summary should match with Total appearing in GSTR 9 after Sr. No. 13

- If possible, try to provide HSN(Harmonized System of Nomenclature) Code of Non-GST supply also, so as to match total Harmonized System of Nomenclature Code Summary value with Sr. No. 13

- if any issue in preparing Harmonized System of Nomenclature Code summary, you can take call what to report and have ‘note’ ready of it, so as to explain the authorities in future if they raise any query.

- Harmonized System of Nomenclature Code summary of Inward Supply is not mandatory.

What is Consequences if mistake declaring the SAC / HSN Code of GST supplied.?

Important elements is classification of services or goods for the purpose of determination of rate of tax under the Under Goods & Services tax law

Answere : Harmonized System of Nomenclature Code/ Service accounting code Yes you are right

- Wrong classification of Harmonized System of Nomenclature Code/ Service accounting code leads to wrong rate of duty which further leads to wrong payment of taxes.

- What if the Goods & Services tax charged at lower rates- This leads to loss of non-recovery of GST tax, interest & penalties from clients.

- In case we made the Wrong exemption claimed- This result in loss of non-availment of ITC.

- Goods & Services tax charged at higher rates- This leads to loss of customer base, loss of creditability & incurring unavoidable loss on account of discounts given to clients.

- GST Dept will ask for differential tax amount and buyer will not be there to reimburse the same.

- We have to pay the tax at a later date and credit will not be available due to Section 16 of Central Goods and Services Tax Act, 2017.

- In case we made the Wrong classification of services or goods may leads to denial of import or export exemption under FTP Policy such as Exports incentives, duty drawback, etc.

- GST Penalty amounting of RS 50k (Rs 25k each for SGST or CGST ) can be levied for mentioning wrong Harmonized System of Nomenclature Code/ Service accounting code or non-mentioning of SCN or HSN code as per u/s 125 of the CGST Act, 2017.

FAQ on GSTR-9/9C for FY 2024-25 provides detailed clarifications issued by GSTN.

GSTR-9/9C for FY 2024-25 Key Sections & Highlights

1. Enabling of GSTR-9/9C

- GSTR-9/9C will be enabled only after all GSTR-1 and GSTR-3B returns for FY 2024-25 are filed.

- If any return is pending, GSTR-9 will not be enabled.

2. Auto-population Logic

- Table 8A: Captures ITC from GSTR-2B for FY 2024-25 and invoices of FY 2024-25 appearing in GSTR-2B of Apr–Oct 2025.

- Supplies added/amended via GSTR-1A will also auto-populate in Tables 4 & 5.

3. New Tables & Changes

- Table 6A1: ITC of preceding FY (2023-24) claimed in current FY (excluding Rule 37/37A reclaims).

- Table 6A2: Net ITC of current FY = (6A – 6A1).

- Table 8H1: IGST credit availed on imports in next FY.

- Delinking of Table 6H from 8B to avoid mismatch in 8D.

4. ITC Reporting Scenarios

- Claim, reversal, reclaim in same FY: Report in 6B, 7A–7H, and 6H.

- Reclaim in next FY (other than Rule 37/37A): Report in Table 13 (current FY) and 6A1 (next FY).

- Reclaim in next FY (Rule 37/37A): Report in 6H of next FY only.

5. Table 8C Clarification

- Includes missed ITC of current FY claimed first time in next FY.

- Does not include ITC reclaimed after reversal in same FY.

6. Imports

- IGST paid on imports in FY 2024-25 but ITC claimed in next FY → Report in 8G & 8H1 + Table 13.

7. Late Fee

- Auto-calculated as per Circular 246/03/2025.

- New Table in GSTR-9C for late fee payable and paid.

8. HSN Reporting

- Download facility for Table 17 HSN details from GSTR-1/1A provided.

9. Special Notes

- ITC reclaimed under Rule 37/37A is treated as ITC of the year in which it is reclaimed.

- Concessional tax rate checkbox (65%) removed from Tables 17 & 18.

Examples Included

- Multiple examples for ITC claim/reversal/reclaim scenarios across FYs.

- Detailed table mapping for 6A, 6A1, 6H, 8A–8D, 12, 13.

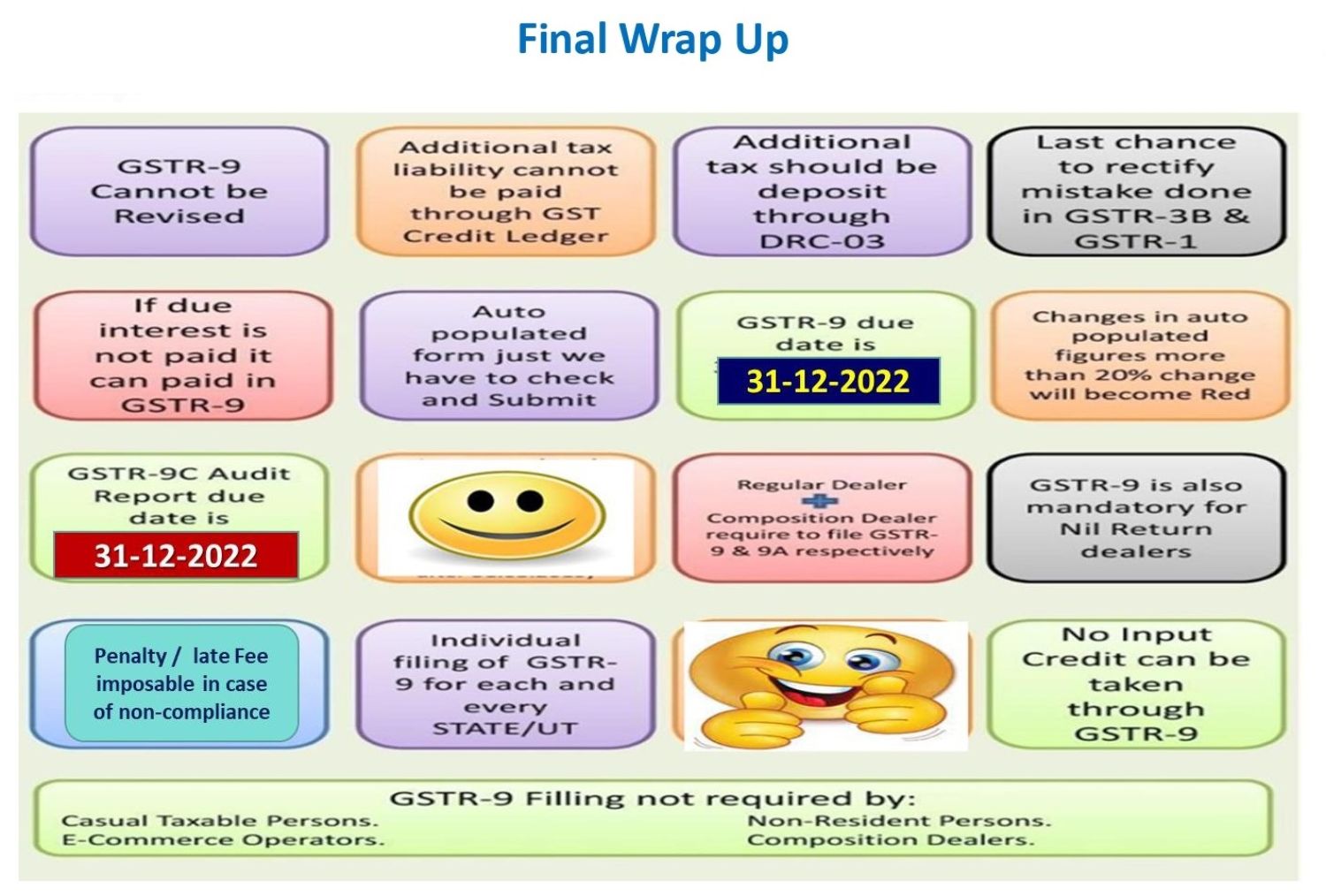

GSTR-9 Mandatory vs Optional Tables & CAPS Summary for FY 2024-25

GSTR-9 Mandatory vs Optional Tables & CAPS Summary provides a detailed guide on. Key Highlights from the Document

-

Mandatory vs Optional Tables in GSTR-9

- Mandatory:

- Outward supplies (Tables 4A–4G, 5A–5F)

- ITC details (Tables 6A–6M, 7A–7G)

- Tax payable & paid (Table 9)

- HSN summary for outward supplies (Table 17)

- Optional:

- Amendments (Tables 5H–5K)

- HSN summary for inward supplies (Table 18)

- Demands & refunds (Tables 15 & 16)

- Mandatory:

-

New Changes for FY 2024-25

- New Tables:

- 6A1 & 6A2 for ITC adjustments

- 7A1 & 7A2 for ITC reversal

- 8H1 for IGST credit on imports in next FY

- Auto-population:

- Table 8A from GSTR-2B (including Apr–Oct 2025 invoices)

- Table 9 from GSTR-3B

- New Tables:

-

Cross-Year ITC Handling

- ITC claimed, reversed, and reclaimed scenarios explained under CAPS 2, 4, 5, 7, 8, 9.

- Special treatment for Rule 37/37A reclaims and imports.

-

Exemption Limits

- GSTR-9: Exempt if turnover ≤ ₹2 Cr

- GSTR-9C: Exempt if turnover ≤ ₹5 Cr

-

Late Fee & Compliance

- Late fee auto-calculated as per Circular 246/03/2025.

- Emphasis on Table-to-Table reconciliation to avoid mismatches.