Table of Contents

- Brief Highlights Of 48th Meeting Gst Council Recommendations

- E-invoice Related :

- Gst Returns Related:

- New Gst Tax Rates:

- Gst Registration Related Streamlining Compliance:

- New Gst Forms Related:

- Definition Changes Related:

- Verification Of Input Tax Credit By Dept Related:

- Pos Related:

- Tax Deducted At Source & Tax Collected At Sources Deductors Related :

- Gst Demand Related:

- For Taxpayers Whose Ibc Proceedings Has Finalized Related :

- Recommendation To Decriminalize Few Offences U/s 132 Of Gst Act

- Recommendation Realated To The Gst Refund To Unregistered Buyers Of Cgst Rules.

- Recommendation Realated To The Facilitate E-commerce For Micro Enterprises

Brief highlights of 48th Meeting GST Council recommendations

The GST Council has, among other things, recommended the following amendments to the GST tax rates, trade facilitation measures, and GST compliance streamlining measures:

E-invoice Related :

- CBEC Circular will be issued for clarification on GST New e-invoices applicability with effect from 1st Jan 2023.

GST Returns related:

- Now the Good and Services Tax Returns (GSTR 1,3B,9,9C,4 etc) can only be filed at maximum of 3 years after the deadline date. Previously there is no limit for GST Return filing, as we know If GST returns not submitted till Six months then GST Registration will get suspended However still GST Returns can be submitted. But now additional of restriction in deadline Limit.

- GSTR-1 FORM will be amended & new tables to be added for appropriate reporting of information & details of supplies made via the e-Commerce operator’s which are come u/s 52 & 9(5).

New GST Tax rates:

|

Sr. No. |

Particular |

From |

To |

|

1 |

Ethyl alcohol supplied to refineries for blending with motor spirit (petrol) |

18% |

5% |

|

2 |

Husk of pulses including concentrates & chilka including churi/ chuni, khanda |

5% |

Nil |

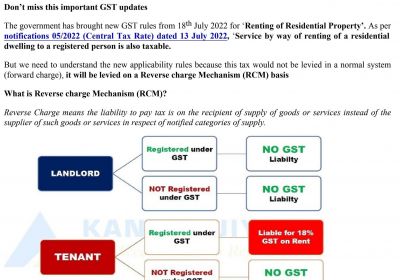

- CBEC decided to include Mentha arvensis supply under RCM Mechanism as has been implemented for Mentha Oil.

GST Registration related Streamlining compliance:

- A proposal to test biometric-based Aadhaar authentication & risk-based physically registration applicant verification in the state of Gujarat.

- GSTN is trying to implement bio-metric based physical verification & aadhar authentication at the time of GST Registration so that no fraudulent & fake registrations can be taken. Proposal to conduct a pilot in State of Gujarat.

- To accommodate this, the CGST Rules 2017 rules 8 and 9 will be amended. By doing this, the problem of bogus and fraudulent registrations will be reduced.

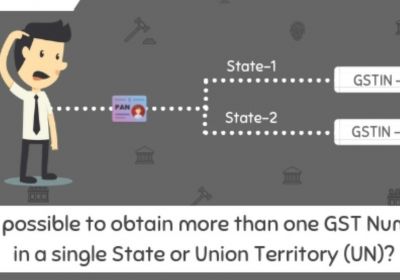

- To prevent a person's Permanent account number from being misused by dishonest individuals without the consent of the said Permanent account number holder, a Permanent account number-linked mobile number and email address (fetched from the CBDT database) must be captured and recorded in FORM GST REG-01.

- At the time of Good and Services Tax Registration now one time password will be shared on email id & mobile no registered with Permanent account number so that no one can get Goods and Services ST Registration without knowledge of Permanent account number Holder.

- OTP-based verification must also be carried out at the time of registration on such Permanent account number linked mobile number and email address.

New GST Forms Related:

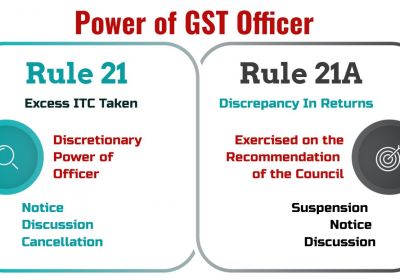

- New Goods and Services Tax form DRC-01B & Goods and Services Tax Rule 88c to be inserted, this will be an intimation form for the Differences in GSTR-3B & GSTR-1 for tax period if difference exceeds an specific % limit and amount, so GST Taxpayers has to pay the amount or explain the differences.

- If not paid or not explained, then the next period GSTR-1 will be restricted & can’t be filed. this form will be system generated so no involvement of any officer for tax difference payment.

Definition changes related:

- Amendment in definition of non-taxable online recipient (NTOR) under section 2(16) of IGST Act, 2017 & Online Information Database Access and Retrieval services under section 2(17) of IGST Act, 2017 will be changed to reduce interpretation on GST issues and GST litigation on taxation of Online Information Database Access and Retrieval Services

Verification of Input Tax credit by dept related:

- For Finance Year 2017-18 & 2018-19, CBES Circular will be issued for clarification about what procedure is followed by GST Dept/ GST Officers for verification of Input Tax credit in GSTR-3B vis a vis available in GSTR-2A.

POS Related:

- For Goods transportation services, CBEC Circular will be issued for clarifying Place of Supply & Input tax credit availability & commission of Section 12(8).

Tax Deducted at source & Tax Collected at Sources Deductors Related :

- GST facility will be given for the GST registration cancelation on their request

GST Demand related:

- CBEC Circular will be issued for clarification of re-determination of demand in section 75(2).

For taxpayers Whose IBC Proceedings has finalized Related :

- CBEC Circular to be issued for explanation GST issue of treatment of statutory dues under Good and Services Tax & GST DRC-25 also to be modify accordingly.

Recommendation to decriminalize few offences u/s 132 of GST Act

- increased minimum threshold limit of GST tax amount for prosecution launching under GST from INR 1 Cr to INR 2 Cr, Except for GST offence of issuance of invoices without supply of goods/ services or supply of both;

- Decriminalize Few offences specified under Section 132(1)(g) (j) and (k) of Central Goods and Services Act, 2017, viz.-

- Decreased compounding from the existing range of 50 percent to 150 percent of tax amount to the range of 25 percent to 100 percent;

- Failure to supply the information.

- deliberate tempering of material evidence;

- Preventing or obstruction any officer in discharge of his official duties under GST law;

- According to Sec 138(2) of the GST law the compounding amounr of offense shall be:

- Mminimum amount shall not be less than Rs. 10k or 50 percentage of GST tax amount involved;

- Maximum amount shall not be less than Rs 30k or 150 percentage of the GST tax amount involved.

- CBEC has recommended to decrrese exiting range of 50 percentage to 150 Percentage to 25 Percentage-100 percentage.

Recommendation realated to the GST refund to unregistered buyers of CGST Rules.

- GST department issue recommendation for amendment in the Central Goods and Services Rules to prescribe the procedure for GST filing application of refund by the unregistered buyers in cases, where there is no procedure for claiming a refund of tax borne by the unregistered buyers in cases where the agreement for supply of services or contract, for example Long-term insurance policy, construction of house/flat is cancelled & time period of issuance of credit note by the concerned supplier is over.

Recommendation realated to the Facilitate e-commerce for micro enterprises

- In order to give the E-Commerce Operators sufficient time to prepare and develop the necessary features for the portal, the GST Council has recommended, among other things, that the scheme be implemented beginning on 1.10.2023. Unregistered suppliers and composition taxpayers will be allowed to use E-Commerce Operators to make intrastate transactions of goods as a result.

All 48th Meeting GST Council recommendations will be effective from date when the CBEC circulars or notification will be issued.