ROC Compliance

E-KYC, Aadhaar, Linking required for Existing GST Taxpayers

RJA 15 Mar, 2021

GST Portal allowed e-KYC/ Aadhaar/Linking for Present GST Taxpayers The GST Portal has allowed Aadhaar Authentication/E-KYC on the GST Portal for Existing Taxpayers. Performance for Aadhaar Authentication and e-KYC where Aadhaar is not accessible has been dispatched to GST Common Portal w.e.f. 6 January 2021 for existing taxpayers. ...

COMPANY LAW

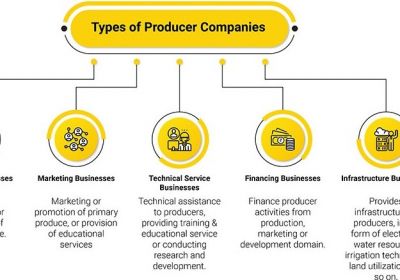

SHARE CAPITAL AND ACCOUNT, AUDIT & OTHER FEATURE OF A PRODUCER COMPANY

RJA 07 Mar, 2021

Normal characteristics of Producer Companies: Producer Company is always a Pvt Ltd company. The name of the Company shall end with “Producer Company Limited” which shall be stated in the MOA of Producer Company. There must be a minimum of Five directors & No need for Minimum Capital ...

COMPANY LAW

Annual Filing & Compliance of a Producer Company

RJA 07 Mar, 2021

Annual Filing & Compliance of a Producer Company A Producer Company is a business registered under the Company Act 2013 with the aim of producing, harvesting, promoting mutuality techniques, etc. Like other registered companies, a producer company also needs to file compliance on a fair and annual basis in order to ...

TDS

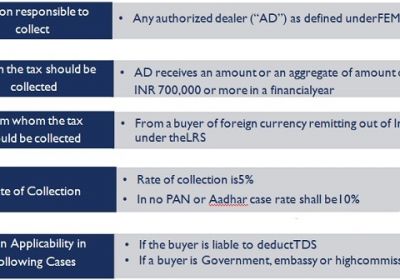

TCS on Tax Foreign Remittance Transactions under LRS

RJA 01 Mar, 2021

TCS on Tax Foreign Remittance Transactions under LRS Forex Facility for Residents – $250,000 per FY Under Liberalised Remittance Scheme (LRS) Scheme of LRS The Foreign Exchange Management Act, 1999 (FEMA) limits forex transactions to the limit permitted by its regulations. RBI Regulations apply to the LRS. Indian residents are permitted ...

GST Compliance

Option to upload e-KYC documents or authenticate your Aadhar card On the GST Portal

RJA 01 Mar, 2021

Now you have the option to upload e-KYC documents or authenticate your Aadhar card On the GST Portal, What is Aadhaar Authentication, and how does it work? Aadhaar authentication is the process of submitting the Aadhaar number, along with other biometric details, to the Central Identities Data Repository (CIDR) for ...

OTHERS

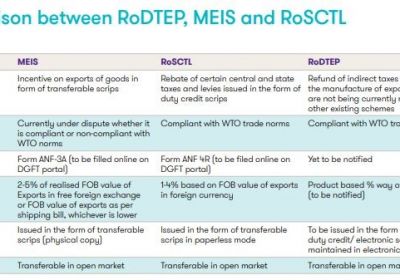

Basics of RoDTEP Scheme – Remission of Duties or Taxes on Export

RJA 19 Feb, 2021

RoDTEP Scheme: The Govt of India announced the Remission of Duties & Taxes on Export Product (RoDTEP) Scheme, which is a combination of 2 existing GOI schemes, including MEIS (Merchandise Export from India Scheme) and RoSCTL (Rebate of State & Central Taxes and Levies Scheme) to ensure compatibility with the World ...

OTHERS

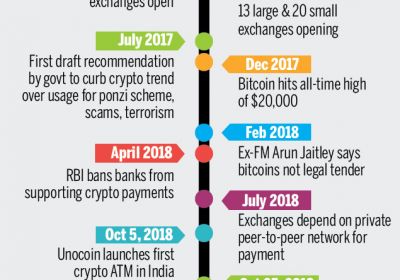

Govt has introduced legislation to ban crypto-currency in India

RJA 13 Feb, 2021

What's Cryptocurrencies-Bitcoin? Bitcoin is a cryptocurrency invented by a few unknown groups of people. You can buy or sell bitcoins on a bitcoin exchange. The currency is not controlled by any bank or government. Blockchain is the leading technique behind bitcoin and other cryptocurrencies. It's a public ...

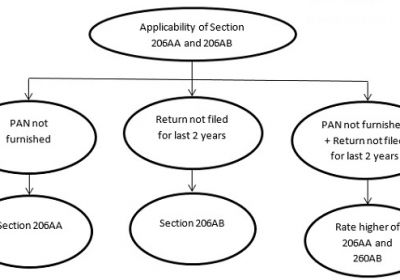

TDS

Higher Rates TDS/TCS on non filed the ITR on time.

RJA 07 Feb, 2021

Income Tax Return filing: Applicable of at higher rates TDS/TCS on non filed the ITR on time (New Section 206AB and Section 206CCA) A higher rate of TDS for Non-Filer of Income Tax Return has been implemented in Budget 2021. The Proposed Section: 1. Section 206AB was proposed in ...

GST Filling

No GST Audit needed in Budget 2021 : latest Update

RJA 07 Feb, 2021

No GST Audit Required in New Budget 2021 On 1 February 2021, Finance Minister Nirmala Sitharaman delivered the 2021 paperless budget. FM also announced several improvements to the tax system on goods and services to target helping small and medium businesses to overcome pandemic disruptions. Relevant GST changes carried out in the ...

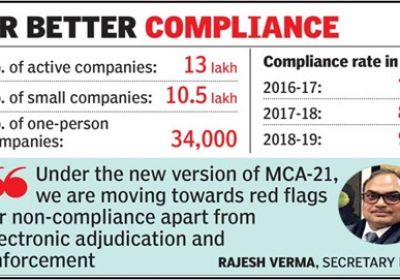

COMPANY LAW

Govt introduces random e-scrutiny of corporate filings

RJA 06 Feb, 2021

MCA launch random e-scrutiny of corporate filings The Ministry of Corporate Affairs (MCA) is about to launch a random digital Scrutiny of company filings over the next year as it aims to use expert knowledge to enhance supervision and compliance, a senior official said. "The random sampling of ...

OTHERS

Highlights on key changes related to start-up Budget 2021

RJA 05 Feb, 2021

Brief Glance at key changes related to start-up Highlights Budget 2021's: The finance minister has announced the first-ever digital financial budget, and the finance minister's red cover tab had several offers for the business world, especially start-up businesses, this year. key changes related to start-up Highlights Budget 2021's: 1. Start-up ...

GST Compliance

Limitation on filing GSTR-1 along with no ITC claim for your Customers

RJA 04 Feb, 2021

100 percentage limitation to avail 'ITC', if No GSTR-1 is filed by the supplier Monthly GSTR-1 is due by 11th October With the deadline closing in, it’s time to file GSTR-1 for your clients and we can help you file them accurately while saving your time As per the ...

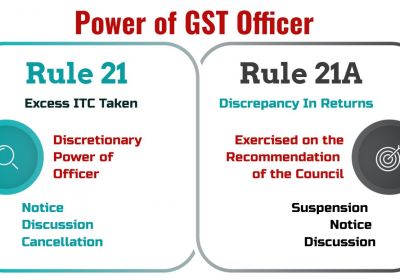

GST Filling

Input Tax Credit in GSTR-3B not to be exceed 105% of GSTR-2A

RJA 04 Feb, 2021

Claiming more than 105% of the ITC as shown in GSTR 2A may offer notice of revocation or cancellation of registration. If you assert the ITC in the GSTR 3B return for a sum that exceeds the specified limit as set out in Rule 36(4), we will inform you of the ...

Goods and Services Tax

GST revenue has hit a record high of INR 1.20 lakh crore in January 2021. Budget Effect

RJA 03 Feb, 2021

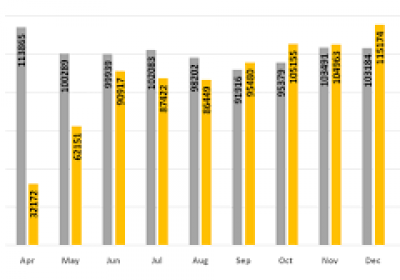

In January, GST revenues hit a record of Rs 1.20 Lakh Crore: Great news on Budget Eve: Goods & Services Tax collections for January reached an all high of around Rs 1.20 lakh crore, the Finance Ministry said. According to the Finance Ministry, in line with the recovery trend in Goods & ...

OTHERS

Govt approved : Startup India Seed Fund Scheme to provide funding for start ups

RJA 02 Feb, 2021

The Government launched the “Startup India Seed Fund Scheme" to provide funding for start-ups powered by technology. The 'Startup India Seed Fund Scheme (SISFS)' has been approved by the Central Government to provide startups with financial assistance for proof of concept, prototype creation, product trials, market presence, ...

Goods and Services Tax

Key Analysis on Indirect Tax Proposals - Budget 2021

RJA 01 Feb, 2021

Key Analysis of Proposed Amendments in GST in Budget 2021 No Requirement of GST Audit Clause 101 of Finance Bill, 2021 has omitted the following Section 35(5) of CGST Act, 2017 which is made effective from the date to be notified: This is a prospective amendment that needs to be notified. It will be applicable ...

Form 15CA & 15CB Certificate

An NRI’s Guidance on Forms 15CA and 15CB for International Remittances

RJA 01 Feb, 2021

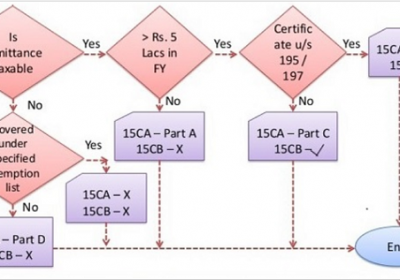

An NRI’s Guidance on Forms 15CA and 15CB for International Remittances For foreign transfers or payments to non-residents, use Forms 15CA and 15CB. When a person is obligated to make a remittance to a non-resident, the remitter is legally required to withhold income tax from the payment. As ...

Goods and Services Tax

Choose the QRMP Scheme only after you identify its drawbacks.

RJA 31 Jan, 2021

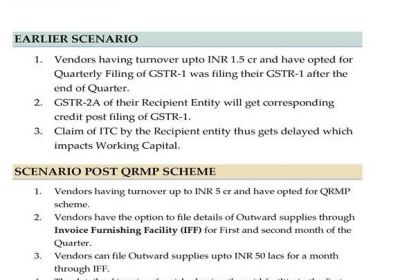

Limitations/ drawbacks you should know before Choosing the QRMP Scheme. In order to benefit small taxpayers whose revenue is less than Rs.5 Cr, the Central Board of Indirect Taxes & Customs (CBIC) launched the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme as under Goods and Services Tax (...

NRI

Allow NRIs to buy gold from foreigners to claim GST refund by filling Return

RJA 31 Jan, 2021

Allow NRIs to buy gold from foreigners to claim GST reimbursement on their return (Expectation from Budget 2021) The gem and jewelry sector is hoping for a positive result from the budget 2021. The gem and jewelry sector is making a major contribution to the overall economy of the country. And ...

OTHERS

Govt to amend Laws for effective Disciplinary points for ICAI, ICWAI, ICSI

RJA 31 Jan, 2021

Govt to amend Laws for effective Disciplinary points for ICAI, ICWAI, ICSI The Govt. of India is ready to amend laws to streamline the workings, in particular disciplinary dimensions, of the three professionals in ICAI, ICWAI and ICSI. The invoice for amending the relevant provisions of the laws governing the ...

OTHERS

Key Points to Consider Before Choosing Types of Business

RJA 28 Jan, 2021

Key Points to Consider Before Choosing Types of Business Ease: The easiest business structures to create are sole proprietorships. It is typically as easy as opening a checking account at your local bank to set up a sole proprietorship. It is also relatively easy to set up partnerships, but you ...

OTHERS

Key Considerations when you launch a startup business

RJA 28 Jan, 2021

Want to Startup Business in India? Here is some Guidelines for YOU! A startup refers to a company that's in the initial stages of business. Startups are created by one or more entrepreneurs who want to create a product or service to be marketed by the founders. ...

INCOME TAX

All about tax benefit enjoy by Resident Senior Citizens

RJA 26 Jan, 2021

Overview on Tax Concessions/ benefit for Resident Senior Citizens So After a lifetime of working, raising families, and making a contribution to the success of this Nation other ways senior citizens deserve a dignified retirement.- Charlie Gonzalez Every Nation Govt provides special specific relief to senior citizens in a ...

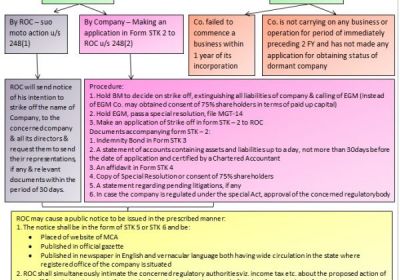

COMPANY LAW

PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY

RJA 26 Jan, 2021

PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY – There really is a goal behind starting every company that will always run the company, although not all companies end up the same way. The company is founded to do a business, but sometimes the business venture does not succeed or the ...