100 percentage limitation to avail 'ITC', if No GSTR-1 is filed by the supplier

Monthly GSTR-1 is due by 11th October

- With the deadline closing in, it’s time to file GSTR-1 for your clients and we can help you file them accurately while saving your time

As per the new regulations, not filing GSTR 3B on a regular basis would lead to a restriction in filing GSTR-1. Only after you have successfully filed GSTR 3B for the prior pending months then only you will be able to file GSTR-1. Being not able to file GSTR-1 on time means Input Tax Credit in GSTR 2A will not be able to claim by your customers. Your customers cannot claim ITC directly leads to degradation of business relations with the future prospects because of the financial losses! The tabular representation below will give you the duration of the time after which the Govt. Restrict the filing of returns:

|

Return Filing Type |

Return Pending Time |

|

Monthly |

Preceding Two Months |

|

Quarterly |

Preceding Tax Period |

In such cases, what should you do?

Businesses face several challenges, which usually render them unable to file returns on time.

If you face liquidity issues and cannot file the return on time, we advise you to borrow cash as a loan and pay GST as you will be able to get a loan from different sources between 9% and 12%, However, the percentage of fine on late filing of GST is 18% from electronic cash ledger.

If money is not an issue, but there is a data validation issue, then take the professional GST Consultancy service. Of itself, just filing returns is not enough. The right returns need to be filed as well. Ensure that, in all cases, you should not reduce the actual sales amount or use more than the eligible ITC amount. Always make sure that you have business systems and operations set up using GST software with the power of automation. If you do not have such a system in place and want to optimize the company's operations and run Tension-Free, You can contact us (RJA), we will assist you to recognize how the Department looks at your business, and avoid any potential problems!

We immediately tell you of the issue that may arise if you claim an ITC in the GSTR 3B return for an amount exceeding the specified threshold as set down in Rule 36. (4).

ITC Availability Limit as stipulated by Rule 36 (4)

Users know, the governor. Subsequently, Rule 36(4) of the CGST Rules 2017 has been amended and the maximum level to claim an input tax credit has been reduced to 105% as seen in GSTR 2A. Originally, the limit was 120 percent, which was decreased to 110 percent and now eventually to 105 percent.

Timeline compiled as an under :

|

Implemented Date with Effect From |

Basis Limit on ITC Availment |

|

09/10/2019 |

120 Percentage |

|

26/12/2019 |

110 Percentage |

|

01/01/2021 |

105Percentage |

Repercussions of ITC claims in exceeding the specified limits

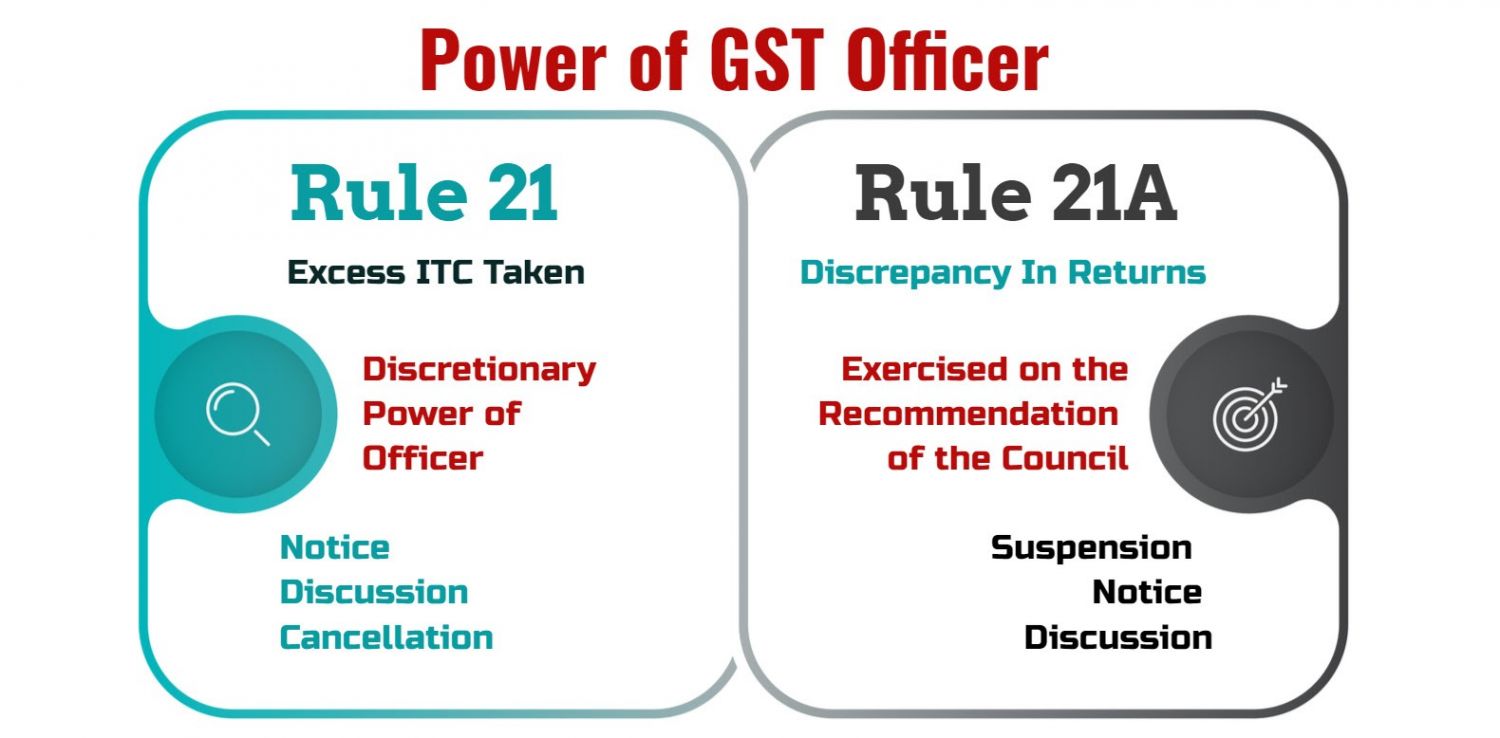

If the ITC claimed is more than 105 percent, the Officer may initiate the cancellation of the enrollment process in accordance with Rule 21(e) of the CGST Rules 2017 or may issue a Discrepancy Notice.

Understand the difference between Rule 21(e) and Rule 21A; Rule (2A)

While this case is comparatively better than the procedure initiated by Rule 21A(2A) of the CGST Rules 2017 on the grounds of non-compliance with the Data as you are provided with a Show-Cause Notice and given the opportunity to explain the justification for claiming more than 105 percent of ITC.

The GST Dept has made big changes to its operational activities and new ways of evaluating a business. In this blog, we're talking about a second fact/consequence of claiming more ITC than is present in the system.

What can/should I do about it on the above issue?

A bunch of issues may arise as a result of this transformation by the Govt, but sometimes when you have an eligible amount of ITC. As per our decades of work expertise and trying to deal with dozens of cases related to ITC issues, these are the main points that you should keep in mind at all times:

- Please ensure that the back-calculation sheet is maintained together with the reconciliation of party-wise and invoice-wise documents. This will help you to know how much you can use at all moments and prevent errors.

- End up making sure to consider only the qualified amounts for the ITC. The eligible amount is the amount that is reflected in GSTR 2A having GSTR 1 Return Filing Date and is eligible to be claimed as ITC.

- There are many cases where ITC's leftovers from the prior month are left. If you use ITC, including the amount of the previous months, the total amount may in most cases exceed 105%. If you have more than 105%, ensure you intimate the Superintendent of Jurisdiction in advance (via written intimation).

- All of this can be performed manually or by way of excel, but it can be reconciled every month, and that too much of an invoice just becomes challenging even by way of excel in case the number of invoices is comparatively small. Although it can be done easily via software, you must use GST software that combines GST 2A, 1, and 3B at all times and inform you of problems just as they do.

- User should use proper GST Software that makes the appropriate Key Ratios & identify the red flags can be easily identified so that you can take action & rectify identified mistakes before the Dept issue the Notice.

At Rajput Jain and Associates, we worked around the clock to design products capable of automatic reconciliation and ensure you don't have any more ITC than 105 percent. If you have hesitations about the management of ITC and other aspects of GST in your business and wish to strengthen your understanding of business and information, Contact Rajput Jain and Associates, and we'll help you get a comprehensive view of how the Dept sees your company and prevents all types of things that can occur in the future!!!