Table of Contents

An NRI’s Guidance on Forms 15CA and 15CB for International Remittances

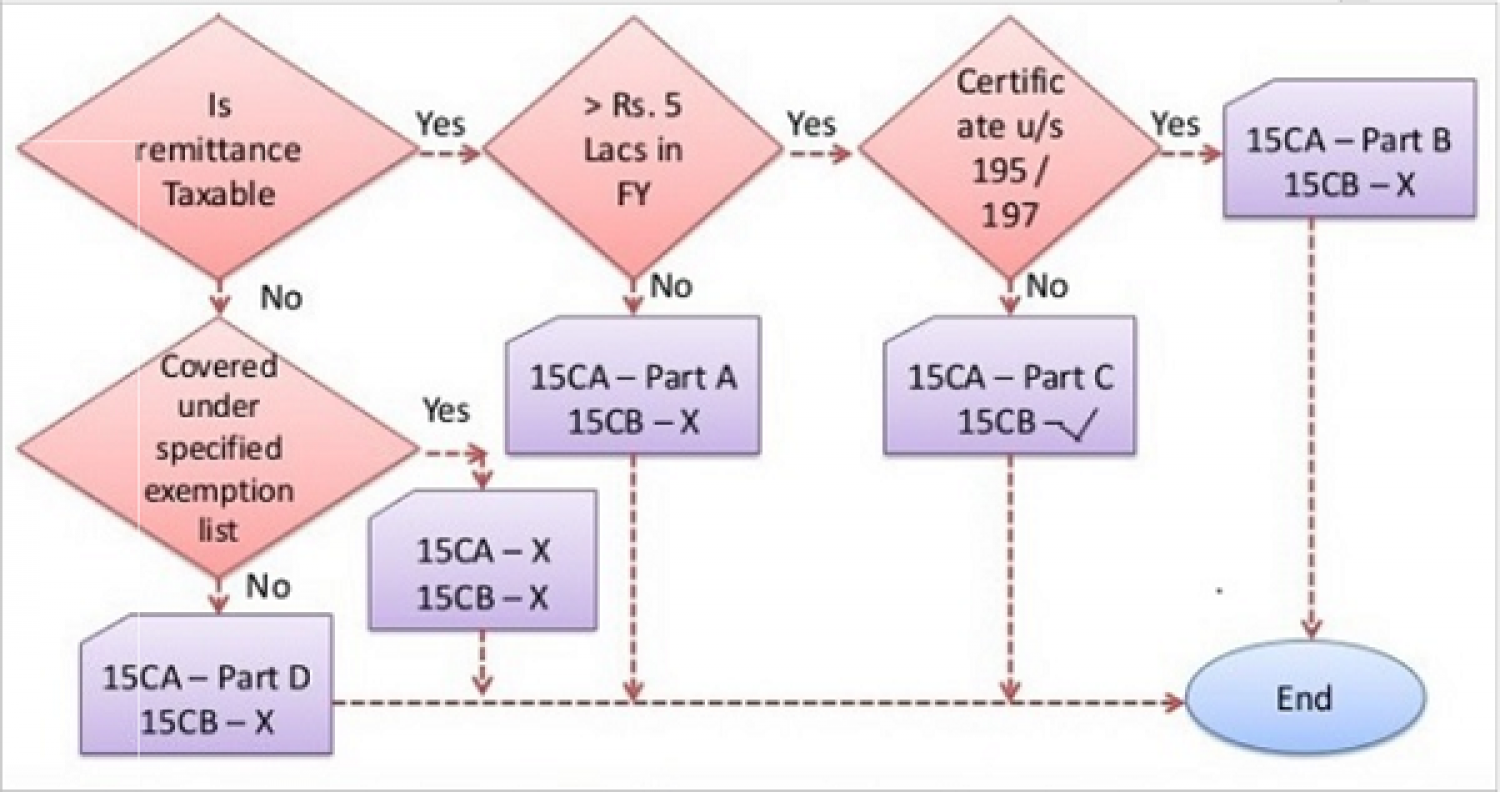

For foreign transfers or payments to non-residents, use Forms 15CA and 15CB. When a person is obligated to make a remittance to a non-resident, the remitter is legally required to withhold income tax from the payment. As the remittance is made on behalf of the customer, the bank has no way of knowing whether or not tax has been properly deducted. To ensure compliance, a mechanism is used to provide Form 15CA and a Chartered Accountant's certificate in Form 15CB, which allows a bank to send money abroad.

What is the purpose of Form 15CA?

- In general, Form 15CA is nothing more than a remitter's declaration that tax has been properly deducted from payments paid to a non-resident recipient. It's a mechanism for gathering information on payments made by a resident to a non-resident. It is information on tax collection that is gathered in advance because it is difficult to recoup taxes afterwards.

What is the purpose of Form 15CB?

- In general, Form 15CB is a certificate given by a CA certifying that the amount of tax-deductible in India has been appropriately deducted in accordance with the terms of the Income Tax Act or the Double Tax Avoidance Agreement (DTAA).

- A Chartered Accountant verifies the terms and type of the payment being made to the non-resident, the rate of TDS and income tax deduction as per Section 195 of the Income Tax Act, and whether or not a Double Tax Avoidance Agreement (DTAA) is applicable in Form 15CB.

Legal requirements for Forms 15CA and 15CB

- Section 195 of the Income Tax Act of 1961 was revised by the Finance Act of 2008, which added a new sub-section (6) to section 195, which reads as follows:

- ‘‘(6) The person referred to in subsection (1) must provide information pertaining to the payment of any money in the form and manner determined by the Board."

- Note: The Finance Act of 2015 eventually replaced the above sub-section (6). Later in this piece, we'll talk about it.

The legal basis for CBDT notifying Form 15CA and Form 15CB under the Income Tax Rules is the provisions for supplying information regarding tax deduction at source under section 195(6).

- Section 195(6) deals with the provision of information in relation to payments made to non-residents and authorizes the Central Board of Direct Taxes to collect data on payments made to non-residents, whether or not they are taxable.

- Section 195(1) requires anybody responsible for paying a non-resident or a foreign firm any interest or other taxable sum (excluding dividends and income under the heading "salaries") to deduct tax at source at the current rates. Payments of royalties to non-residents and payments for technical services are examples of taxable items for which tax must be deducted at the source under this provision.

- Previously, a person making the remittance had to include an undertaking (in duplicate) addressed to the Assessing Officer, as well as a certificate from an accountant in a specific manner. This undertaking and certificate must be sent to the Reserve Bank of India or one of its authorized dealers, who must then provide a copy to the Assessing Officer.

- The goal of the undertaking and certificate was to collect taxes at the time of remittance because it was probable that the tax would not be recoverable later from non-residents.

- Foreign remittances have increased significantly, making manual management and tracking of certificates onerous. It was proposed that the information in the certificate and undertaking be e-filed in order to monitor and track transactions in a timely way. As a result of the change, the person responsible for income-tax deductions must give information relating to the payment of any sum to a non-resident or a foreign company in the form and manner prescribed by the Board.

This modification went into effect on April 1, 2008.

- The person responsible for making the payment to a non-resident, including a foreign firm, must provide the information required by section 195, subsection (6).

- The CBDT was given the power under section 195, subsection (6), to prescribe the form and manner of furnishing information for foreign remittances to non-residents, and the Board, in exercising this power in order to comply with section 295, notified Rule 37BB under the Income Tax Rules, 1962, vide Notification No. 30/2009 dated 25.03.2009.

- Rule 37BB was added to the Rules for the first time, requiring Form 15CA and a certificate from a Chartered Accountant in Form 15CB.

- Form 15CA was required to be filed electronically via the Tax Information Network's designated website, www.tin-nsdl.com, at the time.

- Form 15CA is a Certificate from a Chartered Accountant for ascertaining the nature of remittance and determining the rate of tax deducted at source as per the provisions of sub-section (6) of Section 195 of the Income-tax Act, 1961, and Form 15CB is a Certificate from a Chartered Accountant for ascertaining the nature of remittance and determining the rate of tax deducted at source as per the provisions of sub-section (6) of Section 195.

Form 15CA has to be completed Prior to remitting the money to the non-resident

- The provision of Form 15CA was done online, however, the provision of a certificate from a CA in Form 15CB was performed manually at the time.

- Diplomatic missions in India will be required to submit simply a self-certified undertaking in Form No. 15CA to the remitter bank for remitting consular receipts abroad. They are not necessary to earn an accountant's certificate or an Assessing Officer's certificate (Form 15CB). [30.11.2009 Circular No. 9/2009] .2009]

- However, as of February 12, 2014, the TIN's functionality for obtaining foreign remittance details in Form 15CA and related features has been withdrawn, and the same is now available on the Income Tax Department's e-filing portal, www.incometaxindiaefiling.gov.in. Following that, in keeping with Form 15CA, a certificate in Form 15CB was also issued online.

- In 2013, Notification No. 58/2013 dated 05.08.2013 revised Rule 37BB to change the format of Forms 15CA and 15CB. In some situations, the revised Rule eliminates the necessity to get a certificate in Form 15CB from a CA.

The new Form 15CA has been divided into 3 Parts:

(1) Part A of Form 15CA: Provide information if the payment amount is less than Rs. 50,000 and the total amount of payments made during the financial year are less than Rs. 2,50,000.

There is no need to get a certificate from a CA in Form 15CB if the amount of remittance to non-residents is covered in Part-A of the modified Form 15CA. As a result, lesser payments were not eligible for Form 15CB.

(2) Part B of Form 15CA: To provide information if the amount of payment is not subject to tax and is covered by one of the 39 types of payments listed on the form.

(3) If the nature of the remittance is chargeable to tax and surpasses Rs. 50,000, and the total of the payments made during the financial year exceeds Rs. 2,50,000, fill out Part C of Form 15CA.

The obligation of acquiring a CA certificate in Form 15CB was made mandatory in this case.

Form 15CA and Form 15CB

|

Sr. No |

Form Number |

Description |

|

1. |

Information to be furnished for payments to a non-resident not being a company, or to a foreign company |

|

|

2. |

Certificate of an accountant |

The following is the Specified List indicated in the modified Rule 37BB:

- In brief, according to Notification No. 58/2013 dated 05.08.2013, Form 15CB was not necessary for 39 of the Specified List's payment items, but Form 15CA was.

- Rule 37BB was then revised once more within a month, this time by Notification No. 67/2013 dated 02.09.2013.

The new Form 15CA was amended at that time to remove the previously existing Part-B of the Form 15CA. There were just two parts to the new Form 15CA:

1. Part A of Form 15CA: Provide details if the payment amount is less than Rs. 50,000 and the total amount of payments made during the financial year are less than Rs. 2,50,000.

There is no need to get a certificate from a CA in Form 15CB if the amount of remittance to non-residents is covered in Part-A of the new Form 15CA. As a result, minor payments were barred from getting Form 15CB, identical to the Part-A of Form 15CA at the time.

2. Part B of Form 15CA: If the nature of the remittance is taxable and exceeds Rs. 50,000, and the total of the payments made during the financial year exceeds Rs. 2,50,000, you must provide information.

The obligation of acquiring a CA certificate in Form 15CB was made mandatory in this case. This section was similar to Part C of Form 15CA at the time.

It should be noted that Notification No. 67/2013 reduced the number of items in the Specified List from 39 to 28 by deleting the following 11 payments:

|

Sl. No. |

Earlier Sl. no. |

Purpose code as per RBI |

Nature of Payment |

|

1 |

7 |

S0101 |

Advance payment against imports |

|

2 |

8 |

S0102 |

Payment towards imports-settlement of invoice |

|

3 |

9 |

S0103 |

Imports by diplomatic missions |

|

4 |

10 |

S0201 |

Payment for surplus freight or passenger fare by foreign shipping companies operating in India |

|

5 |

12 |

S0203 |

Freight on imports-Shipping companies |

|

6 |

13 |

S0204 |

Freight on exports-Shipping companies |

|

7 |

14 |

S0206 |

Booking of passages abroad -Shipping companies |

|

8 |

16 |

S0209 |

Freight on imports-Airlines companies |

|

9 |

18 |

S0213 |

Payments on account of stevedoring, demurrage, port handling charges, etc. |

|

10 |

26 |

S0601 |

Payments for life insurance premium |

|

11 |

28 |

S0603 |

Other general insurance premium |

As a result, except for the 28 items included in the Specified List, Form 15CA is required for any remittance outside India under the modified Rule 37BB. when a remittance to a non-resident is taxable and exceeds the threshold limit of Rs. 50,000 and Rs. 2,50,000 in total during the financial year only then Form 15CB required.

Rule 37BB is currently in use.

To strike a compromise between minimizing the difficulty of compliance and collecting information under section 195 of the Act, Rule 37BB was further revised by Notification No. 93/2015 dated 16.12.2015, which is now in effect. Under the same notification, new Forms 15CA and 15CB were also announced.

Form 15CA and 15CB filing services to NRI

- Forms 15 CA and 15 CB: Our country's Income Tax Law requires authentication of foreign remittances (payments) made to a Non Resident or Foreign Company for any amount that is taxable under current laws. The Income Tax Act has established specific rules and guidelines for making foreign remittances to this end.

- Form 15 CA must be submitted by anyone making a remittance (payment) to a Non Resident or a Foreign Company. This form is filled out online. Before uploading Form 15 CA online, a certificate from a Chartered Accountant in Form 15 CB may be required in some cases.

- This is tax determination certificate in which a CA in india detmines the taxability of the remittance in accordance with the Income Tax Act & Provisions of the Recipient's Residence Country's DTAA. In case remittance is taxable, it must be remitted only after TDS

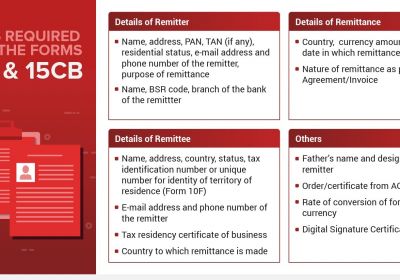

- The information provided in Form 15CB primarily includes the remitter's details, the details of the remittance, the nature of the remittance (whether salary, commission, royalty, etc) as agreed between the two parties, the remitter's bank details, and a Tax Residency Certificate from the remitter if DTAA (Double Taxation Avoidance Agreement) is applicable.

Popular blog:-

- Basic Provision of Form 15CB & 15CA

- Complete Understanding about Form 15CA, Form 15CB

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

- Form 15cb To Be Issued For Payment To NRI

- How to file e-form 15ca & 15cb-process

- New rules for form 15ca/cb under rule 37bb

- Form-15cb-to-be-issued-for-payment-to-non-resident-for-using-immovable-property-situated-in-india