Goods and Services Tax

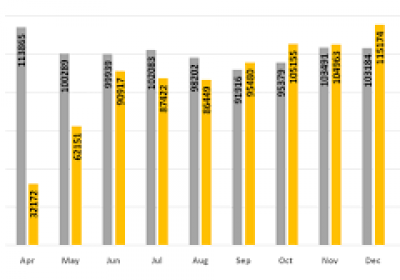

GST revenue has hit a record high of INR 1.20 lakh crore in January 2021. Budget Effect

RJA 03 Feb, 2021

In January, GST revenues hit a record of Rs 1.20 Lakh Crore: Great news on Budget Eve: Goods & Services Tax collections for January reached an all high of around Rs 1.20 lakh crore, the Finance Ministry said. According to the Finance Ministry, in line with the recovery trend in Goods & ...

OTHERS

Govt approved : Startup India Seed Fund Scheme to provide funding for start ups

RJA 02 Feb, 2021

The Government launched the “Startup India Seed Fund Scheme" to provide funding for start-ups powered by technology. The 'Startup India Seed Fund Scheme (SISFS)' has been approved by the Central Government to provide startups with financial assistance for proof of concept, prototype creation, product trials, market presence, ...

Goods and Services Tax

Key Analysis on Indirect Tax Proposals - Budget 2021

RJA 01 Feb, 2021

Key Analysis of Proposed Amendments in GST in Budget 2021 No Requirement of GST Audit Clause 101 of Finance Bill, 2021 has omitted the following Section 35(5) of CGST Act, 2017 which is made effective from the date to be notified: This is a prospective amendment that needs to be notified. It will be applicable ...

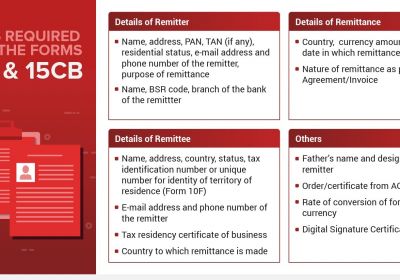

Form 15CA & 15CB Certificate

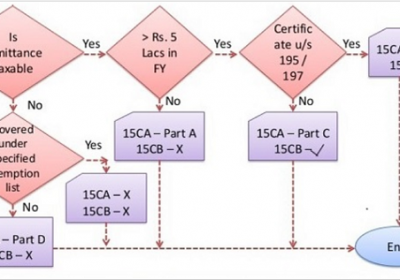

An NRIís Guidance on Forms 15CA and 15CB for International Remittances

RJA 01 Feb, 2021

An NRI’s Guidance on Forms 15CA and 15CB for International Remittances For foreign transfers or payments to non-residents, use Forms 15CA and 15CB. When a person is obligated to make a remittance to a non-resident, the remitter is legally required to withhold income tax from the payment. As ...

Goods and Services Tax

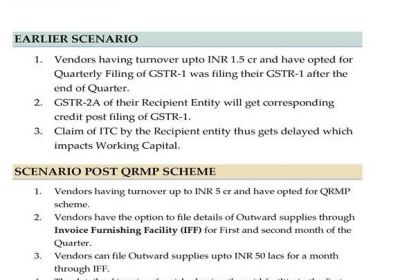

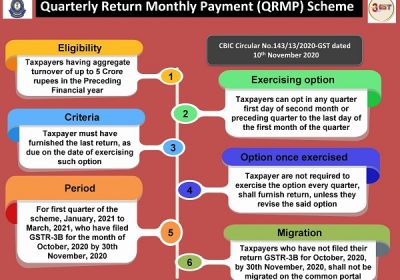

Choose the QRMP Scheme only after you identify its drawbacks.

RJA 31 Jan, 2021

Limitations/ drawbacks you should know before Choosing the QRMP Scheme. In order to benefit small taxpayers whose revenue is less than Rs.5 Cr, the Central Board of Indirect Taxes & Customs (CBIC) launched the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme as under Goods and Services Tax (...

NRI

Allow NRIs to buy gold from foreigners to claim GST refund by filling Return

RJA 31 Jan, 2021

Allow NRIs to buy gold from foreigners to claim GST reimbursement on their return (Expectation from Budget 2021) The gem and jewelry sector is hoping for a positive result from the budget 2021. The gem and jewelry sector is making a major contribution to the overall economy of the country. And ...

OTHERS

Govt to amend Laws for effective Disciplinary points for ICAI, ICWAI, ICSI

RJA 31 Jan, 2021

Govt to amend Laws for effective Disciplinary points for ICAI, ICWAI, ICSI The Govt. of India is ready to amend laws to streamline the workings, in particular disciplinary dimensions, of the three professionals in ICAI, ICWAI and ICSI. The invoice for amending the relevant provisions of the laws governing the ...

OTHERS

Key Points to Consider Before Choosing Types of Business

RJA 28 Jan, 2021

Key Points to Consider Before Choosing Types of Business Ease: The easiest business structures to create are sole proprietorships. It is typically as easy as opening a checking account at your local bank to set up a sole proprietorship. It is also relatively easy to set up partnerships, but you ...

OTHERS

Key Considerations when you launch a startup business

RJA 28 Jan, 2021

Want to Startup Business in India? Here is some Guidelines for YOU! A startup refers to a company that's in the initial stages of business. Startups are created by one or more entrepreneurs who want to create a product or service to be marketed by the founders. ...

INCOME TAX

All about tax benefit enjoy by Resident Senior Citizens

RJA 26 Jan, 2021

Overview on Tax Concessions/ benefit for Resident Senior Citizens So After a lifetime of working, raising families, and making a contribution to the success of this Nation other ways senior citizens deserve a dignified retirement.- Charlie Gonzalez Every Nation Govt provides special specific relief to senior citizens in a ...

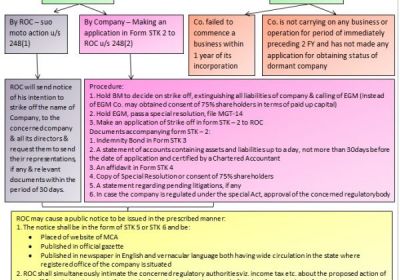

COMPANY LAW

PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY

RJA 26 Jan, 2021

PROCESS OF STRIKING-OFF- A PRIVATE LIMITED COMPANY – There really is a goal behind starting every company that will always run the company, although not all companies end up the same way. The company is founded to do a business, but sometimes the business venture does not succeed or the ...

INCOME TAX

No Notional Taxation! If gap in value of stamp duty is no more than 20% of actual transaction,

RJA 18 Jan, 2021

No Notional Taxation! If the gap in the value of the stamp duty is no more than 20% of the actual value of the transaction, Valuing the stamp duty is a benchmark tax price and plays an important role in the tax obligation evaluation of the property's value. Now ...

FEMA

Increasing Foreign Direct Investment Opportunities in India

RJA 17 Jan, 2021

Continuously Increasing FDI in India As the country has one of the most facilitative policies to draw overseas investors. In the midst of the Covid-19 pandemic, Commerce and Industry Minister Piyush Goyal said India is experiencing a fast and sustained recovery in economic performance measures. In the first nine ...

OTHERS

Single Point Registration Scheme

RJA 15 Jan, 2021

Single Point Registration Scheme Overview of Ministry of Micro Small & Medium Enterprise Scheme In 1955, the Indian Government launched the National Small Industries Corporation Limited to foster the growth of small industries in our country. Under this Single Point Registration Scheme (SPRS) for participation in Government Transactions, NSIC registers all ...

IBC

Retention of records by Insolvency Professionals relating to CIRP under IBC

RJA 08 Jan, 2021

Retention of records by Insolvency Professionals relating to CIRP under IBC Insolvency and Bankruptcy Board of India (IBBI) has issued a circular on “Retention of records relating to Corporate Insolvency Resolution Process (CIRP) by an Insolvency Professional” vide circular no. No.: IBBI/CIRP/38/2021 dated 06th January 2021 in the ...

Goods and Services Tax

GST Rule 86B : 1% payment of tax liability in cash in GST

RJA 06 Jan, 2021

What is the restriction imposed pursuant to Rule 86B on ITC? Recently, the CBIC has inserted new Rule 86B in the CGST Rules, 2017. As per the new rule, the registered person has been restricted to use the amount available in the electronic credit ledger to discharge his liability ...

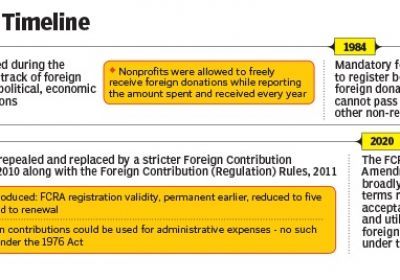

FCRA

Changes to the Annual Return under the FCRA

RJA 01 Jan, 2021

Changes to the Annual Return under the Foreign Contribution Regulations Act : The Foreign Contribution Regulation Act of 2010 (“FCRA”) and the Foreign Contribution Regulation Rules (“FCRR”) have recently undergone some modifications. The modifications are as follows: 1. Registration, Prior Approval, and Renewal of Registration Consolidated Form: Previously, Form ...

Form 15CA & 15CB Certificate

Applicability of Forms 15CA and 15CB for Goods Importation

RJA 01 Jan, 2021

Applicability of Forms 15CA and 15CB for Goods Importation As previously indicated, Form 15CA and Form 15CB are not necessary for payments on the exempted list; nonetheless, Form 15CA and Form 15CB were required for all types of payments. Importers who are compelled to make regular payments to non-residents may ...

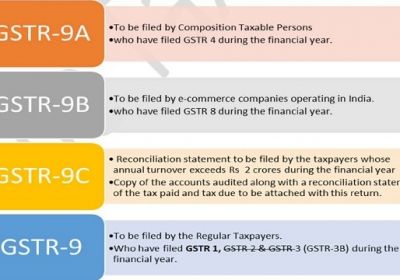

GST Filling

Not required to file GSTR-9C for Financial Year 2019-20 if Total Sale less than INR 5 Cr

RJA 10 Dec, 2020

GST Registered Person having total up to Rs 5 Cr, no needed to file GSTR-9C for Financial Year 2019-20 As per the Central Board of Indirect Taxes and Customs though this notification No. 79/2020-dated 15, Oct 2020 replaced, Subject to Rule 80(3) of the Central Goods and Services Tax Rules 2017 (CGST Rules), the ...

INCOME TAX

Frequently asked questions (FAQ) on UDIN issued by the income tax department

RJA 10 Dec, 2020

Frequently asked questions (FAQ) on UDIN issued by the income tax department The Institute of Chartered Accountants of India has been pioneering in the construct of a unique idea called 'Unique Document Identification Number (UDIN)' after finding false certifications by Non - Chartered Accountants’ that have been misrepresented as ...

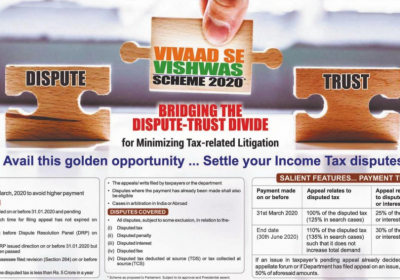

INCOME TAX

Income Tax dept. permit the revision of declarations filed under Direct Tax Vivad se Vishwas scheme

RJA 09 Dec, 2020

Income Tax dept. permit the revision of declarations filed under the “Direct Tax Vivad se Vishwas Act scheme” The CBDT has explained in FAQ’s that the 'Vivad Se Vishwas' scheme should not be used in a situation where proceedings are pending before the Income Tax Settlement ...

Goods and Services Tax

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme

RJA 09 Dec, 2020

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme 1. Who could choose for the scheme: With effect from 1st Jan 2021, Below Registered Persons can opt to submit Qtrly GSTR Returns & Pay tax on a monthly basis: A Registered person’s required to file Form ...

GST Compliance

GST Rate @ 12% applies on Mixed Supply of Works Contract & Job Work: WB AAR

RJA 08 Dec, 2020

GST Rate @ 12% applies on Mixed Supply of Works Contract & Job Work: WB AAR West Bengal - Authority of Advance Ruling directed that 12 per cent GST Rate be extended to a mixed supply of works and job work contracts. The applicant is the owner of M/s Vrinda Engineers Private ...

GST Filling

Prevent common errors when filing with GSTR-1

RJA 02 Dec, 2020

Avoid Common Errors/Mistakes when making GSTR-1 Filing After the introduction of Rule 59(6) of the CGST Rules 2017, you will have the idea that simply filing GSTR-1 is not sufficient for your business. As per the new regulations, not filing GSTR 3B on a continuous basis will result in a limitation ...