Table of Contents

Applicability of Forms 15CA and 15CB for Goods Importation

- As previously indicated, Form 15CA and Form 15CB are not necessary for payments on the exempted list; nonetheless, Form 15CA and Form 15CB were required for all types of payments. Importers who are compelled to make regular payments to non-residents may have reduced compliance and paperwork as a result of this.

- Rule 37BB was changed by CBDT Notification No. 93/2015 on December 16, 2015, with effect from April 1, 2016, to allow import payments as part of the exemption list.

The ‘specified list' includes the following payments for which there is an exemption from filing Form 15CA and Form 15CB-

|

Purpose Code as per RBI |

Nature of Payment |

|

S0101 |

Advance Payment against Imports |

|

S0102 |

Payment towards Imports – Settlement of Invoice |

|

S0103 |

Imports by Diplomatic Missions |

|

S0104 |

Intermediary Trade |

|

S0190 |

Imports below ? 5,00,000(For use by ECD offices) |

As a result, Forms 15CA and 15CB will no longer be necessary for goods import operations.

Also read: An NRI’s Guidance on Forms 15CA and 15CB for International Remittances

Form 15CA and Form 15CB

|

Sr. No |

Form Number |

Description |

|

1. |

Information to be furnished for payments to a non-resident not being a company, or to a foreign company |

|

|

2. |

Certificate of an accountant |

Can read about: LIST OF PAYMENTS FOR WHICH E-FORMS 15CA AND 15CB ARE MANDATED

Forms 15CA and 15CB are applicable for NRI remittances from NRO accounts.

- The income of an NRI who works in India is credited to his NRO account. An NRI may have interest income from Indian assets, rental income from his home in India, sale proceeds from immovable properties in India, and many more sources of income. They may have made such investments or purchased property while in India.

- Such NRIs may be interested in transferring money from India to the country in which they currently reside. Banks allow money to be repatriated from an NRO account.

- An NRI must electronically supply details in Form 15CA on the income tax department's e-filing platform before repatriating the funds. Almost always, banks want a copy of the completed Form 15CA filed with the IRS.

- The submission of a copy of the CA's certificate in Form 15CB is fraught with ambiguity.

- In many circumstances, banks will not release funds unless a Form 15CB certificate is obtained.

- Under the RBI's Liberalized Remittance (LRS) Scheme, neither Form 15CA nor Form 15CB is required for remittances that do not require RBI clearance. Part-D of Form 15CA must be completed in this circumstance.

- Under the RBI's Liberalized Remittance (LRS) Scheme, neither Form 15CA nor Form 15CB is required for remittances that do not require RBI clearance. Part-D of Form 15CA must be completed in this circumstance.

- In addition, if the payment is covered by the Specified List or an exemption list, no Form 15CA or Form 15CB is required. Remittances made by non-residents from their savings or income in India for family maintenance and savings (S1301) or personal gifts and donations (S1302), for example, are covered under the stated list. If the remittances are of the type described, there is no need to file Form 15CA or Form 15CB because of the exemption provided by Rule 37BB(3)(ii) of the Income Tax Rules 1962.

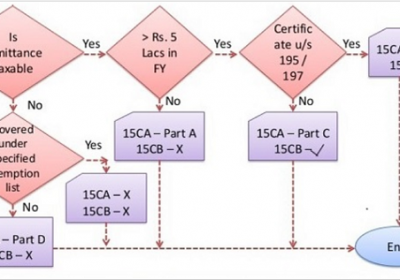

- Form 15CB is only necessary when the amount of the transfer is taxable in India, according to current Rule 37BB. If non-taxable transfers are made, Form 15CB is not necessary. Many banks, however, want a certificate in FormCB before remitting the NRI's funds due to frequent changes in the regulations and uncertainty. Even banks, in many situations, insist on filling out a specific section of Form 15CA that the NRI remitter may not be familiar with.

- As a result, any repatriation of monies by an NRI from his NRO account to his NRE account, including non-taxable funds, may require the remitter to obtain a certificate from a Chartered Accountant in Form 15CB in addition to Form 15CA.

- Only when the amount of transfer out of India is taxable in India and exceeds Rs. 5,00,000 is Form 15CB required.

- In practice, certain banks may require Form 15CA and/or Form 15CB, along with or without supporting papers, to prove that income tax has been properly paid in India before monies are remitted.

May refer the Article : Amended guidelines for submissions of Form 15CA & Form 15CB Certification

Failure to submit Forms 15CA and 15CB may result in a penalty.

There was no penalty for not filing Form 15CA and/or Form 15CB before 2015.

- Furthermore, there was no mechanism at the time for imposing a penalty for failure to submit/inaccurately submit the required information in connection with remittances to non-residents.

- A new provision, section 271-I, was inserted into the Income Tax Act to ensure the submission of accurate information in respect of remittances to non-residents. It states that if the information is not provided or is provided incorrectly under sub-section (6) of section 195, a penalty of Rs. 1,00,000 will be imposed. A subsequent adjustment to the requirements of section 273B was introduced to state that if it is proven that there was justifiable cause for the non-furnishing or erroneous furnishing of information under sub-section (6) of section 195, no penalty will be imposed under this new provision.

The following is the text of Section 271-I:

- Section 195 imposes a penalty for failing to provide information or providing false information.

- 271-I. If a person, who is required to provide information under section 195, sub-section (6), fails to provide such information or provides erroneous information, the Assessing Officer may order that such person pay a penalty of one lakh rupees.

- A penalty is imposed not only for failure to file Form 15CA/Form 15CB but also for giving incorrect or fraudulent information in the filed forms, according to the aforementioned clause.

- Quoting the e-filed Form No. 15CA's Unique Acknowledgement in Form 27Q

- The CBDT has ordered that the ‘Unique Acknowledgement of the related Form No. 15CA' be quoted in the Form 27Q, as per Notification No. 11/2013 dated 19.02.2013. Form 27Q is the quarterly e-TDS statement required by section 200(3) read with Rule 31A for TDS from payments to non-residents.

- You can also review all about the withdral of 15CA and 15CB

Popular blog:-

- Basic Provision of Form 15CB & 15CA

- Complete Understanding about Form 15CA, Form 15CB

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

- Form 15cb To Be Issued For Payment To NRI

- How to file e-form 15ca & 15cb-process

- New rules for form 15ca/cb under rule 37bb

- Form-15cb-to-be-issued-for-payment-to-non-resident-for-using-immovable-property-situated-in-india