Table of Contents

GST Registered Person having total up to Rs 5 Cr, no needed to file GSTR-9C for Financial Year 2019-20

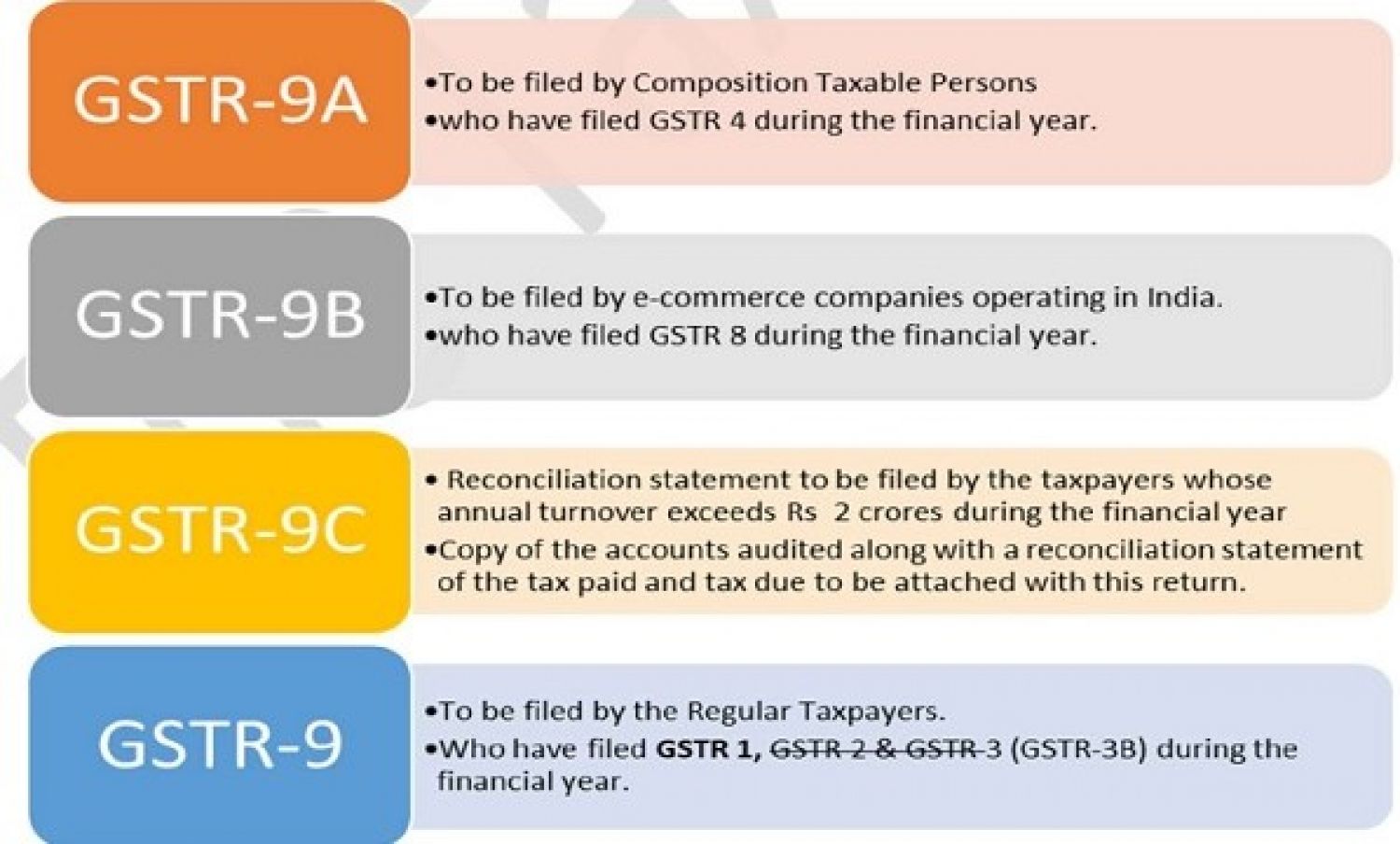

As per the Central Board of Indirect Taxes and Customs though this notification No. 79/2020-dated 15, Oct 2020 replaced, Subject to Rule 80(3) of the Central Goods and Services Tax Rules 2017 (CGST Rules), the obligation to include a copy of the audited annual reports & a reconciliation statement in Form GSTR-9C for FY 2019-20 for each GST Registered person with a total turnover of up to 5 Cr. Now you can read as below:

'Provided that for the fiscal years 2018-2019 and 2019-2020, any registered person whose cumulative turnover exceeds five crore ropes shall be audited in compliance with subsection (5) of section 35 and shall provide electronically, via the common financial year a copy of the audited annual reports and a certified copy reconciliation statement in FORM GSTR-9C for that fiscal year. Previously, this provision for exemption was for FY 2018-19 however through this notification it has been increased to FY 2019-20.

Notes : Important issue in filling GST Audit Filling Form 9C under the GST