GST Consultancy

For Changing or Amendment in the Goods and Services Tax registration

RJA 15 Apr, 2024

For Changing or Amendment in the Goods and Services Tax registration Nature of your Business -New Partners’ Details - For Changing Nature of Business: You would need to provide a detailed description of the new nature of your business. you'll typically need to provide various documents to ensure ...

INCOME TAX

Ten transactions that may trigger tax authorities' income tax scrutiny

RJA 03 Apr, 2024

Ten transactions that may trigger tax authorities' income tax scrutiny In today’s world, taxpayers should ensure that the money they declare accurately reflects their actual financial activity. Transparency regarding finances is important. The Income Tax Department is employing increasingly sophisticated techniques to investigate potential discrepancies between taxpayers' reported ...

INCOME TAX

All about the Equity Linked Savings Scheme & its Returns

RJA 20 Mar, 2024

5 Golden Tips to Maximise ELSS Fund Returns ELSS or Equity Linked Savings Scheme is a type of diversified equity-oriented scheme which comes with a lock-in period of 3 years. By investing in this type of scheme, one will get tax exemptions u/s 80C of the IT Act 1961. A key interesting ...

GST Filling

New Functionality of the interest calculator in GSTR-3B

RJA 16 Mar, 2024

New Functionality of the interest calculator in GSTR-3B on GST Portal: The New GST functionality of interest calculator in GSTR-3B is now live on the Goods and Services Tax Portal. This Goods and Services Tax functionality will facilitate and assist the taxpayers in doing self-assessment. This GST functionality ...

INCOME TAX

How to respond notices for AIS (Annual Information Statement) mismatch?

RJA 09 Mar, 2024

How to respond notices for AIS (Annual Information Statement) mismatch? AIS (Annual Information Statement) mismatch means there is a discrepancy between the information provided in your tax return and the information reported by third parties, such as banks, financial institutions, or employers, to the tax authorities through the Annual ...

INCOME TAX

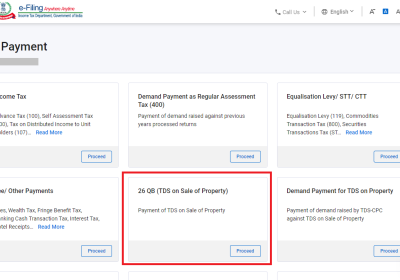

Payment of TDS via using Form 26QB on sale of property

RJA 03 Mar, 2024

Payment of TDS via using Form 26QB on sale of property transaction The following are some essential key points about Form 26QB: 1. Objective of Form 26QB : It assures that income tax is withheld at the moment of the property transaction and is specifically designed for Tax Deducted at Source on ...

RBI

RBI intends to tokenisation assets, bonds as part of the wholesale CBDC pilot.

RJA 26 Feb, 2024

RBI intends to tokenisation assets, bonds as part of the wholesale CBDC pilot. T Rabi Sankar, Deputy Governor Reserve Bank of India, said that The Reserve Bank of India (RBI) is planning to introduce tokenisation of assets and government bonds and such under the wholesale CBDC (Central Bank Digital Currency ...

INCOME TAX

NITI Aayog suggest for mandatory savings plans for elderly & tax reforms

RJA 23 Feb, 2024

NITI Aayog recommends for mandatory savings plans for elderly & tax reforms The apex public policy think tank of the Government of India NITI Aayog has pitched for Income tax & GST tax reforms, mandatory saving plan, & housing plan for elderly in India, as the recent data shows that ...

Goods and Services Tax

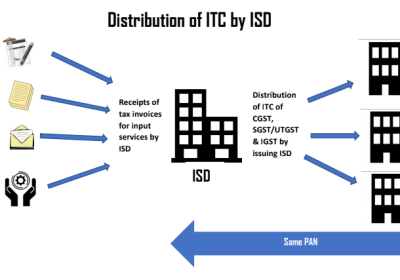

Changes in ISD Concept & Definition: Union budget 2024

RJA 05 Feb, 2024

Changes in Input Service Distributer (ISD) Concept & Definition: Union budget 2024 Registration as input service distributer (ISD) & Distribution of Input Tax Credit is proposed that to to necessary every person receives GST invoices for or on behalf of other branches having separate Goods and Services Tax Identification Number. It ...

INCOME TAX

Outstanding Small Income Tax Demands Not required pay off: Budget 2024

RJA 05 Feb, 2024

Outstanding Small Income Tax Demands Not required pay off : Budget 2024 The Indian Government has extended an olive branch to Income tax taxpayer those who are still handling with Petty small Income tax Demands related to previous year. Tax Dept to waive off small Income tax demands autonomously clear pending petty ...

Goods and Services Tax

Excess RCM claimed: ITC Claimed Twice against the RCM paid

RJA 18 Jan, 2024

Interest on ITC Credit Claimed Twice against the RCM paid : Excess RCM claimed Relevant provisions under GST Act. : Interest on ITC wrongly availed and utilised. As per substituted subsection 50 (3) of the act, interest is applicable only where ITC is wrongly availed and utilized. In order to attract interest u/...

Goods and Services Tax

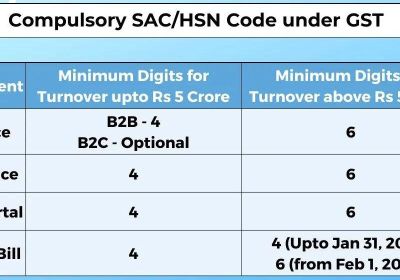

Compulsory e-Invoice Details & New HSN Code Requirements

RJA 17 Jan, 2024

Compulsory e-Invoice Details & New Harmonized System of Nomenclature (HSN) Code Requirements: Here are main basic points related to 2 update related to e-Way bills- New requirement of Changes in e-Waybill Generation/ issuing in GST HSN code is Compulsory in GSTR 1 for B2B exempt supply, depending on the AATO of ...

TDS

Payment made for official Sponsor/Promotion objective is not consider royalty

RJA 31 Dec, 2023

Payment made for official sponsor / promotion objective is not consider royalty: ITAT Assessee had been taken an appointed as the official sponsor of ICC Events, after that said assessee submit an application to remit professional sponsorship amounts to Global Cricket Corporation PTE Ltd. – Singapore (GCC) without deduction of TDS ...

Goods and Services Tax

GST Taxpayers will be permitted to submit Revised GST Returns w.e.f April 2025

RJA 30 Dec, 2023

GST Taxpayers May be permitted to submit Revised GST Returns with effect from Apr 2025 At present, there is no provision for filing revised goods and Services Tax Returns under GST, barring minor corrections in GST Invoice details & information uploaded on goods and Services Tax portal. Indian Industry has been ...

IBC

IBC Code Section 29A disqualification applies in the present time.

RJA 24 Dec, 2023

Principles enshrined in relation to IBC Code Section 29A disqualification applies in the present time. National Company Law Appellate Tribunal give the judgments that Non-Executive Director who wasn’t involved in Mgt of company affairs couldn’t be disqualified u/s 29A, Managing Director of a Successful Resolution ...

IBC

Complete Explanation on IBC Section 29A Eligibility Check

RJA 23 Dec, 2023

Complete Explanation on IBC Section 29A Eligibility Check IBC Section-29A clearly states that “A person shall not be eligible to file a Vibal resolution plan, In case that person, or any other person acting jointly or in concert with a such person— As above expression ...

INCOME TAX

Income Tax refund claimed in ITR for AY 2018-19 to 2020-21 to Jan 31, 2024

RJA 13 Dec, 2023

Income Tax refund claimed in ITR for AY 2018-19 to 2020-21 to Jan 31, 2024 Central Board of Direct Taxes via Order F. No. 225/132/2023-ITA-II, issued on October 16, 2023 extends Timeline for process income Tax refund claimed Income Tax return for Assessment Year 2018-19 to Assessment Year 2020-21 to January 31, 2024 The Central Board ...

COMPANY LAW

Statutory & Tax Compliance Calendar for December 2023

RJA 01 Dec, 2023

Statutory & Tax Compliance Calendar for December 2023 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1. Goods and Services Tax GSTR-7- Tax Deducted at Source Return under Goods and Services Tax Nov-23 10-Dec-23 GSTR 7 is a return to be filed by the persons who is required to deduct ...

INCOME TAX

CBDT: 11.5 Cr PAN cards were deactivated for failing to be linked with Aadhaar cards

RJA 21 Nov, 2023

CBDT: 11.5 Cr PAN cards were deactivated for failing to be linked with Aadhaar cards Link PAN and Aadhaar card: Failure to link PAN and Aadhaar card by 30 June will result in a fine of Rs. 1,000 and PAN deactivation. PAN will become inoprative from 1 July 2023, therafter you needed Reactivating the ...

IBC

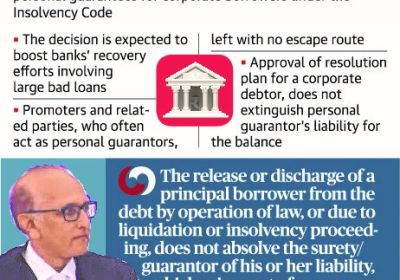

Supreme Court upholds validity of Personal Guarantors’ IP of IBC Code

RJA 07 Nov, 2023

Supreme Court upholds validity of main provisions of Personal Guarantors’ Insolvency Resolution of IBC Code, Supreme Court on Nov 2023 upheld few IBC Provisions of the IBC which were challenged on grounds of being violative of fundamental rights like the right to equality of those against whom insolvency proceedings are ...

GST Filling

GST apply to corporate guarantees between Subsidiaries, Parent & parties

RJA 28 Oct, 2023

18% GST apply to corporate guarantees between Subsidiaries, Parent & Related parties GST on service supplied by State or Central Govt. to their undertakings or Public sector undertaking’s by way of guaranteeing loans taken by them -The Central Board of Indirect Taxes and Customs issue explanation that guaranteeing of ...

INCOME TAX

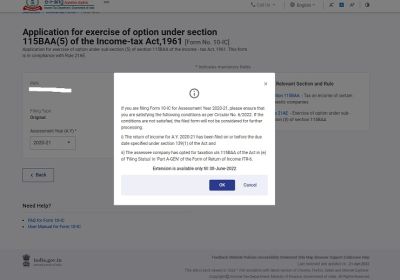

Basic Conditions of Condonation in filing of Income Tax Form 10-IC

RJA 24 Oct, 2023

Conditions of Condonation in filing of Income Tax Form 10-IC 1. Representations had been received by The Central Board of Direct Taxes stating that Income Tax Form No. 10-IC could not be submitted for A.Y. 2021-22 within the Timeline date or extended Timeline date, as the case may be. ...

INCOME TAX

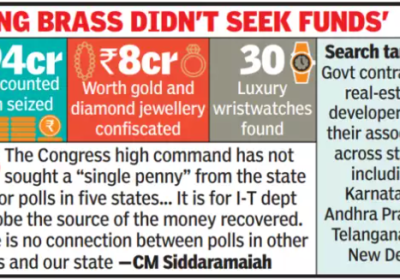

IT Dept. : More than INR 102 Cr value of jewellery & cash seized in searches on contractors

RJA 18 Oct, 2023

More than INR 102 Cr value of jewellery & cash seized in searches on contractors: the Income Tax Department has disclosed. The Income Tax Department has revealed that searches conducted between October 12 and 15 at 55 locations in Karnataka, Telangana, Andhra Pradesh, and Delhi in connection with alleged illicit earnings generated by civil ...

INCOME TAX

Mode of operation in financial fraud & tax avoidance made by contractor

RJA 18 Oct, 2023

Mode of operation in financial fraud & tax avoidance made by contractor The basic method of operation outlined points to a typical scheme for financial fraud and tax avoidance. To decrease their tax liability and produce unaccounted cash and hidden assets, contractors engaging in such activities overstate their expenses and ...