Table of Contents

Debts Trap : Spend too much is Financial trouble fall when borrow without strategy

A debt trap occurs when a person struggles to repay borrowed funds and ends up taking on new loans to repay existing ones, creating a cycle of continuous borrowing. Excessive use of credit cards, high-interest personal loans, unplanned spending, and job loss or reduced income are among the major reasons people fall into debt traps. Falling into a debt trap can cause financial stress, lower your credit score, and make it difficult to secure loans in the future.

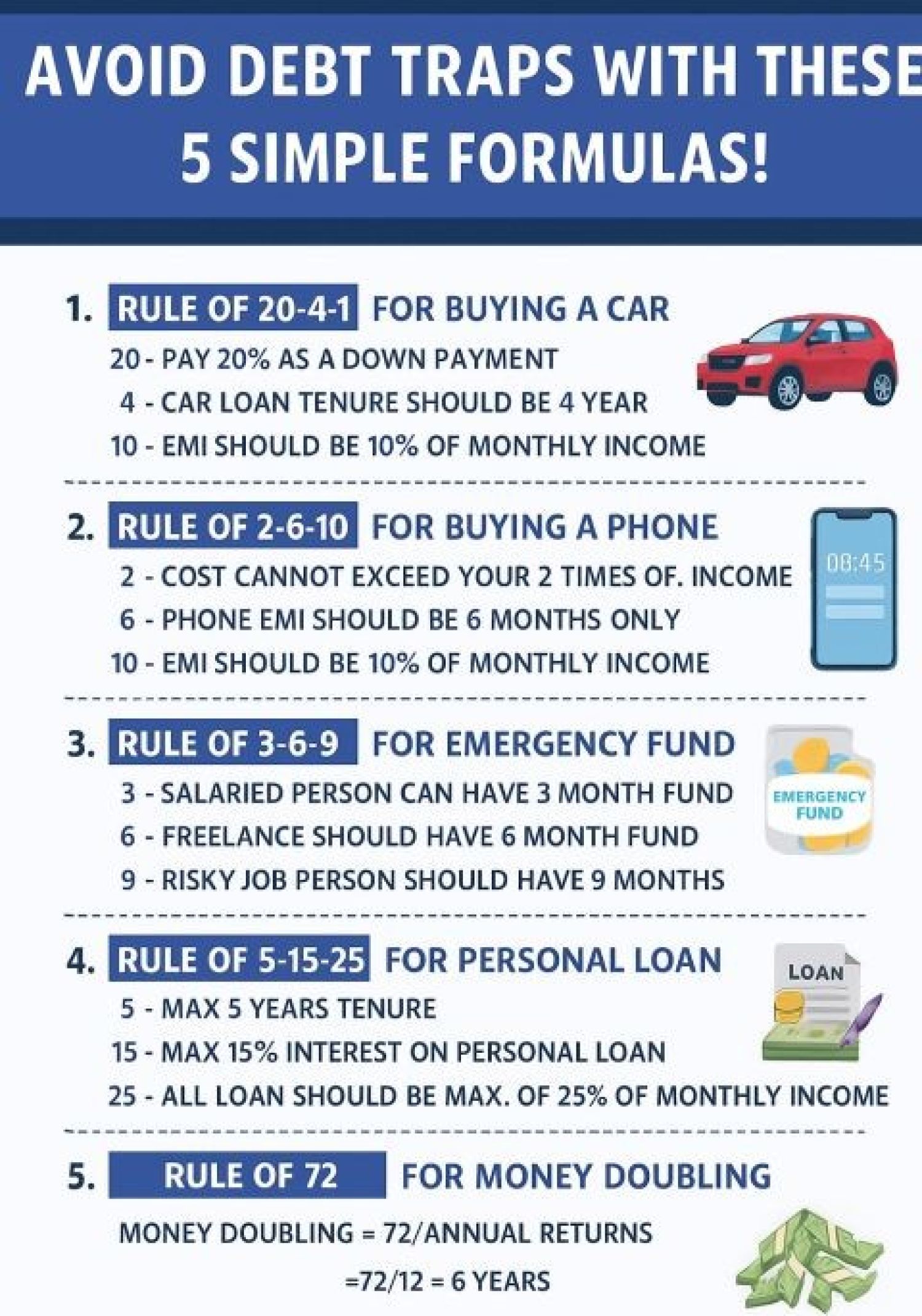

Most people don’t fall into financial trouble because they spend too much they fall because they borrow without a strategy. In today’s world, where EMIs and loans have become normal, understanding how much to borrow and for how long can be the difference between building wealth and being trapped in debt. Smart money habits are built on simple, time-tested rules, not guesswork.

How to Get Out of a Debt Trap

Over time, people often accumulate various kinds of debt. Some of these are productive or “good” debts such as a home loan or car loan which are secured and help build assets. However, high-cost debts, such as credit card balances or market borrowings at steep interest rates, can quickly become overwhelming. When your total debt exceeds your repayment capacity, you fall into a debt trap. Adopt a disciplined repayment strategy start by clearing high-interest debts first, and avoid unnecessary borrowing or lifestyle-driven credit use. Consolidate multiple loans into a single, lower-interest loan to simplify repayments, reduce EMIs, and regain financial control. But not all is lost with discipline and the right strategy, you can regain control of your finances. Here are a few smart ways to break free from a debt trap, Following are financial formulas that act as your shield against debt traps:

- Opt for Debt Consolidation : Combine all your existing debts into a single, lower-interest personal loan.Debt consolidation helps you manage repayments more efficiently, lower your EMIs, and negotiate better terms making it easier to stay on track.

- Avoid Taking Fresh High-Cost Debt : Once you’ve consolidated your loans, don’t take on any new high-interest debt. The goal is to reduce your liabilities not add to them.

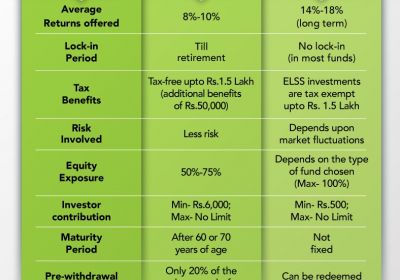

- Rule for Cars: Pay 20% upfront, keep the loan tenure within 4 years, and ensure your EMI is below 10% of your monthly income.

- Rule for Phones: Let your phone budget reflect your income not your emotions.

- Rule for Emergency Funds: Build a savings cushion that matches your job stability and responsibilities.

- Prioritize Expensive Loans First : If consolidation isn’t an option, start by repaying the costliest debt first (usually credit cards or personal loans). This strategy, known as the avalanche method, reduces your interest burden faster.

- Create and Follow a Strict Budget : Track your spending, set limits, and cut non-essential expenses until you’re financially stable. Reduce dependency on credit cards and focus on essential outflows only.

- Rule for Personal Loans: Keep tenure short, interest low, and EMIs capped to maintain healthy cash flow.

- Investing: Understand how long it takes to double your money, and invest with long-term discipline

- Boost Your Income : Consider freelance work, side gigs, or part-time income sources to accelerate debt repayment. Every extra rupee helps reduce your interest costs and financial stress.

- Manage Credit Card Dues Wisely : Credit card debt is unsecured and expensive. Always pay on time to avoid high interest and penalties. Missed payments can trigger higher rates and hurt your credit score.

- Use Balance Transfer Offers Cautiously : Transferring your outstanding credit card balance to another card with a lower promotional interest rate can be helpful but only if you’re confident you can repay the amount within the offer period. If the situation feels overwhelming, contact a debt counselling agency or financial advisor. They can help restructure loans, negotiate with lenders, and guide you toward financial recovery.

The real advantage isn’t in avoiding credit altogether; it’s in using it wisely. Borrow smart, spend mindfully, and let your money serve your goals not control them. Falling into a debt trap can happen to anyone, but with discipline, awareness, and planning, you can get out of it. The key is to take control early, spend consciously, and avoid unnecessary borrowing. Automate your savings and investment plans, build wealth strategies that run on autopilot, ensuring long-term financial security without falling back into debt