GST registration system

Page Contents

The Goods and Services Tax (GST)

What’s the GST Registration System?

Under the GST regime, business owners whose turnover exceeds Rs. 40 lakhs* (Rs. 10 lakhs for NE and hill states) are required to be registered as a normal taxable person. This registration procedure is termed the GST registration process.

Registration under the GST is compulsory for only certain companies. If the organisation sells its goods without registration under the GST, it will be an offense under the GST and severe penalties will apply.

Registration of GST typically takes approximately 2-6 business days. We’re going to help you register for GST in 3 easy steps.

*CBIC reported an increase in the threshold turnover from Rs 20 lakhs to Rs 40 lakhs. The notification shall come into force on 1 April 2019.

Goods and Services Tax (GST) Registration Services at Rajput jain and Associates helps you register your GST company and get your GSTIN.

RJA help via GST Experts will guide you on the applicability & Compliance of your corporate with GST but will register your company with GST.

Who must require to undertake GST Registration services?

- Any business having a turnover of INR 40,00,000/- or more in a FY

- Any business having a turnover of INR 10,00,000/- or more in a FY (For North Eastern States)

- Already registered business under Service Tax (operating online/offline) or Central Excise, VAT ,

- Non-resident taxable person operating his or her business in India.

- Vendors selling online through e-commerce platforms.

List of Documents To Be file while GST Registration

- Letter of Authorization/Board Resolution for Authorized Signatory

- Copy of Identity and Address proof of Promoters/Director with Photographs

- Copy of Bank Account statement/Cancelled cheque

- A Copy of Digital Signature

- Copy of PAN of the Applicant

- Copy of Aadhaar card

- A Copy of Proof of business registration or Incorporation certificate

- Copy of Address Proof of the place of business

- NOC certificate from the owner of the property of the property

What are Services Covered under the GST registration,

- we will complete our filing of Application for GST Registration

- We undertake the follow up till you secure GST Identification Number is not genrated,

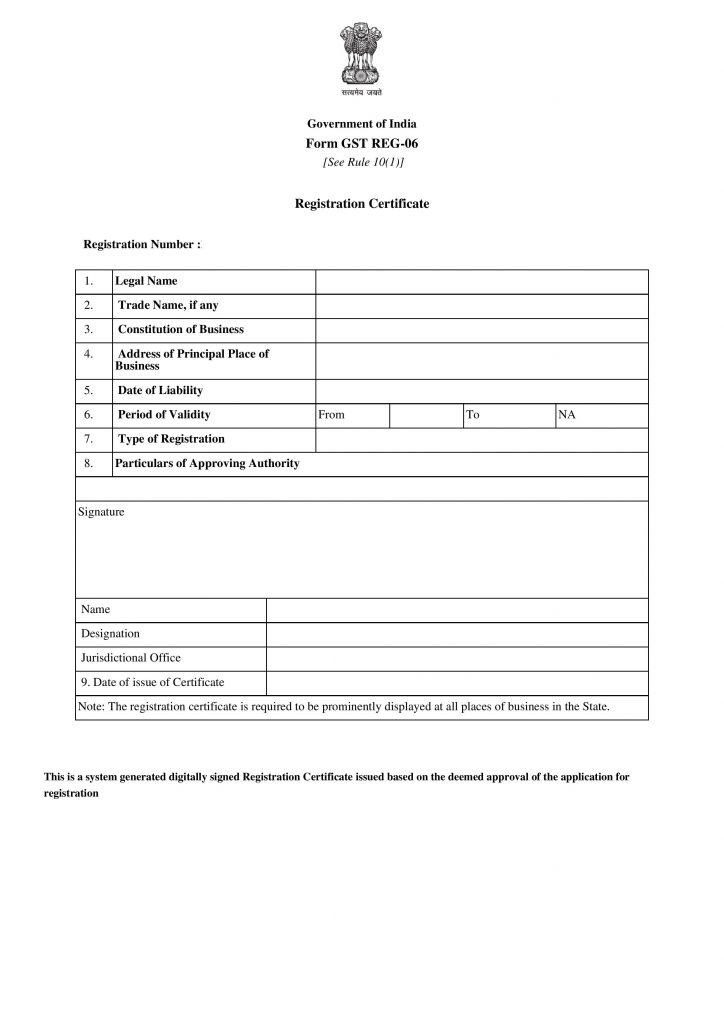

How to Download GST Certificate

No, without login it cannot be acquired. But you can follow the following steps to easily download your GST certificate if you have login details The download of the GST Registration Certificate will take place step by step here.

Step-by-step Process for downloading the GST Registration Certificate:

Step 1-GST Portal login.

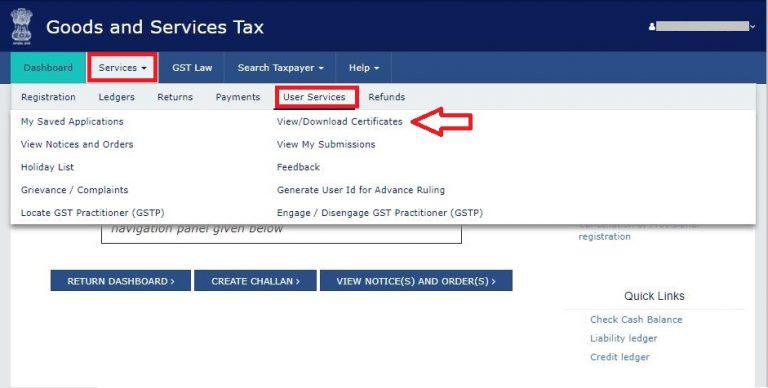

Step 2-Go to ‘Services’ > ‘User Services’ > ‘Certificate view/download.

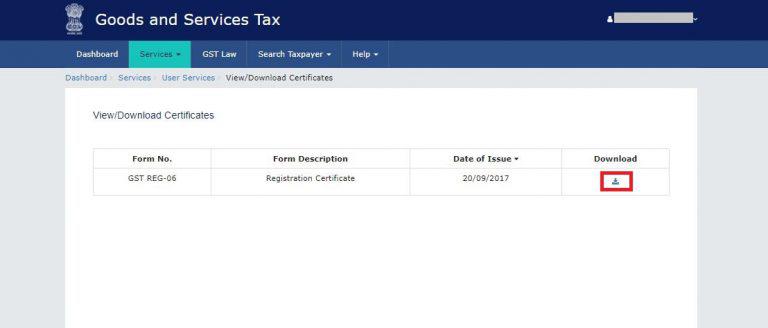

Step 3-Click on the icon ‘Download’

The certificate includes all of the company information. Basic information such as the name, address, and date of company registration is shown on the first page.

The certificate includes all of the company information. Basic information such as the name, address, and date of company registration is shown on the first page.

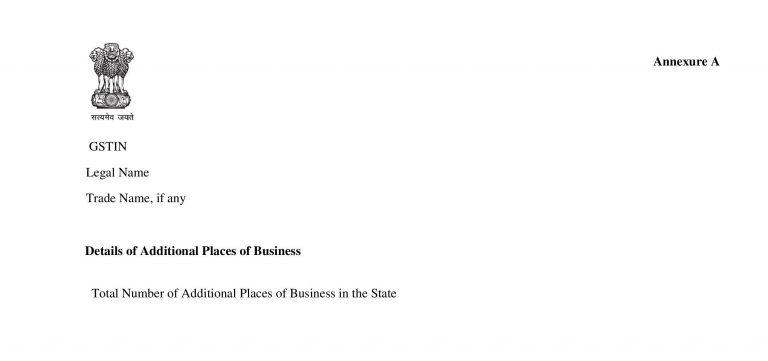

another second page is ‘Annexure A’ which provided details of any other additional place of business of the Firm.

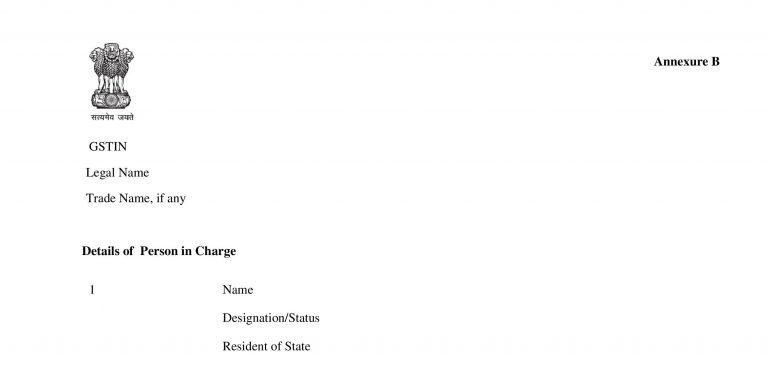

The last and third page as attached in ‘Annexure B’ has details of the person-in-charge of the business.

Penalty for non-registration under GST

An offender who does not pay tax or make short payments (genuine errors) must pay a penalty of 10% of the amount of tax due, subject to a minimum of Rs.10,000.

GST Bill: Government looks forward to decreasing additional tax and compensating the states for 5 years.

The following seven days will be quite a challenging Phase in Rajya Sabha as GST Bill is in the critical stage as it is proposed to implement GST in April 2017.

There are several reasons which had prevented the passing of the GST Bill in the upper house. Out of these some factors were the political agendas which were hidden and other visible factors can be best understood from analyzing the following demands of the Congress Party which is right now the single largest party in the upper house.

India moved a step further to implement the GST when the government agreed on Wednesday to reduce the contentious 1% tax on manufacturing and wholly compensate the states for 5 years for all potential losses suffered after new system comes into force.

What were the demands of Congress?

There were 3 demands of the congress party:

- With a view of benefiting the states which are involved in manufacturing industries, Congress wanted to abolish proposed additional Entry tax by 1%.

- To clearly establish a ceiling limit of 18% rate of GST in the constitution.

- To draw up an independent authority to settle the Goods and Services Tax dispute headed by a judge.

What the government wished for?

The government already has given its consent to 2 demands:

- To establish authority to settle GST dispute.

- Abolishing additional Entry tax of 1% on 27th of July, 2016 in one of its cabinet meetings.

On the other hand, the government is not giving consent to consider the third demand to include a ceiling limit of 18% in the GST rate as it says this rate cannot be easily incorporated in the constitution.

What can be the impact if the Entry tax is dropped by 1%?

After conducting various meetings for around a decade, by the collective efforts of experts, various organizations, and committees led by Dr. Aravind Subramanian, it was agreed to settle with RNR (Revenue Neutral Rate) the rate between 17% to 18%.

It was duly recommended by making a provision of 1% Entry tax but here the petroleum sector was outside the scope of RNR.

What is Revenue Neutral Rate?

Revenue Neutral Rate refers to the single rate which helps in preserving the revenue at desired levels. It is that single rate that slowly gets converted into full-rate structure depending on various exemptions allowed by different policy choices made. It decides what commodities are to to be charged at a lower rate and what commodities with a higher rate.

The RNR can be clearly differentiated from the “standard rate” which is proposed to be given in the GSThttps://carajput.com/gst/gst-consultancy.php Regime which is applied to all the services and goods whose taxation policy is not clearly defined in any act or law. So, typically most if the goods and services are taxed at a standard rate,although it may be noted that it need not be a thumb rule (compulsory rule) to charge a standard rate.

So basically RNR is that rate where both state government and the central government will incur loss from the viewpoint of collection of taxes in order to earn revenue.

Popular updates:

GST Return compliances calendar- Nov 2020

SALIENT FEATURES OF NEW GST SYSTEM IN INDIA

Key points of 42nd GST council Meeting headed By FM N. Sitharaman

GSTN enable auto-populated in the E-invoice information into GST Return -1

FOR FURTHER QUERIES CONTACT US:

E: singh@carajput.com 9-555-555-480