Table of Contents

- Faqs Related To Filling Of Form 67 & Claiming Foreign Tax Credit

- How We Claim The Foreign Tax Credit & Save More Tax?

- What Is Form 67, And When Is It Required To Be Filed?

- What Is A Double Taxation Avoidance Agreement (dtaa)?

- Which Income Qualifies For Claiming Foreign Tax Credit?

- What Determines The Method Of Relief From Double Taxation When There Is A Dtaa Present?

- What Kind Of Relief Does Section 91 Of The Income Tax Act Of 1961 Provide?

- What Is The Difference Between Section 90 And Section 90a Of The Income Tax Act Of 1961?

- What Are The Documents You Need To Submit To Claim A Foreign Tax Credit?

- Do I Need To File Form 67 If I Have Taxes Withheld By A Foreign Employer?

- What Are The Documents Needed To Claim Foreign Tax Credit?

- Quick Reference Summary Sections 90, 90a, And 91 For Claim Foreign Tax Credit

FAQS related to Filling of Form 67 & claiming Foreign Tax Credit

How we claim the Foreign Tax Credit & Save More Tax?

Ans: Effective tax planning goes beyond just avoiding double taxation. By understanding and utilizing the provisions of the Income Tax Act, such as Sections 90, 90A, and 91, and maintaining meticulous records, you can optimize your tax liabilities. Additionally, exploring deductions, exemptions, and other available credits can further enhance your tax-saving strategies. The tie-breaker rule is a key provision in DTAAs designed to resolve conflicts when an individual or entity is considered a tax resident in more than one country.

Common Criteria in the Tie-Breaker Rule:

-

Permanent Home: The country where the individual has a permanent home is given preference for determining residency. If the individual has a permanent home in only one country, that country is considered the country of residence.

-

Habitual Abode: If the individual has residences in multiple countries, the focus shifts to where they spend most of their time, known as the habitual abode. The country where the person has their habitual abode is likely to be considered their country of residence.

-

Center of Vital Interests: This refers to the location where the individual's personal and economic interests are predominantly located, such as family, employment, business, or significant social connections.

-

Nationality: If none of the previous criteria provide clarity, the individual’s nationality or citizenship may determine residency. The individual may be treated as a resident of the country where they hold citizenship.

These criteria are applied sequentially to determine which country should have tax residency status in case of dual residency. Each DTAA may have variations in the application of the tie-breaker rule, depending on the agreement between the two countries involved.

What is Form 67, and when is it required to be filed?

Ans : Form 67 is used to claim Foreign Tax Credit (FTC) in India. It must be filed along with your income tax return (ITR) if you have earned foreign income and paid taxes on it abroad. This form helps in reducing the tax liability in India by crediting the tax already paid in the foreign country.

What is a Double Taxation Avoidance Agreement (DTAA)?

Ans : A Double Taxation Avoidance Agreement is a treaty between two or more countries designed to prevent the same income from being taxed twice. It ensures that individuals or entities do not pay tax on the same income in both their home country and the country where the income is earned.

Which income qualifies for claiming foreign tax credit?

Ans : Any income earned abroad that is taxed both in the foreign country and in India qualifies for claiming FTC. However, the respective countries' Double Taxation Avoidance Agreement should be referred to for understanding the provisions and eligibility for claiming the credit.

What determines the method of relief from double taxation when there is a DTAA present?

When a Double Taxation Avoidance Agreement is present, the method of relief (either exemption or credit) is determined by the terms specified in the DTAA between the two countries. Additionally, whether the Double Taxation Avoidance Agreement is between governments (Section 90) or between organizations (Section 90A) influences the method of relief.

What kind of relief does Section 91 of the Income Tax Act of 1961 provide?

Section 91 provides unilateral relief from double taxation. It is applicable when there is no Double Taxation Avoidance Agreement between India and the foreign country where the income is earned. The relief is offered in the form of a foreign tax credit, limited to the lower of the Indian tax rate or the foreign tax rate applicable to the income.

What is the difference between Section 90 and Section 90A of the Income Tax Act of 1961?

Section 90 of the Income Tax Act is applicable when there is a DTAA between two countries. Section 90A of the Income Tax Act, on the other hand, applies when there is a DTAA between two specific organisations or associations of two countries.

- Section 90: Applicable when there is a DTAA between two countries. It allows for both credit and exemption methods of relief.

- Section 90A: Applicable when there is a DTAA between two specific organizations or associations from different countries. Only the credit method is available under this section; exemption is not applicable.

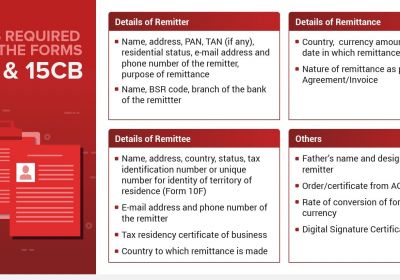

What are the documents you need to submit to claim a foreign tax credit?

Ans : To claim a foreign tax credit, you need to submit Form 67, a certificate from the tax authorities of the foreign country or the tax deductor, and proof of tax payment or deduction. These documents need to be submitted along with your ITR on or before the due date of filing.

Do I need to file Form 67 if I have taxes withheld by a foreign employer?

Ans : Yes, if taxes are withheld by a foreign employer, Form 67 must be filed along with your Indian tax return to claim FTC. Also, it's important to refer to the specific DTAA articles (usually Article 15 or 16) that govern the taxability of such income and allow for credit.

What are the documents needed to claim foreign tax credit?

Ans: To support your foreign tax credit claim, Taxpayer need to file few documents like: As per Income Tax Rule 128, To claim a FTC, Taxpayer required file following documents along with your ITR on or before the timeline date of filing of ITR:

A statement of:

- Certificate/Statement from Foreign Tax Authorities: Indicating the nature of income and the amount of tax deducted or paid.

- foreign income offered to tax (Form 1042S (for income earned in the U.S.), which is a withholding certificate.

- Form 67: Foreign tax deducted or paid on such income in Income tax Form No. 67 (Any other certificate of foreign tax deduction issued by the foreign tax authority or the employer Declaration of foreign income and taxes paid abroad. These documents must be submitted with Income tax Form 67 and your ITR.

Statement or Certificate specifying Nature of income & amount of Income tax deducted therefrom or paid by taxpayer :Self-Signed Statement: If official certificates are unavailable, accompanied by relevant proofs. i.e From Income tax authority of foreign country, from Person responsible for deduction of such withhold tax and Signed by income tax taxpayer.

- Proof of payment of taxes outside India i.e Proof of Tax Payment or Deduction: Such as bank challans, payment receipts, or deduction proofs.

Quick Reference Summary Sections 90, 90A, and 91 for claim foreign tax credit

Understanding and effectively utilizing Sections 90, 90A, and 91 of the Income Tax Act of 1961 are essential for Indian taxpayers earning foreign income. These sections, along with the FTC rules 128, provide robust mechanisms to prevent double taxation, ensuring that your hard-earned income is not unduly eroded by overlapping tax obligations. Proper documentation, timely filing of tax returns, and adherence to the stipulated guidelines are paramount to fully benefit from these relief provisions. Ensure that these documents are submitted on or before the due date of filing your ITR to avoid any delays or rejections in claiming the tax credit.

- Sections 90 & 90A:

- Purpose: Provide relief under DTAA.

- Applicability: Bilateral agreements between governments (Section 90) and associations (Section 90A).

- Section 91:

- Purpose: Provides unilateral relief in the absence of DTAA.

- Applicability: Applies to all other countries without DTAA with India.

- Foreign Tax Credit (FTC):

- Eligibility: Indian residents with foreign taxes paid.

- Calculation: Lower of Indian tax payable on foreign income or foreign taxes paid.

- Forms Required: Form 67 and relevant certificates.

- Penalties:

- Varies based on non-compliance type.

- Ranges: From INR 5,000 for not filing ITR to 60% for severe undisclosed income cases.