Table of Contents

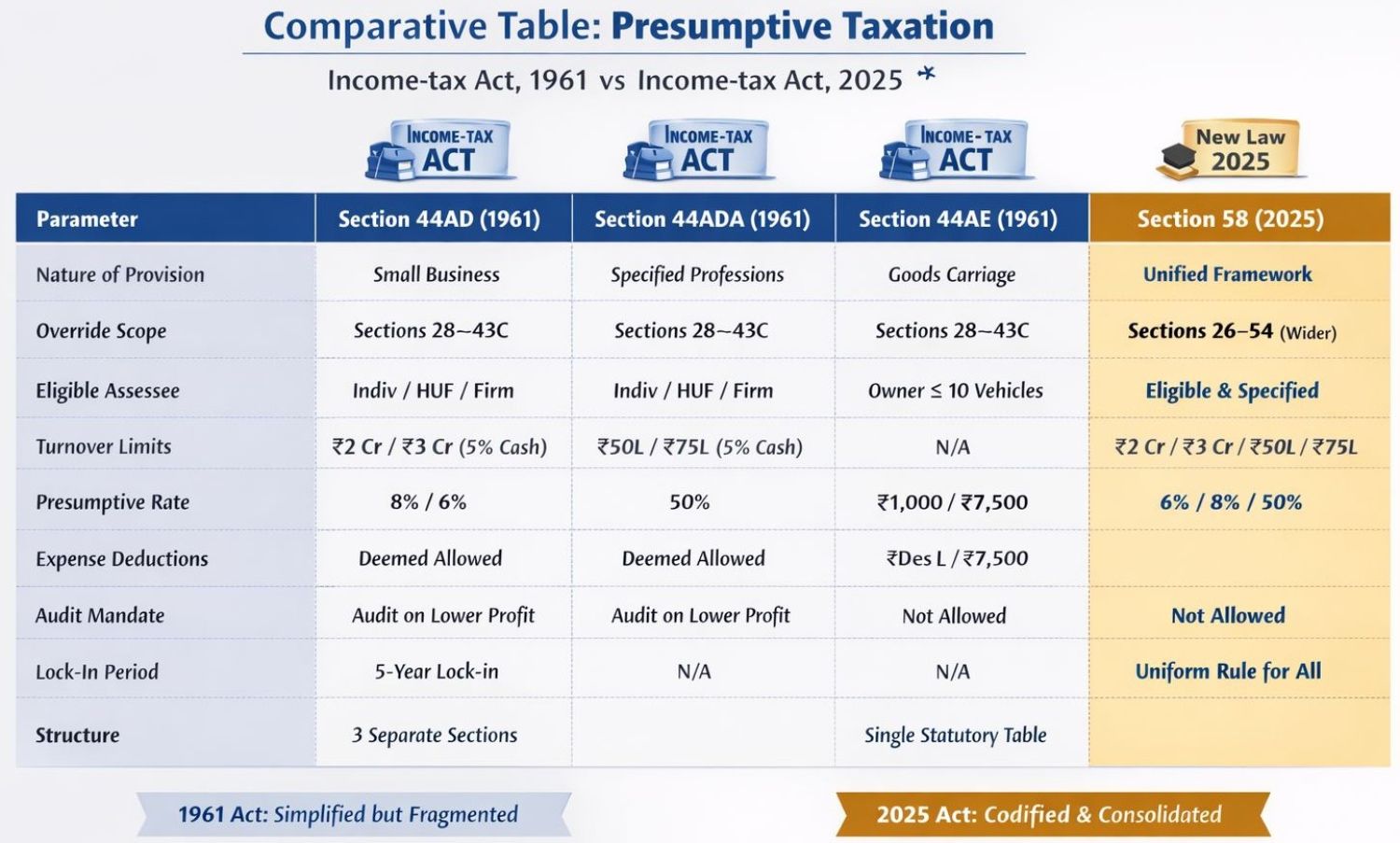

Comparative Chart: 44AD / 44ADA / 44AE vs. Section 58 (Income Tax Act, 2025)

Conceptual Understanding “Presumptive “Taxation Reimagined”

Presumptive Taxation Reimagined

- Section 58—Income Tax Act, 2025

- Section 58 of the Income Tax Act, 2025, marks a structural shift—not merely a rate revision—in the presumptive taxation framework.

Under the Income Tax Act, 1961, presumptive taxation was spread across multiple provisions: Sections 44AD, 44ADA, and 44AE, each designed primarily to provide relief through simplification. The 2025 Act takes a different approach. The focus shifts from simplification to codification and certainty.

What has changed under presumptive taxation in substance?

- One unified section instead of three

- Higher-of-income rule prevents abuse

- Strict ban on deductions removes litigation

- Digital cash incentive continues

- Lock-in provides stability in compliance

- Single consolidated provision: Business, profession, and transport presumptive schemes are now housed under one unified section, improving coherence and reducing overlap.

- Table-based computation mechanism: Income determination is structured through tables, significantly reducing scope for interpretational disputes.

- Digital vs cash receipts embedded into computation: Instead of external conditions, the mode of receipt directly impacts presumptive income—aligning tax policy with the digital economy.

- Clear classification of taxpayers: Distinct demarcation between eligible assessees and specified assessees, leaving little room for ambiguity.

- Stronger exclusion norms: The law explicitly tightens eligibility to prevent misuse by ineligible entities or high-risk profiles.

- Wider overriding effect: Presumptive income under Section 58 overrides Sections 26 to 54, giving it a much broader and clearer statutory dominance than earlier provisions.

What is the spirit of Section 58?

To make taxation simpler (single section), more honest (actual profit rule), more digital (incentives for online receipts), and more predictable (lock-in period). Presumptive taxation now becomes a clean, simplified, “no-questions-asked” regime, but at the cost of no flexibility

What Does Not Change?

- No expansion of presumptive benefits

- No dilution of compliance safeguards

- No relaxation for ineligible taxpayers

Section 58 is not a tax concession expansion—it is a compliance and clarity reform.

Key Professional Takeaway

Presumptive taxation under the 2025 Act is no longer discretion-driven—it is rule-driven. For professionals, MSMEs, and advisors, this translates into:

- More predictable tax positions

- Fewer interpretational disputes

- Cleaner advisory planning

- Better alignment with digital compliance systems

Summary on Presumptive Taxation

Comparative Chart: 44AD / 44ADA / 44AE vs. Section 58 (Income Tax Act, 2025)

following are differences between Sections 44AD, 44ADA, 44AE (Old Income Tax Act, 1961), and Section 58 (New Income Tax Act, 2025).

|

Criteria |

44AD (Business) |

44ADA (Profession) |

44AE (Transport) |

Section 58 – New Act 2025 (Unified Presumptive Taxation) |

|

Covered Assessees |

Resident Individual/HUF/Partnership Firm (No LLP) |

Resident Individual / HUF / Partnership Firm (No LLP) |

Any assessee owning ≤ 10 vehicles |

Resident Individuals, HUFs & Partnership Firms (No LLPs). Some non-residents for specific activities. |

|

Type of Activity |

Small business |

Specified professions (legal, medical, CA, architect, technical, etc.) |

Transport business (plying, leasing, hiring goods carriages) |

Unified scheme covering business, profession & transport under one section. |

|

Turnover / Receipt Limit |

Up to ₹2 Cr (₹3 Cr if cash ≤5%) |

Up to ₹50L (₹75L if cash ≤5%) |

≤10 goods vehicles |

Business: ₹2–3 Cr; Profession: ₹50–75L; Transport: ≤10 vehicles (same as old). |

|

Presumptive Income Rate |

8% (6% digital) |

50% of gross receipts |

Heavy vehicle: ₹1,000/ton/month; Other vehicle: ₹7,500/month |

Business: 6% / 8%; Profession: 50%; Transport: same tonnage model. Unified and consistent. |

|

Higher of Actual vs. Presumptive Income |

No requirement |

No requirement |

No requirement |

Mandatory: Must declare higher of actual profit or presumptive income. A major anti‑abuse reform. |

|

Maintenance of Books |

Not required |

Not required |

Not required |

Not required unless declaring lower income than presumptive and taxable income exceeds exemption limit. |

|

Tax Audit Requirement |

Not required |

Not required |

Not required |

Not required except when opting out with lower income & crossing exemption limit. |

|

Set‑off of Losses (Business, HP, Carry‑forward) |

Allowed under old rules |

Allowed |

Allowed |

Not allowed: Section 58(4) prohibits all deductions & loss set‑offs. Major restrictive change. |

|

Chapter VI‑A Deductions (e.g., 80C, 80D) |

Allowed under old regime |

Allowed |

Allowed |

Not allowed under presumptive income. |

|

Digital Incentive |

6% rate for digital receipts |

Not applicable |

Not applicable |

Continues: 6% for digital turnover. |

|

Lock‑in Period |

No lock‑in |

No lock‑in |

No lock‑in |

5‑year lock‑in. If opted out early → bar for next 5 years. |

|

Nature of Regime |

Separate sections with separate rules |

Separate |

Separate |

Fully consolidated single presumptive section for simplicity & digital alignment. |

Section 58 Reimagines Presumptive Taxation is Simpler, More digital & More transparent But less flexible (due to disallowed deductions). Section 58 reimagines presumptive taxation by:

- Merging 44AD + 44ADA + 44AE into one unified section

- Mandating higher of actual or presumptive profit

- Completely banning deductions, allowances, and loss set‑off

- Introducing a 5‑year lock‑in

- Maintaining digital incentives

- Creating a more structured and less litigative tax environment

Final Insight on Section 58 Reimagines Presumptive Taxation

Section 58 doesn’t make presumptive taxation “lighter”—it makes it “tighter and clearer.” The legislative intent is evident move away from subjective assessments, reduce litigation and strengthen certainty and discipline in small taxpayer taxation, The directions are clear:

- From estimation → to codification.

- From discretion → to rules.