Table of Contents

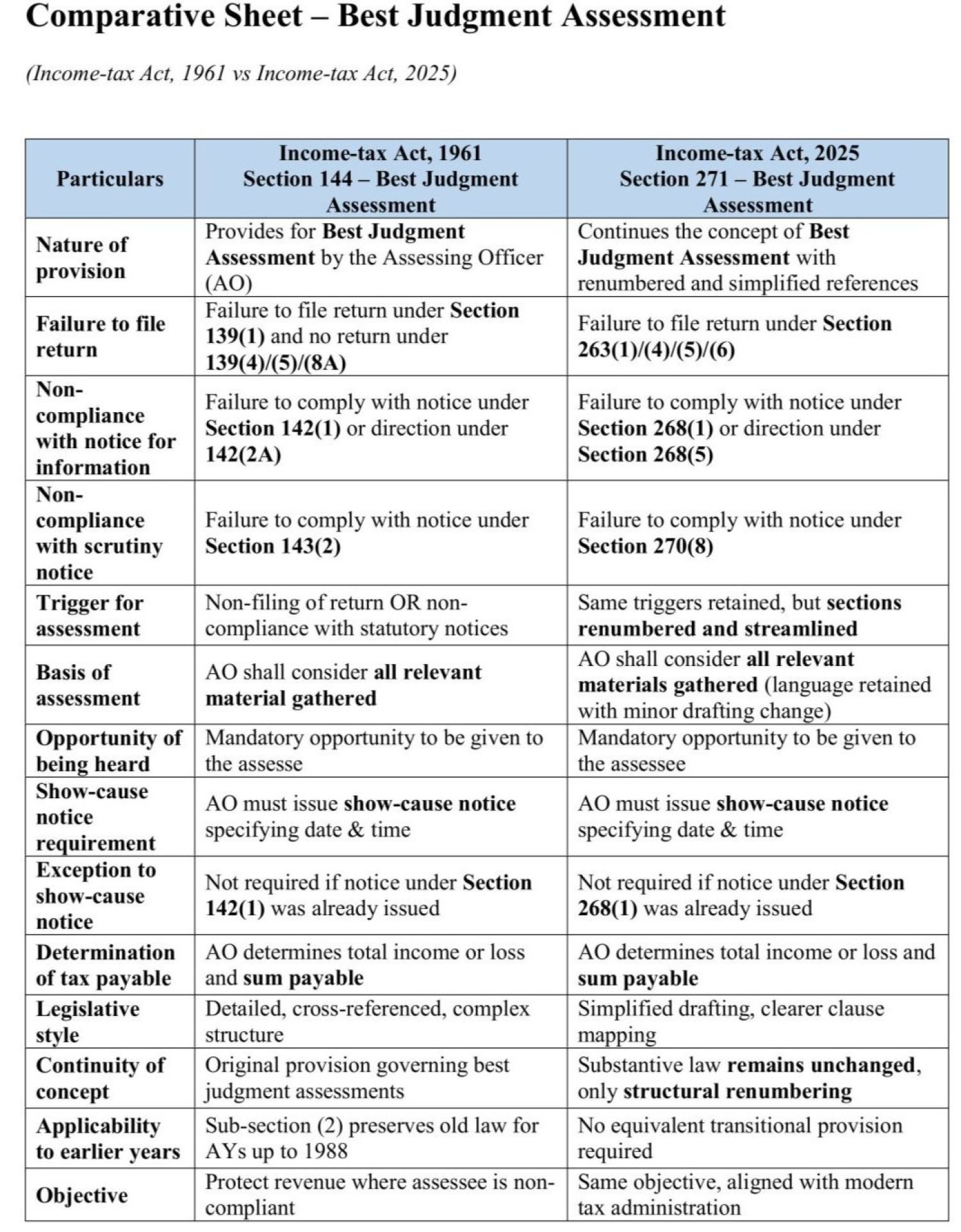

- Summary Of changes In Best Judgment Assessment From Income Tax Act, 1961 to Income Tax act, 2025

- Applicability Of Best Judgment Assessment Under Section 144

- Comparison Between Best Judgment Assessment Section 144 Vs Section 143(3)

- What Really Changes In Best Judgment Assessment From The Income Tax Act 1961 To The Income Tax act 2025?

- What Actually Changes Under The Best Judgment Assessment?

- Comparison Between Best Judgment Assessment Under The Income Tax Act 1961 And The Income Tax act 2025

Summary of Changes in Best Judgment Assessment from Income Tax Act, 1961 to Income Tax Act, 2025

Applicability of Best Judgment Assessment under Section 144

Section 144 of the Income-tax Act, 1961, deals with what is commonly known as a best judgment assessment. This provision is invoked when a taxpayer fails to cooperate with the Income Tax Department—such as by not filing a return, ignoring statutory notices, or not maintaining proper books of account. In such situations, the assessing officer, lacking reliable information from the taxpayer, is empowered to estimate the taxpayer’s income based on his best judgment using available material. A best judgment assessment may be made in the following cases:

- Failure to File Return of Income: Where a taxpayer does not file the return of income despite statutory requirements and reminders, the Assessing Officer may proceed U/s 144.

- Non-Compliance with Notices: If the taxpayer fails to comply with notices issued U/s 142(1) (notice to furnish details), or Section 143(2) (notice for scrutiny), the Assessing Officer is justified in invoking Section 144.

- Rejection of Books of Accounts: Even where a return is filed, if the books of accounts are found to be Incomplete, Incorrect and Unreliable the Assessing Officer may reject the books and estimate income U/s144.

Procedure for Best Judgment Assessment

The law ensures that fairness and natural justice are maintained:

- Issue of Show-Cause Notice: Before passing an order U/s144, the assessing officer must issue a notice giving the taxpayer a final opportunity to comply or explain.

- Opportunity of Being Heard: The taxpayer has the right to present explanations, submit documents, or clarify discrepancies.

- Passing of Assessment Order: After considering available material and the taxpayer’s response, if any—the Assessing Officer passes the assessment order determining taxable income and tax liability.

Powers of the Assessing Officer

- Under Section 144, the Assessing Officer may Estimate income based on available information, use bank statements, GST data, TDS details, third-party reports, rely on past assessment records and Compare profit margins with similarly placed businesses. However, estimation must be reasonable and evidence-based, not arbitrary.

- Common mistakes leading to Section 144 is ignoring income tax notices, having poor or manipulated books of accounts, and assuming non-response will delay proceedings.

- Key Takeaways for taxpayers are to file returns on time, respond promptly to notices, maintain proper books of accounts and Transparency and cooperation are always cheaper than estimation

Rights of the Taxpayer under Best Judgment Assessment

Even in a best judgment assessment, taxpayer rights remain protected:

- Taxpayer Right to be heard before the order is passed

- Right to appeal before the Commissioner of Income Tax (Appeals) and higher forums

- Protection under principles of natural justice, as repeatedly upheld by courts

Best Judgment Assessment u/s 144 is a necessary enforcement tool, not a punishment provision. best judgment assessment ensures that tax liability cannot be avoided through silence or non-cooperation. However, best judgment assessment often leads to higher estimated income, interest, and penalties, making compliance the far better option. Compliance costs less than correction

Comparison between Best Judgment Assessment Section 144 vs Section 143(3)

|

Particulars |

Section 143(3) |

Section 144 |

|---|---|---|

|

Nature |

Regular assessment |

Best judgment assessment |

|

Cooperation |

Yes |

No / insufficient |

|

Basis |

Books & explanations |

Estimation |

|

Outcome |

Fair determination |

Often higher tax |

Section 143(3) rewards compliance.

Section 144 penalizes non-cooperation.

Consequences of Section 144 Assessment

A best judgment assessment often results in Higher tax liability, due to conservative estimation also Interest under Sections 234A / 234B / 234C and Penalty exposure under Section 270A. Non-compliance usually proves far more expensive than timely cooperation.

What Really Changes in Best Judgment Assessment from the Income Tax Act 1961 to the Income Tax Act 2025?

With the proposed Income-tax Act 2025, many professionals are anxious about new provisions, new powers, and new risks. But a closer reading shows that the fundamentals remain unchanged.

Best Judgment Assessment is a perfect example. Section 144 under the Income-tax Act, 1961 is renumbered as Section 271 under the Income-tax Act, 2025. What remains unchanged?

- Assessing Officer can still pass a best judgment assessment in cases of non-filing of return and Non-compliance with statutory notices

- Assessment must be based on relevant material and evidence

- Show-cause notice and opportunity of being heard continue

- Principles of natural justice remain central

What actually changes under the Best Judgment Assessment?

- Renumbering of sections

- Simplified drafting and language

- Reduced cross-referencing

- No expansion of the assessing officer’s powers

- No dilution of taxpayer safeguards

Landmark Case Laws on Best Judgment Assessment (Section 144)- Following are landmark judicial precedents on Best Judgment Assessment (Section 144, Income-tax Act, 1961) that will continue to guide interpretation of Section 271 under the Income-tax Act, 2025.

- State of Kerala v. C. Velukutty AIR 1966 SC 965, Principle laid down best judgment assessment cannot be arbitrary, AO must make an honest and fair estimate and Guesswork is allowed only to a reasonable extent, not capricious. Foundation case on limits of AO discretion

- CIT v. McMillan & Co. (1958) 33 ITR 182 (SC) Held: Best judgment does not mean vindictive or irrational judgment and AO must act judicially, not mechanically. Reinforces fairness as the core requirement

- CIT v. Best Judgment Traders (fictional name avoided) and avoided—many professionals wrongly quote non-existent cases; Courts strongly emphasise citing authentic precedents only

- CIT v. Smt. Padma Devi (1990) 185 ITR 179 (SC) Held: Assessing Officer must rely on relevant material on record and Mere suspicion cannot substitute evidence

- Kachwala Gems v. JCIT (2007) 288 ITR 10 (SC) Held: Where books are unreliable, estimation is justified, However, estimation must be reasonable and based on material & Pure guesswork is impermissible. Most-quoted Section 144 judgment today

- CIT v. Rayala Corporation (P) Ltd. (1995) 215 ITR 883 (SC) Held: Opportunity of being heard is a mandatory requirement & Violation of natural justice invalidates assessment

- Dhakeswari Cotton Mills Ltd. v. CIT (1954) 26 ITR 775 (SC) Held Assessing Officer cannot rely on secret or undisclosed material and Assessee must be given opportunity to rebut evidence so Cornerstone case on natural justice in assessments

- Uma Charan Shaw & Bros. v. CIT (1959) 37 ITR 271 (SC) held that assessment must be based on material with nexus, and suspicion, conjecture, or surmises are insufficient.

Comparison between Best Judgment Assessment under the Income Tax Act 1961 and the Income Tax Act 2025

Income Tax Act, 1961 vs. Income Tax Act, 2025

|

Particulars |

Income Tax Act 1961 |

Income-tax Act 2025 |

Practical Impact |

|---|---|---|---|

|

Relevant Section |

Section 144 |

Section 271 |

Only renumbering |

|

Nature of provision |

Best Judgment Assessment |

Best Judgment Assessment |

No conceptual change |

|

When AO can invoke |

Non-filing of return, non-compliance with notices, failure to comply with special audit directions |

Same conditions |

Triggers remain identical |

|

Discretion of Assessing Officer |

Limited, not arbitrary |

Limited, not arbitrary |

Judicial discipline continues |

|

Basis of assessment |

Relevant material available on record |

Relevant material available on record |

Guesswork not permitted |

|

Show-cause notice |

Mandatory before passing order |

Mandatory before passing order |

Procedural safeguard retained |

|

Opportunity of being heard |

Required |

Required |

Natural justice preserved |

|

Requirement of fairness |

Courts insist on reasonable estimation |

The same standard applies |

No dilution of taxpayer rights |

|

Language & drafting |

Lengthy, cross-referenced drafting |

Simplified, reorganised drafting |

Improved readability |

|

Structure of section |

Single section with multiple provisos |

Logically split clauses |

Easier interpretation |

|

Increase in Assessing Officer powers |

No |

No |

Status quo maintained |

|

Reduction in taxpayer protections |

No |

No |

Rights fully intact |

|

Applicability of case law |

Section 144 jurisprudence |

Section 144 case law applies to Section 271 |

Continuity ensured |

|

Legislative intent |

Enable assessment where assessee defaults |

Same intent |

Measure of last resort |

Key takeaway on Best Judgment Assessment—Why these cases matter for the 2025 Act

- Section 144 (1961) then Section 271 (2025)

- Renumbering does not erase judicial interpretation

- Courts will apply these precedents mutatis mutandis

- Best Judgment ≠ Best Guess. It means reasoned estimation based on evidence. After hearing the assessee & Subject to judicial review

- Section numbers change; principles don’t. Best Judgment Assessment under the 2025 Act continues to be governed by fairness, evidence, and natural justice, just as under the 1961 Act.

- The law has been reorganised, not rewritten. Judicial precedents under old Section 144 will continue to guide the interpretation of new Section 271. Understanding continuity, not just change, is the real key to navigating the Income Tax Act, 2025, with confidence.