Table of Contents

GSTN : Formula Improved for claiming ITC refund in case of inverted duty structures

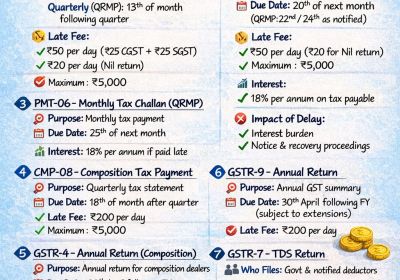

Following the 47th GST Council, the GOI improved the formula of inverted duty structure by issuing Central Tax Notification No. 14/2022, which was published in the Gazette and stated that in the event of a refund due to an inverted duty structure, an input tax credit refund shall be granted using the updated below mention formula:

Maximum Refund Amount = (Turnover of inverted rated supply of goods and services) * Net ITC ÷ Adjusted Total Turnover) – (tax payable on such inverted rated supply of goods and services * (Net ITC ÷ ITC availed on inputs and input services.

According to CBED Notification No. 14/2022, Central Tax, while calculating the eligible GST refund amount in terms of the cumulative ITC of inputs under the inverted rate structure, only the tax payable attributable to the tax payable from the ITC on inputs will be taken into account. The proportion of ITC on inputs compared to ITC on inputs and input services will be the basis for the aforementioned attributions.

Following the notification, the eligible refund amount calculated using the modified formula will be higher than it was using the previous approach.

On the Example are given below it will be more clear:

|

|

Amount |

Total |

|

Input Tax credit on Input |

70 |

Gross Input Tax credit =100 |

|

Input Tax credit (Service) on Input |

30 |

|

|

Gross of Inverted Duty Structure |

500 |

Turnover = 1500 |

|

Gross of Non- Inverted |

1000 |

|

|

Output tax on inverted turnover |

25 |

|

|

Total Refund |

Old/ Previously (70*500/1500)-25 = Rs -1.666 |

New (70*500/1500-25)*(70/100) = Rs -1.666 |

For Further Details Regarding GST refund under Inverted Duty Structure, click here.