Table of Contents

Why Goods and Services tax Registered firms are getting Notices from the GST Dept.

GST Notices for tax evasion, rate non-compliance, late filing, absent or incorrect invoices, eWay Bill inconsistency, and non-payment are frequently issued. Understanding the various notices that a company or professional could get, as well as their timeliness, effects, and required responses to tax officials, is crucial.The Following are few best reason for receiving a GST Notice.

- Non-payment of GST Taxes

- Insufficient, wrong documentation supplied at the time of Goods and Services tax Registration.

- Wrong Input Tax credit Claim in the Returns

- Mismatch between GSTR1 Invoices and the details in e-Way Bills

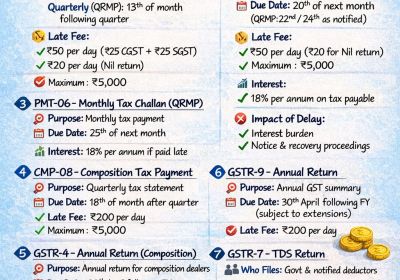

- Non-filing or delayed filing of Goods and Services tax Returns. (most common)

- Wrong Input Tax credit Refund

- Mismatch between Purchase side (inward) invoices and the GSTR 2A report from Goods and Services tax Portal

- Not having GST Registration though the turnover crosses the threshold.

- Revocation Request for a Closed Goods and Services tax Number

- Higher GST rates applied on Sales (Profiteering)

Goods and Services tax Dept. is using deep analytics tools that have been embedded in the Goods and Service Tax Network software. We will be sharing the best useful tips using which you can avoid all or most of the issue linked to the notice.

- Make sure to submit the Goods and Services tax reply within the timeline date, that too using the Tabulated Approach.

- Prepare Input Tax credit Reconciliation at the monthly/Quarterly/ yearly as well as at vendor & invoice levels.

- Make sure to do appropriate proper Reconciliation between GSTR 3B vs GSTR 2A vs Input Tax credit Register vs GSTR 8A Vs GSTR 9C vs GSTR 9.

- In some cases, & as per your specific situation, GST proper reconciliation should also be completed at the e-way bill level.

- Compute entitlement of Input Tax credit with respect to Vendor Registration Status, i.e. cancellation or active, as well as Return submission Trend.

- It is always advisable to check and confirm whether Vendor Goods and Service Tax Network is aadhar linked on the Principle of the Protective Model.

- It has also been seen that GST officers may ask to substantiate whether gst payment to vendor was made within one hundred eighty days or not as well as Harmonized System of Nomenclature/ Services Accounting Code confirmation.

What are the basic consequences of not responding to Goods and Services tax Notices ?

Goods and Services tax Registered taxpayer who received a notice must act to respond to the notice, We'll share the most helpful advice so you can completely or largely avoid the problems associated with the notice. if not the consequences could be severe and may be any of the following

- It is also possible that Rejection of a new Goods and Services tax Registration.

- GST Dept. make Assets Auction

- Recovery of GST Tax Liabilities directly from a Bank (this is the most scariest part of all)

- May happen that rejection of GST Refund

- GST Taxpayer may face the Monetary Penalty

- Dept make Seizure of Assets

- In most cases, there would be a penalty for delayed filing/ non-filing/misrepresentation, further interest being levied on the Goods and Services tax due.

- Cancellation of Goods and Services tax Registration

Notices in general are essential for quick responses. Since the law, its applicability, and its practicality are constantly changing, GST is still a moving target. Unless it is a slam dunk, it is crucial to respond to the GST Notices with the aid of a professional.

The GST Team at Rajput Jain and associates is available to assist you with handling your GST Notice quickly and competently. Since we are India's top-rated Tax Compliance Company, we are suited for that.