Table of Contents

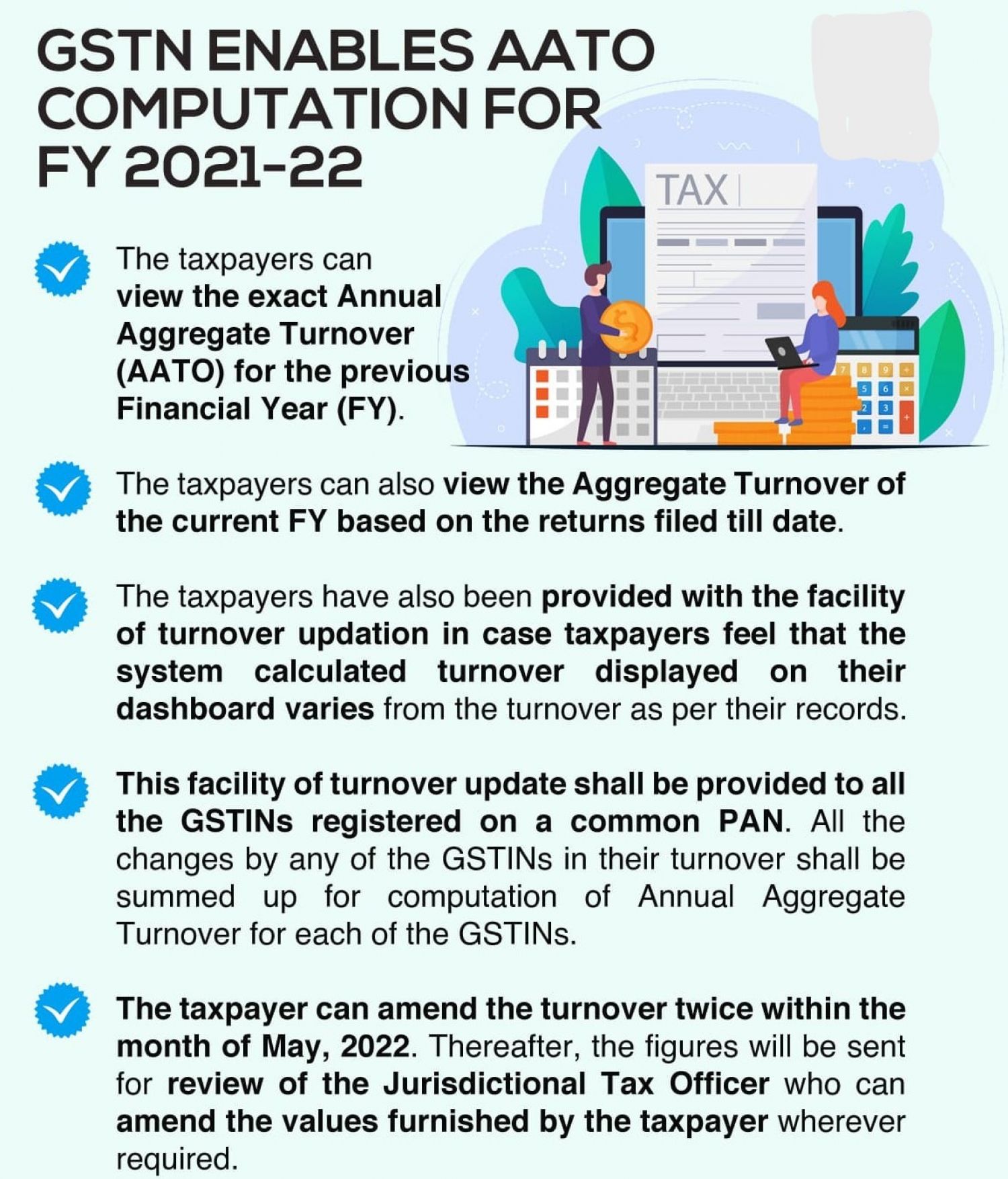

GSTN Enables Functionality Of AATO (annual Aggregate Turnover) For The FY 2021-22 On GST Taxpayers' Dashboards

Functionality of Annual Aggregate Turnover for the Financial Year 2021-22 has now been made live on GST Taxpayers’ GST Dashboards with the below characteristic mentioned here under:

- The GST taxpayers can view the exact Annual Aggregate Turnover (AATO) for the Last FY.

- According to GSTN state that “Aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of services or goods both & inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes Union territory tax, State tax, integrated tax, central tax and cess.

- The supplier's average annual revenue is a key factor that determines whether they are eligible for the exemption threshold limit, as changed from time to time, and the threshold limit for the composition levy. The aggregate turnover is different from turnover in a State.

- GST taxpayers can also view the Aggregate Turnover of the current Financial Year based on the GST Returns filed status till date.

- The GST taxpayers have also been provided with the AATO (annual Aggregate Turnover) computation facility of turnover updation in case taxpayers feel that the GST system calculated turnover displayed on their dashboard varies from the turnover as per their records.

- This AATO (annual Aggregate Turnover) computation facility of turnover update shall be provided to all the GSTINs registered on a common Permanent account number. All the changes by any of the GSTINs in their turnover shall be summed up for Annual Aggregate Turnover computation for each of the GSTINs.

- All GSTINs registered on a single PAN must have access to this capability for turnover updates. For the purpose of calculating the Annual Aggregate Turnover for each GSTIN, all changes in turnover made by any one GSTIN must be added together.

- The GST taxpayer can amend the turnover twice within the month of May, 2022. Next step, the Amount arrived will be share for verification or review of goods and Services Tax Officer respective Jurisdictional, who can amend the values furnished by the taxpayer wherever required,.

Note: For more details, the GST taxpayers may check out the ‘GST Advisory’ section of the aforementioned AATO (annual Aggregate Turnover) functionality on their respective GST dashboards.