Table of Contents

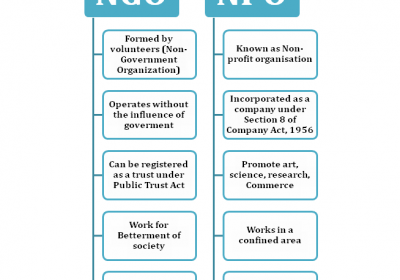

NGO REGISTRATION AND 80G/12AA REGISTRATION REQUIRED

Rajput Jain & Associates are an organization providing consultancy services as well as u/s 12AA and 80G registration Compliance under Income tax. We confirm our willingness to undertake the below assignment.

FOR TRUST REGISTRATION:

BEFORE YOU REGISTER YOUR TRUST YOU WILL NEED TO DECIDE THE FOLLOWING:

- Name of the trust

- Address of the trust

- Objects of the trust(charitable or Religious)

- One the settler of the trust

- Two trustees of the trust

- Property of the trust-movable or immovable property (normally a small amount of cash/cheque is given to be the initial property of the trust, in order to save on the stamp duty).

REQUIREMENTS FOR THE CHARITABLE TRUST

- At least one person Settlor (One who is forming the trust)

- At least one person as Trustee ( Settlor and Trustee may be the same person)

- At least one person as a witness

- The requirement for registration of Trust Deed with the Local Registrar under the Indian Trusts Act, 1882: Some property to form trust (Generally Rs.1000.00)

- Witness by two persons on the Trust Deed.

PROCESS OF TRUST REGISTRATION

- Prepare a Trust Deed on stamp paper of the requisite value (8% of the value of the property of the trust in Delhi. The rate varies from state to state)

- Go to the local registrar & submit the Trust Deed, along with one Photocopy, for registration. The photocopy of the Deed should also contain the signature of the settler on all the pages. At the time of registration, the settler & two witnesses are required to be personally present, along with their identity proof in the original.

- The Registrar retains the photocopy & returns the original a registered copy of the Trust Deed.

DOCUMENTS WE NEED

- One passport size photograph & copy of the proof of identity of the settler

- One passport size photograph & copy of the proof of identity of each of the two trustees.

- One passport size photograph & a copy of the proof of identity of each of the two witnesses.

- Water bill or House tax receipt as address proof of Regd. Office of Trust

- Charitable Trust Deed on stamp paper, Trust Deed on stamp paper of requisite value.

- *.Signed Authority Letter and Signature of settler on all the pages of the Trust Deed

DOCUMENTS REQUIRED FOR REGISTRATION U/S 12A AND 80G:

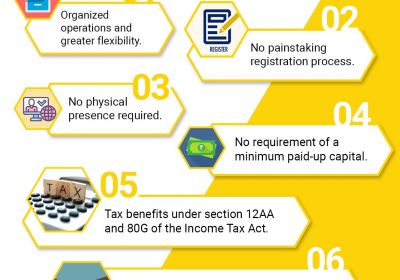

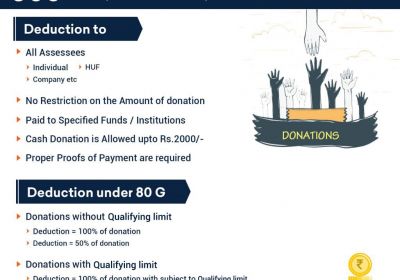

A newly registered NGO can also apply for 12A and 80G, If you are interested to obtain registration under 12A, It will take 2-3months to process the file in the Director of Income Tax (exemption) Department, but nowadays Govt. wants to give the Registration of 12A and 80G only to those NGOs which proves itself indulged in 'welfare activities' supported by the evidence including the following documents, at the time of 12A and 80G Registration,:-

80G/12AA REGISTRATION REQUIRED

- Registration Certificate and MOA /Trust Deed/Society Certificate & Bylaws Copy (three copies – self-attested by NGO head);

- Trust Deed Copy, Deed for verification Original RC and MOA /Trust;

- Any other document or affidavit/undertaking, if extra information is by the Income Tax department.

- Name of the Chief functionary and his Mobile Number, Telephone Number of the office, Copy of PAN of the Society/Trust

- Copy of PAN card of NGO; i.e All Members Address id Proof & Pan Card Copy

- All Document Three Set Copy

- Books of accounts: Books of Accounts, Balance Sheet & ITR (if any), since inception or last 3year and Any other document/affidavit/undertaking the information asked by the Income Tax department

- Charitable/Welfare activities (progress) report for the work done by the NGO.

- Projections/Plans of the action to be undertaken by the NGO during the next two years. Evidence of welfare activities carried out & Progress Report since inception or last 3 years;

- List of donors along with their address and PAN;

- List of governing body board of trustees members with their contact details;

- Authority letter in favour of NGO Factory;

- Expenses details with documentary evidence like telephone, convenience, consumables (free distribution of any things) and others

- List of Name, Address and PAN of the Doner from whom donation has been received.

- Bank Statement if account opening of the NGO.

- NOC from Landlord (where the registered office is situated);

- Electricity Bill / House tax Receipt /Water Bill (photocopy);

- Original Trust Deed/MOA (for the verification purpose only) and

- Duly filled in Form – 10A for registration u/s 12A registration

- Any of the photograph/newspaper cutting/Video visuals for the welfare done.

- In the case of Charitable Activities are done by the NGO, please make sure to arrange for the Board or Banner for the same, so that it will be proved as genuine activities.

Following programmes may be taken -

(a) Distribution of Books, Uniform, Copies and pencils & Foods in Govt. schools / Public / Slum areas-

(b) Tree Plantation, Campaign for Pollution Control

(c) Blood Donation Camp - Medical Check-up camp

(d) Child Welfare Programme- Drawing & Painting Competition, Sports Activities,

(e) Sarak Suraksha Abhiyan, Relief work in natural Calamities

(f) Yoga activities, Health awareness programme

(g) Celebrations - Republic Day, Independence Day, Gandhi Jayanti

Evidence- (i) List of Donors / Sources of Funds, A Copy of PAN card of your NGO

(ii) List of beneficiaries / Attendance Register: List of donors along with their address and PAN and List of governing body or board of trustees members with their contact details

(iii) Photographs with banner & date

(iv) Photocopy of Electricity Bill / House tax Receipt /Water Bill, NOC from Landlord (from the registered office)

(v) Certificate from the School's principal/doctor

(vi) New's paper cutting

(vii) Activity Report

(V) Evidence of welfare activities carried out & Progress Report since inception or last 3 years

(VI) Original RC and MOA /Trust Deed for verification

(VII) Authority letter in favour of NGO.

PROCESS FOR REGISTRATION:

The following step is required for 12A registration

Step1: Dully filled in an application will be submitted to the exemption section of the Income Tax Department.

Step2: NGO will receive notice for clarifications from Income Tax Department in 2-3 months after applying.

Step3: Reply of notice will be submitted by the consultant along with all relevant desired documents to the Income Tax Departments.

Step4: Consultant will personally visit the Income Tax Departments to follow up the case on behalf of the applicant organization.

Step5: An exemption Certificate will be issued.