Table of Contents

How to register under section 12A online

Section 12A Registration

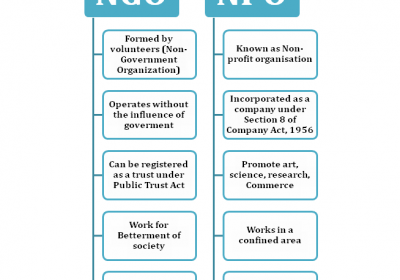

As per section 12A of Income Tax Act, 1961, all the NGOs, being registered as a Trust, or Section 8 Company, or a Society, can obtain registration under this section, in order to avail exemption from payment of income tax. Thus, the foremost step which an applicant shall undertake after the registration of an NGO is to obtain Section 12A Registration. Once such registration is obtained, a 12A certificate would be issued by the Income Tax Department, which will help in acquiring permission from the government and organization established abroad.

Apart from permission, 12A certificate also serves as a legitimate proof which demonstrate the existence of NGO. Hence, wherein an NGO is established and the same haven’t obtained Section 12A registration, Then, the same shall obtain it soon, in order to enjoy the benefits it offers.

Eligibility for 12A Registration

Now, in order to obtain 12A certificate in India, the applicant is required to satisfy the following criteria -

- As per the existing rules, NGOs formed with the object to offer benefits to public in the form of Religious Trusts, Charitable Trusts, Welfare Societies, etc. would be eligible to apply for registration under Section 12A.

- However, any private or family trust is ineligible to apply for Section 12Aregistration.

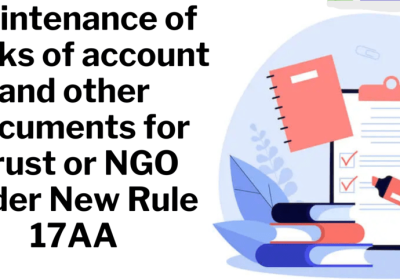

Documents Required for section12 Registration

As per Income Tax Rules, 1962, an NGO willing to undertake registration under Section 12A is required to submit the following documents –

- Form 10A: It is the form which acts as an application form for the registration of a charitable or religious trust or institution incorporated under clause (aa) or clause (ab) of sub-section 12A of Income Tax Act, 1961;

- Next one is the certified copy of documents in respect of modification or adoption of the objects, if applicable;

- Then, a certified copy of document which serves as evidence in respect of establishment or creation of the entity;

- After this, there is a requirement of certified copy of instrument under which the said institution or trust was established or created,

- Next one is, certified copy of registration certificate, which is issued by Registrar of Companies or the Registrar of Societies or Registrar of Public Trusts, whichever is applicable;

- After this, a certified copy of annual reports of the applicant entity for immediately preceding 3 financial years, or since its inception, if the said entity has not completed 3 financial year in existence;

- A note on the activities that are undertaken by the said entity;

- In case the entity is applying for renewal or registration under New Laws, then a certified copy of order granting registration under Section 12A or Section 12AA;

- Any other document as may be prescribed.

Steps by Step Process of section12 Registration

Now, in order to obtain 12A certificate, the applicant is required to follow certain steps. These are –

Step 1: Filing Form 10A

As per Rule 17A of Income Tax Act, 1961, the applicant entity is required to fill in the Form 10A on the Income Tax Portal.

Step 2: Verification of documents

Once the application is submitted, the Commissioner will scrutinize the application along with the documents submitted. Furthermore, the commissioner shall also authenticity of the information provided by the applicant. In case of any query, the Commissioner can demand additional documents as well as information.

Step 3: Issuance of 12A Certificate

Where the commissioner is convinced with the documents submitted, the same shall grant the Certificate of 12A registration. However, wherein the documents or the application is found to be insufficient or incomplete, then the Commissioner has the power to reject the application.

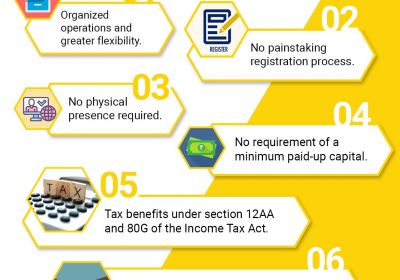

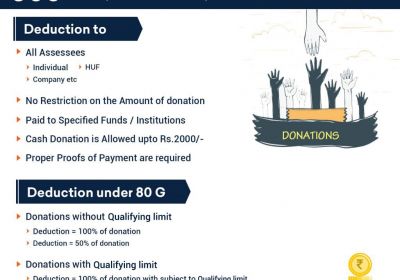

Benefits of Section 12A Registration

Where an applicant entity obtains 12A Registration the same can obtain various advantages like -

- Where any entity applies their income for the religious or charitable purpose, the same shall be deemed as application of income. Thus, the expenditure incurred for the religious or charitable purpose be allowed, wherein the income of the trust is calculated.

- Also, the NGOs with such registrations are able to receive several grants from government as well as other agencies. These grants forms as financial funding.

- Apart from this, the accumulation of income would not be summed up in the total income.

- NGO’s with 12A registration can obtain FCRA registration quite easily.