Table of Contents

All About Non-Governmental Organization

Brief Introduction

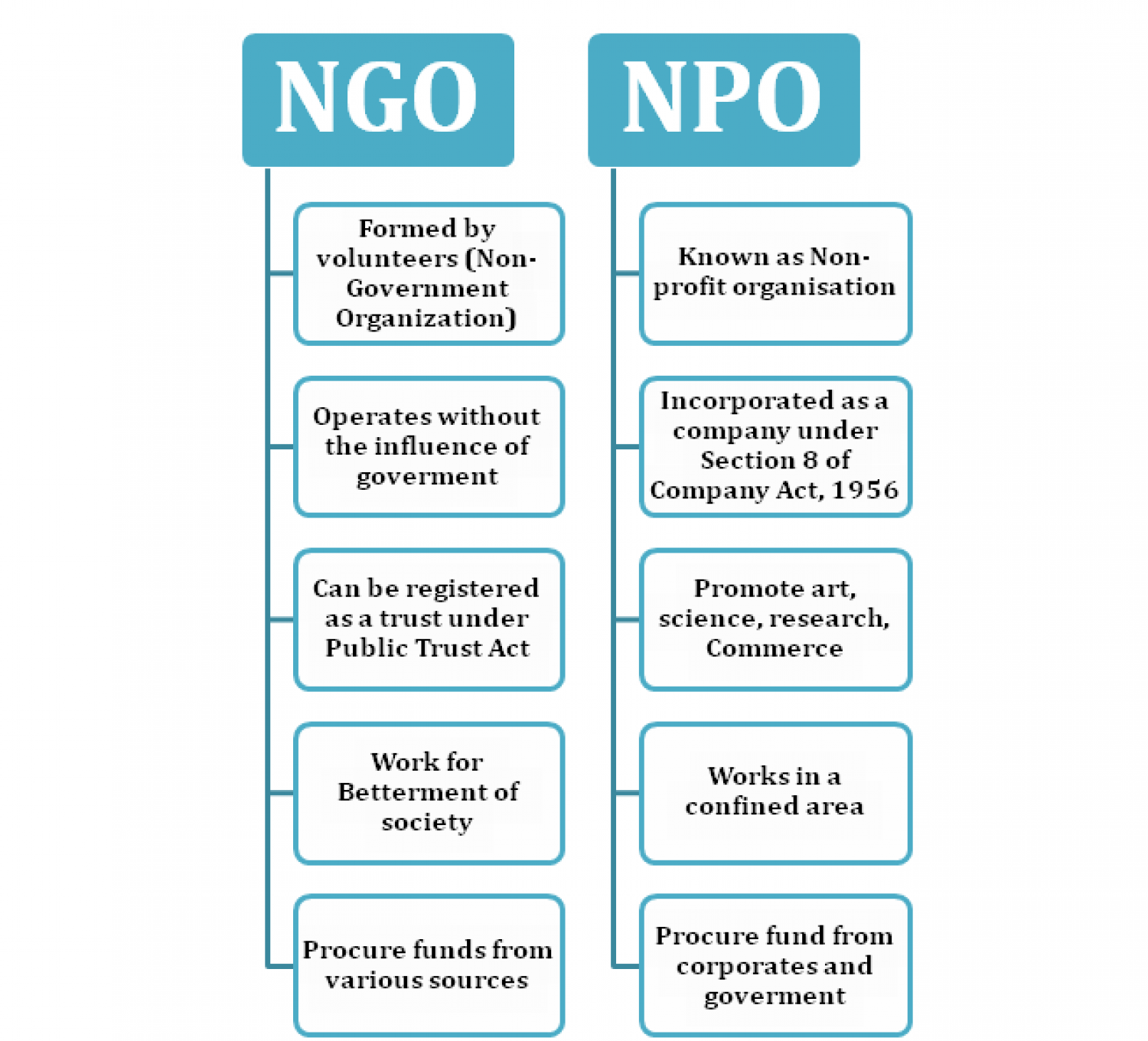

Non Governmental Organizations, commonly known as NGO’s, work for the benefit of society. These organizations fight for and against the evils of the society and strive to work for creation of a better world and hence help in protecting the rights of underprivileged population. Now, an NGO can be established for various reasons like working towards the betterment of environmental, protecting society, reserving animal rights, welfare of kids and development work etc.

Thus, if you want to start an NGO in India, the same requires a detailed NGO registration process to be followed by the applicant. For registration, the prescribed process is quite simple and the same is fully online. For this, the applicant should be in receipt of certain documents and shall upload the same while undertaking registration process online.

Laws Governing NGO Registration

Registration process in India, depends mainly on the type of organization which the applicant wishes to incorporate, i.e., as a Trust, Society or a Non-Profit Company or section 8 company, which has been or is incorporated under Indian Trusts Act, 1882; Society Registration Act, 1860; Company Act, 2013 or any other governing law.

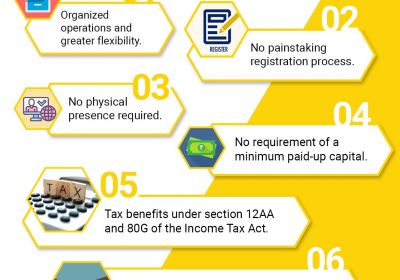

Benefits of NGO Registration

In India, registering a NGO brings many benefits. Some of these are -

- An NGO, which is registered as a trust, would be able to acquire land from government at quite a concessional rate.

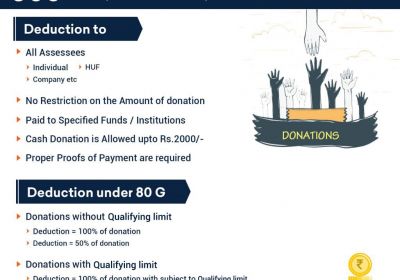

- Also, there are various tax benefits that are provided under the Income Tax Act, 1961.

- Next one is Section 80G Certificate benefit, which can be availed by the doners of such NGO’s.

- And last but not the least, the benefit of entertainment tax and service tax from the respective state government.

Purpose of NGO Registering in India

In case, any person wishes to serve society and work for the betterment of the people, then the same can be achieved by incorporating an NGO. Some of the reasons for registering an NGO in India could be -

- NGO’s are self-governing bodies whose main aim is to work for the betterment of society along with helping the poor and the needy ones.

- Secondly, the ultimate goal of NGO is to provide the underprivileged people an opportunity to grow and undertake personal development.

Types of NGO Registration

Under the NGO framework, the profit earned by such organizations are distributed among its members, rather the same is used for the betterment of society and hence applied for fulfilling the objects of the said entity.

There are basically 3 types of NGO registration in India–

- First one is Trust.

- Second one is Society Registration.

- And last one is a Section 8 Company.

Governing Laws in India

NGO registration in India is subject to certain governing laws such as -

- In case of trust, the same is governed by Indian Trusts Act, 1882

- In case of society, the same is governed by Societies Registration Act, and

- Lastly, Section 8 Company is governed by Companies Act, 2013.

What are the Types of NGOs/NPOs in india

NGOs are differentiated –

1.On the basis of level of orientation

·Charitable Orientation

Such types of NGOs are associated with the purpose of charity i.e. they strive to work towards the betterment of poor people, by providing them with food, clothes, medicines, transport. Thus, these NGOs tend to provide relief activities at the time of natural calamity.

·Service Orientation

These NGOs provide services in the form of educational services, healthcare services, and consultation services in the form of family planning services that are for the betterment of the society.

·Participatory Orientation

These NGOs focus on the development of the community projects, wherein, the locals are invited for making contribution in the form of cash, machinery, labor etc. Such organizations are preferred by cooperative groups and hence are responsible for the planning of the implementation stage of community projects.

·Empowering Orientation/Advocacy

These NGOs focus on particular issue of a society. They work for generating awareness among poor people in respect of government policies, new rules and regulations, as well as their rights. Such NGOs work as facilitators and thus, encourage volunteers to work with them.

2.On the basis of level of Operations

·Community-Based Organizations

Community-Based Organizations or the CBOs have arisen by the initiative of the society on its own. These organizations are associated with the services in the form of educational organizations, women club, health clubs, sports club etc. and hence, strive to achieve awareness among urban poor people in respect of services they can avail on time. These entities are supported by various local NGOs, and is sometimes backed by various National and international NGOs.

·Citywide organizations

These organizations are commonly known as ethnic organizations, Lion’s Club, which operates in order to help the poor and serve for betterment of their welfare.

·National NGO

These organizations operate and helps the society on a national level like Red Cross Society; Young Men’s Christian Association etc. Such organizations operate nationally, with several branches in various states.

·International NGO

Lastly, these organizations work for assisting the different National and local NGOs. Example of some International NGO’s include SOS Children’s Villages, Catholic Relief Services, CARE International, and Lutheran World Relief etc.

Conclusion:

Thus, forming an NGO in India is quite a simple process, provided the applicant is in receipt of complete documents and other information. So in this article we have discussed about the various different types of NGO registration in India, along with their respective benefits of registration. From the above discussion, we can conclude that NGO registration, irrespective of its various forms, is generally undertaken in order to provide aid to the underprivileged section of the society, and also to encourage and promote science, commerce, arts, literature within the society. The profits earned by these entities are to be applied for the growth and well-being of society and also for the achieving their objectives.

So, if you are looking to establish an NGO, then you would be required to first identify the type of NGO which you want to incorporate. Once identified, the applicant shall ensure that the said entity match with their requirements or not. RJA is one of the leading consultants in India, providing best and fast services in the delivery of NGO license. So if you have any query on NGO registration, you can contact our experts.