Table of Contents

All about the Trust Registration and Society Registration

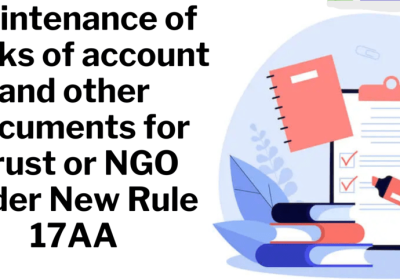

Trust Registration:

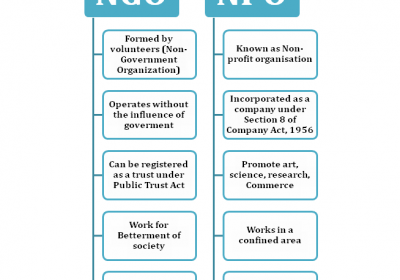

Trust can be one of the form of Non-Governmental Organization that can be registered in India. These NGO’s work towards the eradication of poverty, and also provide help in the form of education and medical relief. Such trusts are irrevocable in nature and also, the national rules and regulations are not applicable to them.

Pre-requisites of Trust Formation -

- Trust’s Name

- Name of at least 2 trustees

- Trust’s address

- The mission statement of the Trust

- Property of the Trust

- One settler of the Trust

Trust Registration Process

- Firstly, the applicant is required to fill in the registration form along with other particulars.

- Next one is collection of pre requisite data and documents.

- Third one is the compilation and creation of Trust Deed.

- Then is the registration of Trust Deed so compiled.

- And lastly, the trust gets registered.

Advantages of Trust Registration

- Acquisition of land from government at concessional rates.

- Registration under the Indian Trust Act 1882, tend to use government registered name.

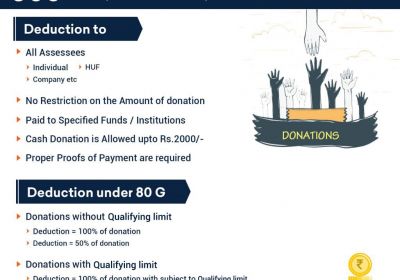

- There is tax benefit under the Income Tax Act, 1961.

- The certification under the Section 80G provide benefit to the doners of the trust.

- Benefit of entertainment tax and service tax from the respective state government.

Society Registration:

Next type of NGO registration is in the form of society. Now, for incorporating a society, the individuals are required to come together for the promotion of science, charitable purpose or any other objectives, as provided under Section 30 of the Society Registration Act 1860.Society registration is a type of member-based organization which functions as a charitable body.

Pre-requisites of Society registration

- In order to incorporate a society, a minimum of seven members are required.

- In case, the society is registered outside India and the same is interested in incorporating a society in India, then the same would be required to subscribe to the Memorandum of Society in India.

- One thing to note here is that, society registration is not mandatory in India.

- However, only a registered society would be able to get the benefit of legal protection, as well as the various advantages that are offered by the government.

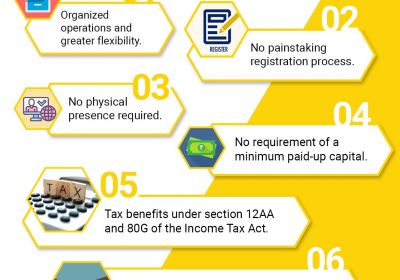

Benefits of Society Registration

- Registered society obtains a separate legal identity and hence, their members would be responsible for their own actions.

- Also, there is limited liability because the society has separate legal identity, and thus, the liability of members would be limited to their respective share only.

- There is tax benefit under the Income Tax Act, 1961.

- Also, there is legal protection, which means that no other person can use their name

Documents Required for Society registration

- MOA

- Regulations and Rules of the Society

Clauses under MOA of Society

- Name

- Domicile

- Liability

- Objects

- Capital

- Subscription.

Process of Society Registration

- First of all, the applicant is required to fill in the registration form.

- After this, the applicant shall compile all the relevant details.

- Then prepare the MOA of the society.

- Next one is drafting the rules and regulations of the society.

- At last, the society gets registered.

Final chance to rectify mistakes committed by the registered/Provisionally registered Trust/NGOs.- Extended due date is 30/06/2024. Download the copy of CBDT Circular No. 7/2024

All about the Section 8 company registration