Q.: What is Section 12A & Section 12AA?

Ans. All you would like to grasp about the Section 12A & Section 12AA Trust, Society and Section 8 Company can seek registration Under Section 12A of income tax Act to assert exemption under income tax Act’ 1961, if certain conditions are satisfied. Section 12A provides for the registration of trust, however, Section 12AA provides for online registration of the trust.

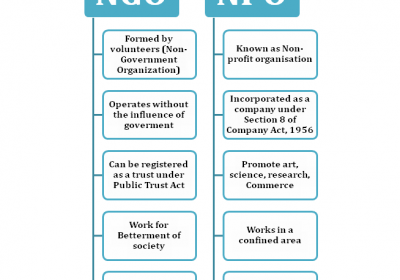

A Non-Governmental Organization (NGO) that's neither part of a government nor a standard for-profit business. Usually founded by ordinary citizens, NGOs is also funded by governments, foundations, businesses, or private persons. NGOs are highly diverse groups of organizations engaged during a big selection of activities, and take different forms in numerous parts of the globe. Some may have charitable status, while others are also registered for tax exemption supported recognition of social purposes. Others could also be fronts for political, religious or other interest groups.

Q.: Difference between Section 12AA and newly introduced Section 12AB

Ans.

|

SECTION 12 AA |

SECTION 12AB |

REQUIREMENT |

|

BENEFITS UNDER SECTION 80G BE AVAILABLE TO ALL NGOS REGISTERED UNDER SECTION 12AA. THESE BENEFITS BE AVAILABLE FOR N NUMBER OF YEARS |

NGOS REGISTERED U/S 12AA SHALL REAPPLY TO OBTAIN NEW REGISTRATION U/S 12AB. |

NGOS WOULD BE REQUIRED TO REAPPLY BEFORE 31ST DECMEBER, 2020 FOR GETTING REGISTRATION U/S 12AA. |

|

EXEMPTIONS BE VALID FOR A LIFETIME. |

EXEMPTION BE PROVIDED FOR A PERIOD OF 5 YEARS; HOWEVER, IN CASE OF NEW REGISTRATION, A PROVISIONAL REGISTRATION BE PROVIDED FOR A PERIOD OF 3 YEARS. |

NGOS TO PROVIDE EVIDENCE FOR CONVINCING THE INCOME TAX AUTHORITIES, REGARDING ACTIVITIES UNDERTAKEN BY THEM DURING THE 5 YEARS OR 3, IN ORDER TO RENEW THEIR REGISTRATION. |

|

DETAILS OF OVERSEAS CONTRIBUTIONS/ DONATIONS BE REQUIRED TO BE DISCLOSED. |

DONOR-WISE DETAILS BE MAINTAINED AND THE SAME BE FURNISHED IN A PRESS RELEASE. |

NGOS WILL BE REQUIRED TO MAINTAIN A COMPLETE RECORD OF THEIR DONORS. |

|

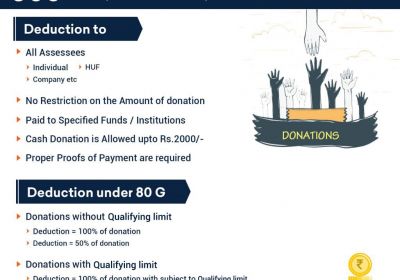

80G BENEFITS ARE AVAILABLE TO DONORS FOR EXEMPT NGOS ON A STABLE BASIS. |

80G DONATIONS IS UNDER UNCERTAINTY IN RESPECT OF EXEMPTION. |

– |

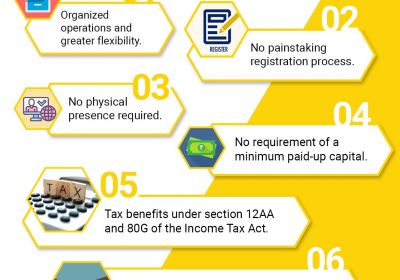

In India, the varied privileges are available to NGO/Charitable Trusts within the context of tax exemption. Now to avail the advantages of tax exemptions the NGO/ trust should register themselves with income tax under section 12A, Section 12AA & Section 80G of the tax Act, 1961.

Q.: What are the time limit for registration under section 12A (1) (ac) and section 12(AB)?

Ans.

|

SUB-CLAUSE OF CLAUSE (AC) OF SECTION 12A (1) |

CATEGORY OF NGO |

TIME LIMIT FOR FILING APPLICATION FOR REGISTRATION |

APPLICABLE FORM |

TIME LIMIT FOR PASSING ORDER |

|

(I) |

TRUSTS OR INSTITUTIONS ALREADY REGISTERED U/S 12A OR 12AA (MIGRATION FROM SECTION 12A/12AA TO SECTION 12AB) |

WITHIN THREE MONTH STARTING FROM 1ST APRIL, 2021 I.E. UP TO 30TH JUNE, 2021 |

FORM 10A |

WITHIN THREE MONTHS FROM THE END OF MONTH IN WHICH THE APPLICATION IS RECEIVED |

|

(II) |

TRUSTS OR INSTITUTIONS ALREADY REGISTERED UNDER SECTION 12AB AND THE PERIOD OF REGISTRATION IS ABOUT TO EXPIRE |

A MINIMUM OF SIX MONTHS PRIOR TO THE EXPIRY OF THE PERIOD OF REGISTRATION. |

FORM 10AB |

WITHIN Six MONTHS FROM THE END OF MONTH IN WHICH THE APPLICATION WAS RECEIVED |

|

(III) |

NEW TRUSTS OR INSTITUTIONS WHICH HAVE BEEN GRANTED PROVISIONAL REGISTRATION UNDER SECTION 12AB (TRUSTS OPTING FOR PROVISIONAL TO FINAL REGISTRATION FOR 5 YEARS) |

EARLIER OF - WITHIN Six MONTHS PRIOR TO THE EXPIRY OF THE PROVISIONAL REGISTRATION WITHIN Six MONTHS FROM THE DATE OF COMMENCEMENT OF THEIR ACTIVITIES. |

FORM 10AB |

WITHIN SIX MONTHS FROM THE END OF THE MONTH IN WHICH THE APPLICATION WAS RECEIVED |

|

(IV)

|

TRUSTS OR INSTITUTIONS WHOSE REGISTRATION HAS BECOME INOPERATIVE DUE TO THE FIRST PROVISO TO SECTION 11(7) OF THE ACT. REGISTRATION U/S 12A OR 12AA SHALL BECOME INOPERATIVE FROM THE DATE ON WHICH THE TRUSTOR INSTITUTION IS GRANTED REGISTRATION U/S 10(23C) |

A MINIMUM OF SIX MONTHS PRIOR TO THE COMMENCEMENT OF THE ASSESSMENT YEAR IN WHICH SUCH REGISTRATION IS SOUGHT TO BE APPLIED.

|

FORM 10AB |

WITHIN SIX MONTHS FROM THE END OF THE MONTH IN WHICH THE APPLICATION WAS RECEIVED |

|

(V) |

TRUSTS OR INSTITUTIONS UNDERTAKING ANY MODIFICATIONS OF THE OBJECTS, NOT IN CONFORMITY WITH THE CONDITIONS OF REGISTRATION |

WITHIN 30 DAYS FROM THE DATE OF ADOPTION OR MODIFICATION |

FORM 10AB |

WITHIN SIX MONTHS FROM THE END OF THE MONTH IN WHICH THE APPLICATION WAS RECEIVED |

|

(VI) |

IN ANY OTHER CASE (INCLUDING FRESH PROVISIONAL REGISTRATION) |

A MINIMUM OF 1 MONTH PRIOR TO THE COMMENCEMENT OF THE PREVIOUS YEAR RELEVANT TO THE ASSESSMENT YEAR FROM WHICH THE SAID REGISTRATION IS SOUGHT |

FORM 10A |

WITHIN 1 MONTH FROM THE END OF THE MONTH IN WHICH THE APPLICATION IS RECEIVED |

Q.: For how long will the registration granted under section 12AB be valid?

Ans. Where the trusts or institutions are already having registration u/s 12AA, they shall apply for registration u/s 12AB, latest by 30-06-2021 in Form 10A and the validity of said registration shall be for a period of five years. However, in the case of new registration, the same would be granted a provisional registration, which shall be valid for a period of three years.

Q.: What is the procedure for obtaining registration under section 12AB?

Ans.

Step-1: At first, the applicant is required to logging into the Income Tax India E-Filing Portal using the login credentials and password.

Step-2: Navigate to “Income Tax Forms” under the E-File tab and choose Form 10A/ 10AB, because the case could also be

Step-3: Select the choice “Prepare and Submit online” to fill required details within the form

Step-4: Attach the requisite document together with Form 10A/10AB

Step-5: Submit the Form using digital signatures or EVC

Step-6: On receipt of application in Form No. 10A or 10AB, because the case is also, the PCIT or CIT shall process the applying within the prescribed time limit: -Where the applicant is already registered u/s 12AA or where they apply for provisional registration, Form No. 10A would be required to be submitted by the applicant

Order granting registration be made in writing in Form No. 10AC and a 6-digit alphanumeric URN will also be allotted. In cases applicable Form No. 10AB has been submitted, & thereafter order granting registration or rejection or cancellation shall be inapplicable Form No. 10AD.

Q.: Is digital signature compulsory for filing Form No. 10A/10AB

Ans. Form No. 10A or 10AB, because the case could also be is required to be digitally signed, only where the taxation Return of the Trust/institution is required to be furnished digital signature.

In other cases, the forms are also submitted with Electronic Verification Code (EVC)

Q.: Who shall verify the Form 10A/10AB?

Ans. Form 10A/10AB shall be verified by the one who is allowed to verify the return of income of trust or institution u/s 140 of the taxation Act.

Q.: What are the documents required together with Form No. 10A or 10AB?

Ans. Following is that the list of documents needed to be submitted together with Form No. 10A/10AB: -

- In case, the applicant is incorporated or established under an instrument, then the self-certified copy of that particular instrument.

- In case, the applicant is incorporated or established other than under an instrument, then the self-certified copy of the document evidencing the establishment of the applicant;

- Self-certified copy of registration certificate, being obtained from the Registrar of Companies or Registrar of Firms and Societies or Registrar of Public Trusts.

- Self-certified copy of registration certificate, being issued under Foreign Contribution (Regulation) Act, 2010(42 of 2010), where the applicant is registered under this Act;

- Self-certified copy of the order, providing for the registration granted under section 12A, 12AA or 12AB.

- Self-certified copy of the order, providing for the rejection of application made under section 12A, 12AA or 12AB.

- Where the entity is already incorporated, the copies of their annual accounts for a period of the last 3 years or since their inception.

- Where the income of the entity includes profits and gains of business as per the provisions of sub-section (4A) of section 11, copies of annual accounts and audit report u/s 44AB for past 3 years or since their inception.

- Self-certified copy of the documents evidencing adoption or modification of the objects

- A detailed list of the activities undertaken by the respective trust or institution

- If registered on DARPAN Portal, then details of such registration

Apart from the above-mentioned documents, the following documents are also needed:

- Where the PAN/Aadhar is available- PAN and Aadhar of all the members or directors holding at least 5% of shareholding respectively.

- Where the PAN/ Aadhar is not available: - Voter ID or Passport or driver's license of the above persons

Q.: Can approval granted under section 12AB be cancelled?

Ans.

- Where, at any time, Form No. 10A is found to be incomplete or was filled by providing false or inaccurate information or documents, the PCIT or CIT has the full authority to cancel the registration in Form No. 10AC

- However, a chance of being heard are allowed before cancellation.

- In case of cancellation of registration, it shall be deemed that URN is never granted or issued to the said entity.

QUESTIONS STILL UNCLEAR

- What about those cases where ITAT put aside the registration matter back to the file of CIT(E) and therefore the matter is yet pending with CIT(E) as on 31.03.2021? Would these cases be considered as pending applications and tend provisional registration?

- What about the cases, where ITAT directed the CIT(E) for granting registration and also matter which is still pending with CIT(E) as of 31.03.2021? Whether the concerned trust, be eligible for provisional registration or will they be granted final registration?

- When would it not be considered that trust has ‘commenced its activities? Does it mean, at the time of receipt of funds or when the payment is made or at the time of starting the on-field activities?

just in case a trust having final registration, (which was converted from provisional registration), from which year the expiry period of 5 years be counted. would it not be from the first AY within which provisional registration was granted or from the date of granting final registration?