Table of Contents

- What Does Section 80g For Ngo?

- Required Conditions Section 80g (5) Registration.

- Section 80g (5) Registration Requires The Fulfillment Of Certain Conditions.

- Documents Required By Form Nos. 10a Or 10ab

- Conditions U/s 80g (5)(vi) Must Be Met For Approval U/s 80g (5):

- After Registration What Compliance Must Be Completed.

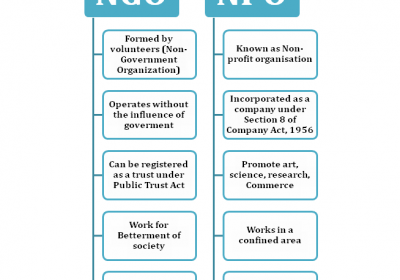

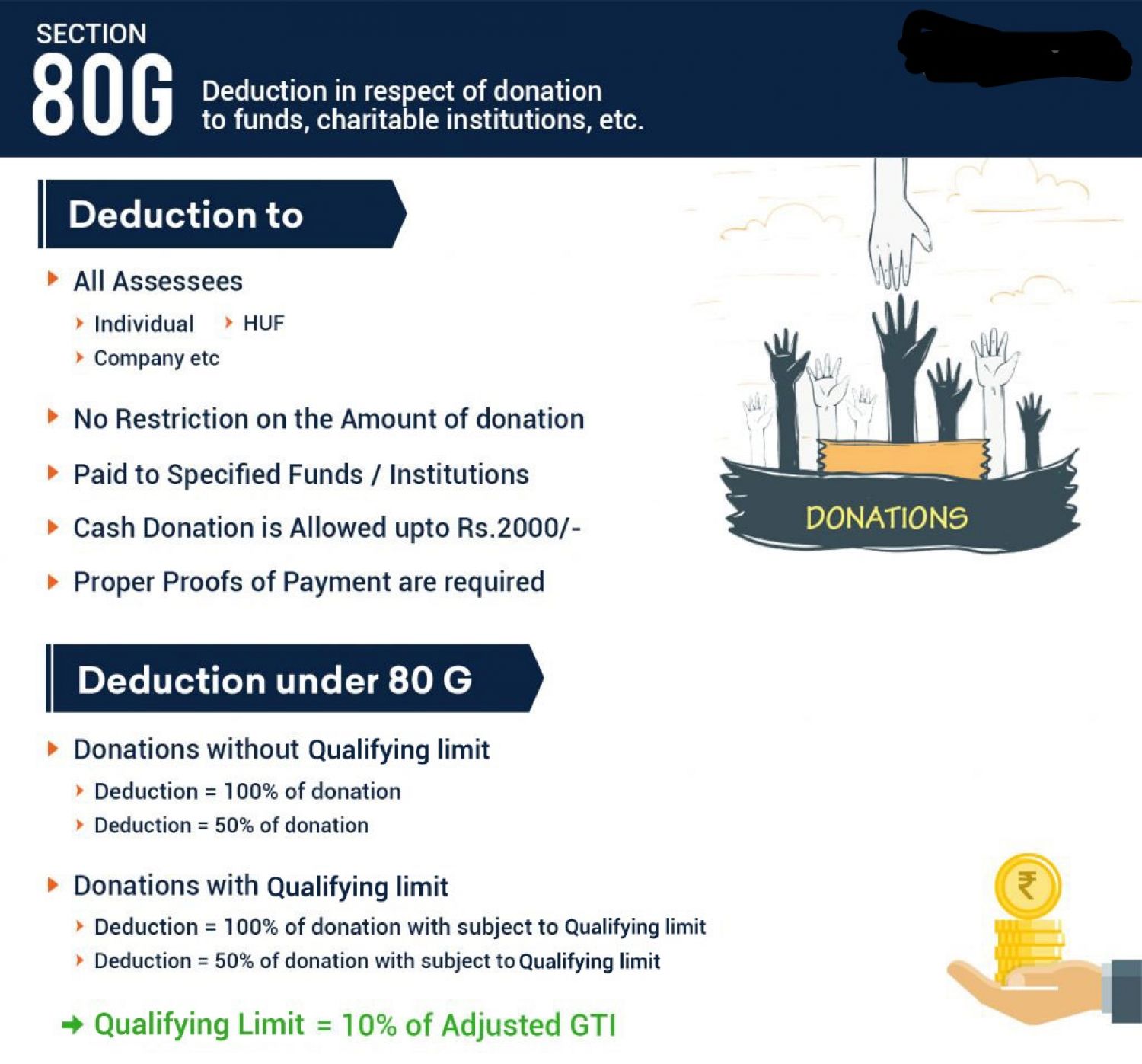

What does Section 80G for NGO?

The contributor of a non-profit organization can benefit from Section 80G of the Income Tax Act. The donor receives financial advantages that are included in his taxable income.

Required conditions section 80G (5) Registration.

- The NGO should not have any non-exempt revenue, such as corporate profits. If the NGO earns money through a company, it should keep separate books of accounts and not use donations for the purpose of the business.

- NGOs' bylaws or goals should not include any provision for using the organization's income or assets for anything other than philanthropic purposes.

- The NGO may not work to help a certain religious community or caste.

- NGO must keep accurate records of its income and expenditures.

Section 80G (5) Registration requires the fulfillment of certain conditions.

- The NGO should not have any non-exempt revenue, such as corporate profits. If the NGO earns money through a company, it should keep separate books of accounts and not use donations for the purpose of the business.

- NGOs' bylaws or goals should not include any provision for using the organization's income or assets for anything other than philanthropic purposes.

- The NGO may not work to help a certain religious community or caste.

- NGO must keep accurate records of its income and expenditures.

Documents required by Form Nos. 10A or 10AB

The following documents required by Form Nos. 10A or 10AB, as the case may be, must be submitted with the application under sub-rule (1):

- where the applicant is created, or established under an instrument, a self-certified copy of the instrument;

- In case the applicant is created, or established, otherwise than under an instrument, a self-certified copy of the document evidencing the creation and establishment of the applicant.

- a self-certified copy of the firm's registration with the Registrar of Companies, the Registrar of Firms and Societies, or the Registrar of Public Trusts, as required;

- if the applicant is registered under the Foreign Contribution (Regulation) Act, 2010(42 of 2010), a self-certified copy of the registration;

- a self-certified copy of an existing order granting registration according to section 80G, paragraph (5), clause (vi);

- if applicable, a self-certified copy of the order rejecting the application for permission under paragraph (vi) of sub-section (5) of section 80G;

- self-certified copies of the applicant's annual accounts relating to any prior year or years (not more than three years immediately preceding the year in which the said application is made) for which such accounts have been composed, if the applicant has been in existence during any year or years prior to the financial year in which the application for registration is made;

- a record of the applicant's activities

- On receipt of an application in Form No.10A, the Principal Commissioner or a Commissioner authorised by the Board shall issue a sixteen-digit alphanumeric Unique Registration Number (URN) to the applicants making application as per clause I or (iii) of the second proviso read with the third proviso of sub-section (5) of section 80G in form 10AC (1).

Note: If it is discovered at any point during or after registration that registration was granted based on the applicant supplying false information, registration will be denied.

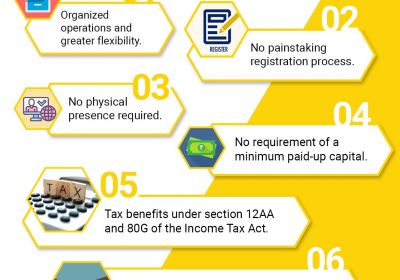

Online registration is required under section 80 G (5). How to acquire approval for a Charitable Trust, Society, or NGO under Section 80 G (5):

Conditions U/s 80G (5)(vi) must be met for approval U/s 80G (5):

The NGO should not have any non-exempt income, such as company profits. If the NGO earns money through a business, it should keep separate books of accounts and not use donations for the purpose of the business.

- NGOs' bylaws or objectives should not include any provision for using the organization's income or assets for anything other than philanthropic purposes.

- The NGO may not strive to help a certain religious community or caste.

- NGO must keep accurate records of its receipts and expenditures.

- Donor information must be kept up to date, and all donors must receive a certificate.

- When Donors who choose the reduced rate of tax will not be eligible for tax deductions under section 80 G.

After registration what compliance must be completed.

- Keep proper accounting records as required by law.

- File your income tax return on schedule and have your accountants' records audited by a Chartered Accountant.

- Adhere strictly to the guidelines under which registration has been granted.

- Issue a certificate to the donor in Form 10 BE for each financial year, in accordance with Rule 18AB.

Conclusion

- Registration under Section 12AB entitles a non-profit organization to a tax rate exemption. Failure to do so will make them ineligible to file ITRs.

- The 80G clause, on the other hand, assures that a person donating to a non-profit organization can deduct the amount from their taxable income, resulting in greater donations.

- The new provisions took effect from October 1, 2020, and every trust or institution that is already in existence is required to renew the certificate given under sections 12A, 12AA, 80G, or 35 within the time period provided, which was no later than December 31, 2020.

- If a new trust or institution is formed, it must apply for registration under section 12AB within the timeframe specified.

- Section 80G has also received a similar change in the registration/renewal procedure. As a result, existing trusts/institutions will need to apply for a new registration under section 80G in the same way as section 12AB requires. Form No. 10A or 10AB, as the case may be, shall be used to submit such an application.

- One significant change is that trusts or institutions that are registered under section 80G must now provide a statement in Form No. 10BD in the required format, detailing the donations received during the year. A donation certificate in Form No. 10BE must also be issued to the donor by the trust or institution.

NGO UPDATE :

- Audit of Charitable Trusts - 30-11-2021 is Extended Due date for furnishing Audit Report for Public Charitable Trusts.

- Central Board of Direct Taxes issues order u/s 119(2)(b) of Income-tax Act, 1961 for filing applications for settlement before Interim Board for Settlement by 30th Sept 2021, subject to certain conditions. (F. No. 299/22/2021-Dir(Inv.III)/174 dated 28.09.2021)