Table of Contents

- Ngo’s Accepts Foreign Grants & Its Utilisation Provisions Under Income Tax & Fcra Act

- Summary Of Points Covered Under Fcra, 2010

- Foreign Grant Received From Outside Country

- Utilization Of Foreign Grant

- Annual Filling And Miscellaneous Reporting

- Summary Of Points Covered Under Income Tax Act 1961

- Provisions For Claiming Exemption Against Grant Received For Charitable Purpose.

- Surplus From Activities Undertaken For Charitable Purpose

- Faq On ngo’s Receipt Of Foreign Grants & Its Utilizations Provisions

- What Precautions Should Be Taken By Trust?

- Icai Has Issued Handbook On Statement Of Donations Received By Charitable Institutions Under Income Tax Act.

- New Income Tax Update :

NGO’s accepts foreign grants & its Utilisation Provisions under Income Tax & FCRA Act

Legality of foreign donations/Grants and its Utilisation of the for charitable purpose Provisions under Income Tax & FCRA Act. We hereby giving some applicable provisions of Income Tax Act 1961 and FCR Act 2010,for your understanding.

A: List of points covered under FCRA 2010

- Foreign Grant Received from outside country

- Utilization of Foreign Grant

- Annual Filling and Reporting

- Other Miscellaneous items

B: List of points covered under Income Tax Act 1961

- Provisions for claiming exemption against Grant Received for Charitable Purpose.

- Surplus from Activities undertaken for Charitable Purpose

- Other Miscellaneous Items

Summary of points covered under FCRA, 2010

Foreign Grant Received from outside country

- As per Section 2(1)(h), foreign contribution constitutes donation, delivery or transfer from a foreign source, in the form of –

- any article

- currency (whether Indian or foreign) or

- any security or

- Income arising from Foreign Contribution

However, the said contribution shall not include any amount of fees or any amount incurred towards costs of goods or services provided under ordinary course of NON profit activity.

- Also, in accordance with Section 2(1)(j), Foreign Source has been defined as –

- Any Government of any foreign country or territory and any agency of such Government

- Any international agency, not being the United Nations or any of its specialized agencies.

- The World Bank, International Monetary Fund or such other agency as the Central Government may, by notification, specify in this behalf.

- A foreign company n Foreign incorporated corporation.

- A company within the meaning of the Companies Act, 1956 or 2013, and more than one-half of the nominal value of its share capital is held, either singly or in the aggregate, by one or more of the following, namely:

- The Government of a foreign country

- Foreign citizens

- Corporations incorporated in a foreign country or territory;

- Trusts, societies or other associations of individuals formed or registered in a foreign country.

- Foreign company

- Foreign Contribution shall be Received & Utilized from Designated Bank Account only

- Entity which is either registered under FCRA, or wishes to obtain new registration or applies for renewal of registration, the same shall ensure that the entity be registered on DARPAN portal.

- The entity shall not have any foreign national, as members of executive committee of the trust, because such trust would be ineligible to obtain foreign contributions. However, foreigners can be associated with trust in ex-officio capacity.

Utilization of Foreign Grant

- Foreign Contribution shall be Received & Utilized from Designated Bank Account only

- The trust/Entity shall utilize the FCRA contribution specifically for the welfare purpose or activities for which it is received. Such utilization should be in line with the objectives of the trust and shall not be applied for any non-permissible activities under FCRA 2010.

- The association should utilize such funds for the welfare purpose or activities for which it is received. The utilization should be in line with the objectives of the association.

- Every assets purchased with the amount of foreign contribution shall be acquired and possessed in the name of trust and the same shall not be in the name of its members and any other person.

- In case FCRA registered person intends to transfer foreign contribution to any unregistered person, the same would require permission from the FCRA authority before making such contribution.

- As per Section 7, prohibition in respect of transfer of foreign contribution to other person has been provided. Under this, No person who—

(a) is registered and granted a certificate or has obtained prior permission under this Act; and

(b) receives any foreign contribution,

shall be allowed to transfer any such foreign contribution to any other person.

7. The amount of administrative expenditure, in the form of salaries and Wages, Electricity and Water Charges, Accounting Charges, and other charges, shall not exceed 20% of the total foreign funds utilized in a particular financial year. As per Rule 5 of Foreign Contribution Rules 2011, the following constitute administrative expenses:-

- salaries, wages, travel expenses or any remuneration which has been realized or expedited by the Members of Executive Committee or Governing Council of the trust;

- all expenses incurred in respect of hiring of personnel for management of the activities of the entity and shall include the salaries, wages or any kind of remuneration paid, including cost of travel, to such personnel;

- all expenses incurred in respect of consumables in the form of electricity and water charges, telephone charges, postal charges, repairs to premise(s) from where the organisation is functioning;

- also include cost of accounting for and administering funds;

- incurring of expenses in respect of running and maintenance of vehicles;

- cost in respect of writing and filing reports;

- legal and professional charges

- Ensure that the capital assets acquired by the trust from the foreign contribution, shall be registered only in the name of trust only.

Annual Filling and Miscellaneous Reporting

- The trust would be required to file form FC-6, which is an annual report, which provides the information as to how much foreign contribution has been received and used during a particular financial year. Such report shall includes contribution in the form of money as well as kind. The trust would be required to file this annual report by 31st December of the particular financial year.

- Wherein any new key member is appointed, elected, resigns or dies, intimation would be required to be served within 15 days from the event of such change.

- Being an NGO, the trust would be required to get their accounts finalized and audited, and will have to file quarterly and annual returns with the Ministry of Home Affairs.

- Provide intimation to the Government about receiving large gifts from relatives, who are classified as foreign nationals/NGO. Such intimation be provided within 30 days from the date of receipt of gift. However, one thing to note is that the said intimation be made, where the amount of gift exceeds Rs. one lakh in one financial year.

- Where any article is received by the trust during a particular financial year, the entity would be required to provide intimation to Government by 31st December of the following financial year.

- In case any security is received during a particular financial year, the entity would be required to provide intimation to Government by 31st December of the following financial year.

- In case the trust wishes to undertake change of more than 50% in key members, the same would require an earlier intimation to be provided to the Government of India.

Other Miscellaneous items

- The trustees shall work in accordance with the trust deed and since they are under fiduciary relationship, they shall carry out their obligations in a fair manner.

- The trust shall ensure that the Foreign Contribution is received and Utilized for the Specific Purposes and not for Speculative Investments such as Mutual Funds, Shares.

- Bank Accounts must be separate for Foreign Contributions or Non Foreign Contributions.

- Ensure that the trust applies for renewal of FCRA Registration, within 6 months before the expiry of existing registration.

- The trust shall raise funds in a legal way, and the same shall not indulge in any lobbying activity.

- All the funds received under FCRA registration, be utilized only for the purpose for which they have been received, and shall not be applied to activate not permitted under FCRA.

- The governing body of the trust shall receive and prepare the reports on the finances and operations of the entity.

- Ensure that the foreign contribution account is not mixed up with the amount of domestic receipts.

- Also, no amount of foreign contribution received to be transferred to any other NGO, without the prior approval of Government of India.

- Governing documents of the entity shall be well thought and should reflect the ideas and philosophies of the said entity.

- The trust shall ensure highest level of code of conduct and performance for self regulation.

- In accordance with section 13(1), where the Central Government is satisfied that pending consideration of the question of cancelling the certificate on any of the grounds mentioned in sub-section (1) of section 14, and it is necessary, then by order in writing, the same shall suspend the certificate of the NGO, and the same shall be suspended for a maximum period of 180 days.

Summary of points covered under Income Tax Act 1961

-

Provisions for claiming exemption against Grant Received for Charitable Purpose.

For availing exemption under section 11, the entity is required to obtain registration under Section 12A of Income Tax Act, 1961. Now, as per section 11 of Income Tax Act, 1961, following incomes be exempt from tax –

- The amount of income which is derived from property held under trust wholly for charitable or religious purposes, to the extent to which such income is applied to such purposes in India

- In order to avail registration under section 12A, the trusts with total income exceeding the basic exemption limit, which is of Rs. 2,50,000/-, would be required to get their accounts, audited by a qualified Chartered Accountant, and the audit report regarding the same, be filed in Form No. 10B.

- Under the Income Tax Act, 1961, donations/voluntary contributions received by a charitable institution or trust, and the same shall constitute a voluntary contributions with a specific direction to form part of corpus of trust or institution, would be exempt only in case if the said Charitable/ religious trust or institution is registered under Section 12A of Income tax act, 1961.

- However, in case of Anonymous donations i.e., the donations wherein the donee does not maintain record of identity/any particulars of the donor, and the amount of donation exceeds higher of:

- 5% of total donations received by trust or

- Rs. 1,00,000

In such cases, the amount of tax be @ 30%

- For the charitable objectives, the definition is provided under Section 2(15) of the Income Tax Act, 1961. As per section 2(15) of the Income Tax Act, 1961, “charitable purpose includes relief of the poor, education, yoga, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest, and the advancement of any other object of general public utility.

- where any entity fails to apply at least 85% of their income for charitable purpose, then the said amount can be exempted provided –

- The trust or institution would be required to furnish Form No. 10, which is the notice of accumulation of income, and the same be filed on or before the due date of filing return of income.

- Secondly, the entity shall mention the purpose for which income the accumulated or set aside income be utilized.

- Such income shall not be accumulated for a period exceeding 5 years, however, the years in which income accumulated is due to order or injunction by any court, the same be excluded from the computing of 5 years.

- And lastly, the amount of money so accumulated or set aside shall be invested or deposited in the prescribed mode. The prescribed modes of investment are –

- Investment in government saving certificate/UTI.

- Deposit in post office savings bank/scheduled bank/co-operative bank.

- Investment in immovable property.

- Investment in any security for money created and issued by the Central or State Government.

- Company debentures, which are fully and unconditionally guaranteed by Central or State Government.

- Investment or deposit in Public Sector Company.

- Deposit with or investment in bonds of a financial corporation or public company engaged in providing long term finance for India’s industrial development.

Surplus from Activities undertaken for Charitable Purpose

- Apart from the application to charitable objectives, section 11(1) of Income Tax provides that any sought of Donation/ Revenue/ Surplus, which has been derived by the entity, from a property, being held wholly for religious and charitable purposes, shall be excluded from the total income of the trust or institution, however, the same shall be applied for charitable purposes only. Now, this exemption is available, provided the charitable trust or institution applies at least 85 % of their income for charitable purposes. However, in case the income spent falls short of 85 % of income derived, then such shortfall of amount would be subject to tax.

- Now, in terms of reimbursement of operating expenses, the amount of income, which is utilized for the purpose of purchase of capital asset, repayment of loan for purchase of capital asset, revenue expenditure and donation to trust which has obtained registration under Section 12A and Section 10(23C), shall also be treated as applied for charitable purposes and would be exempt from income tax.

- However, there are certain cases, where the above exemption from income tax would not be available. These are -

- Where the entity uses the entire income from property, exclusively for the benefit of the private religious purpose and hence do not benefit the public. or

- Where the entire income of the entity is applied for the indirect benefit of any particular religious community or caste. or

- Wherein the entire income, or property of the entity is used exclusively for the benefit of specified person, who can be –

- Author or founder of trust or institution.

- Any person making substantial contribution of more than Rs 50,000 in a particular financial year.

- Any member of HUF, where the author, founder or person is HUF.

- The Trustee/ manager of.

- Any relative of above mentioned persons

- No earning or Surplus of the entity shall be distributed to any member or entity of the said entity. Such Surplus be ploughed back for the charitable objectives only.

- Also, the assets of the entity shall not be distributed among members, wherein the entity is dissolved.

- Ensure that the charitable activities of the trust shall fall within the category of activities provided under Section 2(15) of Income Tax Act, 1961. It is to be noted that such entities shall not undertake any commercial activity, if not connected with their objectives, and their annual gross receipts shall not exceed Rs. 25 lakhs in a particular previous year.

- the surplus amount in excess of Rs. 25 lakhs shall be taxable in the hands of entities engaged in advancement of general public utility.

(3) Other Miscellaneous Items

- One thing to note that in case of accretion in income of the trust or institution, the same shall be taxable on conversion of the entity into any other from that is not eligible for registration under section 12 A of Income Tax Act 1961; or wherein the entity merged with another entity, not having similar objects and is not registered under section 12 A. It also includes non –distribution of assets on dissolution of the entity registered under section 12A or approved under section 10(23C) within 12 months from the date of dissolution.

- Second one is deemed conversion. So, a trust or institution would be deemed to have been converted into any other entity, which is not eligible for registration under section 12 A, provided, the registration granted to such entity under section 12A stands cancelled, or where the said entity tends to modify their objects and do not apply for fresh registration, then also the amount shall be taxed.

- In accordance with section 139A, every person, excluding individual, entering into financial transaction of amount aggregating Rs. 2,50,000 or more in a financial year would be required to obtain PAN number. Such a PAN serves as a Unique Entity Number (UEN) for non-individual entities. Apart from non-individual entities, the trustee, author, founder, chief executive officer, principal officer or office-bearer or any person competent to act on behalf of trust, shall also be liable to obtain PAN.

- Apart from this, the provisions of section 40(3) and 40(3A) shall mutatis mutandis be applicable to trusts as well. Thus, payment made in excess of Rs. 10,000 in cash shall not be considered as the application of income and the same be taxable in the hands of trusts.

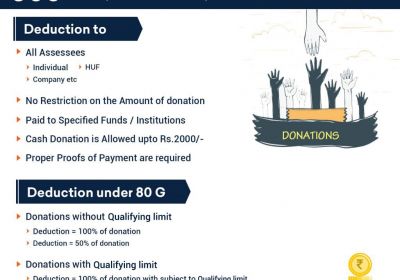

- Restrictions imposed in respect of cash donations made to charitable trusts under section 80G. It is to be noted that the said limit has been reduced from Rs. 10,000 to Rs. 2,000. Thus, a maximum of Rs. 2000 can be donated by a person in cash.

FAQ on NGO’s Receipt of foreign grants & its Utilizations Provisions

Query No.1 Will there be any constraints from Income Tax or FCRA point of view on the above points?

Reponses : With reference to above stated provision of Income FCR Act 2010 and Tax Act 1961, there is no any specific constraint or hurdle in doing any activities in the name of Registered Trust having charitable and religious purpose subject to certain provision of the respective Acts which must be followed and taken care at the time of doing any type of activity other charitable and religious purpose.

The important point of consideration respective acts is briefed here below;

FCR Act 2010

- Foreign contribution must be receive from foreign sources in the form any article, currency (whether Indian or foreign) or any security or Income arising from Foreign Contribution in received & utilized from the designated bank Account only by the entity registered under FCRA and entity does not have any foreign national, as members of executive committee.

- Contribution received must be utilized only for the welfare purpose or activities for which it is received and should be in line with the objectives of the trust and shall not be applied for any non-permissible activities under FCRA 2010.

- Annual report in the “Form FC-6”, clearly reporting the information about the receipt and utilization of foreign fund should be filed by 31st December of the particular financial year.

Income Tax Act 1961

- For claiming exemption entity must get registered u/s 11, and required to obtain registration U/s 12A of Income Tax Act, 1961. for claiming any exemptions all type of receipts & income of the entity must be derived only from property held under trust wholly for charitable or religious purposes in India,

- Where entity fails to apply at least 85% of their income for charitable purpose, then entity required to furnish accumulated income in the Form 10 and the same must be on or before the due date of filing Income Tax Return of the entity, maximum accumulation period should not exceed 5 years subject to any order or injunction by any court, the same be excluded from the computing of 5 years. The amount of money so accumulated or set aside shall be invested or deposited in the prescribed mode.

- Apart from the application of funds to charitable objectives, Revenue/ donation or grant surplus derived by the entity, shall be applied for charitable purposes only.

- Operating expenses, purchase of capital asset, repayment of loan for purchase of capital asset, revenue expenditure and donation shall also be treated as applied for charitable purposes and would be exempt from income tax.

- There are certain cases, where exemption from income tax would not be available. e.g. Entity uses the income from property, exclusively for the benefit of the private religious purpose and not for the benefit public, for the indirect benefit of any particular religious community or caste, used exclusively for the benefit of specified person, as explained in point ni B(2) above

Conclusion: on the basis of above discussion, there is no specific constraint or hurdles in doing any activities by the Trust having charitable purpose for the overall benefit of society subject to compliances of above briefed provisions of respective acts.

Query No.2 : Are there any other matters we should consider for these transactions?

Reponses : With reference to above stated provision of Income FCR Act 2010 and Tax Act 1961, there is no other specific matters need to considered especially for the illustrated as explained in main query. Still there are some important point need to consider in respective acts is briefed here below;

FCR Act 2010

- All the Assets purchased out of foreign contribution must be acquired & possessed in the name of trust and the same shall not be in the name of its members and any other person, in case of trust need to transfer the foreign contribution to any unregistered person, the same would require permission from the FCRA authority before making such contribution.

- All type of administrative and other expenditure incurred by the Trust must be in compliance of provisions mentioned in Point No. A(2)(vii) above

Income Tax Act 1961

- Any payment on account of reimbursement of operating expenses and income utilized for the purpose of purchase of capital asset, repayment of loan for purchase of capital asset, revenue expenditure and donation to trust which has obtained registration under Section 12A and Section 10(23C), shall also be treated as applied for charitable purposes and would be exempt from income tax.

- The charitable activities of the trust shall fall within the category of activities provided under Section 2(15) of Income Tax Act, 1961. It is to be noted that such entities shall not undertake any commercial activity, if not connected with their objectives, and their annual gross receipts shall not exceed Rs. 25 lakhs in a particular previous year.

- Further, the surplus amount in excess of Rs. 25 lakhs shall be taxable in the hands of entities engaged in advancement of general public utility.

- Restrictions imposed in respect of cash donations made to charitable trusts under section 80G, and said limit has been reduced from Rs. 10,000 to Rs. 2,000. Thus, a maximum of Rs. 2000 can be donated by a person in cash.

Conclusion: on the basis of above discussion, there is no specific other matters need to considered especially for the illustrated as explained in main query subject to compliances of above briefed provisions of respective acts.

Query No.3

What precautions should be taken by Trust?

Reponses : With reference to above stated provision of Income FCR Act 2010 and Tax Act 1961, there is no other specific precaution need to undertake by the trust especially for the illustrated as explained in main query. Still there are some important point other than above points need to consider in respective acts is briefed here below;

FCR Act 2010

- Foreign Contribution shall be Received & Utilized from Designated Bank Account only

- Timely submission & compliances of all FC-6

- Compilation of Books of accounts and Audit of the same on Quarterly basis.

- Foreign Fund must not be transferred to any unregistered FCRA person.

- Any application of foreign fund for ristrive purpose must be avoided.

- In case of any violation, the Central Government may by order in writing shall suspend the certificate of the NGO, and the same shall be suspended for a maximum period of 180 days.

Income Tax Act 1961

- Form 10 must be on or before the due date of filing Income Tax Return of the entity otherwise benefit of accumulation period will be allowed

- The amount of money so accumulated or set aside shall be invested or deposited in the prescribed mode only.

- No Surplus of the entity shall be distributed or incurred on any member or entity. Such Surplus be ploughed back for the charitable objectives only.

ICAI has issued Handbook on Statement of Donations Received by Charitable Institutions under Income Tax Act.

New Income tax Update :

CBDT Issue notification New ITR-7 Form Applicable for the AY 2023-24

You can reach me anytime at +91-9555 555 480