Table of Contents

- All About The Registration Of A Section 8 Company In India

- Benefits Of Registration Section 8 Company In India

- Pre-requisites For Section 8 Company Registration

- What Are Documents Needed For Registering A Section 8 Company (ngo)

- Process Of Section 8 Company Registration

- Section 8 Company Registation process Mca

- Apart From These Forms, The Applicant Would Required Certain Other Documents Like -

- Brief Process Of Ngo Registration In India

All about the Registration of a section 8 company in India

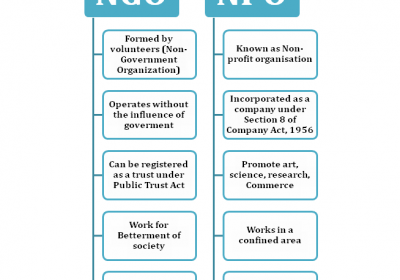

Section 8 Company Registration: NGO can be registered via Section 8 company, which is incorporated under Companies Act, 2013. Such companies work towards charity, religion, trade etc.

Benefits of Registration section 8 Company In india

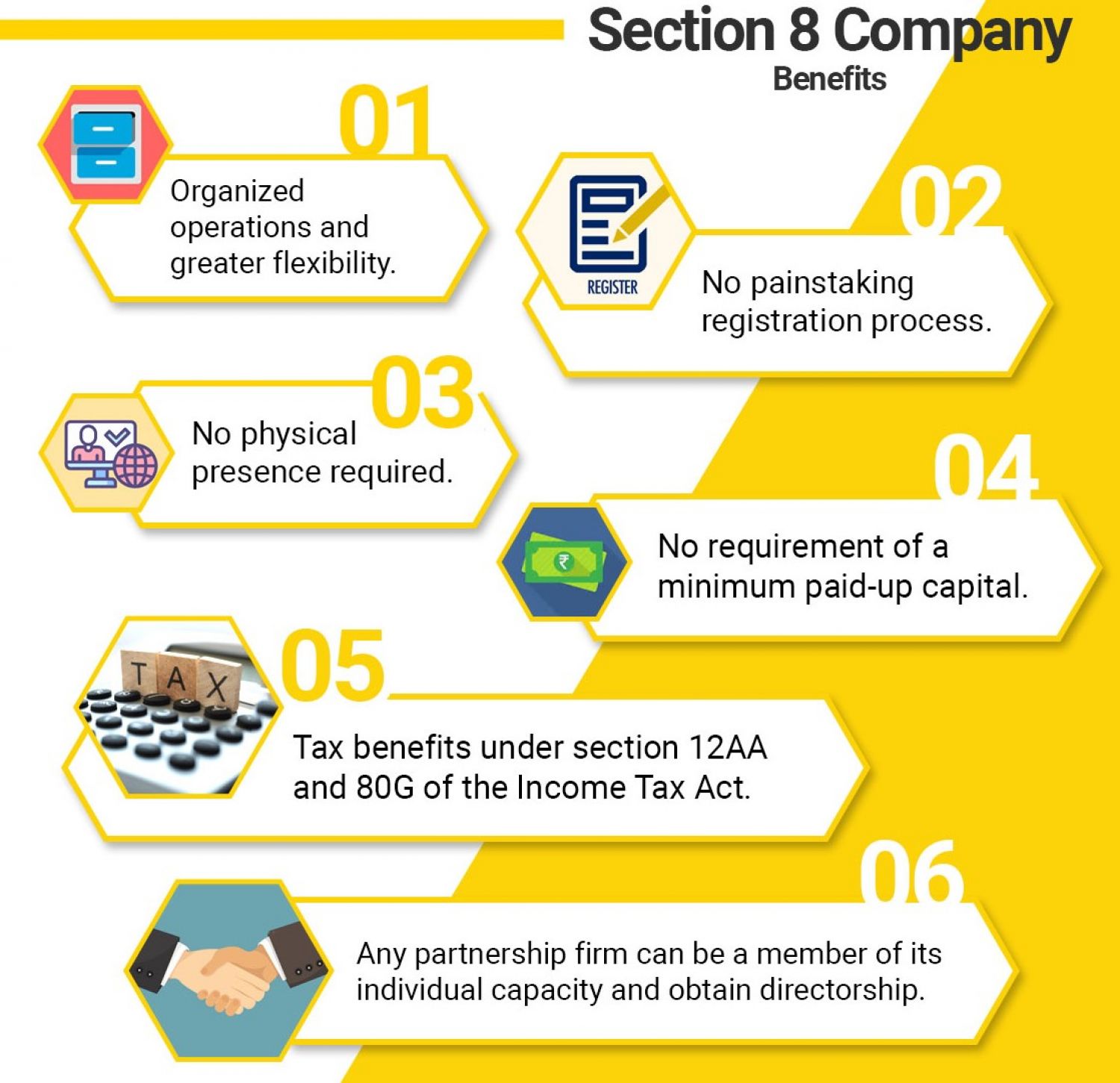

- No minimum capital requirement in order to establish a section 8 company.

- Just like trust, section 8 company also obtains the recognition as a separate legal entity.

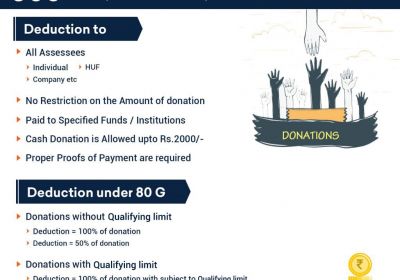

- Apart from this, the NGO as section 8 company, shall also obtain the benefit under Income Tax Act, 1961. The contributors, or the stakeholders would also get tax exemption in respect of donation made by them in such NGO’s.

- These entities are exempted from the payment of stamp duty during the registration process, which is commonly applicable on the registration process of other entities.

- Also, there is no requirement as to the title of the company, i.e., the section 8 companies would not be required to suffix anything to its name, which is not in the case of a public limited or private limited company.

- Then, there is better credibility. It means that in comparison with any other NGO structure, Section 8 company trust is more credible.

- Lastly, a Section 8 Company enjoys the transfer of ownership. Thus, in accordance with the Section 8 of Income Tax Act 1961, the management of the company can transfer the ownership of moveable as well as immovable assets without any restrictions.

Pre-requisites for Section 8 Company Registration

- For incorporating a Section 8 Company, Memorandum of Association (MoA) and Articles of Association (AoA) is required to be drafted.

- The said company be registered either as a private limited or public limited or can even be a limited liability partnership firm.

- Lastly, there should a minimum of two directors available, along with atleast two members for incorporating section 8 company.

What are Documents needed for Registering a Section 8 Company (NGO)

- Photographs(Passport size) of Directors

- Digital Signature Certificate of Directors

- Members Id Proof such as Aadhar Card, Passport, Voter ID.

- Complete Details of Director & Address Proof of Directors

- Electricity Bill.

- Passport.

- Ration Card.

- Telephone Bill.

- Driving License.

- Aadhaar Card.

- Election Card or Voter Identity Card.

- Memorandum of Association & Articles of Association (MOA and AOA)

- Director Identification Number (DIN) of of Directors

Process of Section 8 Company Registration

- First step is the filling of application form for incorporating a Section 8 company.

- For this, there is a requirement of Digital Signature Certificate and DIN for the proposed directors of company. Also, the applicant entity is required to get their name approved by the Registrar of Companies.

- After this comes the verification and name approval, which generally takes 2 days from the date of application.

- The, the applicant is required to apply for the license as well as the COI of Section 8 Company.

- Upon successful verification, the Section 8 Company gets ready for operations.

Section 8 Company Registation process mca

ROC Forms Required of section 8 company Registration

- INC1- Form for name registration

- FORM INC12- Form for obtaining license for running NGO

- INC13- MOA of the applicant NGO.

- FORM INC 15- Form for declaration by the subscribers of MOA

- INC7- Form for application for NGO registration.

- Form INC 22- Form containing details of registered address of NGO.

- DIR 12- Form for appointment of directors.

Apart from these forms, the applicant would required certain other documents like -

- A request letter issued for the registration, which is to be signed by all the members.

- Certified copy of Memorandum of Association

- A copy of rules and regulations of the Non Governmental Organization

- Details in the form of name, address, and occupation in respect of the members along with their respective signature.

- Declaration by the President of Society

- An affidavit confirming the principle address proof of registered office and NOC certificate from the landlord.

Brief Process of NGO Registration in India

We can that registering an NGO in India is quite easy and a quick process and the same can be done online with RJA by undertaking 3 simple steps:

- Selection of Right Entity–All the queries pertaining to selection of the right entity shall be provided by our experts.

- Complete Paperwork – At RJA, our experts help in the complete process of filing and registration of NGO entity.

- Registration of Entity– And lastly, we would be assisting in the registration of the NGO and will handle all the formalities with due care, that are required for the registration of NGO.