Conversion of the Partnership Firm into LLP

The Limited Liability Partnership in India was introduced by the Limited Liability Partnership Act of 2008. It was organized for a number of reasons which include creating a flexible environment for small enterprises and uplifting the service sector so that the business synergies can be brought together easily. Out of all the the most prominent reason is to provide a simple business organization that is less complicated and the owners should have the right of limited liability. There are a number of benefits one can get through a Limited Liability Partnership. Hence it is reasonable for one to convert the present partnership firm into the Limited Liability Partnership which will give them certain benefits. The benefits or the reasons for conversion are stated below-

Limited Liability for Partners

The Private Limited Company is preferred by most partners because of one great reason. This is that in a partnership firm it is seen that the partners are individually and personally responsible and liable to the creditors. Therefore many of them hesitate to form a PARTNERSHIP Firm. In the case of Private Limited Liability, it is a completely different thing. The partners in the limited liability are reasonably liable for the acts only to which they have contributed are directly connected to, rather than being personally liable to their creditors. This stands to be a major reason for the existing partnership firm to be converted into a Limited Liability Partnership.

Perpetual Existence

In the case of a partnership firm, the partnership is automatically dissolved if any of the partners or all partners die due to an accident or due to some reason. The case is different in the case of a Limited Liability Partnership. There is a situation of perpetual existence present here where a separate juristic person is present. The existence of this person is not decided or dependent on his partners. In Limited Liability Partners, all the partners keep changing from time to time. But this will definitely not have an effect on the LLP’s task or continuity. If one wants to ensure the continuation of his/her business firm irrespective of the partners being present or not LLP is best for them.

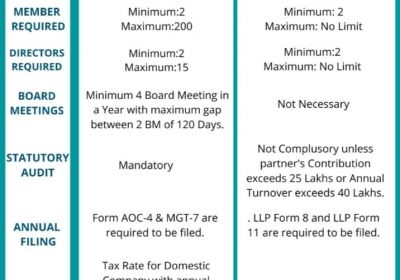

Partners are not Limited

The minimum number of partners in an LLP is taken to be two. However, the maximum number of partners in a Limited Liability Partnership can be 10 when it is concerned will banking business and it may exceed 20 in cases of all other types of business. it should be noted that the maximum number of partners who can join the LLP is not limited or fixed. However, at least two members should be present. In case if two members are not present the partner who remains continues the firm who now becomes personally liable.

Better Access to Credit

The Limited Liability Partnership is known to be an independent corporate body that has a clear understanding of their assets and what they are liable to. It is seen that because of this reason the banks and investors easily provide bank loans without any hesitation to the Limited Liability Partnership firm. It is also seen that the Limited Liability Partnership has a better Governance system and its management capacity is also high. This is because of the compulsory audits they are required to fulfil. This is why they are always preferred by all the banks and investors.

Potential for growth

The business environment at present reflects a number of strategies to promote the business. There stands to be a whole lot of mergers, amalgamation which helps to unfold the various business synergies. Such mergers and amalgamation are only possible in the case of a Limited Liability Partnership and not a Partnership firm. Therefore most people prefer to convert into LLP from their existing partnership firm

Steps for the conversion of the Partnership Firm to LLP:

Step by step instructions for the conversion of the Partnership Firm to LLP:

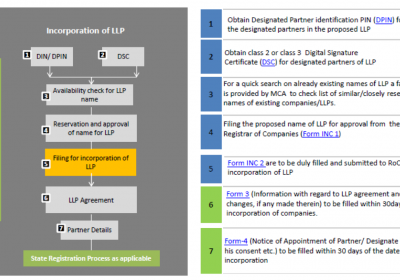

- Get the DSC for all partners. : Normally, partners in a partnership firm do not have a digital signature, as this is not mandatory for the registration of a partnership firm.

- LLP partners need a DPIN/DIN. For this purpose, obtain DPIN/DIN for all partners: A DIN is a unique number for each person who is an LLP Partner or Director.

- Submit an application in the RUN-LLP form to reserve your name: before applying for a name reservation, the applicant must review the rules for the selection of the name of the LLP.

- File Form FiLLiP for Application and Declaration of Conversion of Partnership Company to LLP. : Documents are needed for the registration of the LLP and the FiLLiP form.

Information & Documents required for Form- Fillip:

- Name of Proposed Limited Liability Partnerships

- Latest Utility Bill (Not Older Than two Months)(for Registered Office)

- Copy of Registered Office Proof (Index-2/ Allotment Letter/ Possession Letter/ Sale Deed/ Rent Agreement)

- Phone No. and Email Id of upcoming Partners

- Copy PAN of all Designated Partners/ partners

- Copy Bank Statement of Designated Partners/ partners

- Requirement DSC of Designated Partners

- Capital of Proposed Limited Liability Partnerships and Contribution of Proposed Partners

- Voter Id Card/Driving Licence/Passport of Proposed Partners

Following Attachments required for Form Fillip:

- Copy of Proposed Object.

- Copy of Subscriber Sheet Including Consent.

- Copy of Proof of Address of Registered Office of the Limited Liability Partnerships which includes No Objection certificate of the Owner.

- Limited Liability Partnerships or Company if the proposed Partner/ Designated Partner is Partner of any other Company or Director or Limited Liability Partnerships respectively.

5. If the incorporation process is completed by filing the FILLiP form, the next step is to file the LLP agreement: File LLP Form 3 for registration of the LLP Agreement, which includes specifics of the LLP agreement with the MCA partners. Details on the limited liability partnership agreement and changes, if any, made to it. Following Attachments required for Form 3:

- Agreement with the LLP.

6. Certificate of incorporation of LLP shall be given upon complete conversion to LLP ROC. : Furthermore, when the LLP is incorporated and the Partnership Firm is converted, the Partnership Firm will be considered to have been dissolved.

Limited Liability Partnerships provides a host of features listed below that make it more appealing than a partnership:

• Freedom to consider an infinite number of partners &

• Ease of change of ownership.

• defence of limited liability,

• Survival status,