ANNUAL FILINGS OF LIMITED LIABILITY PARTNERSHIPS (LLPS)

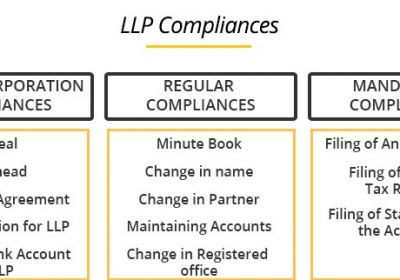

Is the next important task marked in the compliance list? Every Limited Liability Partnerships (LLPs) which are registered with the Ministry of Corporate Affairs (MCA) have to file the Annual Returns and Statement of Accounts for the FY 2018. here are three main compliances which should be red-flagged by all the designated partners of LLP:-

(i) Preparation and filing of Annual Return under the LLP Act, 2008;

(ii) Preparation and filing of Financial Statements of the LLP

(iii) Filing of Income Tax Returns under the Income Tax Act, 1961.

The majority of the Stakeholders are ambiguous to the fact that whether filings of the Annual Returns are the mandatory thing even if they are not doing the business?

& the answer to the dubious question is YES! Every LLP has to be compliant even if there are no operations in the organization.

It is the responsibility of the organization to file all the required documents even if there are no operations or business during the financial year.

Let’s understand which LLP’s have to file the Annual Returns and Income Tax Return for the year 20X2:

(I) FILING ANNUAL RETURN OF LLP:-

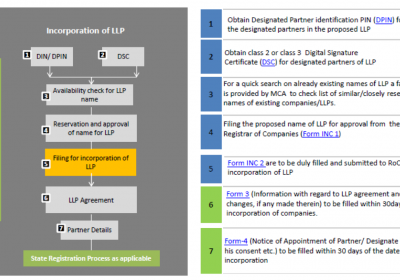

Annual Returns in LLP i.e… Form 11 is a Summary of LLP’s Partners like whether there are any changes in the management of the LLP.

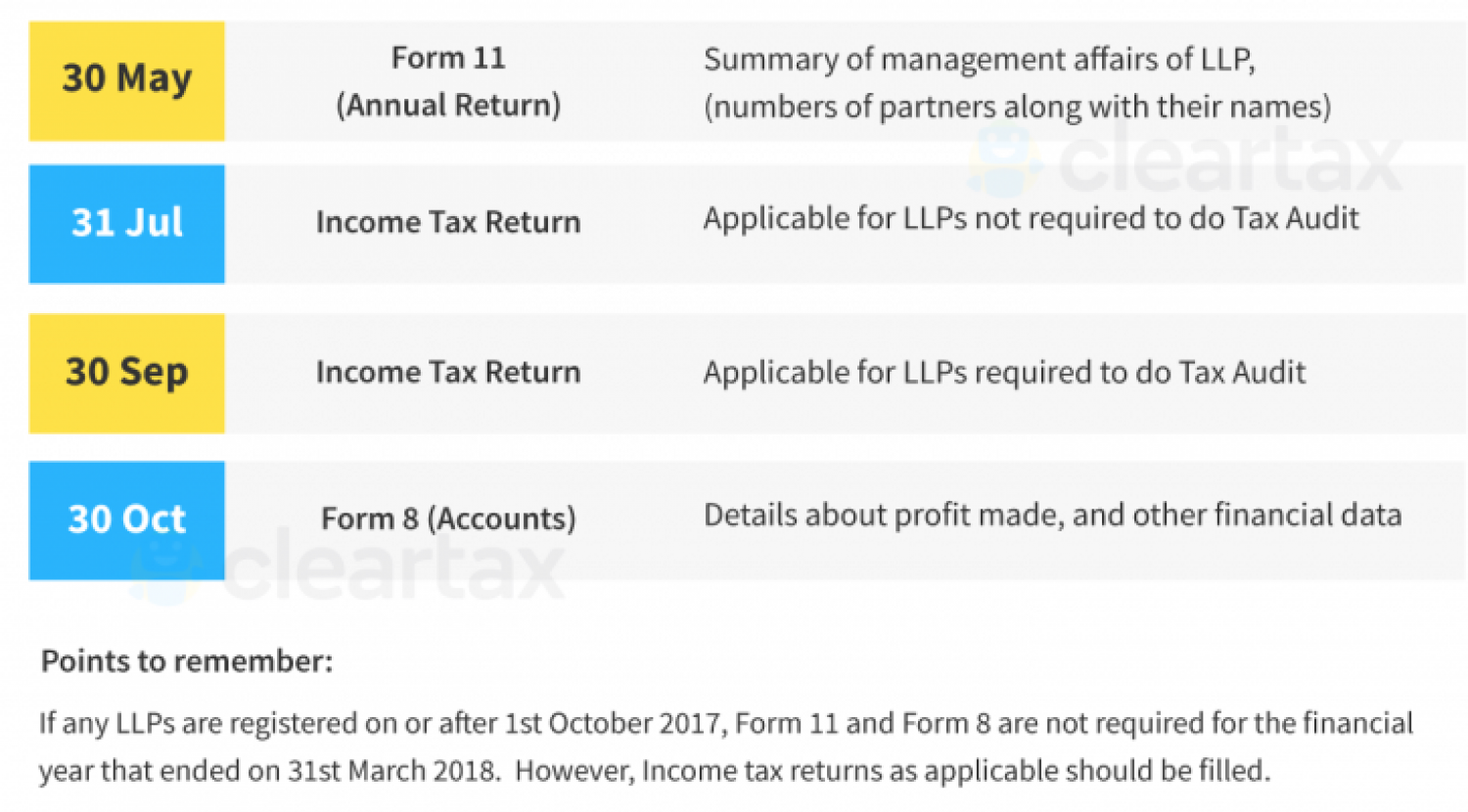

Every LLP is required to file an Annual Return in Form 11 to the Registrar within 60 days from the closure of the financial year i.e. the Annual Returns has to be filed on or before 30th May every year and for the financial year ended on 31st March 20X2 the last date for filing the annual return is 30th May 20X2.

Note:- Form 11 or Annual Return is Applicable on those LLPs which are registered until the 30th of September 20X1. If your LLP is registered on or after the 1st October 20X1 then you do not require to file LLP Annual Return in the year 20X2.

(II) FILING ANNUAL ACCOUNTS OR STATEMENT OF ACCOUNTS OR P&L AND BALANCE SHEET:-

Every LLP or any other legal entity from a solo firm to a Private limited company has to prepare their accounts to get the information regarding your business that how much profit is earned by your LLP.

Every LLP has to close their accounts till 31st March 20X2 on this year. They are required to maintain the Books of Accounts in the Double Entry System and has to prepare a Statement of Solvency (Accounts) every year ending on 31st March.

LLP Form 8 to be filed with the Registrar of LLPs on or before 30th October every year. Therefore, 30th October 20X2 is the last date for filing annual accounts this year.

Note:– Form 8 or Annual Statements for the year 20X2 is applicable to those LLP which is registered till the 30th of September 20X1. If your LLP is registered on or after the 1st September 20X1 then you do not require to file LLP Annual Statements in the year 20X2.

(III) FILING INCOME TAX RETURNS FOR THE LLP:-

Every LLP has to file the Income Tax Returns for the year 20X2. In simple words, LLP is a separate legal entity so with the partner’s income tax return you have to always file the LLP Income tax return where you show your LLP’s Income and calculate the tax liability and pay the taxes to the government of India. LLP have to calculate their tax liability from their financial statements for the year 20X2.

Mostly Income Tax Return the Last date is 31st July 20X1 (unless extended) this year for the Individual and legal entities. However, in the case where an Audit is required, the last date for filing Income Tax returns is 30th September 20X2.

If the LLP has not carried any business during the year ended 31.03.20X2, the LLP has to file a NIL IT RETURN with Income Tax Authorities.

Note:- Filing of Income Tax Return is Applicable on all the LLPs which are registered during the financial year 201X1-X2. Therefore, it’s not a matter if your LLP is registered after 01-10-20X1 still you have to file an Income tax return from the date of incorporation till 31-03-20X2.

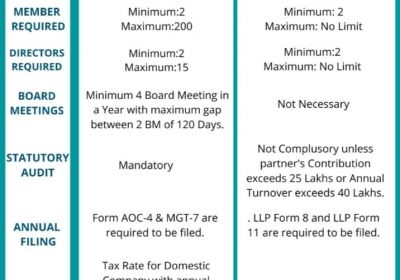

AUDIT REQUIREMENT UNDER LLP ACT, 2008:-

Only those LLPs whose annual turnover exceeds Rs. 40 lakhs or whose contribution amount exceeds Rs. 25 lakhs are required to get their accounts audited by a qualified Chartered Accountant. Meaning thereby, All the statements of accounts are certified by the CA.

AUDIT REQUIREMENT UNDER INCOME TAX ACT, 1961:-

Audit of accounts is a mandatory requirement under the Income Tax Act when the annual turnover of LLP is more than Rupees one hundred lakhs.

CERTIFICATIONS FROM COMPANY SECRETARY IN PRACTICE (PCS):-

In the case of LLPs with a turnover of more than five crore rupees in a financial year or a contribution of more than INR 5 lakh, the annual return shall be certified by a CS in Practice.

CONSEQUENCES FOR NON-FILING LLP ANNUAL RETURNS AND ACCOUNTS:-

If there is a delay in filing Form No. 8 and Form No. 11 of LLP, you will have to pay a penalty as applicable on today’s date. If the filing is not done within the stipulated time, there is a penalty of Rs. 100 per day until it is compiled. You cannot close or wind up your LLP without filing Annual Accounts.

So if you don’t file mandatory forms on time with the MCA, your LLP turns into unlimited statutory liability until the day it is compiled.

The provisions of the Act require LLPs to file the documents like Statement of Account and Solvency (SAS) in Form 8 and Annual Return (AR) in Form 11 within the time specifically indicated in relevant provisions.

The LLP Act contains provisions for compounding of offenses which are punishable with fine only. Further, for defaults/non-compliance on procedural matters such as time limits for filing requirements provisions have been made for charging default fees (on daily basis) in a non-discretionary manner. To avoid the consequences of heavy penalties, it would be advisable to comply on time within the stipulated due date of filing.

Actions are taken by the Registrar of Companies against the LLPs who have not filed their Returns and Statement of Accounts:-

Apart from the above consequences and penalties, the Registrar has the right to strike off the LLPs who are not filing their Financial Statements (Form 8) and Annual Returns (Form 11) for a period of two immediate financial years.

In the line of the above right and under the provisions of Section 75 of the LLP Act, 2008 read with Rule 37 of the LLP Rules, 2009, the following registrar of Companies has issued the public notice proposing striking of the name of LLPs who are not filing their Annual Returns and Financial Statements:

It is advisable for all the Designated Partners to complete their Annual Filings in respect of LLPs to avoid striking off the name of LLPs and prevent the disqualification of DPIN (DIN).

Consequences of non-filing Form 8:

Form 8 must be duly completed by 30 October. Failure to file through result in a penalty of Hundred INR per day of delay.

Specifics need to be given along with Form 8:

Form 8 is a declaration of accounts and solvency (Accounts). It must depict the financial transactions carried out during the FY as well as the financial status of the year. In addition to this the Limited Liability Partnership is also expected to declare

1. The turnover, whether above or below Rs 40 lakh

2. It must also state that it has previously filed a statement indicating the creation of charges/modifications/satisfactions up to the current financial year.

3. Also, announce that the partners/authorized members have taken due accountability and concern for the preparation of the accounts and for the proper management of the accounts.

Attachments to Form 8:

Form 8 must be added to the supporting information:

• Disclosure under the MSME Development Act, 2006 is a necessary supplement.

• Required declaration of contingent liabilities to be attached if any contingent liabilities exist.

• Any other related details may be included as an optional attachment.

Information should be given in form 11:

- Form 11 is the Partner Information Statement and all contributions made. In addition, the Limited Liability Partnership often has to include details on other corporations or Limited Liability Partnerships in which the partners hold similar roles.

- The contribution carried out in Form 11 must be consistent with the declaration made in Form 8 and must therefore be carefully filled out.

Filing for LLP is Compulsory post-incorporation. If an LLP Firm fails to file Form -8 and Form -11- i.e. Statement of Accounts & Solvency (Accounts), then it may have to bear a penalty of up to INR 5 Lakhs.

Consequences of non-filing Form 11:

- If Form 11 is not filed by the Limited Liability Partnership by 31 May, Rs 100 will be imposed as a fine per day for delay. The amount will also rise over time as there is no penalty cap.

This LLP Annual Compliance Package includes: -

- On-call discussion about the requirement.

- Filling of ROC forms, PL, BS & Solvency report.

- Turnaround time 7 Working days.

Latest Update On May 2021

- As per combined reading of circular no. 6 & 7 of MCA dated 03/05/2021 and List of Forms issued on 13th May 2021 in respect of waiver of additional fees one-forms of Company and LLP

- There is no extension or waiver in additional fees of Form-11 LLP for the Financial Year ended 31st March 2021

- Therefore the Due Date of filing Form-11 LLP shall be 30th May 2021

- File ASAP to Avoid Penalties