Table of Contents

- What Is Limited Liability Partnership (llp)?

- Benefits/features Of Limited Liability Partnership

- How To Strike Off Of Limited Liability Partnership?

- What Documentation Is Required For Striking Off Of Llp?

- What Are The Fundamental Requirements For Striking Off Of A Llp?

- Procedure For Striking Off Limited Liability Partnership

- Frequently Asked Question For Strike Off Of Limited Liability Partnership’s :

What is Limited Liability Partnership (LLP)?

A limited liability partnership (LLP) is a mixture of a corporation and a partnership. It's a newer corporate structure that allows for partnership flexibility while also limiting the company's liability and lowering compliance costs.

Benefits/Features of Limited Liability Partnership

- Simple to establish: The partners must sign the limited liability partnership agreement at the Registrar of Companies office.

- Limited-Liability along with Separate Legal Entity: It is distinct from its partners, or the partners are distinct from the firm. No one can touch a Partners personal property if Firms suffers significant losses. Only the money they have put into the business will be gone. Liabilities are restricted and proportional to the capital contribution of the partners. Furthermore, all partners should be the Limited Liability Partnership's agent, not the agents of other partners.

- Flexible: It allows for changes to be made. It provides members with the ability to organize their internal administration according to mutual agreement, as in a partnership business.

- No restriction on the number of partners: There must be a minimum of two partners, at least one of whom must be an Indian citizen, but there is no limit on the number of partners, and overseas partners are permitted.

- Continuous Existence: It also has perpetual existence, which implies the firm will not dissolve if any of the partners dies or goes bankrupt.

- Only for Profit: A limited liability partnership cannot be established for charitable or non-profit objectives.

Furthermore, a limited liability partnership is less expensive to create and simple to dissolve since it involves few legal formalities and the partners cannot be held liable for the wrongdoing, forgeries, and other faults of other partners.

How to strike off of Limited Liability Partnership?

Limited Liability Partnership strike off is governed by Rule 37(1) of Limited Liability Partnership (Amendment) Rules, 2017, The following are the two ways for strike off an LLP:

1. Voluntary strike off of Limited Liability Partnership by Partner

When a Limited Liability Partnership has not been in operation for a year or longer and wishes to close its business, it can request to the registrar to be declared defunct and have its name removed from the Limited Liability Partnership records.

2. Compulsory strike off of Limited Liability Partnership by Registrar

When the Registrar discovers that a Limited Liability Partnership has not carried on any business or operations for at least two years, the Registrar may issue a notice to the Limited Liability Partnership and all of its partners, giving them one month to make any representations they may have.

What documentation is required for striking off of LLP?

When we want to get rid of the Limited Liability Partnership name, we need to fill out e-Form 24 and attach the following documents:

- All partners must sign a document stating that they have the authority to make the application.

- Receipt of the most recent income tax return- self explanatory.

- Detailed Application- Describe the Limited Liability Partnership in detail, as well as the grounds for its striking off.

- A statement of account containing nil assets and nil liabilities verified by a CA in practice and dated within 30 days of the date of Form 24 filing.

- The initial LLP agreement, as well as any subsequent revisions, if entered into but not filed.

- Filling an affidavit signed jointly or severally by the authorized partners.

What are the fundamental requirements for striking off of a LLP?

• A LLP must have completed all Registrar of Companies filings prior to submitting a striking off application.

• LLP shall be inactive for at least one financial year.

• There should be no unpaid debts in a LLP.

Procedure for striking off Limited Liability partnership

There are essential steps required for Strike off Limited Liability Partnership

Step-1: Organize Partner’s Meeting

Limited Liability Partnership organize the partners meeting and aprove the resolution in respect of striking off on of the Limited Liability Partnership and authorized any of the partner for filing the application with registrar.

Step-2: Following action should be done before filing of Application

- Put an end to commercial activities: Only that Limited Liability Partnership who desires to close their business permanently should fill out Form 24. As a result, if a Limited Liability Partnership is already in business and its founders intend to dissolve it, the Limited Liability Partnership must cease all commercial activity before filling the Limited Liability Partnership form-24.

- Bank account(s) closure: Before completing Form 24, a Limited Liability Partnership must close all of its bank accounts in its own name and get a document stating that the account has been closed.

- Draft affidavits and declarations: The Limited Liability Partnership’s designated partners must certify, jointly or severally, that the Limited Liability Partnership’s has ended all commercial activity as of the date, or that the Limited Liability Partnership has not begun any business in the previous year. They must also state that their Limited Liability Partnership is free of all liabilities and creditors, as well as any indemnification obligations that may emerge after the striking off.

Step 3: Filing Application with ROC

Limited Liability Partnership must file an application with the Registrar in Limited Liability Partnership Form 24 for the striking off of Limited Liability Partnership, together with the accompanying documents:

Form 24 attachments Needed for filling

- Statements of Accounts certified by a Chartered Accountants that are no more than 30 days old as of the application date.

- Acknowledgement copy of the most recent Income Tax Return submitted

- If applicable, a bank account closure certificate

- Consent of Partners/Resolution for Closure of Limited Liability Partnership

- Affidavit stating that no creditors or liabilities exist

- LLP Closure Indemnity Bond and Affidavit

Step 4: Registrar's Confirmation

ROC will review all of the documentation given by the Limited Liability Partnership, and if the ROC has no objections, the Limited Liability Partnership will be struck off and notified via mail.

Frequently Asked Question for Strike off of Limited Liability Partnership’s :

Question-1: Is it mandatory to complete the Limited Liability Partnership’s yearly filings before striking off of Limited Liability Partnership?

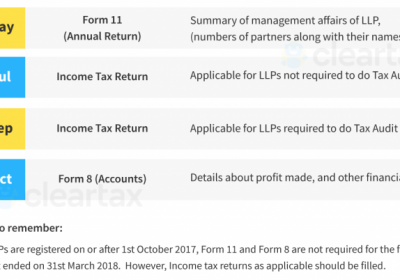

Ans. According to the Limited Liability Partnership Rules, a Limited Liability Partnership must submit forms LLP-8 and LLP-11 up to the end of the FY in which it was in operating.

Question-2: Is it necessary to file Form LLP-3, which relates to the Limited Liability Partnership Agreement, before the striking off Limited Liability Partnership?

Ans. There is no exemption in the Limited Liability Partnership Act or Rules for submitting an Limited Liability Partnership Agreement in Form LLP-3.

Question-3: What should you do if the Limited Liability Partnership has not yet to register a bank account? Is it still possible to file Form 24?

Ans. Yes, Limited Liability Partnership can file Form -24 if they haven't created a bank account. They must include a declaration from all partners stating that they haven't opened a bank account.

- Prepare the following documents: A Limited Liability Partnership must also include the income tax return and the Limited Liability Partnership deed with the form 24. The application for strike off must be accompanied by a copy of the acknowledgement of the most recent income tax return.

- Submit any pending documents: A LLP agreement must be completed with the Ministry of Corporate Affairs within thirty days of registration, if it enters into that agreement and is not filled, then that agreement must be filled with revisions, if any, before filling out Form 24. Before completing Form 24, any overdue returns in Form 8 or Form 11 must be completed up to the end of the financial year in which the Limited Liability Partnership stops its commercial activity.

- Obtain a certificate from CA: Once all the documents for filing of Limited Liability Partnership Form 24 have been prepared, a statement of accounts disclosing NIL assets and NIL liabilities that is certified by a practicing CA up to a date not earlier than thirty days from the date of filing of Form 24 must be taken.

- File Limited Liability Partnership Form 24: The aforementioned papers coupled with Limited Liability Partnership Form 24, can be filed with the Ministry of Corporate Affairs to have the name of the LLP struck out. If the application is judged to be acceptable, the relevant Registrar of Companies will post a notice on the Ministry of Corporate Affairs website notifying the striking off of Limited Liability Partnership's.

NOTE: Even after the LLP is closed, the obligation of designated partners will not be extinguished if you use Form 24.