Table of Contents

- Limited Liability Partnerships (llp) Registration

- Difference Between Llp, Company And Partnership

- Easy & Fast Steps To Register Llp In India-a Comprehensive Procedure

- Needed To File Your Post-incorporation Llp Compliances

- Llp Services in India

- Llp Consultation services

- New Llp Filing Fees From 1.4.2022

- What Rajput Jain & Associates Offers

- Few Registrations & Compliances Needed

- Key Highlights Of The Amendments Passed In The Llp Act, 2008 Via The Llp (amendment) Act, 2021

Limited Liability Partnerships (LLP) Registration

LLP has become the most preferable form of organization among entrepreneurs as it leverages the benefits of both partnership and the company in a single organization. The cost of forming an LLP is low with limited formalities and documentation processes without any requirement of limited capital contribution. The rights and duties of LLP partners are governed under the LLP Act 2008 and the provisions of the LLP agreement. One needs to register under LLP Act 2008 for effectively starting a business with Limited Liability Partnerships. Prior to starting an LLP, you need to submit the DSC (Digital Signature Certificate) of the designated partners of the proposed LLP. In short, documents are required to be signed digitally while filling the form online. PAN Card/ ID proof, address proof, residence proof, photographs are essential documents for the partners for registration.

You will be able to gain insight into the submission of the required documents in LLP Registration in Delhi and how the whole process unfolds. One needs to apply for the DIN (Director Identification Number) of all the members which are required to be signed by the Company Secretary and attached with the Aadhaar card and PAN card.

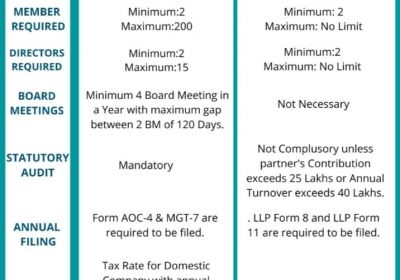

DIFFERENCE BETWEEN LLP, COMPANY AND PARTNERSHIP

|

FEATURES |

COMPANY |

PARTNERSHIP FIRM |

LLP |

|

REGISTRATION |

Registration with the ROC is mandatory. The Certificate of Incorporation is conclusive evidence. |

It is not necessary. Unregistered Partnership Firms will be unable to sue.

|

Registration with the ROC is mandatory. |

|

NAME |

A public company's name should end with the word "limited," and a private company's name should end with the words "private limited." |

There are no regulations. |

The name must end with “LLP,” which stands for “Limited Liability Partnership.” |

|

LIABILITY |

The amount of unpaid capital is limited. |

Unlimited, and can include the partners' personal assets. |

Only to the extent of the contribution to the LLP. |

|

LEGAL ENTITY STATUS |

Is a legal independent entity. |

It is not a distinct legal entity. |

Is a legal independent entity. |

|

AUDIT |

Mandatory, regardless of share capital or turnover. |

Mandatory. |

it is required, If the contribution exceeds Rs.25 lakhs or the annual turnover exceeds Rs.40 lakhs. |

|

Ownership of Assets |

All assets belonging to the partnership firm are owned jointly by the partners. |

Assets are owned by the company, which is independent of the members. |

Assets are owned by the LLP, which is separate from the partners. |

|

FOREIGN NATIONALS AS SHAREHOLDER / PARTNER |

Shareholders who are not citizens are allowed to participate. |

Foreign nationals are not permitted to form a partnership firm. |

Partnership with foreign nationals is a possibility. |

|

TAXABILITY |

The income is taxed at a rate of 30% plus surcharge and cess. |

The income is taxed at a rate of 30% plus surcharge and cess. |

Not yet notified. |

|

MEETINGS |

A quarterly Board of Directors meeting and an annual meeting of stockholders are required. |

It is not required. |

It is not required. |

|

WHISTLE BLOWING |

There is no such provision. |

There is no such provision. |

Employees and partners that contribute useful information during the investigative process are protected. |

|

NO. OF SHAREHOLDERS / PARTNERS |

A minimum of two is required. There is a limit of 50 shareholders in a private corporation. |

2 – 20 people A minimum of two is required. |

Minimum of 2 people and there is no cap. |

|

HOW DO THE BANKERS VIEW |

The creditworthiness is very high due to strict compliances and disclosures that are required. |

Creditworthiness is determined by the partners' goodwill and creditworthiness. |

Perception is higher than that of a partnership but lower than that of a corporation. |

|

DISSOLUTION |

Very procedural. Voluntary or by National Company Law Tribunal Order. |

By partnership agreement, insolvency, or court order. |

In comparison to the company, it is less procedural. Voluntary or by National Company Law Tribunal Order. |

|

CAPITAL CONTRIBUTION |

A private company should have a minimum paid-up capital of Rs. 1 lakh, whereas a public company should have a minimum paid-up capital of Rs. 5 lakhs. |

Not specified |

Not specified |

|

ANNUAL RETURN |

Annual account and an annual return to be filed with ROC. |

The Registrar of Firms does not need any returns to be filed. |

An annual account statement and annual return must be filed with ROC. |

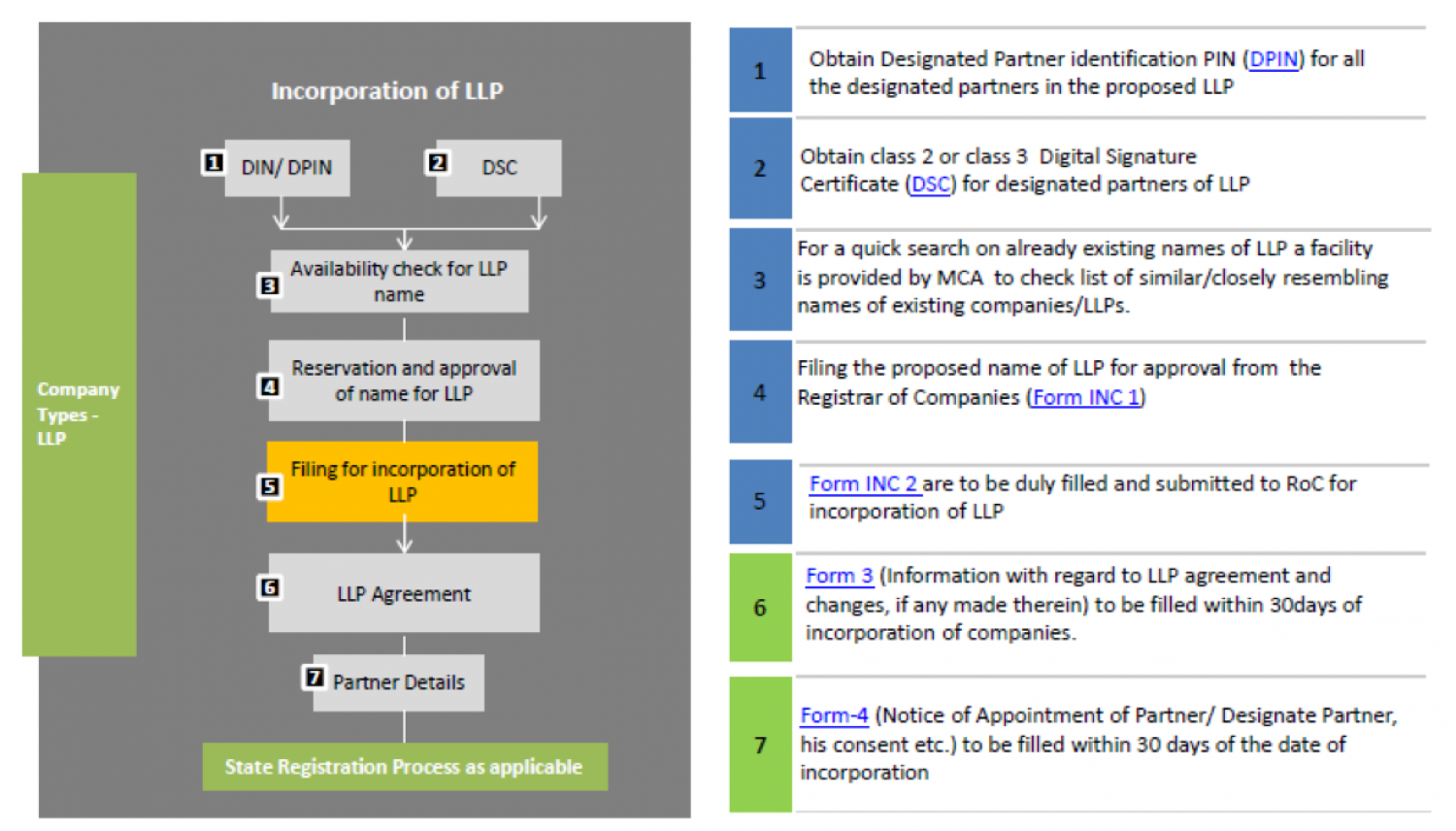

Easy & fast steps to register LLP in India-a comprehensive procedure

At Rajput Jain and Associates, we make the LLP registration process smooth and extra cost.

- Coordinate the key records of the Partners

- Please fill in an online form with the correct details

- Apply to the Digital Signature and DIN of Partners

- Prepare for all legal documents

- Apply to the name of availability of the proposed LLP

- Verification of all records and forms by the relevant Government Department and authorities

- File Incorporation Documents with ROC

- Get your LLP Incorporation Certificate

- Development of the LLP Agreement

- Needs to file the LLP Agreement

The professionals for LLP Registration in India will guide you through the registration of the LLP name or LLP RUN ((Limited Liability Partnership-Reserve Unique Name) which is processed by the central Registration Centre under non-STP. The registrar can either reject it or can approve it if it does not resemble any existing partnership accompanied by a reasonable fee and re-submission can be initiated after 15 days of the defect’s rectification. LLP is used for the company’s incorporation and it allows the company to file for DPIN. Form 3 of the LLP agreement is important and should be file within 30 days of incorporation as a part of LLP registration in Delhi and the agreement has to be printed on stamp paper. CA Rajput will help you finish the registration process without any confusion for you to start your business as soon as possible.

https://carajput.com/blog/everything-that-you-need-to-know-about-limited-liability-partnership/

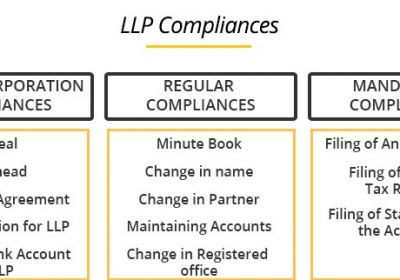

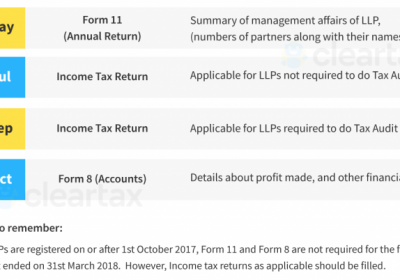

Needed to file your post-incorporation LLP Compliances

- Required to Filing LLP Agreement within 30 days - Mandatory, heavy penalty of Rs.100 per day of default with no ceiling on the maximum fine

- LLP PAN Application - Preferably within the first 30 days of incorporation.

- Audit of Accounts - LLPs whose annual turnover exceeds ₹ 40 lakh or whose contribution exceeds ₹ 25 lakh are required to get their accounts audited by a qualified Chartered Accountant mandatorily.

- LLP Annual Return - Within 60 days from the closure of a financial year i.e. 30th May of every year, Mandatory, heavy penalty of Rs.100 per day of default with no ceiling on the maximum fine

- Filing Annual Accounts or Statement of Accounts or P&L and Balance Sheet - Within 30 days from the end of six months of the close of financial year i.e. 30th October of every year

- ITR -Returns (LLP), annually

- Income Tax Returns (for Partners), annually

LLP Services in India

- Documentation & Planning for Limited Liability Partnership.

- Complete Consultancy on the requirements of a Limited Liability Partnership.

- Full support in getting DPINs and DSCs, using Form-7.

- Reservation of Proposed Names & Approval through Form-1.

- Support on Meeting the requirements demanded by Form-2 and Form-4, & Compliance Filing the same.

- Preparing Limited Liability Partnership Agreement & filing Form-3.

LLP Consultation Services

In any business practice, the partnership is subjected to multiple risks that can be legal or financial. Practising within the partnership in the commercial arena means that consultants may require an entirely different framework of relationships with each other in comparison to the departmental relationships. LLPs were introduced as legal entities that exist independently of their members. It provides flexibility in traditional partnerships within a legal structure.

LLP is a democratic and representative body with the members sharing voting rights with control over the purchase of assets and disposal of assets. For obtaining legal assistance, the contract has to be signed by all the members.

LLPs need to register at the company house which can be accessed over the net. LLP consultation in Delhi will help you in exercising your business initiatives and experiments lawfully. LLP s are exempted from taxation and profits and losses are reported on partners' tax returns. Partners through perfect grooming of LLP consultation in India effectively exercise flexibility in management structure and are able to decide the roles and responsibilities of the partners. Partners in LLP are not held responsible for business debts and liabilities and LLP does not protect against liability for partners' actions. CA Rajput by essentially viewing the documents required at a reasonable price under professional LLP consultation in Delhi helps you gain the required momentum in your business ventures.

New LLP filing fees from 1.4.2022

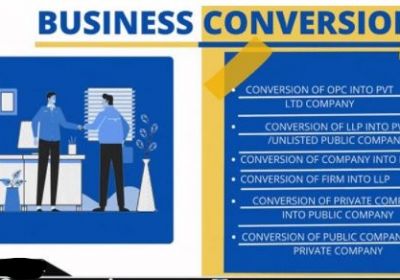

What Rajput Jain & Associates Offers

We provide LLP Consulting / Advisory services and are well-known in Delhi/NCR as a one-stop shop for LLP Consulting services. We provide professional support in obtaining LLP Consulting services at reasonable rates and in a reasonable timeframe. The following LLP Services are available from us:

- Name Reservation

- LLP Agreement Drafting

- Annual Filing Services

- Modifications in the induction of new partners.

- Firms/companies are converted to LLPs.

- Conversion of an LLP to a Corporation (under Part IX of the Companies Act, 1956).

- Limited Liability Partnerships: Compromise, Arrangement, or Reconstruction

Few Registrations & Compliances needed

After the online Limited Liability Partnership Registration, few other required registrations include the tax registrations based on the Limited Liability Partnership size and activities registered. Such registrations are:

• Obtain Importer Exporter Code

• Shop & Establishment license under the Shop Act

• PF and ESI, if applicable

• GST Registration, if required

• Profession Tax Registration

• other activity-specific registrations Intellectual Property Registration