Table of Contents

All about Compliance Post LLP Formation

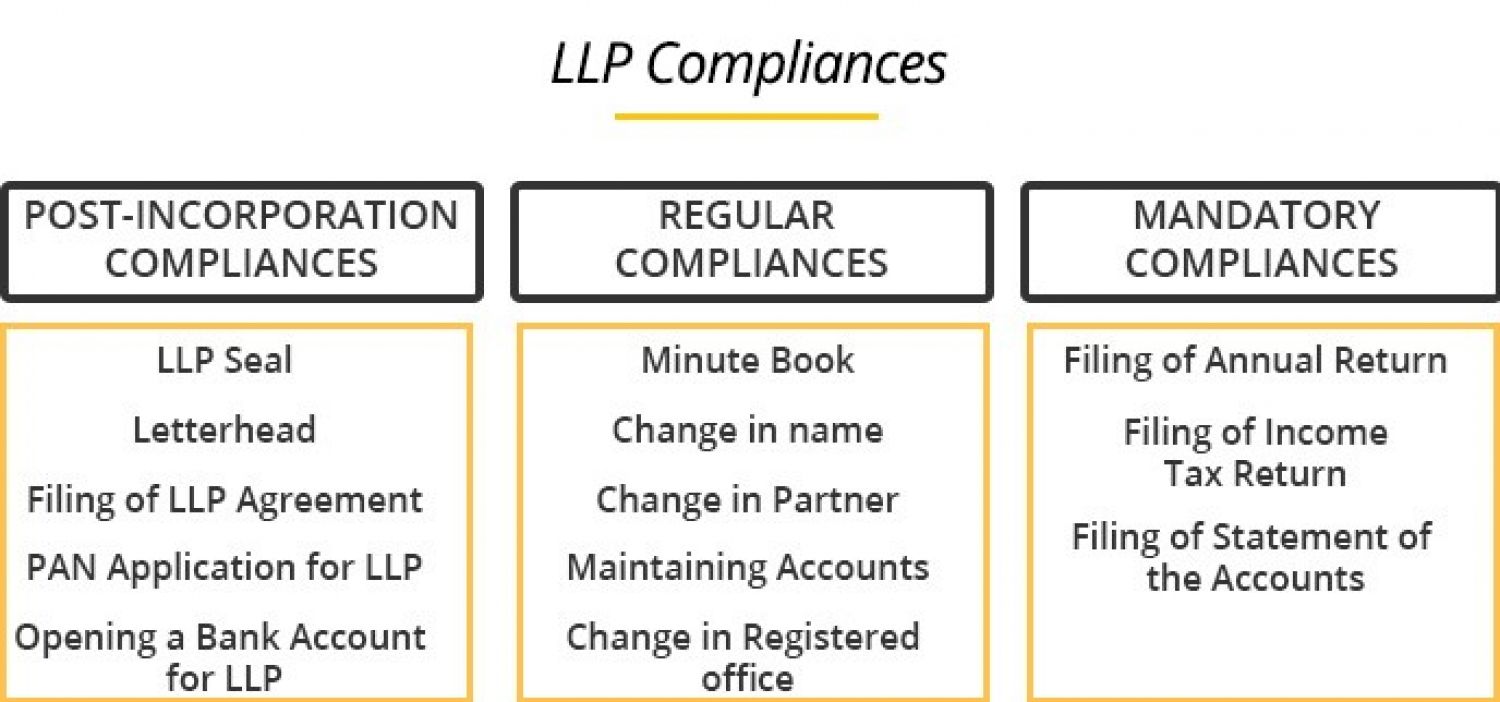

For the perfect and efficient functioning of the Limited Liability Partnership, there are compliances and legal matters that need to be settled.

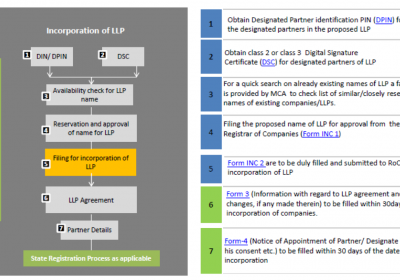

To file an LLP Agreement:

This agreement looks over the powers and entitlements of the partners and the organization itself. This must be filed to the ministry of corporate affairs in a month. It is very important and necessary for each and every Limited Liability Partnership. If the organization fails to file an LLP within a month then they have to pay a hefty fine of 100 rupees a day with no maximum fine limit. Hence care should be taken in matters of filing the agreement.

LLP stationery:

- LLP seal

For running the LLP, one needs to open an account in a bank. Also, there is a requirement for PAN. But these two things cannot be completed without the company/ LLP seal.

- Letterhead

To send important information and to communicate, a letterhead is an important thing. It is an A4 sized paper with the companies name, registered address and phone number written on it.

- Book of accounts

These firms/ Limited Liability Partnership are required to maintain proper accounts. Every rupee should be accounted for in their books. They can hire accountants for this purpose or use online software.

PAN Card for LLP:

After the LLP is incorporated there is a requirement of applying for a PAN card for the LLP. This can be done online by the submission of an application. Anyone partner of the LLP needs to sign the application and send it to the NSDL office. After that, you will receive your PAN card for the LLP.

Bank Account opening for LLP:

The following documents are required for opening of an account for the LLP:

- Photocopy of the agreement of the LLP.

- Photocopy of the document of incorporation.

- Photocopy the registration certificate provided by the ROC.

- Photocopy of bank account opening resolution.

- Signature of authorized partners of the LLP.

- Photocopy of PAN.

For a Limited Liability Partnership to appoint an auditor to audit the accounts that particular LLP must have more than forty lakhs of turnover. The LLPs must also file the return within two months of the closing of the fiscal year. Also, the solvency with a month after six months has passed from the previous fiscal year. As always, there will be a 100 rupees fine per day if the return is not duly filled.

https://carajput.com/blog/everything-that-you-need-to-know-about-limited-liability-partnership/

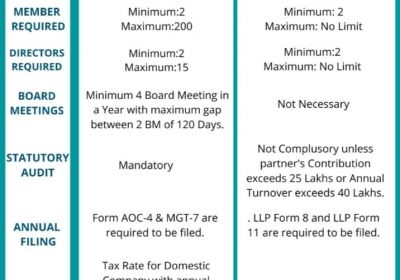

As per the Limited Liability Partnership Act, Due dates for the annual filing of ROC returns are as follows.

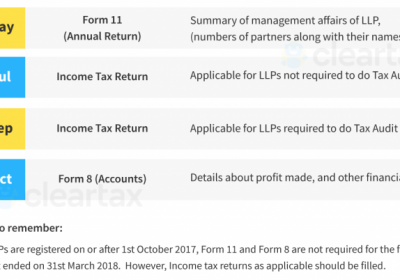

LLP Annual Return- E-Filing Due Date

All the Limited Liability Partnership shall compile an annual return in Form 11 within Sixty days of closure of an FY ending on 31st March

The Basic requirement of Annual Return contains:

- Information of Profit sharing ratio etc.

- Information of partners,

- Information on LLP contribution

- Address of LLP Registered office,

- Information of designated partners,

In case of a Limited Liability Partnership with a turnover of excessed INR 5 crore in an FY or a contribution excessed INR 50 lakh, the annual return shall be certified by a Practicing CS.

Annual Filing of LLP {Form -8 and Form -11- i.e. Statement of Accounts & Solvency (Accounts)} for Financial Year

All the Limited Liability Partnership has required to maintain books of accounts as per Indian GAAP and accounting system and needed to prepare a Statement of Accounts & Solvency statement in every FY closing of 31st March & shall be filed with the ROC the same in Form 8 , within thirty days from the end of 6 months of the FY. So the filing of accounts has to be done on or before 30th October of every year. In the case of a Limited Liability Partnership registered on or after 1 October of the year, the financial year will end on 31 March of the year following the following year.

In the case of Limited Liability Partnerships with sales crossing INR 40 lakh in either FY or with an enhanced contribution INR 25 lakh, the Books of Accounts of Limited Liability Partnerships must be audited by the CA.

Consequences of non-filing Form 8:

Form 8 must be duly completed by 30 October. Failure to file through results in a penalty of a Hundred INR per day of delay.

Specifics need to be given along with Form 8:

Form 8 is a declaration of accounts and solvency (Accounts). It must depict the financial transactions carried out during the FY as well as the financial status of the year. In addition to this the Limited Liability Partnership is also expected to declare

1. The turnover, whether above or below Rs 40 lakh

2. It must also state that it has previously filed a statement indicating the creation of charges/modifications/satisfactions up to the current financial year.

3. Also, announce that the partners/authorized members have taken due accountability and concern for the preparation of the accounts and for the proper management of the accounts.

Attachments to Form 8:

Form 8 must be added to the supporting information:

• Disclosure under the MSME Development Act, 2006 is a necessary supplement.

• Required declaration of contingent liabilities to be attached if any contingent liabilities exist.

• Any other related details may be included as an optional attachment.

MAT FOR LIMITED LIABILITY PARTNERSHIP

Relevant to the income tax applied to a corporation, a Limited Liability Partnership is also subject to a minimum alternative tax. For Limited Liability Partnership, a minimum alternative tax of 18.5 percent of the adjusted total income applies. The income tax owed by Limited Liability Partnership cannot, therefore, be less than 18.5 percent (increased by income tax surcharge, education cess, and secondary and higher education cess).

Limited Liability Partnership Tax Payment

Limited Liability Partnership tax payments may be made on a physical basis via authorised banks or through e-payment. Limited Liability Partnerships required to audit their accounts are required to pay tax by e-payment only. In order to pay tax to specified banks, the following tax payment must be made to Challan ITNS 280.

Tax Audit of LLP

Limited Liability Partnerships are needed to have their accounts audited by the Chartered Accountant if their annual turnover in any financial year exceeds INR 40,00,000/- or if their contribution cross INR 25,00,000/-. In order to make use of the exemption from statutory audit, the Limited Liability Partnerships accounts filed with the MCA must include a declaration from the Partners that the Partners recognize their responsibility for filling compliance with the criteria for the accounting and preparation of the financial statements.

ITR Filling of LLP

Limited Liability Partnerships must file an ITR using the ITR 5 form. Form ITR 5 can be submitted Online via the revenue tax website using the digital signature of the designated partner. The deadline for filing LLP tax in India is 31 July, unless a tax audit is required. Limited Liability Partnerships whose revenue exceeds INR 40,00,000/- or whose contribution exceeds INR 25,00,000/- are required to have their accounts audited by a qualified CA. The tax filing Due date for Limited Liability Partnerships needed for audit is 30 Sept.

|

S. No. |

ITR Return Details |

Deadline of compliance |

|

1. |

In the case of Tax Audit is not Needed (In case Limited Liability Partnerships whose turnover does not exceed INR 40,00,000/- or partner’s obligation of contribution exceeds INR 25,00,000/- are required to file their Income Tax. They are not required to get their accounts audited by their Auditor) |

31st July of every year |

|

2. |

In Case Tax Audit is required (In Case Limited Liability Partnerships whose annual turnover exceeds INR 40,00,000/- or partner’s obligation of contribution exceeds INR 25,00,000/- are required to file their Income Tax. They are required to get their books audited under the Income Tax Act.) |

30th Sept. of every year |

|

3. |

Limited Liability Partnerships needed in International Transaction (Limited Liability Partnerships that entered into an international transaction with associated enterprises or undertook certainly Specified Domestic Transactions are required to file Form 3CEB. Form 3CEB must be certified by a CA) |

30th Nov of every year |

Consequences of non-filing Form 11:

- If Form 11 is not filed by the Limited Liability Partnership by 31 May, Rs 100 will be imposed as a fine per day for delay. The amount will also rise over time as there is no penalty cap.

Information should be given in form 11:

- Form 11 is the Partner Information Statement and all contributions made. In addition, the Limited Liability Partnership often has to include details on other corporations or Limited Liability Partnerships in which the partners hold similar roles.

- The contribution carried out in Form 11 must be consistent with the declaration made in Form 8 and must therefore be carefully filled out.

Filing for LLP is Compliance post-incorporation. If the LLP Firm does not file Form-8 and Form-11-i.e. Statement of Accounts & Solvency (Accounts) could be subject to a fine of up to INR 5 Lakhs.

This annual LLP Compliance Kit includes:-

• Discussion of the requirement on call.

• ROC Type Fill, PL, BS & Solvency Report.

• Turnaround time Seven working days.