Table of Contents

LIMITED LIABILITY PARTNERSHIPS (LLP) CONSULTING SERVICES

The concept of limited liability partnership was introduced in order to adopt a corporate form that combines the organizational flexibility of a partnership firm with the benefit of limited liability for its partners. Some or all of the partners in a limited liability partnership have limited liability (depending on the jurisdiction). In an LLP, one partner is not responsible or liable for the misconduct or negligence of the other partners. In some countries, however, at least one partner has unlimited liability. In accordance with the LLP Agreement, the designated partners to the LLP have the right to manage their internal and external business affairs directly. Every partner has their own responsibilities and liabilities, and no partner is responsible or liable for the misconduct, negligence, or delinquent behaviour of other partners to the LLP.

LLP FEATURES:

- An LLP is a separate legal and corporate entity from its partners. It is in a never-ending cycle.

- It has elements of both a "corporate structure" and a "partnership firm structure."

- Every LLP must have at least two designated partners, at least one of whom must be a resident of India, and all partners must be agents of the limited liability partnership but not of other partners.

- An LLP agreement is not mandated, but in the absence of one, the mutual rights and liabilities of partners shall be determined in accordance with Schedule I to the LLP Act.

- Every limited liability partnership must include the phrase "limited liability partnership" at the end of his or her name.

- The provisions of the Partnership Act are not applicable here because it is separate legislation.

BENEFITS OF FORMING LLP:

- The partners' liability is limited to the extent specified in the agreement at the time of its creation.

- An LLP is a juristic person who can sue in its own name and be sued in its own name. The LLP partners are not liable to be sued for any debts owed to the LLP.

- The cost of forming an LLP is cheaper than that of other types of legal entities.

- The partners are not liable or responsible for the other partner's wrongdoing or negligence.

- In comparison to a firm, the government imposes fewer restrictions and compliance requirements.

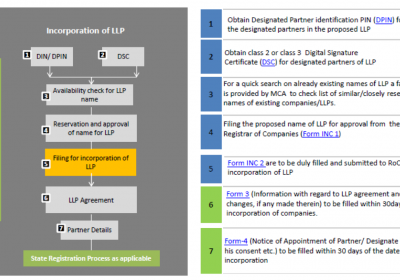

Requirements at the time of Incorporation for Limited Liability Partnership (LLPs)

|

Minimum Partners |

Two |

|

Maximum Partners |

No Limit |

|

Minimum Designated Partners |

at least one designated partner shall be resident in India |

|

Designated Partners Identification Number |

All the designated partners shall obtain Designated Partners Identification Number (DPIN) by filing E-Form no. 7 online on the Limited Liability Partnership Portal. |

|

Filing Fee for E-Form no.7 |

Rs.100/- |

|

Documents Required for obtaining DPIN |

1) Proof of identity, 2) Proof of residence, 3) Latest Passport size photograph 4) Digital Signature Certificate |

|

Digital Signature Certificate (DSC) |

Mandatory for all the Designated Partner |

|

Financial year |

Financial year means the period from the 1st April to 31st March of the following financial year. |

|

Reservation of Name of Limited Liability Partnership |

E-Form no.1 is filed for reservation of name of Limited Liability Partnership |

|

Filing Fees for E-Form no.1 |

Rs.200/- |

|

Registration/Incorporation Document |

E-Form no. 2 |

|

Filing Fees for E-Form no.2 |

(a) If a contribution does not exceed Rs. 1 lakh - Rs. 500 (b) If the contribution is between Rs. 1 lakh to Rs. 5 lakhs - Rs. 2000 (c) If contribution is Rs. 5 lakh to Rs. 10 lakhs - Rs. 4000 (d) If the contribution is more than Rs. 10 lakh - Rs. 5000 |

|

Registration of Limited Liability Partnership Agreement |

E-Form no.3 |

|

Filing Fees for E-Form no.3 |

The difference between the fees payable on the increased slab of contribution and the fees paid on the previous slab of contribution shall be paid through E-Form no.3 |

|

Notice of Appointment of Partner/ assigned Partner and their consent |

E-form no.4 |

|

Filing Fees for E-Form no.4 |

(a) If a contribution does not exceed Rs. 1 lakh - Rs. 50 (b) If contribution is between Rs.1 lakh to Rs.5 lakhs - Rs. 100 (c) If the contribution is between Rs. 5 lakhs to Rs.10 lakhs - Rs. 150 (d) If the contribution is more than Rs. 10 lakh - Rs. 200 |

Notes: Penalty for non-compliance:

The Limited Liability Partnership and its every partner shall be punishable with a fine of Rs 10000 & maybe extend to Rs 5,00,000.

In the absence of a Limited Liability Partnership Agreement, Schedule I to the Limited Liability Partnership Act, 2008 is applicable.

Every Limited Liability Partnership should mandatorily file E-Form no.3 and E-Form no.4 within 30 days of incorporation failing of which Rs.100/- per day will be charged as additional fees on each Form.

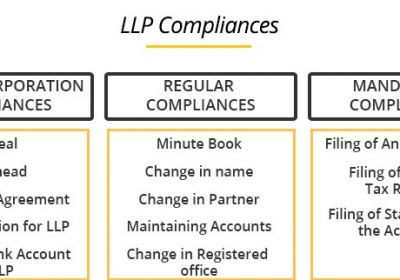

Limited Liability Partnership – Event Based Compliances

|

Head |

Section |

Compliance |

Penalty for Non-Compliance |

|

Procuring Designated Partners Identification Number |

7(6) |

Every Designated Partner should obtain a DPIN from the Central Government |

Every partner shall be punishable with a fine which may extend to Rs 5000 and where the contravention is continuing one, with a further fine, which may extend to Rs 500 for every day during which the default continues. |

|

Consent and Particulars of Partner/assigned Partner |

7(3) & 7(4) |

Filing of the consent of Partner/ Designated Partner to act as such with the ROC in E-Form no.4 within 30 days of the appointment as the designated partner |

The Limited Liability Partnership and its every partner shall be punishable with a fine which shall not be less than Rs. 10,000 & maybe extend to Rs. 1,00,000 |

|

Vacancy of Designated Partner |

9 |

Filing of a vacancy in Designated Partner within 30 days of vacancy and intimation of same to Registrar in E-Form no.4 and in case if no designated partner being appointed then each partner shall be deemed to be the designated partner |

The Limited Liability Partnership and its every partner shall be punishable with a fine which shall not be less than Rs. 10,000 but which may be extended to Rs. 1,00,000. |

|

Change of Registered Office |

13(3) |

File the notice of any change in the registered office with the Registrar of Companies in E-Form no. 15 and any such change shall take effect only upon such filing. |

The Limited Liability Partnership and its every partner shall be punishable with a fine which shall not be less than Rs. 10,000 but which may be extended to Rs. 1,00,000. |

|

Change of Name |

1 |

Limited Liability Partnership may change its name registered with the Registrar by filing with the Registrar notice of such change in E-Form no. 5. |

A person guilty of the offence shall be punishable with a minimum of Rs.5000 to Rs.500000 and with a further fine which may extend to Rs 50 for every day after the first day after which the default continues |

|

Name of Limited Liability Partnership on Invoice and Official Correspondence |

21(1) |

All invoices and official correspondence of the Limited Liability Partnership shall include its name, address and registration number and a statement that it is registered with Limited Liability |

The Limited Liability Partnership shall be punishable with a fine which shall not be less than Rs 2000 but which may extend to Rs 25,000. |

|

Limited Liability Partnership Agreement & Changes therein |

23(2) |

Limited Liability Partnership Agreement and any changes made therein shall be filed with the Registrar in E-Form no. 3. |

A person guilty of the offence shall be punishable with a minimum of Rs 5,000 & a maximum of Rs 5,00,000 and with a further fine which may extend to Rs 50 for every day after the first day after which the default continues. |

|

Change in Partners |

25(2) |

Where a person becomes or ceases to be a partner or where there is any change in the name or address of a partner, notice of the same signed by the designated partner and to be filed within 30 days to the Registrar in E-Form no. 4. |

The Limited Liability Partnership and every designated partner of the Limited Liability Partnership shall be punishable with a fine minimum of Rs 2000 & a maximum of Rs 25,000. |

|

Books of Accounts |

34(1) |

The Limited Liability Partnership shall maintain proper Books of Accounts for each year on a cash basis or on an accrual basis and according to the Double Entry System of Accounting at its registered office and shall get them audited in accordance with the rules as may be prescribed |

The Limited Liability Partnership shall be punishable with a fine minimum of Rs. 25,000 and maximum Rs 5,00,000 and every designated partner of such LIMITED LIABILITY PARTNERSHIP shall be punishable with a fine minimum of Rs 10,000 & a maximum of Rs 1,00,000 |

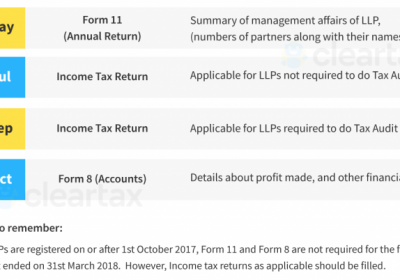

Limited Liability Partnership – Annual Compliances

|

Head |

Section |

Compliance |

Penalty for Non-Compliance |

|

Statement of Accounts & Solvency |

34(2) |

The Limited Liability Partnership shall within a period of 6 months from the end of every financial year prepare and file a Statement of Account and Solvency with the ROC in E-Form no. 8. |

The Limited Liability Partnership shall be punishable with a fine minimum of Rs 25,000 and a maximum of Rs 5,00,000 and every designated partner of such Limited Liability Partnership shall be punishable with a fine minimum of Rs 10,000 & a maximum of Rs 1,00,000 |

|

Annual Return |

35(1) |

The Limited Liability Partnership to file Annual Return compliance to the ROC within 60 days of closure of the financial year in E-Form no. 11. |

The Limited Liability Partnership shall be punishable with a fine minimum of Rs 25,000 & a maximum of Rs 5,00,000 and every designated partner of such Limited Liability Partnership shall be punishable with fine minimum of Rs 10,000 & maximum of Rs 1,00,000 |

Notes: 1) Every Limited Liability Partnership has to file E-Form no.11 within 60 days from the date of closure of the financial year without any additional fee and later additional fees of Rs. 100/- per day of delay.

2) Financial year in relation to Limited Liability Partnership means the period from the 1st April to 31st March of the following financial year. Provided that in the case of Limited Liability Partnership incorporated after the 30th day of September of a year, the financial year may end on the 31st March of the next following year.

MCA UPDATE :

Relaxation in paying additional fees in case of delay in filing Form 11(Annual Return) by Limited Liability Partnerships up to 30th June, 2022.