Table of Contents

The distinction between a private company and an LLP:

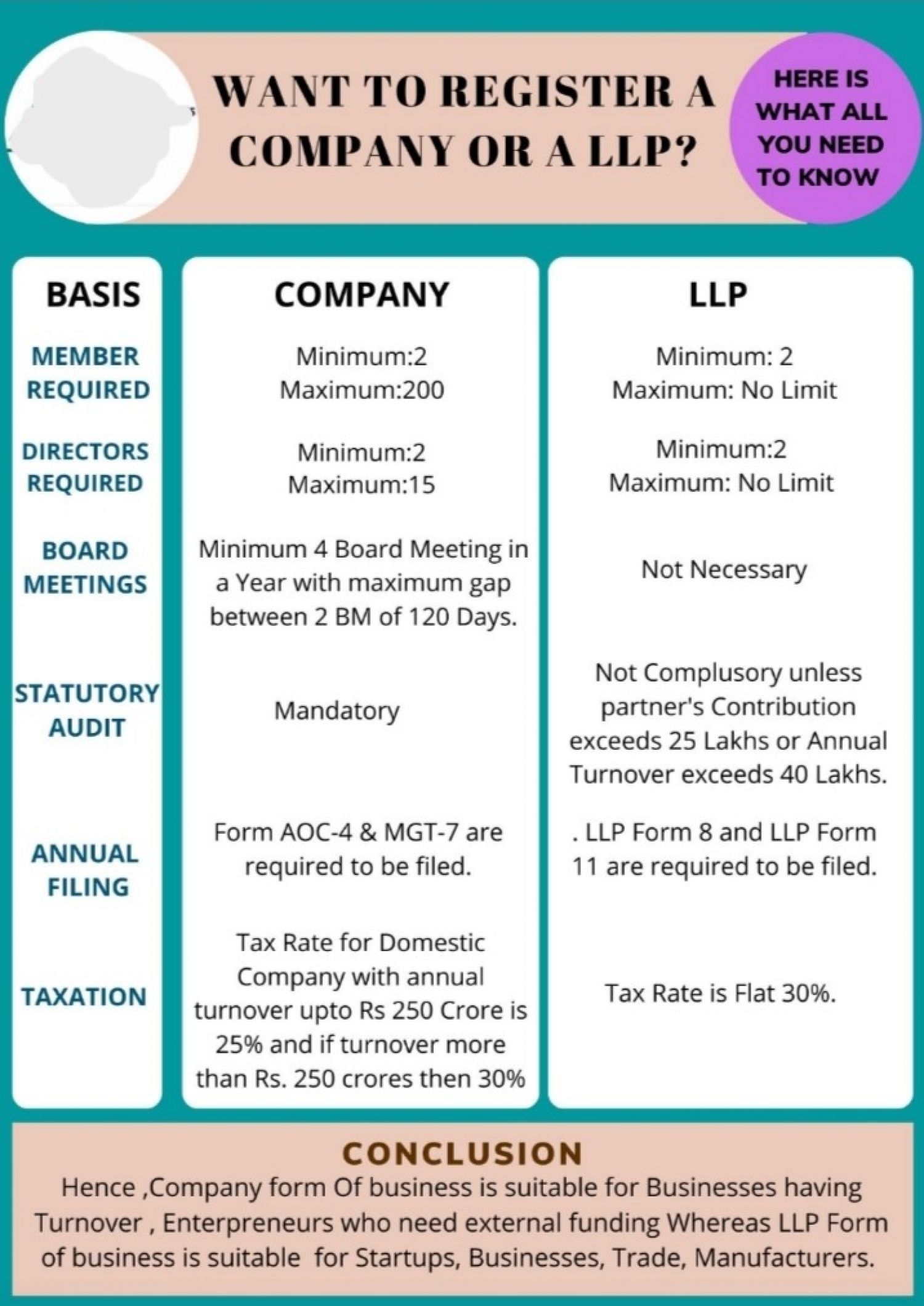

Entrepreneurs, businesses, investors have many choices to select a kind of company, such as private companies, public companies, LLPs, partnerships, and so on, in which they want to invest hard money. When deciding between a Private Company and an LLP, many people become perplexed, despite the fact that there is a significant difference between the two.

According to Section 2(68), a private company is one that has a minimum paid-up share capital as prescribed by its articles.

- Restricts the transferability of its shares.

- Except in the case of a One Person Company, a maximum of two hundred members.

However, according to Section 1(n) of the LLP Act of 2008, a limited liability partnership is one that is formed and registered under the act.

The basic difference between a private company and an LLP is as Follows:-

|

S. No. |

Basis |

Private Company |

Limited Liability Partnership |

|

1. |

Regulatory Authority |

It is regulated under the Companies Act, 2013 |

It is regulated under the Limited Liability Partnership Act, 2008 |

|

2. |

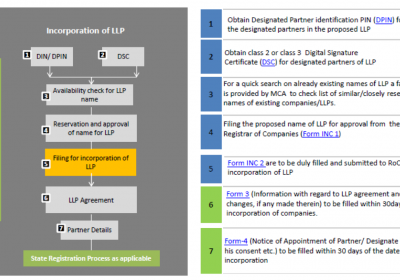

Incorporation process |

Form SPICe + Part A and B, Form SPICe + MOA, Form SPICe + AOA, AGILE Pro, Form INC-9 are required to be filed for Incorporation of Private Comp[any |

Whereas, Form RUN-LLP, Form FiLLiP, Form 3 are required to incorporate LLP. |

|

3. |

End Name |

Private Companies end their name with “Private Limited.” |

LLP’s end their names with “LLP.” |

|

4. |

Number of Member |

Maximum 200 members can be there in a Private company |

There is no limit on a number of members. |

|

5. |

Meetings |

They need to hold and conduct proper Board Meetings and General meetings |

There is no such requirement to hold a minimum number of meetings. |

|

6. |

Audit |

It is mandatory for private companies. |

The audit is mandatory if the contribution is more than 25 Lakhs or turnover is more than Rs. 40 Lakhs |

|

7. |

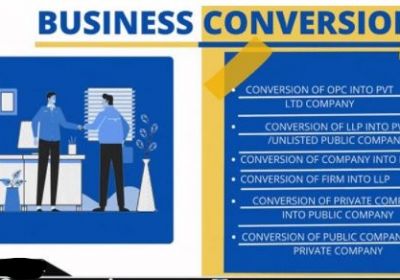

Conversion |

A Private Company can be converted into LLP |

But LLP can not be converted into Company |

|

8. |

Ownership |

Although, members are the owner of Company directors hold the position of manager for day to day working. |

There is no such confusion between management and ownership. As Designated partners are the owner as well as managers of the LLP |

|

9. |

Tax |

The company is required to pay a Dividend Distribution Tax when it declares its dividend. |

ITR filing is required to be paid by LLP. There is no requirement to pay Dividend Distribution Tax. |

Clauses that must be included in the LLP agreement:

Definitions:

Any LLP agreement's ethos is embodied in this clause. The definition of authorized partners, the accounting period, the LLP's activity, and the name by which the LLP will be known are all things that must be included in an LLP Agreement. The agreement must also include the full address of the LLP's registered office as well as the addresses of all partners.

Designated Partners:

The name, age, and address of each of the Designated Partners shall be properly mentioned in the LLP Agreement.

The LLP's name and it's changed:

This clause shall state that the LLP's business shall be conducted under the name and style of [Name of LLP]. In accordance with the provisions of the LLP Act and Rules, any change in the name of the LLP must be notified to the Registrar by the Designated Partners.

Registered Office of the LLP:

LLP agreement states that the partnership undertaking is carried out at the address indicated above, and is also registered as its headquarters. The business shall also be conducted from such other locations as the partners may mutually agree upon from time to time.

The business of the LLP:

This clause must specify the type of business that the LLP will conduct. The LLP may participate in any activities that are essential, desirable, or incidental to the operation of the LLP's business, including but not limited to auxiliary activity. It may also include any other business conducted in such a manner as the majority of Partners may decide from time to time.

Contribution to Capital:

The total contribution of the LLP, as well as the contributions of each partner, as well as the percentage of contribution, must be specified in this clause. If a partner is contributing in a non-monetary way, such as by providing services instead of money, include that as well. Additional capital contribution by a partner during the term of the agreement to be included as well. This clause must also specify how the partners can withdraw their contributions.

Profit-Sharing Ratio:

An ideal LLP Agreement should also specify how the profits and losses of the business will be distributed among the partners. The partners must clearly state the amount of profit that each member receives, or the amount of loss for which they are liable will be specified in the agreement.

Designated Partners' Rights and Responsibilities:

The Designated Partners' varied rights and responsibilities must be specified in the LLP Agreement as mutually agreed upon by them. In the absence of such separate agreement between the partners regarding such rights and duties, etc., the provisions of Schedule I of the Limited Liability Act, 2008, as stated in Section 23(4) of the said act, will apply.

Admission of Partner, Retirement Resignation, and Expulsion of Partners:

Partner Admission, Partner Retirement, Partner Resignation, and Partner Expulsion. The LLP agreement must include provisions for new partner admission, retirement, and death of a partner, among other things. The agreement must also provide instructions for partner expulsion.

Partners will receive remuneration and interest:

The LLP agreement must include a clause specifying the amount of remuneration to be paid to the Designated Partner(s) for providing the services. This clause specifies the rate of interest to be paid to the partners on their capital contribution.

Bank Account:

This clause shall specify the procedure for the LLP's Bank account transactions.

Books of Accounts and Accounting Year

The LLP agreement must include a clause relating to the maintenance of books of accounts and other documents, the method of accounting, and the details of the LLP's fiscal year.

Meetings:

Meetings The LLP agreement must explicitly define how the LLP's decisions will be made in the partners' meeting, as well as how the decisions will be documented in the minutes and where the minute's book will be kept, among other things.

Indemnity:

An indemnity provision should be included in the LLP agreement. The indemnity clause states that the LLP must protect its partners from any liability or claim incurred while carrying on the LLP's business. The partners must also agree to indemnify the LLP for any losses incurred as a result of any breach committed by them.

Resolution of Disputes:

A well-drafted LLP must have to include a provision for settling member disputes. In most cases, every LLP favors arbitration as a means of resolving disagreements. The Arbitration and Conciliation Act of 1996 governs such LLPs. As a result, every LLP agreement must include a section establishing a dispute resolution procedure in order to minimize disputes that end in time-consuming and costly litigation.

LLP Term/Winding Up:

The partners must state whether the LLP agreement is perpetual or for a specific period of time. The agreement must also address scenarios in which the partners have agreed to wind up the LLP's affairs either voluntarily or in response to a Tribunal order for particular violations of Section 64 of the Act.

General Requirements:

In addition to the above-mentioned sections, the LLP agreement should include general provisions on binding on heirs, successors, counterparts, serving of notices, waiver, governing legislation, and so on.

Is it necessary to file an LLP agreement in order for it to be valid?

The LLP Agreement must be signed and registered within 30 days of the LLP's incorporation, according to Section 23 of the Act. Every LLP Agreement must be executed on appropriate stamp paper, depending on the amount of contribution and the state in which the registered office is located. The agreement must be signed by all parties and notarized by the authorities in addition to the stamp duty requirement.

The liability does not end with the signing of the agreement; the LLP Agreement must also be submitted with the registrar in Form 3 within the time frame specified.

What is the stamp duty on a limited liability partnership agreement?

A contract must be written on stamp paper and notarized. Stamp duty is a state-level issue. Every state has its own stamp duty statute, and there is no set rate for stamp duty; rates vary from state to state. Furthermore, the stamp duty varies depending on the amount of capital invested in the LLP.

Different states in India levy stamp duties. - Stamp Duty on a Limited Liability Partnership (LLP) Agreement

The Stamp Duty charged on an LLP Agreement varies by jurisdiction and is governed by the State Stamp Act. In light of the Finance Bill, 2009, the stamp duty on partnership agreements is also applicable to LLPs. For various states in India, the stamp duty on LLP agreements is as follows:

Are there any penalties for failing to execute the LLP Agreement on time?

In the event that any of the partners fails to register the agreement with the Registrar. Then they must pay a penalty of one hundred rupees for each day they are in default.

What is the purpose of an LLP Agreement?

The following are the essential elements of a valid LLP Agreement:

- Name of the LLP: The name of the LLP should appear at the top of the agreement. The name must be approved by the Registrar following an inspection of the Form 1 application.

- The date and location of execution must be clearly stated at the outset of the agreement.

- Partners' Information: Each partner's information, including name, father's name, and residence, must be listed separately.

- Make sure to include the LLP's registered office address. It should be the same address that was given when the LLP was formed.

- Introductory provisions: This section will define the technical words used throughout the agreement. In addition, information about the founding partners, among other things, is provided.

- The LLP's objects, including mail and all supplementary objects necessary to the achievement of the main objectives, must be explicitly stated in the agreement.

- All partners' capital contributions must be fully stated in the agreement. Along with the amount of the contribution, the nature of the contribution must be specified.

- In the agreement, all relevant information relating to the appointment, removal, cessation, and so on of partners, including their remuneration, rights, and duties, must be clearly stated.

- The names of Designated Partners, as well as all relevant information relating to appointment, removal, cessation, and so on, including their remuneration, rights, and duties, must be clearly mentioned in the agreement.

- A remuneration and profit-sharing clause must also be included, in which all relevant information must be clearly mentioned.

- A clause specifying the LLP's bookkeeping provisions, describing the accounting and recording provisions, should be included.

- A winding-up clause must also be included, stating the procedures to be followed if the partners decide to dissolve the organization.

- Along with all of the previously specified material, the partners can include any further clauses that they agree on and that are legal.

Conclusion:

- As a result, we can conclude that LLP is more advantageous to entrepreneurs than company incorporation. Although LLP and Private Company appear to be the same, there are some distinctions that make LLP the better option.

- It goes without saying that forming an LLP is a cost-effective way to do business with the least amount of risk. Furthermore, as the name implies, a Limited Liability Partnership is the most secure and cost-effective business structure. Through LLP, a business aspirant can enter the competitive market of the corporate world. As a result, if you require assistance with the LLP registration process, please contact RJA.

Rajput Jain & Associates Associate will understand your business requirements and help you with LLP-related issues. Also, we will help to obtain the necessary registrations to open a bank account in the name of your business, thereby proving an identity for the business.

For any information/queries, you can contact us. For Contact:

Website- Click here

Email id- info@carajput.com