INCOME TAX

How can we save Income Tax in India?

RJA 23 Jan, 2022

How can we reduce income tax in india You can Reduce your Tax Liability by save money/investment for your future 1. Deductions Upto 80C We can use up to deduction under chapter VI Rs 1.5 lakh ceiling u/s 80C. Income Tax Deductions or investments are all this subjected to ...

GST Filling

Latest New feature in GSTR 3B - under the GST Portal

RJA 22 Jan, 2022

New feature in GSTR 3B - GST Portal The GST Network, which functions as the technology backbone for the indirect tax system, will soon include interest calculator capabilities to the monthly tax payment form GSTR-3B, which will aid taxpayers in computing interest for late payments. In an advisory, GSTN ...

Goods and Services Tax

Supply of Restaurant Services via E-Commerce Operator liability to pay GST w.e.f. 01.01.2022

RJA 21 Jan, 2022

Supply of Restaurant Services via E-Commerce Operator liability to pay GST w.e.f. 01.01.2022 E-Commerce Operators will be responsible to pay Goods and Services Tax on any restaurant service supplied via them, including by an unregistered person. Because there is no exemption for the supply of restaurant services by unregistered ...

NGO

NGOs Receipt of foreign grants & its Utilizations Provisions

RJA 20 Jan, 2022

NGO’s accepts foreign grants & its Utilisation Provisions under Income Tax & FCRA Act Legality of foreign donations/Grants and its Utilisation of the for charitable purpose Provisions under Income Tax & FCRA Act. We hereby giving some applicable provisions of Income Tax Act 1961 and FCR Act 2010,for ...

AUDIT

Compliance of CARO order deferred by one Year: MCA

RJA 14 Jan, 2022

Compliance of CARO order deferred by 1YR: MCA MCA defers the applicability of CARO 2020 to FY 2021-22: MCA Order dated 17.12.2020 changed the date of operation of the Order of the Companies (Auditor's Report) 2020 to the financial years starting on or after 1 April 2021. As a result, the Companies (Auditor&...

NGO

How to register under section 12A online

RJA 13 Jan, 2022

How to register under section 12A online Section 12A Registration As per section 12A of Income Tax Act, 1961, all the NGOs, being registered as a Trust, or Section 8 Company, or a Society, can obtain registration under this section, in order to avail exemption from payment of income tax. Thus, the ...

NGO

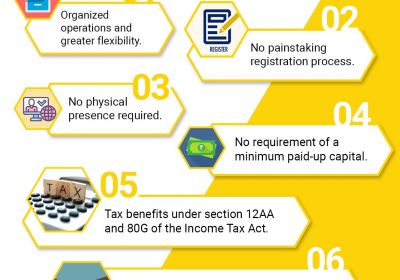

All about the Registration of a section 8 company in India

RJA 13 Jan, 2022

All about the Registration of a section 8 company in India Section 8 Company Registration: NGO can be registered via Section 8 company, which is incorporated under Companies Act, 2013. Such companies work towards charity, religion, trade etc. Benefits of Registration section 8 Company In india No minimum capital requirement in ...

NGO

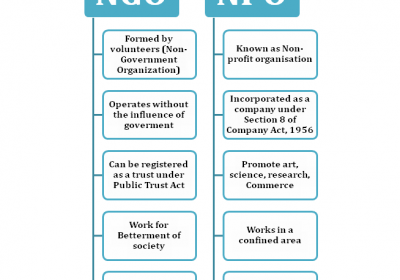

All About Non-Governmental Organization

RJA 13 Jan, 2022

All About Non-Governmental Organization Brief Introduction Non Governmental Organizations, commonly known as NGO’s, work for the benefit of society. These organizations fight for and against the evils of the society and strive to work for creation of a better world and hence help in protecting the rights of ...

NGO

All about the Trust Registration and Society Registration

RJA 13 Jan, 2022

All about the Trust Registration and Society Registration Trust Registration: Trust can be one of the form of Non-Governmental Organization that can be registered in India. These NGO’s work towards the eradication of poverty, and also provide help in the form of education and medical relief. Such ...

INCOME TAX

Industry wants clarity on Crypto Tax Laws in the Union Budget 2022-23

RJA 11 Jan, 2022

Industry wants clarity on Crypto Tax Laws in the Union Budget 2022-23 The Indian industry association Indiatech has written to the country's finance minister Mrs. N Sitharaman about Crpto Taxation. Coinswitch Kuber, Wazirx, and Coindcx are among the major cryptocurrency exchanges represented by the group. Business group requested clarification ...

Goods and Services Tax

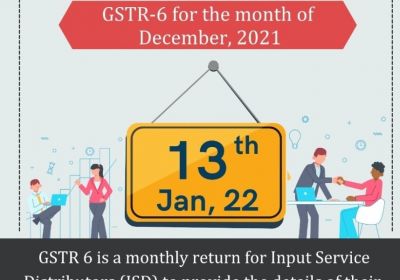

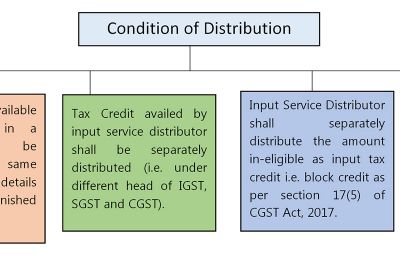

FAQS ON INPUT SERVICE DISTRIBUTOR

RJA 11 Jan, 2022

FAQS ON INPUT SERVICE DISTRIBUTOR Q.: Who is an Input service distributor (ISD) under GST? Input Service Distributor is defined as follows – Input Service Distributor is an office of a business that receives tax invoices for input services and distributes available ITC to other branch offices of the identical ...

Goods and Services Tax

Input Service Distributor Mandatory Registered Under GST ACT

RJA 11 Jan, 2022

Input Service Distributor Mandatory Registered Section 24(Viii) CGST ACT 2017 Input Service Distributor stands for Input Service Distributor and has been defined u/s 2(61) of the CGST/SGST Act. It is basically an office meant to receive tax invoices towards receipt of input services & further distribute the credit to ...

Goods and Services Tax

Input Transaction are genuine & supported by valid documents then ITC can Not be denied

RJA 08 Jan, 2022

Input Transaction are genuine & supported by valid documents then ITC can Not be denied Payment along with tax actually paid to supplier or not is to be verified before disallowing ITC (LGW Industries Ltd. v. Union of India - [2022]) Petitioner was served with letters by the GST Dept, ...

INCOME TAX

Chartered Accountantís Role in Tax Planning in India

RJA 07 Jan, 2022

What is a Chartered Accountants: CHARTERED ACCOUNTANT: A Internationally Recognized Profession. Chartered Accountants normally called as CA is a Internationally recognized profession related to finance and it’s management. Key roles that a chartered accountant plays is to manage budgets, auditing, formulating taxes and business strategies for clients ...

OTHERS

Extension of deadline Date for filling applications for scrip-based claims - FTP Schemes

RJA 03 Jan, 2022

Extension of deadline Date for filling applications for scrip-based claims - FTP Schemes Directorate General of Foreign Trade has extended the due date for filling applications for the below scrip-based claims from 31st Dec 2021 to 31st Jan 2022 : For Service Exports from India Scheme (SEIS): To encourage and maximize ...

COMPANY LAW

Tax & Statutory Compliance Calendar for January 2022

RJA 02 Jan, 2022

What are the Tax & Statutory Compliance Calendar for January 2022 S. No. Statue under Purpose Under the Compliance Period Due Date- Timeline Details of compliance 1 Goods and Services Tax GSTR-1 Dec-21 11-Jan-22 "1. GST Filing of returns by GST registered person with aggregate turnover exceeding Rs. 5 Crores during preceeding ...

Goods and Services Tax

Deferred decision to raise GST Rates in textiles from 5% to 12% w.e.f. 01.01.22

RJA 01 Jan, 2022

GSTN Deferred decision to raise textile GST Rates in textiles from 5% to 12% w.e.f. 01.01.2022 The 46th GST Council meeting will be chaired by Hon'ble Finance Minister Smt. Nirmala Sitharaman today at 11 a.m. in Delhi, according to the Ministry of Finance. MOS Shri. Pankaj Chaudhary and Dr. Bhagwat ...

INCOME TAX

Overview of Deductions under Chapter VI A of Income Tax Act

RJA 31 Dec, 2021

Q.1 What are the different deductions under Schedule VI of Income tax Act ? The following deductions have been provided under Schedule VI of Income Tax Act, 1961 – SECTIONS PARTICULARS ELIGIBLE PERSONS PRESCRIBED LIMIT OF DEDUCTION SECTION 80C INVESTMENT IN LIC, PPF, SUKANYA SAMRIDDHI ACCOUNT, MUTUAL FUNDS, FD ETC INDIVIDUAL AND ...

Goods and Services Tax

Aadhaar authentication is mandatary under GST w.e.f. 01.01.2022

RJA 27 Dec, 2021

Aadhaar authentication is mandatary under GST w.e.f. 01.01.2022 The GST Council approved recommendations at its 45th meeting, including making Aadhaar authentication of registration necessary for filing refund requests and applications for revocation or cancellation of registration under GST. As a consequence, the Central Board of Indirect Taxes and Customs ...

Goods and Services Tax

GST ITC available only when reflected in GSTR 2B/2A w.e.f. 01-01-2022

RJA 26 Dec, 2021

GST ITC available only when reflected in GSTR 2B/2A w.e.f. 01-01-2022 Central Board of Indirect Taxes and Customs through Notification No. 39/2021–Central Tax dated Dec 21, 2021 which specified following amendments made vide Section 109 of the Finance Act, 2021 w.e.f. January 01, 2022 Section -16(2) : Conditions and ...

Goods and Services Tax

GST leviable on services provided by Association or club to its members

RJA 26 Dec, 2021

GST on Transactions by a Club / Association or Activities with its members retrospectively w.e.f. July 01, 2017 (Under Section 7(1)(aa)) The definition of supply was expanded to cover services provided by members to club/AOP and vice versa. To overcome the Apex court's verdict in the Calcutta Club ...

Goods and Services Tax

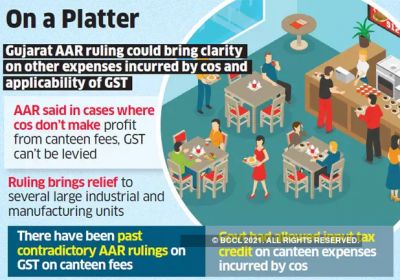

No Input Tax credit available on Canteen Services provided to Employees

RJA 26 Dec, 2021

No Input Tax credit available on Canteen Services provided to Employees M/s Tata Motors Ltd. (Applicant) has requested clarification on whether ITC will be applicable on GST levied by the service provider on canteen services given to factory personnel, and whether the ITC will be limited to the cost ...

INCOME TAX

FAQ on the filing of an Income Tax return

RJA 25 Dec, 2021

FAQ on the filing of an Income Tax return Q.1: Would the Dept of Income Tax provide an e-filing utility? Yes, the e-filing service has been offered by the Tax Department. E-filed returns can be generated and provided by electronic means. Q.2: What's the distinction between e-payment ...

Goods and Services Tax

Check points of GST Annual Return & GST reconciliation statement

RJA 25 Dec, 2021

CHECK POINTS OF GST ANNUAL RETURN AND GST RECONCILIATION STATEMENT Annual Returns and Reconciliation Statements are required by GST Laws. These must be filed for each Financial Year (April – March) by December 31st of the Next Year. After the long ongoing effort to minimize the burden on small taxpayers. ...