FCRA

ONLINE FCRA REGISTRATION PROCESS, DOCUMENTATION & ELIGIBILITY

RJA 02 Jun, 2021

FCRA Registration The 1976 Foreign Contribution Act (FCRA) was implemented in 1975 with the major purpose of regulating the acknowledgement and use of the foreign contribution and of foreign hospitality, by individuals and associations working in the important domestic areas. This is important to ensure that such assistance ...

INCOME TAX

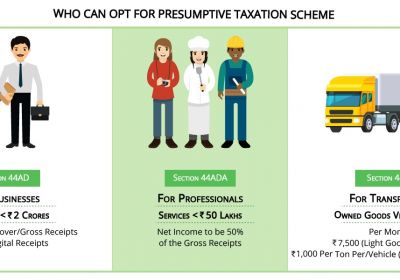

FAQS ON PRESUMPTIVE TAXATION IN INDIA

RJA 01 Jun, 2021

FAQS ON PRESUMPTIVE TAXATION IN INDIA Q.: What does a presumptive taxation scheme mean? Presumptive taxation scheme related to providing relief to small taxpayers. Any small taxpayer whose turnover is less than Rs 2 crores shall be eligible for such a scheme. To facilitate the running of businesses without any burden ...

TDS

TDS/TCS | Non-Filers of Income Tax Return: Analysis of Sections 206AB and 206CCA

RJA 01 Jun, 2021

Analysis of Sections 206AB and 206CCA- Non-Filers of Income Tax Return: The Finance Bill 2021 proposed new section 206AB and section 206CCA, according to the 1961 Income Tax Act, that would provide the higher rate of TDS and of TCS for the deductors who do not file their income tax ...

INCOME TAX

EQUALISATION LEVY ON E-COMMERCE OPERATORS

RJA 01 Jun, 2021

BRIEF INTRODUCTION ON EQUALISATION LEVY ON E-COMMERCE OPERATORS Equilisation levy was introduced in India in 2016 and the same was substantially implemented in the 2020 Budget. Apart from taxing the online advertisement services, the equalization levy shall also be applicable on the consideration, being received by an e-commerce operator, having turnover ...

COMPANY LAW

Listing of Non Convertible Debentures by Private Companies

RJA 31 May, 2021

Listing of Non-Convertible Debentures by Private Companies BRIEF INTRODUCTION The most important step for a corporate entity to begin with its operations is funding. Funding is something that is required, not only for investment and expansion purposes but also for day-to-day operations. Companies, while looking for funding, consider various sources ...

Business Setup in India

COMPLETE TAXATION GUIDANCE FOR FREELANCERS

RJA 30 May, 2021

BRIEF INTRODUCTION Freelancers seek a flexible lifestyle, where people are not bound to 9 to 5 jobs. Freelancers can pursue their other interests, having more family time and thus, is simply a way to avoid a tedious routine. As per the income tax laws, freelancers are also liable to pay taxes on ...

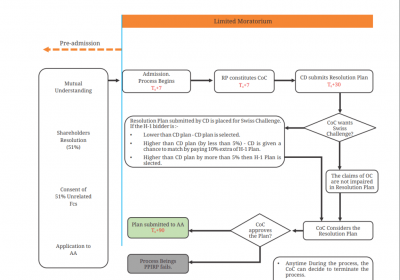

IBC

COMPLETE UNDERSTANDING OF PRE-PACK INSOLVENCY OF MSME

RJA 29 May, 2021

INTRODUCTION With the introduction of IBC 2016, there has been a transformative turnaround in the corporate distress resolution framework of India. The act provided a new lease of life to a Company whose future was earlier based on debt restructuring and sale. In India, most organizations are driven by their promoters. ...

IBC

SECTION 29A CERTIFICATION SERVICES UNDER IBC

RJA 28 May, 2021

SECTION 29A CERTIFICATION SERVICES UNDER IBC In the Corporate Insolvency Resolution Process (CIRP), Section 29A of the Insolvency and Bankruptcy Code, 2016 (“the Code”) has emerged as a fundamental statute in assessing Resolution Applicants' eligibility. The Code did not include any protections to prevent defaulting promoters from purchasing back ...

Goods and Services Tax

ONLINE INFORMATION DATABASE ACCESS OR RETRIEVAL

RJA 27 May, 2021

BRIEF INTRODUCTION In today’s world, with so much technological developments, businesses are nowhere restricted by geographical borders. The Internet is the most easy and affordable means for providing services abroad. To facilitate such services, there are several mechanisms, which are used in conjunction with business activities, to deliver ...

IBC

All about Moratorium U/s 14 of IBC, 2016 including judicial pronouncements

RJA 26 May, 2021

MORATORIUM UNDER IBC 2016 BRIEF INTRODUCTION While undertaking a Corporate Insolvency Resolution Process, the RP is under an obligation to apply for a moratorium as declared by the adjudicating authority and a public announcement be made regarding the last date for submission of claims and the details of the interim resolution ...

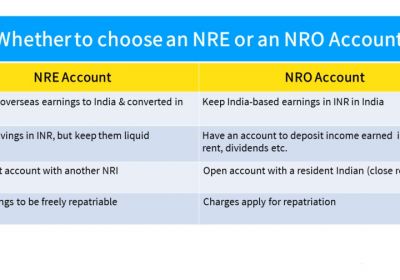

NRI

Tax Guidelines for Non Resident Indian (NRI)

RJA 24 May, 2021

TAX GUIDELINES FOR NON-RESIDENT INDIAN (NRI) This article provides detailed information on various tax compliances, required by a Non-resident in India. Starting with the basic information and then going to some technical aspects are the key of this article. BASICS 1. RESIDENTIAL STATUS OF NRI An individual is said ...

NRI

Lower TDS Certificate for NRI Property Sales

RJA 21 May, 2021

LOWER TDS/NIL TDS/EXEMPTION CERTIFICATE U/S 197 ON PROPERTY SALE BY NRIs, OCIs CITIZENS Non-Residents' TDS on Property Sale Transactions (NRIs, OCIs) According to the Indian tax Act 1961- TDS provisions apply to various financial transactions in India. Tax deduction at sources is also applicable to property sale transactions ...

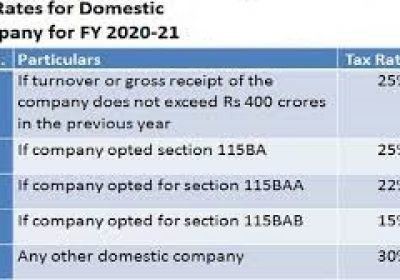

INCOME TAX

TAXATION UNDER SEC-115BAA & 115BAB

RJA 21 May, 2021

SECTION 115BAA Under this section, newly set up manufacturing companies are provided with a concessional rate of tax. The tax rate is as follows – The annual income is subject to a tax @ 22%. In Addition to this, a surcharge of 10 % and cess of 4 % is also levied, thus making the effective ...

NRI

NRE A/c Salary Income Receipt - Not Taxable in the Hand of NRIs Working Abroad

RJA 19 May, 2021

Mumbai ITAT decided in a recent judgment that it was not possible to cause a tax incident that the only receipt of salary income by the employee of the NRE Bank accounts in India (which works in a ship on international routes run by Singapore's shipping company). Under ...

NRI

Capital Gains on the Sale of NRI Immovable Property

RJA 19 May, 2021

Purchase Immovable Property in India by Non-Resident Indians. This purchase is made either through the Non-Resident Indians' own investment or through inheritance from their parents/grandparents, etc. Non-Resident Indians always want to sell their immovable property for two reasons. It is bringing them a strong profit. they are relocating outside ...

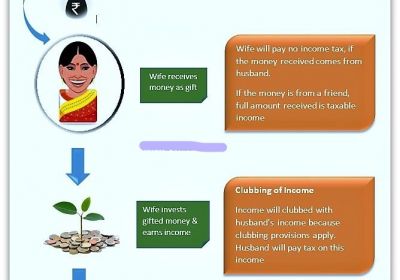

INCOME TAX

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse

RJA 19 May, 2021

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse In India there is normal practice to buy/transfer properties under the name of a woman, for example, acquisition of real estate under the name of a wife, buying jewelry or stock under the name of a wife, ...

OTHERS

RISK AND SAFETY GUIDE FOR INVESTMENT IN CRYPTO

RJA 18 May, 2021

ANSWERS TO SOME BIG/TOP QUESTIONS RELATED TO CRYPTO Cryptocurrency is gaining the attention of investors worldwide. The beginning of 2021 saw a huge spike in crypto prices as Bitcoin hit its record high of $62,575 in April and Ethereum price soared above $4,000 with the rest following the trend. Presently, Bitcoin is ...

FCRA

Overview about FCRA Registration renewal

RJA 12 May, 2021

FCRA Registration Renewal The registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked. The FCRA 2010 requires organizations to update their registration every five years. Organizations who want to extend ...

OTHERS

WHAT ARE THE TOP CRYPTOCURRENCY OF 2021

RJA 08 May, 2021

Cryptocurrencies are making investors enthusiastic and are creating thought in their minds. It is such a hot popcorn from the media’s outlook due to its volatile price highs and lows. In case one knows only about Bitcoin, then they are underestimating the strength of the crypto market. There ...

Income tax return

Must Know Significant changes in ITR Form for FY 2020-21

RJA 07 May, 2021

Must Know Significant changes in ITR Form for FY 2020-21 Income tax return Form ITR-1 cannot be filed in cases where TDS has been deducted under section 194N: If the amount of cash withdrawn during the year from a co-operative bank, a banking company or post-office from 1 or more bank ...

OTHERS

RISE IN ETHER: A THREAT TO BITCOIN

RJA 01 May, 2021

RISE IN ETHER: A THREAT TO BITCOIN Ether price went beyond $4,000 on 10th May, Monday, thereby hitting its all-time high. Though it is the second-largest cryptocurrency, this new record is seen as an out beat to Bitcoin for the world’s largest cryptocurrency. Ether runs on the ...

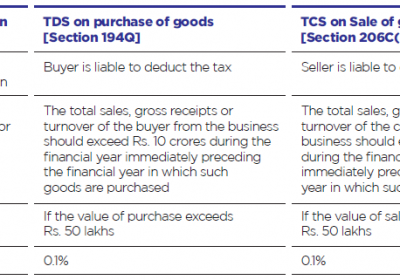

TDS

FAQs ON TDS ON PURCHASE OF GOODS

RJA 01 May, 2021

FAQs ON TDS ON PURCHASE OF GOODS Q.: Who will be liable to deduct TDS under Section 194Q? The provisions of section 194Q apply to a buyer, who makes a total sales, gross receipts, or turnover from any business undertaken by them, exceeds Rs 10 Crores during the financial year immediately ...

Goods and Services Tax

SUMMARY OF PENALTY ON DEFAULTS UNDER THE GST LAW

RJA 01 May, 2021

Summary of Penalty on Defaults under the GST Law The GST law specifies the types of violations that can be committed and the penalties that will be imposed in each case. This is critical information for all business owners, accountants, and tax professionals, as even a minor error can ...

INCOME TAX

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT

RJA 28 Apr, 2021

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT Exempted Income tax income under the Income Tax Act 1961 like interest on PPF account etc need not be reported. The CBDT published detailed guidelines for reporting information on taxpayers' interest & dividend income from banks and companies. The “specified reporting ...