FEMA

RBI reporting under Single Master Form

RJA 30 Jun, 2021

RBI reporting under Single Master Form BRIEF INTRODUCTION The reserve bank of India has announced the new reporting structure for FDI related transactions during which they need combined different reporting into one combined form i.e., the only Master Form (‘...

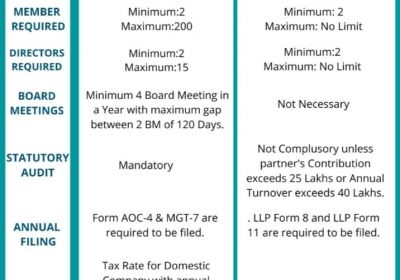

Limited Liability Partnership

The distinction between a private company and an LLP

RJA 30 Jun, 2021

The distinction between a private company and an LLP: Entrepreneurs, businesses, investors have many choices to select a kind of company, such as private companies, public companies, LLPs, partnerships, and so on, in which they want to invest hard money. When deciding between a Private Company and an LLP, many ...

Nidhi company

FAQ’s on open Liaison /Branch office in India

RJA 29 Jun, 2021

Foreign citizens can open an entity in India via either by opening a Liaison Office or Branch Office or Subsidiary Company. A company that is incorporated outside India has the option to have offices in India that are not primarily subsidiary companies. Subject to the Reserve Bank of India (“...

OTHERS

CRYPTOCURRENCY SECURITY: A DIGITAL WAY TO PROTECT INVESTMENT

RJA 27 Jun, 2021

CRYPTOCURRENCY SECURITY: A DIGITAL WAY TO PROTECT INVESTMENT How does one retain a high standard of workflow? How are you able to keep your team connected and receptive to collaboration when they’re separated? is that this the proper time ...

Goods and Services Tax

FAQs ON GOODS AND SERVICES TAX REFUND

RJA 26 Jun, 2021

FAQs ON GST REFUND Q.1 What are the situations which can produce to refund under GST? Ans. Any sought of claim for refund arising in relation to - Export of products or services on payment of tax Supply of products or services to ...

COMPANY LAW

MCA enlarges the definition of a small business, as well as its turnover and borrowing limits.

RJA 24 Jun, 2021

The ministry of corporate affairs has broadened the definition of small and medium businesses (SMBs), allowing them to borrow more money and increase their turnover. According to a statement released on Wednesday, this would allow a broader range of enterprises to benefit from greater flexibility in accounting requirements. Small and ...

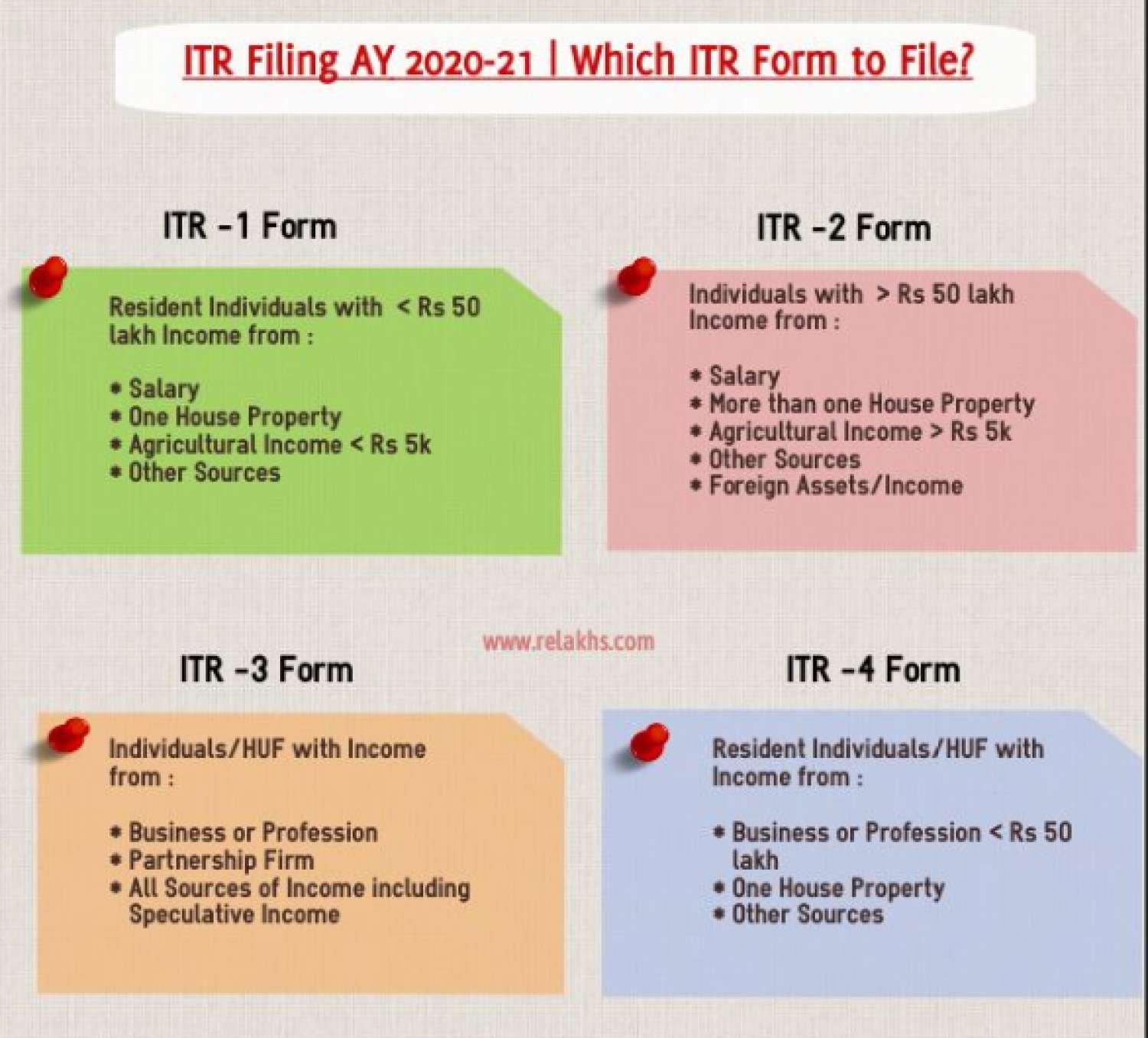

Income tax return

LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21: NEW ITR FORM

RJA 22 Jun, 2021

ITR Forms- LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21 Identifying the ITR form for the specific income of the taxpayer was a very important and technical task when all ITRs were filed in physical mode. However, in today's technological age, this task is done by ...

SEBI

SEBI has issued a framework for a supervisory body for investment advisors.

RJA 21 Jun, 2021

Compliance will be monitored by SEBI-registered investment advisers, who will be supervised by a supervisory body Sebi, the market regulator, released a system/framework for investment adviser administration and supervision on Friday. Sebi may recognize anyone or a body corporate for the purpose of regulating investment advisers (IA) ...

INCOME TAX

Housewives savings deposited in bank A/c up to 2.5 lakh in demonetization cannot be consider income

RJA 21 Jun, 2021

Housewives savings deposited in bank A/c up to Rs. 2.5 lakh in demonetization cannot be income: ITAT Agra Brief Summary of the Case: During the demonetization phase, the assessee, a housewife, deposited cash in her bank account totalling Rs. 2,11,500/-. She was asked to explain the source of the deposit ...

Income tax return

FAQS RELATED TO INCOME TAX RETURN FILLING IN INDIA

RJA 21 Jun, 2021

Frequently Asked Question on Income Tax return filling in India Q.: What is the difference between an ITR-V form and an ITR-Acknowledgement? Form ITR-V contains information from income tax returns filed in Forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, and ITR-7 but not e-verified. Form ITR-Acknowledgement shows and verifies data ...

OTHERS

Required Only Aadhaar and PAN Card to Complete MSMEs Registration

RJA 19 Jun, 2021

Entrepreneurs who want to start a Micro, Small, or Medium Enterprise should rejoice. Shri Nitin Gadkari, Minister of Micro, Small, and Medium Enterprises (MSME), announced the streamlining of the Micro, Small, and Medium Enterprises (MSME) registration process. Shri Gadkari declared on an occasion that for MSMEs registration, only Aadhaar and ...

COMPANY LAW

COMPLETE OVERVIEW ON INTERIM AND FINAL DIVIDEND

RJA 18 Jun, 2021

COMPLETE OVERVIEW ON INTERIM AND FINAL DIVIDEND INTRODUCTION- INTERIM AND FINAL DIVIDEND Funds are the essence of the long term perspective of any business. Companies sought to rely on available for the management of their activities. One of the main sources of funds, available with a company are shareholders. ...

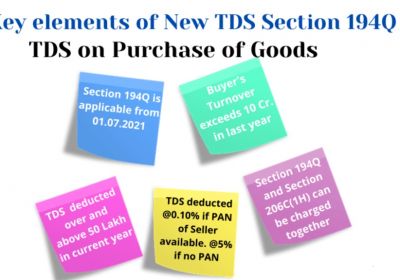

TDS

TDS U/s 194Q when purchasing the goods- Applicability | Analysis of Section 194Q |

RJA 13 Jun, 2021

TDS on Purchase-Tax Deducted at Source (TDS) u/s 194Q when purchasing the goods- Applicability A new section 194Q was introduced in Budget 2021-22, which will come into force on July 1, 2021. In Budget 2021-22 a new section 194Q relating to the payment of a certain sum to purchase goods. As ...

Goods and Services Tax

GST Council 44th & 43th Meeting 2021 Conclusion: Press Briefing

RJA 12 Jun, 2021

Today, Finance Minister Nirmala Sitharaman will preside over the 44th meeting of the GST Council, which is likely to make a decision on relief for COVID-19-related individual items based on the Group of Ministers' report. GST Council 44th Meeting 2021 Conclusion: GST Council agrees to a 5% GST rate for ...

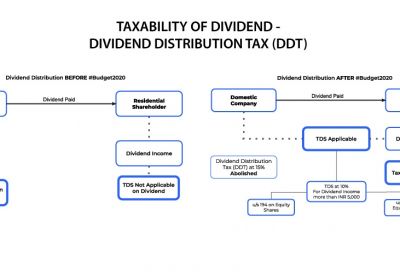

TDS

NRI and TDS on Dividend Income from Equity Shares(194

RJA 11 Jun, 2021

TDS on Dividend on Equity Shares Applicable: This section is effective beginning on April 1, 2020, for the financial year 2020-21. Update on Dividend Tax in Union Budgets 2020 and 2021 After the elimination of the Dividend Tax in Budget 2020, dividends that were previously exempt will now be taxed beginning in FY 2020-21. TDS ...

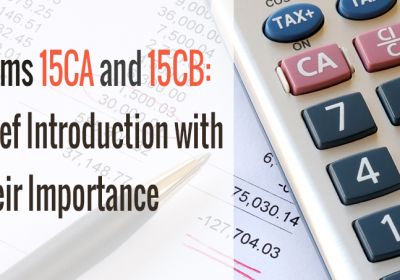

Form 15CA & 15CB Certificate

LIST OF PAYMENTS FOR WHICH E-FORMS 15CA AND 15CB ARE MANDATED

RJA 10 Jun, 2021

FORM 15CA & FORM 15CB FORM- 15 CA PROVISONS Amount can be remitted to any other non-resident or foreign company Such remittance be made by any resident /non-resident/ domestic company/foreign company from India. The income from which such remittance will be made, shall accrue/ arise/ received or deemed ...

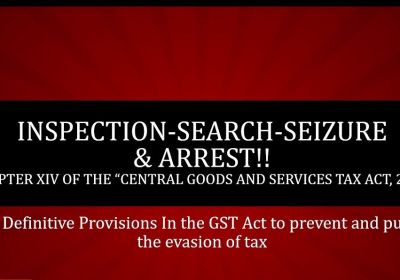

ROC Compliance

FAQS ON INSPECTION, SEARCH AND SEIZURE UNDER GST

RJA 09 Jun, 2021

FAQS ON INSPECTION, SEARCH AND SEIZURE UNDER GST Q.: What does search mean under GST? Under the law, search has been defined as an action undertaken by government machinery involving visiting, inspection and examination of the place, area, person, object etc., where there is an instinct to find something concealed ...

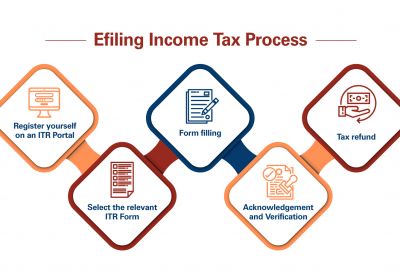

Income tax return

Latest Features of the new e-filing income tax Launched portal 2.0

RJA 07 Jun, 2021

The income tax Dept introduced a new e-filing portal on June 7, 2021. The Tax Dept of India has updated the official tax filing system in India with a new design and interface. The rebuilt website, dubbed ITR e-filing portal 2.0, aims to improve user experience with a new dashboard that houses all ...

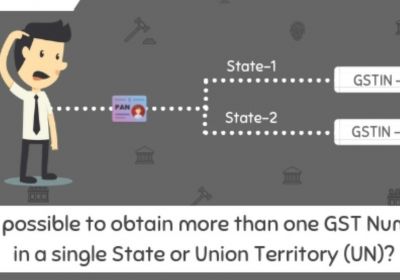

GST Compliance

2 GSTIN IN ONE STATE/UT UNDER 1 PAN

RJA 05 Jun, 2021

BRIEF INTRODUCTION After the introduction of GST, any business entity having an aggregate turnover exceeding the prescribed limit of Rs 20 lakhs and Rs 10 lakhs, depending on the state or UT in which they are operating, are required to get registered under that state/UT. Once registration is granted, a GSTIN ...

Nidhi company

How was the Nidhi Company established in India?

RJA 05 Jun, 2021

How was the Nidhi Company established in India? The Nidhi firm is classified as an NBFC, however, it does not require an RBI licence. Section 406 of the Companies Act, 2013 governs Nidhi company registration. The basic business is to take and give money (borrowing and lending by monitory means) among its ...

Nidhi company

How to Closing of a Nidhi Company?

RJA 04 Jun, 2021

Nidhi Company is a type of Non-Banking Financial Company established under Section 406 of the Companies Act, 2013. The primary goal of a Nidhi Company is to cultivate the norm of thrift and saving within its members. If a Nidhi Company does not comply with the regulations, it is preferable ...

OTHERS

Food Law Relaxations/Extensions for Covid-19-Affected Food Industries

RJA 04 Jun, 2021

Food Law Relaxations/Extensions for Covid-19-Affected Food Industries The Food Processing Industry (FPI) is extremely important because it develops crucial linkages and synergies between agriculture and industry, which are the two foundations of the economy. After China, India produces the second-largest amount of fruits and vegetables in the world, ...

OTHERS

Frequently Asked Questions on FSSAI -Compliance Mechanism

RJA 04 Jun, 2021

Compliance Mechanism under FSSAI: Mandatory compliance was implemented on April 1, 2021. W.e.f FY 2020-21, online submission of Annual Returns on Food Safety Compliance System (FOSCO - https://foscos.fssai.gov.in) has been made mandatory for food businesses involved in food manufacturing and importing (window for return ...

INCOME TAX

Income Tax Notices in India - Meaning & Types

RJA 03 Jun, 2021

Income Tax Notices in India - Meaning & Types An income tax notice is a written letter from the Income Tax Department to a taxpayer informing him of a problem with his tax account. The notification might be given for a variety of reasons, including filing or not submitting ...