Table of Contents

FORM 15CA & FORM 15CB

FORM- 15 CA PROVISONS

- Amount can be remitted to any other non-resident or foreign company

- Such remittance be made by any resident /non-resident/ domestic company/foreign company from India.

- The income from which such remittance will be made, shall accrue/ arise/ received or deemed to accrue/ arise/ received in India (Section 5 & 9 of Income Tax Act).

- The whole form is divided into 4 parts and the required part be filled by the NRI, while providing declaration.

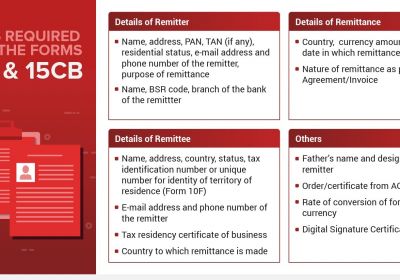

FORM- 15 CB PROVISIONS

- Such form be certified and issued by a Chartered Accountant in India.

- Remittance be made to a non-resident or foreign company.

- A certificate be obtained from a CA, where the amount subject to tax exceeds Rs. 5,00,000.

- Also, where the certificate u/s 195(2)/195(3)/197 of the Act has not been received from the Assessing Officer, such certification is required

- It is basically a Tax Determination Certificate wherein the details pertaining to the remittance is examined by the CA and the taxation aspect is also taken care of.

SECTION 195(6) OF INCOME TAX ACT 1961

The provisions related to furnishing of information regarding deduction of tax at source was provided under section 195(6). Section 195(6) provides that remitter shall furnish the information in respect of remittance made outside India.

It was provided that under section 195(1), any person responsible for paying any interest or any other sum chargeable to tax excluding dividends and income from salary to any non-resident or to a foreign company, shall deduct TDS at the rates applicable. Under this section, TDS is required to be deducted on the payments made to a non-resident by way of royalty and for technical services.

Before inserting this section, the remitter was required to furnish an undertaking (in duplicate) addressing the Assessing Officer, the information related to remittance to be made, along with a certificate from Chartered Accountant in a specified format. This undertaking and certificate will initially be submitted to RBI or its authorized dealers who in turn are required to forward a copy to the Assessing Officer.

Such undertaking and certificate serve as the means to collect taxes at the stage of making the remittance, since it is believed that it is impossible to recover the tax at a later stage from the non-residents. But after some time, looking at the substantial increase in foreign remittances, the manual handling and tracking of certificates became difficult. Thus, to monitor and track the transactions in a timely manner, CBDT proposed to introduce the e-filing of the information in the specified forms.

Such an amendment came into effect from the 1st April 2008. Under this, the information under sub-section (6) of section 195 shall be furnished by the person remitting the payment to a non-resident including a foreign company. Such a person shall be liable to file the form and furnish the information, as required under section 195(6). As a part of these amendments, the Rule 37BB was inserted in the Income Tax Rules, providing for the manner of furnishing information in Form 15CA and a certificate from a Chartered Accountant in Form 15CB.

In case of remittance of consular receipts abroad by diplomatic missions in India, they will be required to submit only a self-certified undertaking in Form No. 15CA to the remitter bank. Thus, they are not required to obtain a certificate from an accountant/certificate of Assessing Officer (Form 15CB).

Also read : An NRI’s Guidance on Forms 15CA and 15CB for International Remittances

FORM 15CA PARTS

PART A

Information be provided under this part, where the amount of payment does not exceed Rs. 50,000 and the aggregate of the payments to be made during the financial year does not exceed Rs. 2,50,000. It is to be noted, that were the remitter is required to fill information in this part, there is no requirement to obtain a certificate from a CA in Form 15CB.

PART B

Information be provided under this part, where the amount of payment is not chargeable to tax and the same is covered under the specified payments of 39 items.

PART C

Information be provided under this part, where the amount of remittance chargeable to tax exceeds Rs. 50,000 and the aggregate of the payments during the financial year exceeds Rs. 2,50,000.

SPECIFIED LIST OF PAYMENTS

SL.NO. |

CODE PROVIDED BY RBI |

PARTICULARS PAYMENT MADE TO ABROAD |

|

1 |

S0001 |

INDIAN INVESTMENT IN EQUITY SHARES. |

|

2 |

S0002 |

INDIAN INVESTMENT IN DEBT SECURITIES. |

|

3 |

S0003 |

INDIAN INVESTMENT IN BRANCHES AND WHOLLY OWNED SUBSIDIARIES. |

|

4 |

S0004 |

INDIAN INVESTMENT IN SUBSIDIARIES AND ASSOCIATES. |

|

5 |

S0005 |

INDIAN INVESTMENT IN REAL ESTATE. |

|

6 |

S0011 |

LOANS TO NON-RESIDENTS |

|

7 |

S0101 |

ADVANCE PAYMENT MADE AGAINST IMPORTS |

|

8 |

S0102 |

PAYMENT AS COSIDERATION FOR IMPORTS. |

|

9 |

S0103 |

IMPORTS BY DIPLOMATIC MISSIONS |

|

10 |

S0201 |

PAYMENTS FOR SURPLUS FREIGHT AND PASSENGER FARE EARNED BY FOREIGN SHIPPING COMPANIES OPERATING IN INDIA. |

|

11 |

S0202 |

PAYMENT IN RELATION TO OPERATING EXPENSES OF INDIAN SHIPPING COMPANIES OPERATING OUTSIDE INDIA. |

|

12 |

S0203 |

FREIGHT ON IMPORTS MADE BY SHIPPING COMPANIES |

|

13 |

S0204 |

FREIGHT ON EXPORTS MADE BY SHIPPING COMPANIES |

|

14 |

S0206 |

BOOKING OF PASSAGES MADE BY SHIPPING COMPANIES |

|

15 |

S0208 |

OPERATING EXPENSES MADE BY INDIAN AIRLINES COMPANIES. |

|

16 |

S0209 |

FREIGHT ON IMPORTS MADE BY AIRLINES COMPANIES |

|

17 |

S0212 |

BOOKING OF PASSAGES BY THE AIRLINES COMPANIES |

|

18 |

S0213 |

PAYMENTS IN RELATION TO STEVEDORING, DEMURRAGE, PORT HANDLING CHARGES ETC. |

|

19 |

S0301 |

REMITTANCE MADE FOR BUSINESS TRAVEL. |

|

20 |

S0302 |

TRAVEL EXPENSE UNDERTAKEN UNDER BASIC TRAVEL QUOTA (BTQ) |

|

21 |

S0303 |

TRAVEL IN RELARION TO PILGRIMAGE |

|

22 |

S0304 |

TRAVEL IN RELATION TO MEDICAL TREATMENT |

|

23 |

S0305 |

TRAVEL IN RESPECT OF EDUCATION (INCLUDING FEES, HOSTEL EXPENSES ETC.) |

|

24 |

S0401 |

POSTAL SERVICES MADE OUTSIDE INDIA. |

|

25 |

S0501 |

CONSTRUCTION OF PROJECTS ABROAD, INCLUDING IMPORT OF GOODS ON THE PROJECT SITE |

|

26 |

S0601 |

PAYMENTS IN RELATION TO LIFE INSURANCE PREMIUM |

|

27 |

S0602 |

FREIGHT INSURANCE PAID IN RELATING TO IMPORT AND EXPORT OF GOODS |

|

28 |

S0603 |

OTHER SOUGHT OF GENERAL INSURANCE PREMIUM |

|

29 |

S1011 |

PAYMENTS IN RELATION TO MAINTENANCE OF OFFICES |

|

30 |

S1201 |

MAINTENANCE IN RESPECT OF INDIAN EMBASSIES ABROAD |

|

31 |

S1202 |

REMITTANCES MADE BY FOREIGN EMBASSIES IN INDIA |

|

32 |

S1301 |

REMITTANCE IN RELATION TO FAMILY MAINTENANCE AND SAVINGS |

|

33 |

S1302 |

REMITTANCE IN THE FORM OF PERSONAL GIFTS AND DONATIONS |

|

34 |

S1303 |

REMITTANCE IN THE FORM OF DONATIONS TO RELIGIOUS AND CHARITABLE INSTITUTIONS |

|

35 |

S1304 |

REMITTANCE IN RELATION TO GRANTS AND DONATIONS TO OTHER GOVERNMENTS AND CHARITABLE INSTITUTIONS. |

|

36 |

S1305 |

CONTRIBUTIONS OR DONATIONS MADE BY THE IINDIAN GOVERNMENT TO INTERNATIONAL INSTITUTIONS |

|

37 |

S1306 |

REMITTANCE MADE IN RESPECT OF PAYMENT OR REFUND OF TAXES. |

|

38 |

S1501 |

PAYMENT IN RESPECT OF REFUNDS, REBATES OR REDUCTION IN INVOICE VALUE ON ACCOUNT OF EXPORTS |

|

39 |

S1503 |

PAYMENTS IN REPSECT OF PARTICIPATION IN INTERNATIONAL BIDDING |

However, within a span of one month, Rule 37BB was again amended vide Notification No. 67/2013 dated 02.09.2013. under this amendment, the Form 15CA was again changed and shall exclude Part-B in the Form 15CA. thus, the new Form 15CA will only two parts -

PART A

Information be provided under this part, where the amount of payment does not exceed Rs. 50,000 and the aggregate of the payments to be made during the financial year does not exceed Rs. 2,50,000. It is to be noted, that were the remitter is required to fill information in this part, there is no requirement to obtain a certificate from a CA in FORM- 15 CB.

PART B

Information be provided under this part, where the amount of remittance chargeable to tax exceeds Rs. 50,000 and the aggregate of the payments during the financial year exceeds Rs. 2,50,000.

The specified list of payments under which FORM- 15 CA and FORM- 15 CB are not required to be filed have been reduced from 39 items to 28 items, and the same was provided under Notification No. 67.

The following 11 items have been excluded -

SL. NO. |

EARLIER SL. NO. |

PURPOSE CODE AS PER RBI |

NATURE OF PAYMENT |

|

1 |

7 |

S0101 |

ADVANCE PAYMENT MADE AGAINST IMPORTS |

|

2 |

8 |

S0102 |

PAYMENT AS COSIDERATION FOR IMPORTS. |

|

3 |

9 |

S0103 |

IMPORTS BY DIPLOMATIC MISSIONS |

|

4 |

10 |

S0201 |

PAYMENTS FOR SURPLUS FREIGHT AND PASSENGER FARE EARNED BY FOREIGN SHIPPING COMPANIES OPERATING IN INDIA. |

|

5 |

12 |

S0203 |

FREIGHT ON IMPORTS MADE BY SHIPPING COMPANIES |

|

6 |

13 |

S0204 |

FREIGHT ON EXPORTS MADE BY SHIPPING COMPANIES |

|

7 |

14 |

S0206 |

BOOKING OF PASSAGES MADE BY SHIPPING COMPANIES |

|

8 |

16 |

S0209 |

FREIGHT ON IMPORTS MADE BY AIRLINES COMPANIES |

|

9 |

18 |

S0213 |

PAYMENTS IN RELATION TO STEVEDORING, DEMURRAGE, PORT HANDLING CHARGES ETC. |

|

10 |

26 |

S0601 |

PAYMENTS IN RELATION TO LIFE INSURANCE PREMIUM |

|

11 |

28 |

S0603 |

OTHER PAYMENTS IN RELATION TO GENERAL INSURANCE PREMIUM |

PRESENT RULE 37BB

As per the current Rule 37BB, the same was amended again under the Notification No. 93/2015 dated 16.12.2015, which was made to strike a balance between reducing the burden of compliance and collection of information under section 195 of the Act.

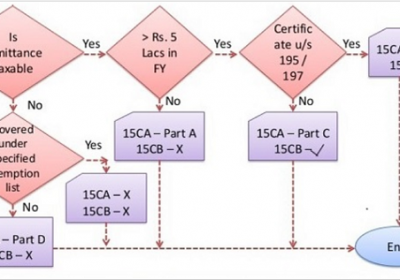

The new Form 15CA has been divided into four parts –

PART A

Information be provided under this part, where the amount of payment or aggregate of such payments made during the financial year does not exceed Rs. 5 Lakh. Where such a form is filed, Form 15CB is not required to be obtained.

PART B

Information be provided under this part, where the amount of payment or aggregate of such payments made during the financial year exceeds Rs. 5 Lakh, determined after obtaining the certificate from the Assessing officer under Section 197 or an order passed by the Assessing Officer under Sections 195(2) or 195(3).

PART C

Information be provided under this part, where the amount of payment or aggregate of such payments not included in part A, made during the financial year exceeds Rs. 5 Lakh, and the same is filed after obtaining a certificate in Form 15CB from a Chartered Accountant.

PART D

Information be provided under this part, where the amount of payment is not chargeable under the provisions of the Income Tax Act. Information under Part D of Form 15CA is not required to be furnished if –

- The remittance made, does not require prior approval of the Reserve Bank of India as per Section 5 of the Foreign Exchange Management Act.

- The remittance related to payment under the 33 items listed in in the Specified List, which is as follows –

SL.NO. |

CODE PROVIDED BY RBI |

PARTICULARS PAYMENT MADE TO ABROAD |

|

1 |

S0001 |

INDIAN INVESTMENT IN EQUITY SHARES. |

|

2 |

S0002 |

INDIAN INVESTMENT IN DEBT SECURITIES. |

|

3 |

S0003 |

INDIAN INVESTMENT IN BRANCHES AND WHOLLY OWNED SUBSIDIARIES. |

|

4 |

S0004 |

INDIAN INVESTMENT IN SUBSIDIARIES AND ASSOCIATES. |

|

5 |

S0005 |

INDIAN INVESTMENT IN REAL ESTATE. |

|

6 |

S0011 |

LOANS TO NON-RESIDENTS |

|

7 |

S0101 |

ADVANCE PAYMENT MADE AGAINST IMPORTS |

|

8 |

S0102 |

PAYMENT AS COSIDERATION FOR IMPORTS. |

|

9 |

S0103 |

IMPORTS BY DIPLOMATIC MISSIONS |

|

10 |

S0104 |

PAYMENT IN RESPECT OF INTERMEDIARY TRADE. |

|

11 |

S0190 |

IMPORTS MADE BELOW THE AMOUNT OF RS 5 LAKHS, TO BE USED BY THE ECD OFFICES |

|

12 |

S0202 |

PAYMENT IN RELATION TO OPERATING EXPENSES OF INDIAN SHIPPING COMPANIES OPERATING OUTSIDE INDIA. |

|

13 |

S0208 |

OPERATING EXPENSES MADE BY INDIAN AIRLINES COMPANIES. |

|

14 |

S0212 |

BOOKING OF PASSAGES BY THE AIRLINES COMPANIES |

|

15 |

S0301 |

REMITTANCE MADE FOR BUSINESS TRAVEL. |

|

16 |

S0302 |

TRAVEL EXPENSE UNDERTAKEN UNDER BASIC TRAVEL QUOTA (BTQ) |

|

17 |

S0303 |

TRAVEL IN RELARION TO PILGRIMAGE |

|

18 |

S0304 |

TRAVEL IN RELATION TO MEDICAL TREATMENT |

|

19 |

S0305 |

TRAVEL IN RESPECT OF EDUCATION (INCLUDING FEES, HOSTEL EXPENSES ETC.) |

|

20 |

S0401 |

POSTAL SERVICES MADE OUTSIDE INDIA. |

|

21 |

S0501 |

CONSTRUCTION OF PROJECTS ABROAD, INCLUDING IMPORT OF GOODS ON THE PROJECT SITE |

|

22 |

S0602 |

FREIGHT INSURANCE PAID IN RELATING TO IMPORT AND EXPORT OF GOODS |

|

23 |

S1011 |

PAYMENTS IN RELATION TO MAINTENANCE OF OFFICES |

|

24 |

S1201 |

MAINTENANCE IN RESPECT OF INDIAN EMBASSIES ABROAD |

|

25 |

S1202 |

REMITTANCES MADE BY FOREIGN EMBASSIES IN INDIA |

|

26 |

S1301 |

REMITTANCE IN RELATION TO FAMILY MAINTENANCE AND SAVINGS |

|

27 |

S1302 |

REMITTANCE IN THE FORM OF PERSONAL GIFTS AND DONATIONS |

|

28 |

S1303 |

REMITTANCE IN THE FORM OF DONATIONS TO RELIGIOUS AND CHARITABLE INSTITUTIONS |

|

29 |

S1304 |

REMITTANCE IN RELATION TO GRANTS AND DONATIONS TO OTHER GOVERNMENTS AND CHARITABLE INSTITUTIONS. |

|

30 |

S1305 |

CONTRIBUTIONS OR DONATIONS MADE BY THE IINDIAN GOVERNMENT TO INTERNATIONAL INSTITUTIONS |

|

31 |

S1306 |

REMITTANCE MADE IN RESPECT OF PAYMENT OR REFUND OF TAXES. |

|

32 |

S1501 |

PAYMENT IN RESPECT OF REFUNDS, REBATES OR REDUCTION IN INVOICE VALUE ON ACCOUNT OF EXPORTS |

|

33 |

S1503 |

PAYMENTS IN REPSECT OF PARTICIPATION IN INTERNATIONAL BIDDING |

In short, Form 15CA is not required to be furnished where the payment relates to any of the above 33 items. The ‘specified List’ is also known as an exemption list i.e., exemption from furnishing Form 15CA and Form 15CB.

It is also provided that an individual, shall also be not required to furnish Form 15CA where the remittance is not subject to any prior approval from RBI under FEMA.

VERIFICATION OF FORM 15CA

Where the information is provided in Form 15CA, the same be verified, electronically using digital signature. Before 2015, verification using digital signature was not mandatory, while the same is mandatory for TAN users.

Also, where the remittance is made to a non-resident who is a director or any other employee of the company/firm, the Form 15CA can be filed without a digital signature.

The authorised dealers shall also furnish a quarterly statement in Form 15CC with the income tax department under their digital signature, and the same be filed within 15 days from the end of the quarter to which such statement is related to.

Thus, under the new Rule 37BB the following points be considered -

- Form 15CA and Form 15CB shall not be filed in respect of remittance made under Liberalised Remittance Scheme (LRS) of RBI.

- Also, where the remittance involve payments, as provided in the specified list, the Form 15CA and Form 15CB shall not be filed.

Another main aspect was that under the Finance Act, 2015 the words ‘person referred to in sub-section (1)’ was revised and the same include words ‘person responsible for paying to a non-resident’. By undertaking such amendment, all the persons making any payment to non-resident will be required to furnish the information in Form 15CA and Form 15CB whether the same is chargeable to tax or not.

Thus, such a mechanism of obtaining information in relation to remittances fulfils twin objectives, including proper deduction of tax at the appropriate rate as well as identification of the remittances on which the tax be deductible

For providing the same, the provisions of section 195 were amended, so that the person responsible for paying any amount, whether charged to tax or not, shall be required to furnish the information regarding such remittance in Form 15CA and 15CB.

FORM 15CA AND 15CB FOR IMPORT OF GOODS

Rule 37BB was amended via Notification No. 93/2015 on 16th December 2015, and the same shall be effective 1st April 2016, regarding import payments as a part of exempted list.

The following items were included in specified list regarding imports –

CODEPROVIDED BY RBI |

PARTICULARS |

|

S0101 |

ADVANCE PAYMENT MADE IN RESPECT OF IMPORTS |

|

S0102 |

PAYMENT MADE FOR CONSIDERATION OF IMPORTS |

|

S0103 |

IMPORTS MADE BY THE DIPLOMATIC MISSIONS |

|

S0104 |

PAYMENT MADE IN RELATION TO INTERMEDIARY TRADE |

|

S0190 |

CONSERATION FOR IMPORTS MADE BELOW THE AMOUNT OF RS 5,00,000, AND THE SAME IS USED BY THE ECD OFFICES. |

FORM 15CA AND FORM 15CB FOR REMITTANCE FROM NRO

It is provided than an NRI who is earning any income in India shall take the credit of the same in his NRO account. Whenever, the NRIs is interested in taking back the money from India to their domestic country, they can ask their banks to repatriate their money from their NRO account.

In such a case, the NRI would be required to furnish information electronically in the Form 15CA on the e-filing portal of the income tax department. Also, the Form 15CB would be required to be filed, where the amount of single or aggregate remittance exceeds Rs. 5,00,000 during a financial year.

It is to be noted, that the Form 15CA and Form 15CB are not required in relation to remittance made under the Liberalised Remittance Scheme. In this case, Part-D of Form 15CA will be required to be filled.

Under the present Rule 37BB, it is clear that Form 15CB will be required to be obtained, where the amount of remittance is taxable in India. It is thereby clarified, that any remittance made by an NRI from his NRO account to NRE account or even to a non-taxable funds, will trigger the obligation to obtain the certificate from a Chartered Accountant in Form 15CB along with Form 15CA.

also read : Applicablity of 15CA and 15CB

QUOTING OF UNIQUE ACKNOWLEDGEMENT

CBDT issued a Notification No. 11/2013 dated 19.02.2013, requiring the person filing Form 15CA, to mandatorily quote the Unique Acknowledgement number generated after successful submission of Form 15CA in the Form 27Q, which serves as the quarterly e-TDS statement for TDS deducted on payments made to non-resident under section 200(3)

PENALTY FOR FAILURE

It is to be noted, that before 2015, no specific penalty was provided in relation to non-furnishing of Form 15CA and/or Form 15CB. Also, there was no provision to levy a penalty for non-submission or inaccurate submission of the prescribed Forms.

However, to ensure proper and accurate submission of information in respect of remittance, a new provision in the name of section 271-I, was inserted in the Income Tax Act, providing for penalty in case of non-furnishing of information or furnishing of incorrect information under section 195(6). As per the said section, a penalty of Rs. 1,00,000 be levied for the above-mentioned failure. But another amendment was made to section 273B, providing that the authority shall not levy any penalty, where it is proved that the person is having reasonable cause for non-furnishing or incorrect furnishing of information under section 195(6).

Certification Work in India

Our team of highly efficient chartered accountants, tax consultants, and corporate financial advisors. We possess in-depth knowledge in various industrial fields which help us to adopt a rather productive approach towards offering a personalized gateway to the client’s problems.

Certific action Work - Advanced Certification Services

We specialize in providing advanced certification services that align well with your requests and offer certification services across all major standards. Undertaking the requirements of the clients, we help to gain certificates within a limited time frame and abiding the law.

Popular blog:-

- Basic Provision of Form 15CB & 15CA

- Complete Understanding about Form 15CA, Form 15CB

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

- Form 15cb To Be Issued For Payment To NRI

- How to file e-form 15ca & 15cb-process

- New rules for form 15ca/cb under rule 37bb

- Form-15cb-to-be-issued-for-payment-to-non-resident-for-using-immovable-property-situated-in-india