BRIEF INTRODUCTION

After the introduction of GST, any business entity having an aggregate turnover exceeding the prescribed limit of Rs 20 lakhs and Rs 10 lakhs, depending on the state or UT in which they are operating, are required to get registered under that state/UT. Once registration is granted, a GSTIN is allotted which will be a 15-digit unique identification number.

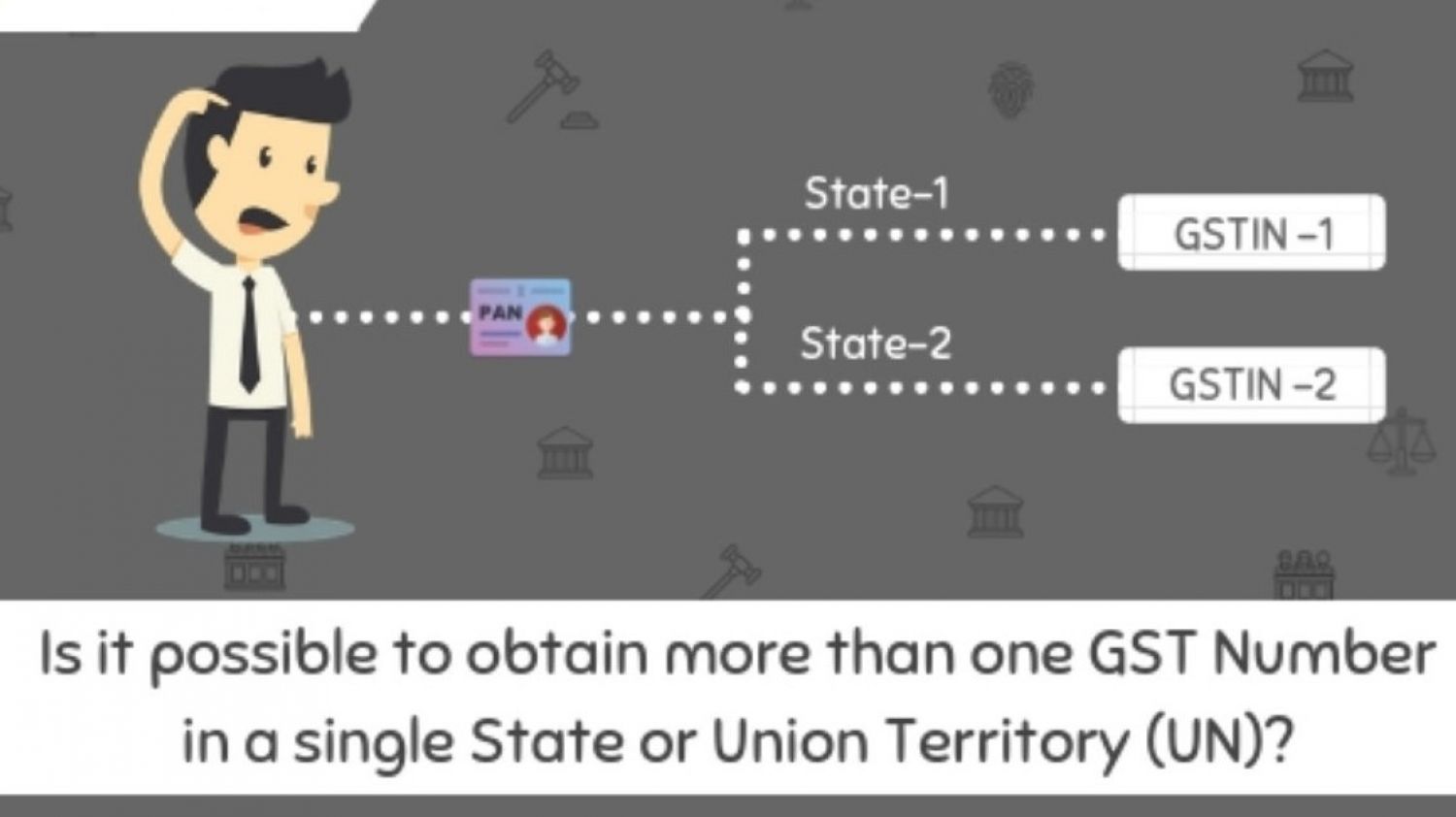

As per the government norms, such a GSTIN shall be allotted on the basis of the PAN of the said entity only. However, where a person is to operate in more than one state/UT, they need to have GSTIN for each of its units, but they all be issued under one PAN.

MULTIPLE REGISTRATION UNDER GST ACT

As per the Section 25(1) CGST Act, 2017, where any person undertakes their business activity in more than one state/UT, they are compulsorily required to obtain separate GSTIN for each unit and all these GSTIN be registered under one PAN only. Thus, businesses in different states/UTs would attract the liability to have different GSTIN, in each of these states/UTs, as per section 25(1) of CGST Act 2017.

EXAMPLE

Suppose a person is carrying a business in Delhi and Mumbai. Thus, the said person is required to obtain separate GSTIN for the unit in Delhi and Mumbai, and both of this registration be made under one PAN.

We have noticed that we can easily have different registration in different states. However, what about multiple registrations in one state/UT.

As per the Section 25(2) CGST Act, 2017, any person carrying on business with different verticals in a single State or Union territory, can apply for a separate GSTIN for each of its verticals, provided the specified rules and conditions are complied by the applicant.

However, after the CGST Amendment Act 2018, this section 25(2) was substituted and it was provided that any person having multiple places of operating business in one state/UT, can apply for each of such places of business operation, provided the applicant complies with the specified conditions and rules.

Thus, after the amendment, it was clear, that any person having a different place of business in one state can apply for different GSTIN for each place of operation. Therefore, the restriction in relation to having a business vertical, for taking different GSTIN has been removed.

BUSINESS VERTICAL

As per Section 2 (18) CGST Act, 2017, business vertical is a sought of business having different operations in respect of the main business entity, working for the supply of goods or services or both, which involves certain risk and return.

Two businesses are said to be related where they share the following factors in common –

- The type and nature of the goods, services, or both, provided by the companies.

- Their production process and steps involved in it.

- The class/type of customers they are catering to.

- The type of distribution channel, they are using to provide their supply.

- The regulatory environment with which they are complying.

It is very much clear, that where there are two distinguished businesses operating in the same state, can apply for separate GSTIN under the same PAN of the applicant.

PROVISIONS APPLICABLE ON VERTICLE

1. As per Rule 11- CGST Rules, 2017, any person requiring new registration for its vertical in the same state shall ensure that –

-

The person shall have more than one business vertical, as provided in section 2 (18) CGST Act 2017.

-

Also, the vertical business shall not apply or be granted registration under section 10, which relates to the composition scheme, where any other business vertical, registered under the same PAN, is already registered under section 10.

-

Where any of the business verticals are ineligible to be registered under the composition scheme, the other business verticals shall also become ineligible.

2. As per Section 9 of CGST Act 2017, all the business verticals under the same PAN, shall pay taxes separately, and shall also be liable to pay tax in respect of goods, services, or both, supplied to any other vertical, as the same shall be considered as supply to a distinct person and the same is taxable even in the event of supply without consideration

3. As per Rule 8(1), CGST Act 2017, where any person is operating in a Special Economic Zone or is an SEZ developer, they need to apply separately as a vertical situated outside Special Economic Zone while taking GST registration.

MULTIPLE GSTIN FOR DIFFERENT PLACES OF BUSINESS

With effect from 1st February 2019, CGST amendment 2018 was implemented, thus the taxpayers can obtain separate registration for each of the places of operation within a single state or union territory.

FORM ITC – 02A

As discussed above, a person can have multiple GSTIN for each place of operation in the same state/UT. Apart from this relaxation, the person is also allowed to transfer the unutilized amount of ITC lying with the main place of business, to a place of operation, established in the same state/UT. The amount of ITC to be transferred shall in the ratio of the value of assets held by the new entity, and it shall be made within 30 days from the date of taking the new registration. For transferring of ITC, the person is required to file Form GST ITC-02A within the prescribed time.

PURPOSE

Under this method, the unutilized ITC can be transferred, similar to the way of distribution of ITC by ISD. The asset transfer is undertaken within the same state/UT and the amount is determined on the basis of the assets held by the newly established entity.

It relates to the assets which have already been used by the principal business and have been transferred to the newly established entity. Since the ITC on the goods transferred belongs to the new entity, the unutilized amount should be transferred to them. For this, Form ITC-02A is required to be filed within 30 days of registration of the new entity.

CONDITIONS APPLICABLE

As per the Rule 11- CGST Rules, 2017, any person requiring new registration for its vertical in the same state shall ensure that –

- The person shall have more than one business vertical, as provided in section 2 (18) CGST Act 2017.

- Also, the vertical business shall not apply or be granted registration under section 10, which relates to the composition scheme, where any other business vertical, registered under the same PAN, is already registered under section 10.

- Where any of the business verticals are ineligible to be registered under the composition scheme, the other business verticals shall also become ineligible.

PROCEDURE FOR REGISTRATION

The procedure for undertaking multiple registrations is provided on the GST portal. The portal is controlled and maintained by the Government of India and they have appointed certain GST Suvidha Providers, for providing help in respect of the registration procedure.

The procedure to be followed is –

- The applicant is required to fill the Part A of Form GST REG – 01, as provided on the GSTN portal. The applicant shall be in receipt of the information related to the PAN, mobile number, and email address of the person to be registered.

- Once the details of PAN, Mobile number and email address, are provided, they are verified by means of OTP on the GST portal. After successful verification, the applicant is provided with a reference number or an acknowledgement in FORM GST REG-02.

- After this, the reference number received, is required to be mentioned in Part- B of FORM GST REG-01 and the form is to be submitted on the portal, after filing the required information and uploading of documents.

- However, where the GST authority requires certain additional information, the same is requested in FORM GST REG-03.

- In reply to the request received in Form GST REG 03, the applicant is required to file FORM GST REG-04, providing the required information and the same be filed within 7 working days from the date of the receipt request form.

- Where the authority is satisfied with the information provided, they will issue the certificate of registration in Form GST REG –06 in respect of the place of business for which the application was made.

- However, if the information provided does not fulfil the object for which they were requested, the application form shall be rejected and be communicated in Form GST REG-05.

CONCLUSION

It is to be noted that GST registration is Pan based, and is provided for a particular state/UT. However, a person can apply for more than one GSTIN in a single state/UT, where such person is having different business verticals or place of operation in the same state/UT. Also, the principal business can transfer the unutilized amount of ITC to its newly establish entity, within the same state, by filing FORM ITC 02A.