Table of Contents

- Section 43b(h) Compliance Requirements, Impact, Auditor’s Responsibilities

- Section 43b(h) Background :

- Legal Framework :

- Section 15 Of Msmed Act, 2006: Time Limit For Payment

- No Benefit Of First Proviso To Section 43b

- Who Qualifies As Msme -relevant Cross-reference Section 15 Of Msmed Act, 2006:

- Impact Of Section 43b(h)

- Practical Scenarios For section 43b(h) Of The Income Tax Ac

Section 43B(h) Compliance Requirements, Impact, Auditor’s Responsibilities

Section 43B(h) Background :

Section 43B(h) of the Income Tax Act introduced via the Finance Act 2023, and its implications for payments to MSMEs. Section 43B of the Income Tax Act specifies certain expenses that are allowable as deductions only when actually paid, regardless of the method of accounting followed (cash or mercantile). The Finance Act, 2023 inserted clause (h) to address delayed payments to Micro and Small Enterprises (MSEs), effective from Assessment Year 2024-25 (FY 2023-24). Summarized breakdown of Section 43B(h) the key points:

Legal Framework :

- Section 43B(h) Applies to Micro and Small Enterprises (not Medium). Deduction allowed only on actual payment, if delayed beyond MSMED timelines (15/45 days). Exclusions

- No benefit of first proviso to Section 43B (i.e., payment before ITR due date doesn’t help).

- Capital expenditure and presumptive taxation cases (44AD/ADA/AE) are excluded.

- Traders registered under MSME are not eligible for 43B(h) benefits.

- Objective of this section is to Promote timely payments to Micro & Small enterprises (with valid Udyam registration) with effect from FY 2023–24 (AY 2024–25) which time limit As per Section 15 of MSMED Act (≤45 days). In the violation of this section Disallowance of Expense allowed only on actual payment beyond due date. Auditor’s Duty Verify, segregate, report, and disclose outstanding dues under the Form 3CD Impact in New reporting requirement under Clause 26

- Introduction to promote timely payments to micro and small enterprises. With Effective from AY 2024–25 (FY 2023–24). Also Disallows deduction of expenses payable to micro/small enterprises unless actually paid within the time limits specified u/s 15 of the MSMED Act. Relevant of Section 43B(h):

“Any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in Section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act) shall be allowed as a deduction only in the previous year in which such sum is actually paid.”

Section 15 of MSMED Act, 2006: Time Limit for Payment

Where there is a written agreement, payment must be made on or before the agreed date or within 45 days of acceptance, whichever is earlier. If there is no written agreement, payment must be made within 15 days of acceptance.

No Benefit of First Proviso to Section 43B

- Unlike other expenses u/s 43B, payments to MSMEs cannot be claimed merely because they were paid before the due date of filing the return. Deduction is allowed only in the year of actual payment, if delayed beyond MSMED timelines.

- the benefit of payment made up to the “due date for filing of return u/s 139(1)” does not apply to clause (h). Hence, delayed payments cannot be claimed merely because payment is made before the filing due date.

Who Qualifies as MSME -Relevant Cross-Reference Section 15 of MSMED Act, 2006:

- Micro: Investment ≤ ₹1 crore, Turnover ≤ ₹5 crore.

- Small: Investment ≤ ₹10 crore, Turnover ≤ ₹50 crore.

- Medium: Investment ≤ ₹50 crore, Turnover ≤ ₹250 crore.

Impact of Section 43B(h)

On Businesses (Buyers / Purchasers):

- Disallowance of Expense: If payment to a Micro or Small Enterprise is delayed beyond 45 days (or agreed shorter period), the expense cannot be claimed in that year. It will be allowed only in the year of actual payment.

- Not applicable to Medium Enterprises: Applies only to Micro and Small suppliers (as per Udyam Registration).

- Impact on Profit and Tax: Increases taxable income if payments are delayed & May lead to higher tax outgo and deferred deduction.

- Incentivizes Timely Payments: Promotes financial discipline and supports liquidity for small suppliers.

On Micro and Small Enterprises (Sellers):

- Encourages faster payment realization.

- Improves working capital and cash flow.

- Strengthens the enforcement of MSME Act provisions indirectly through the Income-tax mechanism.

On Accounting and Tax Computation:

The assessee must segregate creditors: MSME vendors (Micro/Small) or Others (Medium/Non-MSME). Mapping of payment dates vs. invoice dates is necessary. Expenses must be reconciled to determine disallowance u/s 43B(h).

Important Clarifications u/s 43B(h) :

Only UDYAM-registered MSMEs are covered. Traders registered under MSME are not eligible for benefits u/s 15 of MSMED Act : 43B(h) not applicable. If a supplier is engaged in both trading and manufacturing/services, 43B(h) applies to the manufacturing/services portion. Capital expenditure is not covered under 43B(h) as it's not deductible under the Act. Presumptive taxation cases (44AD/ADA/AE) are excluded from 43B(h) applicability.

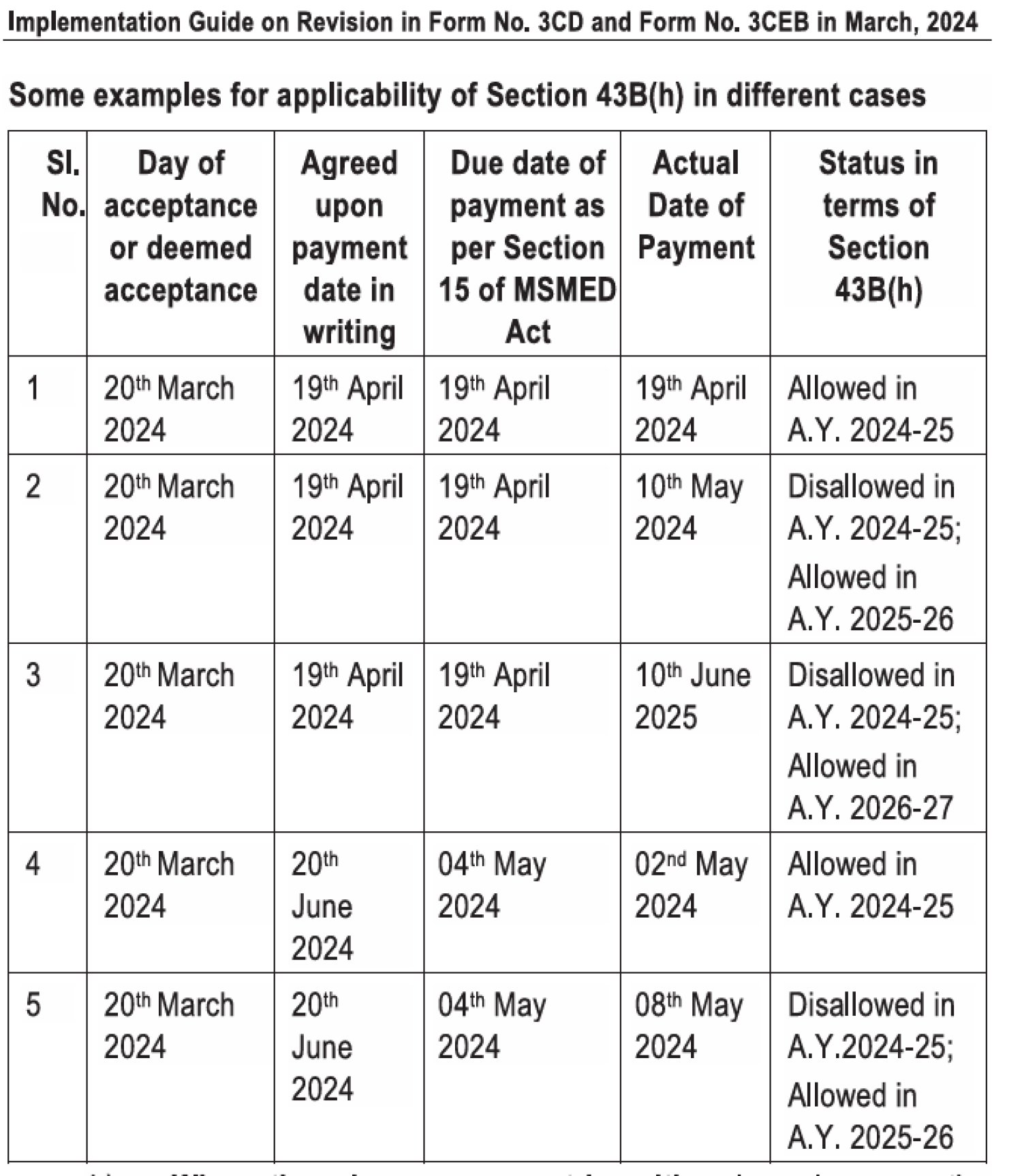

Practical Scenarios for Section 43B(h) of the Income Tax Ac

- Payment after 15/45 days but before year-end : Deduction allowed in same year.

- Payment after year-end but within MSMED time limits : Deduction allowed in year of accrual.

- Payment after MSMED time limits : Deduction allowed only in year of payment.

- Cheque issued but not encashed : No disallowance if delivery and date are proven.