Form 15cb To Be Issued For Payment To NRI

Page Contents

www.carajput.com: Form15CA & 15CB

Form 15cb to be issued for the payment to NRI for using Immovable Property situated in India

- The primary right to tax the income from immovable property is with the country where the immovable property is situated as per Article 6 of the DTAA.

- This view holds good for all the Model Tax conventions namely, OECD, U.N, U.S. The situs of the immovable property has a vital role in determining distributive rules for taxation i.e. State of source vs. State of residence. Various paragraphs of Article 6 has been discussed under all the three Model Conventions:

Distributive Rule of Taxation

- This paragraph denotes that income derived by a resident of a Contracting State from immovable property situated in other contracting states may be taxed in that other state.

- The paragraph uses the words “may be taxed in” which implies that the state of source is not getting exclusive but primary right to tax and hence, the state of residence may also tax the same income. Double taxation so arising, is mitigated by way of exemption or tax credit mechanism available under the tax treaty (Article 23A or 23B).

- There are tax treaties of India with Bangladesh, Greece, and Egypt which provide that- income from immovable property shall be taxable in the contracting state in which such property is located. Thus, the source state retains an exclusive right to tax the income from immovable property.

- The use of different terminologies, i.e, ‘maybe taxed in’ & ‘shall be taxed only in’ led to controversies in the interpretation of tax treaties.

CIT vs. P.V.A.L. Kulandagan Chettiar.

- With respect to Article 6, a landmark decision was given by the Apex court of India in the case of CIT vs. P.V.A.L. Kulandagan Chettiar.

- The Supreme Court held that income arising from rubber estate in Malaysia was not liable to tax in India, even though Article 6 uses the language ‘may be taxed in’.

- A notable fact, in the context of language, ‘maybe taxed in’ is NOTIFICATION 91/2008 dated. 28 August, 2008 which clarifies – in case tax treaty provides that any income of a resident of India “may be taxed in” in the other country, such income shall be included in his total income chargeable to tax in India, and relief shall be granted in accordance with the treaty provisions.

- It is clear that India preserves the right to tax the worldwide income of its tax residents also under the tax treaties. However, this notification has remained unnoticed and doesn’t find reference in rulings dealing with the phrase ‘may be taxed in.

- In a situation where a resident of one of the Contracting State earns income from immovable property located in a third state, the same shall fall outside the ambit of Article 6 and it shall bear the character of ‘other income ‘ and be taxed accordingly.

Income from Agriculture and forestry

- Model tax Conventions also include Income from agricultural and forestry within the ambit of income from immovable property, because of the concept that these incomes are primarily concerned with use of land.

- Ownership of immovable property that is exploited for the purpose of agriculture and forestry need not rest with the person carrying out the activities of agriculture and forestry.

- However, Income from Agriculture is exempt u/s 10 of Income Tax Act, 1961, hence, there is no need to take the benefit of the treaty.

Computation of income from immovable property

- Article 6 deals only with attribution of taxation on income arising from immovable property, it is silent on the modalities of determining income. It also doesn’t mention about deductible expenses.

- In absence of such specification, the computation shall have to be carried out as per domestic tax laws of the state of source.

Conclusion

The primary taxation right over income from immovable property is always with the State of suits.

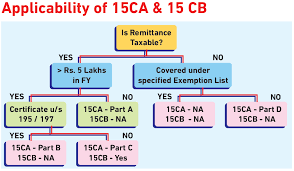

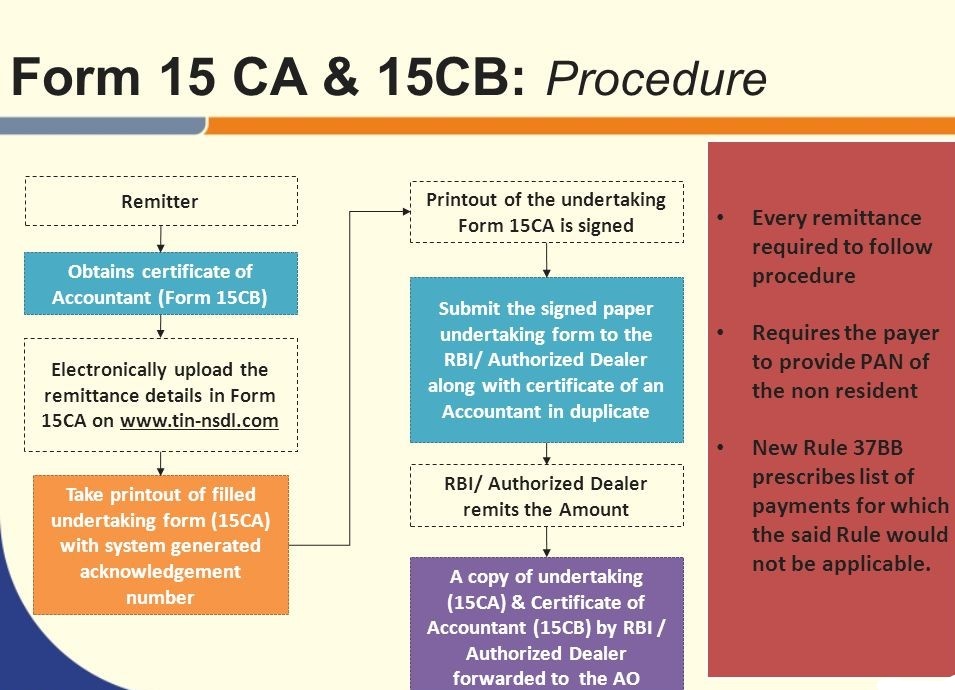

Procedure for 15CA and 15CB

Penalty pursuant to Section 271-I of the Income Tax Act:

- Any person convicted of delaying or failing to submit Forms 15CA and 15CB to the tax authority is entitled to impose a penalty of Rs. 1 Lakh on the defaulter.

- The penalty is also payable in the event that the person files incorrect information or files the wrong section of Form 15CA.

- The person shall be deemed to have defaulted until he/she has been unable to make a reasonable reason for failure to submit the form.

Popular Articles :

For query or help, contact: singh@carajput.com or call at 9555555480