New rules for form 15ca/cb under rule 37bb

Page Contents

NEW RULES FOR FORM 15CA/ CB UNDER RULE 37 BB OF THE INCOME-TAX RULES

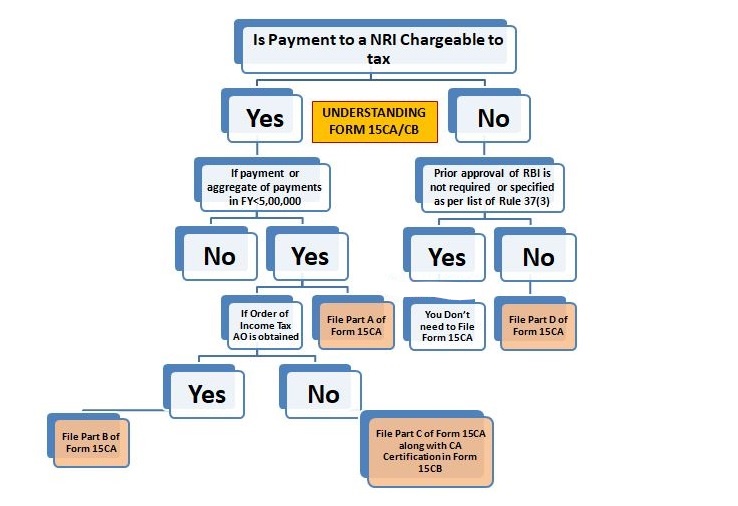

Section 195 of the Income-tax Act (‘the Act’) empowers the Central Board of Direct Taxes to capture information in respect of payments made to non-residents, whether chargeable to tax or not. Rule 37BB of the Income-tax Rules have been amended to strike a balance between reducing the burden of compliance and collection of information under section 195 of the Act.

The CBDT has amended Rule 37 BB of the Income-tax Rules and made notable changes which are as under:

- No Form 15CA and 15CB will be required to be furnished by an individual for remittance which do not requiring RBI approval under its LRS.

- Further the list of payments of specified nature mentioned in Rule 37 BB which do not require submission of Forms 15CA and 15CB has been expanded from 28 to 33 including payments for imports.

- A CA certificate in Form No. 15CB will be required to be furnished only in respect of such payments made to non-residents which are chargeable to tax and the amount of payment during the year exceeds Rs. 5 lakh.

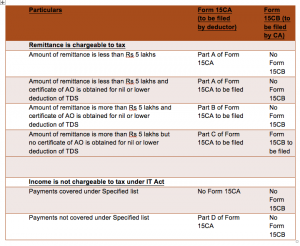

The furnishing of information for payment to a non-resident, not being a company, or to a foreign company in Form 15CA has been classified into 4 parts- Part A, Part B, Part C and Part D, wherein:

Part A :

Where the remittance is chargeable to tax under the provisions of the Income-tax Act,1961 and the remittance or the aggregate of such remittances does not exceed five lakh rupees during the financial year.

Part B :

Where the remittance is chargeable to tax under the provisions of the Income-tax Act,1961 and the remittance or the aggregate of such remittances does not exceed five lakh rupees during the financial year and an order/ certificate u/s 195(2)/ 195(3)/ 197 of Income-tax Act has been obtained from the Assessing Officer.

Part C :

Where remittance is chargeable to tax under the provisions of Income-tax Act, 1961 and the remittance or the aggregate of such remittances exceeds five lakh rupees during the financial year and a certificate in Form No. 15CB from an accountant as defined in the Explanation below sub-section (2) of section 288 has been obtained.

Part D :

Where the remittance is not chargeable to tax under the provisions of the Income-tax Act,1961 {other than payments referred to in rule 37BB(3)} by the person refer 3red to in ru7BB(2).

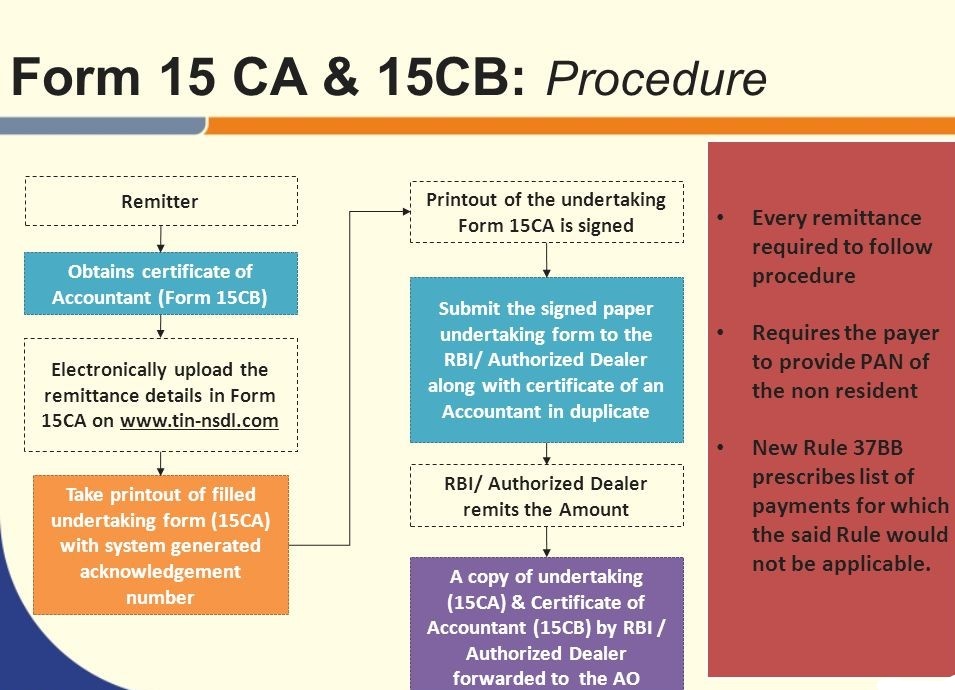

Basic Procedure of 15CA and 15CB

NEW RULES FOR FORM 15CA/ CB UNDER FEW SITUATIONS

Who fail or default in file 15CA and 15CB

Any person who fails for delaying or failing to submit Forms 15CA & 15CB to the Income-tax dept is entitled to impose a penalty of INR 1,00,000/- on the defaulter. The penalty is also payable in the event that the person files incorrect information or files the wrong section of Form 15CA. The person shall be deemed to have defaulted until he/she has been unable to make a reasonable reason for failure to submit the form.

Overview on Form 15CA and Form 15CB Process and forms

How to Fill Out Forms 15CA and 15CB

The steps to take before sending money to a non-resident are listed below:

Form 15CA must be provided by anyone making a payment to a Non-Resident. Any of the relevant elements of Form 15CA must be filled out, depending on the amount of payment and the authority to levy tax.

| Parts of Form 15CA | Description |

| Part A | To be filled up if the remittance is chargeable to tax under the provisions of the Income-tax Act,1961 and the remittance or the aggregate of such remittances, as the case may be, does not exceed five lakh rupees during the financial year) |

| Part B | To be filled up if the remittance is chargeable to tax under the provisions of the Income-tax Act, 1961 and the remittance or the aggregate of such remittances, as the case may be, does not exceed five lakh rupees during the financial year and an order! certificate u!s 195(2)! 195(3)! 197 of Income-tax Act has been obtained from the Assessing Officer. |

| Part C | To be filled up if the remittance is chargeable to tax under the provisions of Income-tax Act, 1961 and the remittance or the aggregate of such remittances, as the case may be, exceeds five lakh rupees during the financial year and a certificate in Form No. 15CB from an accountant as defined in the Explanation below sub-section (2) of section 288 has been obtained |

| Part D | To be filled up if the remittance is not chargeable to tax under the provisions of the Income-tax Act,1961 other than payments referred to in rule 37BB(3) by the person referred to in rule 37BB(2) |

Note: Before filling out Part C of Form 15CA, you must first upload Form 15CB. The Acknowledgment number of e-Filed Form 15CB should be provided to prefill the details in Part C of Form 15CA.

Form 15CA and Form 15CB

| Sr. No | Form Number | Description |

| 1. | FORM- 15 CA | Information to be furnished for payments to a non-resident not being a company, or to a foreign company |

| 2. | FORM- 15 CB | Certificate of an accountant |

The steps that must be taken in order to file Form 15CB

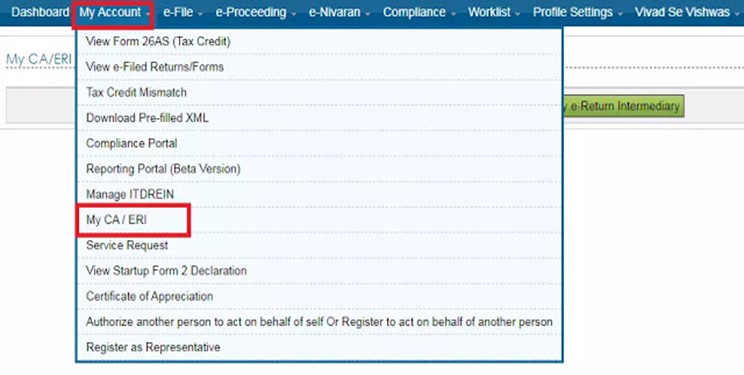

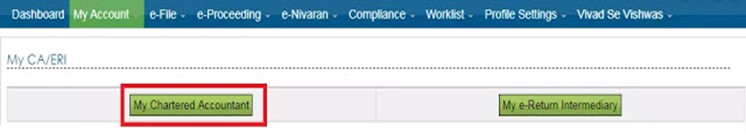

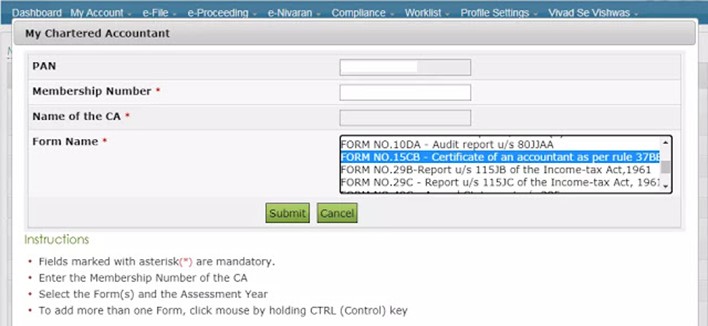

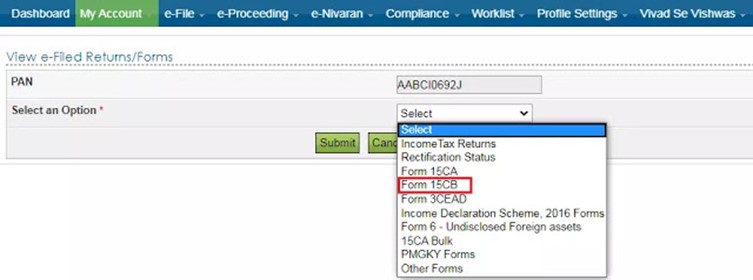

Step 1: Go to the e-filing portal and log in. Go to ‘My Account,’ then to ‘My CA/ERI,’ and finally to ‘My Chartered Accountant.’

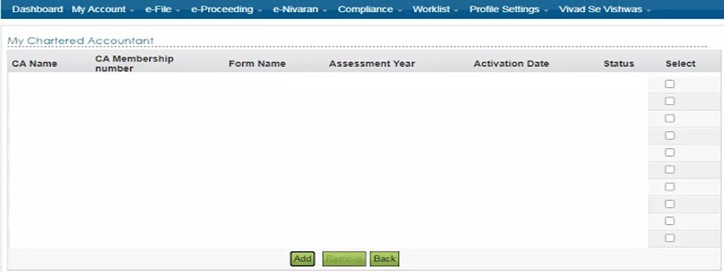

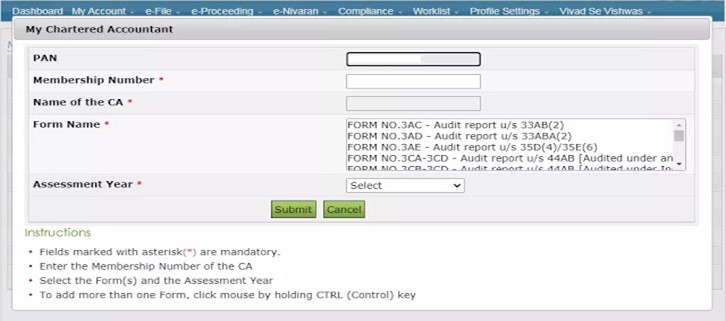

Step 2: Select ‘Add’ from the drop-down menu. Enter the Chartered Accountant’s “Membership Number.” The CA’s name will be filled in automatically. To do so, the CA must first create an account on the e-filing portal.

The website will also display the assessee’s previously added CA.

Step 3: Click Submit after selecting ‘Form No. 15CB – Certificate of an accountant as per Rule 37BB’ as the Form Name. When Form 15CB is selected, the page’s field “Assessment Year” is obscured.

Once the assessee has added CA, the CA can file Form 15CB on the assessee’s behalf.

To file the Form 15CB by the CA, go to the e-filing portal’s downloading area and download the program. Fill out the Form in the utility and the XML file will be generated. The CA then uploads this XML file on behalf of the assessee to the e-filing portal.

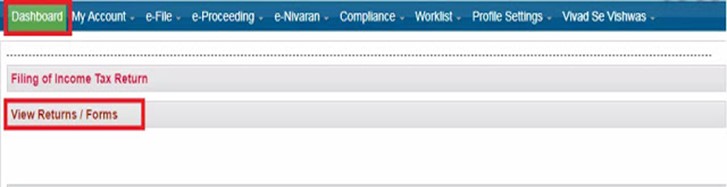

- On his e-filing account, the assessee can see the e-filed Form 15CB.

- Select ‘View Returns/Forms’ from the ‘Dashboard.’

- Select Form 15CB from the ‘Select an Option’ drop-down menu.

- Click the ‘Submit’ button.

A list of all Form 15CBs that have been filed will be presented.

Note: The CA’s digital signature is required to upload the XML file of Form 15CB.

The steps that must be taken in order to file Form 15CA

After filing the Form 15CB, or if the Form 15CB is not necessary, the Form 15CA must be filed. The assessee must file Form 15CA through his e-filing account.

The steps to e-File Form 15CA (e-filing portal) issued by the Income Tax Department are listed below.

Form 15 CA, which had been e-filed, has been withdrawn.

- Within 7 days of filing, Form 15CA can be withdrawn. Users will be able to withdraw the uploaded FORM 15CA by clicking on the “Withdraw Form 15CA” link. Within seven days of submitting Form 15CA, users can withdraw. There is, however, no way to withdraw Form 15CB.

- The status of a Form 15CA will be changed to ‘Form 15CA Withdrawn’ once it has been successfully withdrawn.

Latest Update For The Months of June 2021

Due to technical issue of the Released recently income Tax Portal, Manual Submission of 15CA/CB to AD are allowed, AD is encouraged to accept the manual form. Later on a service will be supplied to upload such manual form for records.

Popular blog:-

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

For query or help, contact: singh@carajput.com or call at 9555555480