Basic Provision of Form 15CB & 15CA

Page Contents

Basic Provision of Form 15CB & 15CA

What is Form 15CB

There are some provisions to make payments outside India, one of this compliance is the submission of Form 15CA and 15CB compliance. Rule 37BB provides the manner of supplying information in form 15CB and making a declaration in form 15CA.

What form-15CA?

In 15CA, all the information concerning payments made to non-residents is given, making it a tool for the collection of data on international remittances. In general, this form is a statement used by the sender to gather information on payments due.

- Therefore, Form 15CA helps the country’s Income tax department keep track of international remittances and their taxability.

- Form 15CA will NOT have to be equipped for remittance by a person who does not need RBI approval.

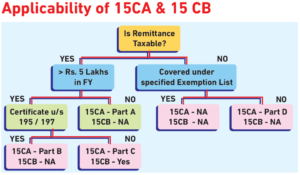

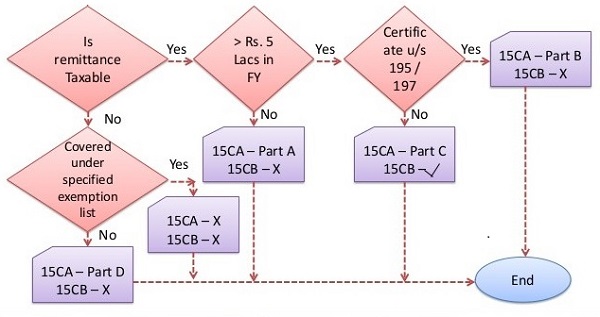

Applicability of Form 15CA

Form 15CA is a declaration statement of any person who is planning to make a foreign remittance:

- To a non-resident or a foreign company (regardless of whether the remittance is taxable)

- Remitter who can be a resident/non-resident/domestic/foreign company

- Where income accrues/ arises/ acquired or considered to accrue/ arise/ received in India. (Section 5 of the Income Tax Act)

Non- Applicability of Form 15CA

Non-requirement of Form 15 CA

- When the Foreign remitter allows Foreign remittance in compliance with the list of payments stated in the Income Tax Rules of Rule 37BB.(Refer: Rules of Income Tax)

- Not applicable by Section 5 of the Foreign Exchange Management Act, 1999 to an individual who does not need RBI approval.

What is Form-15CB?

This is the kind of certificate that is required only if the remittance is not taxable. It is a channel for getting tax clearance/approval. In general, this form is a declaration used by the remitter to gather information on payments due.

Applicability Form 15CB certificate

Form 15CB certificate is required from Chartered Accountant when the foreign remittance is made in the following case

- Non-resident or Foreign companies are Taxable,

- Payment above Rs. 5 lakhs; &

- Where the order/certificate has not been received from the Assessing Officer (AO).

Form 15CB is a form that a Chartered Accountant is required to sign. This certificate is regarding the rate and the correct type of tax paid by Assess. some information Form 15CB is requested at the time of submission of Form 15CA.

It appears at first glance that Form 15CA is not necessary to be completed if the remittance or payment to a non-resident Indian is not taxable.

According to Rule 37BB of the Income Tax (14th Amendment) Rule, 2013, There is no reporting of Form 15CA & Form 15CB in the case of international remittances of the following nature since October 2013.

List of payments where Form 15CA / 15CB is not required

| Purpose code as per RBI | Nature of Payment |

| S0001 | Indian investment abroad -in equity capital (shares) |

| S0002 | Indian investment abroad -in debt securities |

| S0003 | Indian investment abroad -in branches and wholly-owned subsidiaries |

| S0004 | Indian investment abroad -in subsidiaries and associates |

| S0005 | Indian investment abroad -in real estate |

| S0011 | Loans extended to Non-Residents |

| S0202 | Payment- for operating expenses of Indian shipping companies operating abroad. |

| S0208 | Operating expenses of Indian Airlines companies operating abroad |

| S0212 | Booking of passages abroad -Airlines companies |

| S0301 | Remittance towards business travel. |

| S0302 | Travel under basic travel quota (BTQ) |

| S0303 | Travel for pilgrimage |

| S0304 | Travel for medical treatment |

| S0305 | Travel for education (including fees, hostel expenses, etc.) |

| S0401 | Postal services |

| S0501 | Construction of projects abroad by Indian companies including import of goods at the project site |

| S0602 | Freight insurance – relating to import and export of goods |

| S1011 | Payments for maintenance of offices abroad |

| S1201 | Maintenance of Indian embassies abroad |

| S1 202 | Remittances by foreign embassies in India |

| S1301 | Remittance by non-residents towards family maintenance and-savings |

| S1302 | Remittance towards personal gifts and donations |

| S1303 | Remittance towards donations to religious and charitable institutions abroad |

| S1304 | Remittance towards grants and donations to other governments and charitable institutions established by the Governments. |

| S1305 | Contributions or donations by the government to international institutions |

| S1306 | Remittance towards payment or refund of taxes. |

| S1501 | Refunds or rebates or reduction in invoice value on account of exports |

| S1503 | Payments by residents for international bidding”. |

Popular Article :